College Savings Bank

- 1. College Savings Bank Safe, Secure & Reliable Investment Options for your Clients

- 2. Mission “ To be a partner to investment professionals who provide educational planning services to their clients, who are preparing their children for higher education. We are in the financial business, but as a partner, we treat all of our beneficiaries like family members - and in as such, deliver products and services to the market that we would want as parents ourselves." Join our mission to help Arizona families save with the Arizona Family College Savings Program!

- 3. Company History • College Savings Bank has been in business since 1987. • Joined the Arizona Family College Savings Plan initiative in 1999. • Company was recently purchased by a group of private investors in the beginning of 2012.

- 4. Jason Lampa • Located in Phoenix • 12 years working with Advisors • Have raised more than $2 billion in assets with Advisors • Represented firms such as OppenheimerFunds, New York Life and Citi.

- 5. A Simple Story • Preservation • Participation • Protection

- 6. Safe & Secure Product Line • CollegeSure CD • InvestorSure CD • Fixed Rate CD

- 7. Availability CSB 529 and IRA CDs are available in all 50 States through the state programs we manage:  CollegeChoice 529 CD Savings Plan– Indiana  Arizona Family College Savings Program  Montana Family Education Savings Plan In addition non tax qualified product are sold directly through the bank.

- 11. Common Questions

- 12. Graduate School My 28-year-old son has just graduated with his undergraduate degree. Can I now start a 529 plan for his graduate degree? He is uncertain just when he will go. If he should not go, can I transfer the money for my grandson's education?

- 13. Parents Pride I am a grandfather contributing to a 529 plan for my granddaughter. I am the owner of the account and my granddaughter is the beneficiary. Can I withdraw the funds from the account and reimburse my son who has paid the tuition, room and board and other qualified expenses? The reason for this question is the parents want to pay the expenses since they feel it is a parental obligation to educate their children.

- 14. Retirement or College My wife and I have more than $100,000 in Roth IRA contributions in addition to another $400,000 in retirement savings. We have zero in a 529 plan or other college savings. With our first child five years from college, we are concerned that Roth contribution withdrawals may not be a good vehicle for college tuition as the withdrawals show up as income on parent's financial aid even though they're not taxable income. This may affect ability of our child to obtain student loans. We are considering cutting back on our 401(k) investments and saving aggressively in a 529 plan. What are your thoughts?

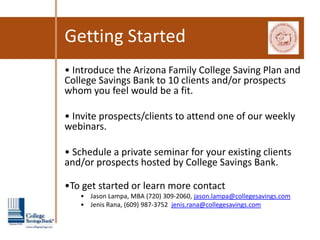

- 15. Getting Started • Introduce the Arizona Family College Saving Plan and College Savings Bank to 10 clients and/or prospects whom you feel would be a fit. • Invite prospects/clients to attend one of our weekly webinars. • Schedule a private seminar for your existing clients and/or prospects hosted by College Savings Bank. •To get started or learn more contact • Jason Lampa, MBA (720) 309-2060, jason.lampa@collegesavings.com • Jenis Rana, (609) 987-3752 jenis.rana@collegesavings.com

Editor's Notes

- #7: is a variable rate CD indexed to college costs and designed to meet the future cost of college. pays an annual percentage yield linked to the rate of college inflation as measured by the Independent College 500TM Index (IC500TM).is a variable rate certificate of deposit indexed to the Standard & Poor’s 500® (S&P 500) Composite Index. provides security and does not risk principal, unlike many other investments. Should the value of the S&P 500 decline from issue date to maturity (5-years), depositors will receive full principal back at maturity. will receive at least 70% of the average increase in the S&P 500 based upon a formula, when investments are held until maturity. provide the safety of FDIC insurance while earning competitive rates.are offered with 1- and 3-year maturity options and earn a fixed rate of return for the entire term of the CD.

