Concept of Permanent Establishment

- 1. CONCEPT OF PERMANENT ESTABLISHMENT All rights reserved | CA Darpan Mehta Concept of Permanent Establishment | 1 DISCLAIMER This presentation provides general information existing at the time of its preparation. The presentation is meant for general guidance and no responsibility for loss arising to any person acting or refraining from acting as a result of any material contained in this publication will be accepted by BMR Advisors. It is recommended that professional advice be taken based on the specific facts and circumstances. This presentation does not substitute the need to refer to the original pronouncements All rights reserved | Concept of Permanent Establishment | 2 1

- 2. CONTENTS Permanent Establishment (ŌĆśPEŌĆÖ) History and Origin Types of PE Fixed Place PE Specific PE Exclusions Installation PE Service PE Agency PE Challenges to PE concept All rights reserved | Concept of Permanent Establishment | 3 PERMANENT ESTABLISHMENT - History and Origin - Types of PE All rights reserved | Concept of Permanent Establishment | 4 2

- 3. HISTORY AND ORIGIN ŌĆ£International taxation should be based on either political, residential or economic allegiance between the taxpayer and the taxing state.ŌĆØ PE as a concept originated in Prussia in 1845 in the Industrial Code The primary use of the PE concept is to determine the right of a state to tax the profits of an enterprise of another state No definitive tests; facts based determination All rights reserved | Concept of Permanent Establishment | 5 TYPES OF PE Types of PE Fixed Place PE Agency PE Installation PE Service PE An office is a Dependent Independent Building site, fixed place Service by Agent Construction, Agent employee or Installation or other assembly project personnel Preparatory and Income generating auxiliary activities activities PE if lasts PE if NO PE greater services All rights reserved | than 6/12 last PE (if certain months beyond conditions are satisfied) specified NO PE PE time Concept of Permanent Establishment Tax Update ŌĆō India | 6 3

- 4. FIXED PLACE PE All rights reserved | Concept of Permanent Establishment | 7 FIXED PLACE PE - CONCEPT There must be a fixed place of business (situs test); The fixed place of business must be located [in a] certain territorial area (locus test); The use of the fixed place of business must last for a certain period of time (tempus test); The taxpayer must have a certain right of use [over] the fixed place of business (ius test); The activities performed through the fixed place of business must be of a business character (business activity test) All rights reserved | Concept of Permanent Establishment | 8 4

- 5. FIXED PLACE PE ŌĆō LOCUS TEST All three tests (locus, situs and business activity) must be satisfied Presence to be ŌĆśvisibleŌĆÖ in the other contracting state Usually linked to a geographical location Covers premises as well as tangible assets used for carrying on business Movable places of business with a temporary fixed location meet the locus test Activities carried out within a defined geographical location could constitute a PE; eg, a diving offshore vessel functioning within a defined area, dealer selling merchandise from a mobile van All rights reserved | Concept of Permanent Establishment | 9 FIXED PLACE PE ŌĆō EXAMPLES Fishing boat operated within the territorial waters Streets in a city? E.g. Milkman case and Taxicab in Hamburg Circus or a carnival performing at different places in a city Concert tours, music shows etc. Restaurants and shops on-board ships in international traffic? Home offices PartnerŌĆÖs premises ŌĆō a PE for Partnership? All rights reserved | Concept of Permanent Establishment | 10 5

- 6. FIXED PLACE PE ŌĆō OECD POSITION AND INDIAŌĆÖS OBSERVATIONS/COMMENTS OECD Position: Both geographical and commercial coherence would be necessary to construe a fixed place of business for the purpose of establishing a PE OECD does not consider tangible or intangible property leased out by an enterprise without maintaining a place of business to constitute a PE IndiaŌĆÖs Position: Both the conditions ie geographical and commercial coherence in isolation, may construe a fixed place of business; work under a series of unrelated contracts for different clients in a large building may trigger a PE Even tangible and intangible properties could, in certain circumstances, constitute a PE of the lessor in the source country All rights reserved | It is necessary to determine who actually exercises control over the property and whose business is being carried out through such leased asset Concept of Permanent Establishment | 11 FIXED PLACE PE ŌĆō TEMPUS TEST No minimum threshold under Indian law An isolated activity cannot lead to establishment of a fixed base PE as the ingredients of regularity, continuity and repetitiveness are essentially missing If a non-resident is carrying its activities through a place which is exclusively available to its business in India then that place will be deemed to be its fixed place PE even if the same is used for a day Interestingly, in a recent ruling, the AAR has held that conducting of golf tournament in India for a weekŌĆÖs duration does not lead to existence of a fixed base PE in India. Golf in Dubai, LLC v. ADIT, In re (2008) 306 ITR 374 (AAR) All rights reserved | Concept of Permanent Establishment | 12 6

- 7. FIXED PLACE PE ŌĆō IUS TEST Place should be at the disposal of the foreign enterprise for the purpose of its business activities The foreign enterprise should have the ability to exercise some right or dominion or control The place may be owned, rented or leased; Legal right to use need not be the sole determinant; factual use or exercise of such right will have a greater bearing Even illegal occupation could constitute a PE All rights reserved | Concept of Permanent Establishment | 13 FIXED PLACE PE ŌĆō BUSINESS ACTIVITY TEST The definition of PE requires that the business of the foreign enterprise, wholly or partly, ought to be carried out through the fixed place Place of business must ŌĆśserveŌĆÖ the business activity and not be ŌĆśsubject toŌĆÖ it The use of the premises by an agent for the purpose of the business of the principal may lead to the interpretation that such premises are at the disposal of the principal and therefore constitute a PE (Galileo International Inc) Similarly, in ACIT v DHL Operations BV, the office of a local courier company was considered to constitute a PE for the foreign company engaged in providing courier services since the foreign company delivered packages to the local courier company for onward delivery to the addressee All rights reserved | Concept of Permanent Establishment | 14 7

