Computer - TYPES OF MORDEM E-PAYMENT SYSTEM

- 2. TYPES OF MORDEM EPAYMENT SYSTEM ’üČElectronic cheques/Internet cheques (i-cheques) ’üČSmart Card ’üČMicro Payments (Electronic wallet or microtransactions)

- 3. Electronic cheques/Internet cheques (icheques) ’ü¼ Electronic cheques also known as i-cheques are used to make electronic payment between two parties through an intermediary and not very much different from the current cheque processing system. Here the electronic cheque are generated and exchanged online. The intermediary will debit the customer account and credit the merchant account.

- 4. SMART CARD ’ü¼ A smart card is a plastic card about the size of a credit card, with an embedded microchip that can be loaded with data, used for telephone calling, electronic cash payment, & other application, & then periodically refreshed for additional use. Currently or soon, you may be able to use a smart card to:

- 5. CONTINUEŌĆ”. ’ü¼ Dial a connection on a mobile, telephone and be changed on a per-call basis. ’ü¼ Establish your identity when logging on to an Internet access provider on to a online bank. ’ü¼ Give hospital or doctors personal data without filling out a form. ’ü¼ Make small purchases at electronic stores on the web (a kind of cyber cash)

- 6. HOW SMART CARD WORKS ’ü¼ A smart card contain more information than a magnetic stripe card and it can be programmed for different applications. Some cards can contain programming and data to support multiple application and some can be updated to add new applications after they are issued. Smart cards can be designed to be inserted into a slot and read by a special reader or to be read at a distance, such as at a toll booth.

- 7. TYPES OF SMART CARD ’ü¼ Contact smart card They are inserted into a reader or validator for the data to be read. When the card is inserted into the reader, it transfers data to and from chip via electrical connectors.

- 8. TYPES CONTINUEŌĆ”.. ’ü¼ Contact less smart card They are passed near an antenna to connect via a radio signal. They have both a microchip & an antenna embedded. This allows the smart card to communicate without physical contact.

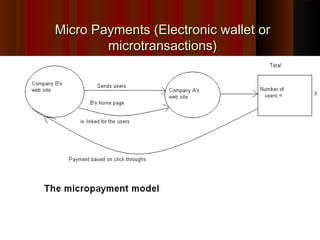

- 9. Micro Payments (Electronic wallet or microtransactions)

- 10. CONTINUEŌĆ”. ’ü¼ A micro payment is a small fee paid when a visitor is sent from another website to your site. The payment is usually tracked by a third party and when a specific amount has been accumulated, say rupees thousand, the fee is paid to the website that sent the traffic. This payment mechanism helps a way for you to encourage other companies to add to your links into websites. If any of the customers of other websites enter their site and click the link, the click through to your website will be recorded.

- 11. CONTINUEŌĆ”. ’ü¼ In view of services provided, when in of visitors click through to your websites have been accumulated, a payment will be made to company that sent the traffic. ’ü¼ It is cash payments which is made as a result of using a service on Internet. These are also made between two or more Internet companies to help generate traffic through links.

- 12. CONTINUEŌĆ”. ’ü¼ A micropayment work based on registration made within an organisation that verifies and reports on traffic levels between sites. ’ü¼ Next a very small payment per link is calculated and when the total owing reaches a specified threshold, the payment is released from the customer actual or virtual bank account to vendors account.