- #8: Take Advantaged and Tax-Free Withdrawals Gifting (Lump Sum) Estate Planning Employer Benefit Program Rotary Club Scholarship Program

- #9: Take Advantaged and Tax-Free Withdrawals Gifting (Lump Sum) Estate Planning Employer Benefit Program Rotary Club Scholarship Program

- #10: Differentiated Marketing Strategy leading to additional assets Products pay up to 4% commission Get additional referrals within the family Gifting equals big tickets

- #11: “ 529 plans are small accounts and not worth the time”“ I already use a mutual fund company for my 529 business”“ I do not have time to learn a new product”“ Your commissions are too low”

- #13: If he is thinking about graduate school, and you wish to help pay for it, a 529 plan can be a great vehicle for tax-free savings. Since there are no age limits with 529 plans, it won’t matter how old your son is when he decides to go back to graduate school.Most graduate schools do fit the definition of an eligible education institution for purposes of your 529 plan, and you can verify eligibility for any particular school by accessing the U.S. Department of Education's school code look-up at ed.gov and determining if the school is listed as having a "school code."

If your son changes his mind about grad school, the leftover funds in your 529 plan can be redirected to your grandson or other family member. You simply change the beneficiary on the account, or transfer a portion of the funds to another 529 plan with your grandson as beneficiary.

If you switch the account to a grandson, your son who was the original beneficiary may have to report a gift for gift-tax purposes depending on the value of the transfer. So be sure to look into that when the time comes to make that change.

- #14: Many people assume that you must be able to trace the money withdrawn from your 529 plan to the actual payment of college costs. However, nothing in the law or in IRS pronouncements says you do. For a 529 plan withdrawal to be tax-free, you simply have to be able to show that the account beneficiary, in this case your granddaughter, incurred a sufficient amount of qualified higher education expenses in the same year.This means you should be fine doing what you propose to do. The fact that you are using the 529 money to reimburse the parent is irrelevant.The IRS has proposed some anti-abuse rules to prevent taxpayers from taking unfair advantage of the flexibility provided under the tax law. I do not see anything abusive about your plan. However, what you need to do is make sure that no one else, such as the parent, is using 529 plans to pay those same college costs. Otherwise, there could be a conflict and you would have a problem claiming those costs for your own particular 529 withdrawals.Another issue you face concerns gift taxes. When you request a distribution from the 529 plan to yourself, the money comes back into your pocket. Your tax professional may advise that the payment to your son become a gift from you to him, and if the amount of reimbursement exceeds the gift tax annual exclusion amount (currently $13,000), you will need to file a gift tax return.

- #15: don’t cut back on 401k contributions that your employer will match. That match is a substantial guaranteed return on your investment.Beyond that amount: not a bad idea to start pumping some savings into a 529 plan. Provided you end up using it for college, the 529 earnings will be tax-free, just like using your Roth IRA in retirements. Plus with a 529 plan, you may be able to deduct some of your contributions on your state income tax return, depending on where you live and which 529 plan you use.Any way you slice it, your family is going to have to come up with the money for college some how. It could come from your Roth IRA, it could come from a 529 plan, it could come from student loans or parent loans. It probably should not come from borrowing on your 401K because you’ll have to start paying it back right away or face some stiff penalties.As you obviously already know, withdrawing your Roth IRA contributions can be a good tax-free way to pay for college. The problem is that it can derail any need-based financial aid because the withdrawals have to be reported on the aid application. Withdrawals from a 529 plan do not get reported, although a small percentage of the account value does get reported.The best outcome is to not use any of your retirement money for college, so that it stays there for your retirement. At the same time, you don’t want your child to graduate from college with a lot of debt, whether or not your child qualified for government subsidized loans. 529 plans help you accomplish these goals.I know that some advisors might tell you to put every penny possible into your 401K and your IRAs before turning to 529 plans. After all, you can’t borrow for retirement although your child can borrow for college. But I don’t completely subscribe to that theory, especially when your college costs begin in five years and your retirement is sometime in the future. Many parents say that they would rather delay retirement than see their child burdened with a lot of debt, so shifting at least some of your focus from retirement savings to college savings can make sense.