Commissions, piecework pay

- 1. Other Ways of Earning Income Commissions, Piecework, and Contract Work

- 2. Pay Plans ? We have considered the following previously: ? Hourly Pay ®C paid by the hour ? Annual Salary ®C paid by the year ? What other types of pay plans are there? ? Commission ? Paid according to money from sales ? Piecework Pay ? Paid according to units produced ? Contract work ? Paid according to the duty described in the contract

- 3. Commission ? Some jobs that get paid commission: a) Real Estate Agent b) Used Car salesmen c) Any type of sales job Typically, the salesperson°Øs transactions are tracked, and a percentage of that is paid to the salesperson as income.

- 4. Piecework Pay ? Jobs that may have piecework pay plans: a) Newspaper delivery b) Tree planting c) Factory workers in an assembly plant Typically, the salesperson°Øs production is tracked, and a set amount is paid to the worker for each °∞unit°±

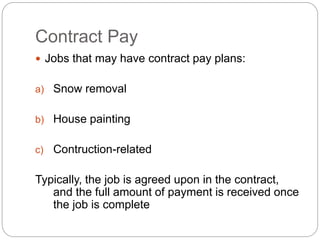

- 5. Contract Pay ? Jobs that may have contract pay plans: a) Snow removal b) House painting c) Contruction-related Typically, the job is agreed upon in the contract, and the full amount of payment is received once the job is complete

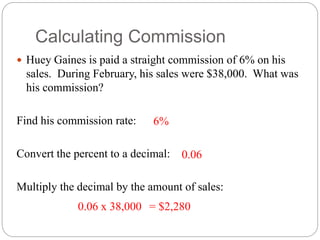

- 7. Calculating Commission ? Huey Gaines is paid a straight commission of 6% on his sales. During February, his sales were $38,000. What was his commission? Find his commission rate: Convert the percent to a decimal: Multiply the decimal by the amount of sales: 6% 0.06 0.06 x 38,000 = $2,280

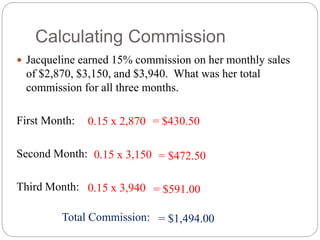

- 8. Calculating Commission ? Jacqueline earned 15% commission on her monthly sales of $2,870, $3,150, and $3,940. What was her total commission for all three months. First Month: Second Month: Third Month: 0.15 x 2,870 0.15 x 3,150 0.15 x 3,940 = $591.00 = $430.50 = $472.50 Total Commission: = $1,494.00

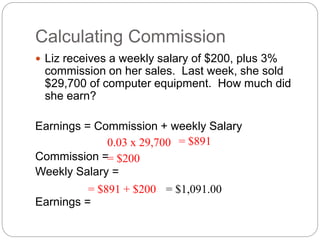

- 9. Calculating Commission ? Liz receives a weekly salary of $200, plus 3% commission on her sales. Last week, she sold $29,700 of computer equipment. How much did she earn? Earnings = Commission + weekly Salary Commission = Weekly Salary = Earnings = 0.03 x 29,700 = $891 = $200 = $891 + $200 = $1,091.00

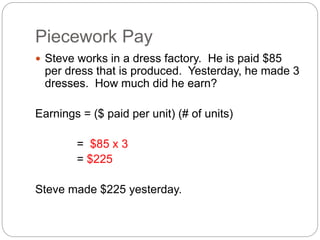

- 11. Piecework Pay ? Steve works in a dress factory. He is paid $85 per dress that is produced. Yesterday, he made 3 dresses. How much did he earn? Earnings = ($ paid per unit) (# of units) = $85 x 3 = $225 Steve made $225 yesterday.

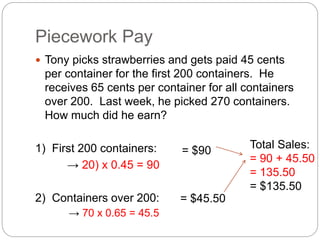

- 12. Piecework Pay ? Tony picks strawberries and gets paid 45 cents per container for the first 200 containers. He receives 65 cents per container for all containers over 200. Last week, he picked 270 containers. How much did he earn? 1) First 200 containers: °˙ 20) x 0.45 = 90 2) Containers over 200: °˙ 70 x 0.65 = 45.5 = $90 = $45.50 Total Sales: = 90 + 45.50 = 135.50 = $135.50

- 13. Advantages vs. Disadvantages ? As an employee, what are the advantages of being paid commission, piecework, or by contract? ? What are the disadvantages? ? As an employer, what are the advantages of being paid commission, piecework, or by contract? ? What are the disadvantages?