- 8. SPECIFIC PE All rights reserved | Concept of Permanent Establishment | 15 SPECIFIC PE - ILLUSTRATIVE LIST Article 5(2) provides for an illustrative list of facilities constituting a PE The term PE includes especially: A place of management A branch An office A factory A workshop; and A mine, an oil or gas well or any other place of extraction of natural resources OECD considers the satisfaction of conditions prescribed in paragraph 1 of Article 5 as a prerequisite for examples in paragraph 2 to constitute a PE India does not agree with the above interpretation and holds that all the examples provided under paragraph 2 of Article 5 would independently All rights reserved | constitute a PE Concept of Permanent Establishment | 16 8

- 9. INDIAŌĆÖ RESERVATIONS TO OECD ŌĆō ARTICLE 5 India reserves its right to include a warehouse, a sales outlet and a farm, plantation or other place where agricultural, forestry, plantation or related activities are carried on, under paragraph 2 as an example of a PE India reserves its right to treat an enterprise as having a PE, if a person, in India, acting on behalf of the enterprise habitually maintains a stock of goods or merchandise from which it regularly delivers goods or merchandise on behalf of the enterprise India reserves its right to provide that an insurance enterprise of a Contracting State shall, except with respect to re-insurance, be deemed to have a PE in India if it collects premiums in India or insures risks situated therein through a person other than an agent of an independent status All rights reserved | Concept of Permanent Establishment | 17 EXCLUSIONS All rights reserved | Concept of Permanent Establishment | 18 9

- 10. EXCLUSIONS The following are excluded from the definition of PE: Use of facilities solely for storage or display of merchandise Maintenance of stock of goods solely for the purpose of processing by another enterprise Maintenance of a fixed place of business solely for Advertising Supply of information Scientific research Other similar activities which have a preparatory or auxiliary character All rights reserved | Concept of Permanent Establishment | 19 EXCLUSIONS According to OECD, a PE could be constituted if a foreign enterprise maintains an office with employees that are involved in the maintenance of goods/ machinery supplied to customers India is of the view that even the maintenance of an office and employees that are substantially involved in the negotiation of contracts for the import of products or services will form a PE. India would not include scientific research in the list of examples of activities indicative of preparatory or auxiliary nature All rights reserved | Concept of Permanent Establishment | 20 10

- 11. INSTALLATION PE All rights reserved | Concept of Permanent Establishment | 21 INSTALLATION PE - CONCEPT Building site or construction or installation project including the construction of buildings, bridges or canals, excavating and dredging and the laying of pipelines Installation project means putting together or re-grouping of pre-fabricated elements such as the erection of steel scaffolding or units of production Final assembling of moveable objects (eg airplanes) also covered by the above term Planning and supervision covered only if carried on by the building contractor himself Delivery of materials to a construction or assembly project is not itself a construction or assembly project All rights reserved | Concept of Permanent Establishment | 22 11

- 12. INSTALLATION PE ŌĆō TEMPUS TEST The permanence element of a PE is replaced by a test of minimum length of time The minimum period starts when the enterprise starts to perform business in connection with the building or construction or installation project Building works for different ordering parties mark the beginning of new periods even if they are operated at one and the same place IndiaŌĆÖs Position/Observation: India does not agree with the words ŌĆ£the 12 month test applies to each individual site or projectŌĆØ. It considers that a series of consecutive short term sites or projects operated by a contractor would give rise to the existence of a PE in the country concerned India has reserved its right to replace construction or installation project with construction, installation or assembly project or supervisory activities All rights reserved | in connection therewith and reserves its right to negotiate the period of time for which they should last to be regarded as a PE Concept of Permanent Establishment | 23 SERVICE PE All rights reserved | Concept of Permanent Establishment | 24 12

- 13. SERVICE PE - CONCEPT Article 5(2) / (3) of the DTAA - furnishing of services by a non-resident in India through employees or other personnel may result in creation of ŌĆśService PEŌĆÖ, provided the duration of such services exceeds the specified period Services may be rendered to an associated enterprise of the service provider or a third party service recipient The permanence element of a PE is replaced by a test of minimum length of time in the case of Service PE as in case of Installation PE It is important to evaluate the requirements of Article 12 before examining the service PE clause The number of days calculation is based on man days All rights reserved | Concept of Permanent Establishment | 25 STEWARDSHIP Stewardship services are rendered to protect the interest of the customer/ principal Stewards are typically not involved in the day-to-day management or in rendering the services undertaken by the service provider Their function is essentially of quality control and ensuring confidentiality Usually, the foreign enterprise does not receive fees from the recipient of such services and the cost of the personnel performing these services are also borne by the foreign enterprise Given the above, stewardship activities do not lead to the constitution of a service PE All rights reserved | Concept of Permanent Establishment | 26 13

- 14. SECONDMENT The typical features of a secondment are: An employee of enterprise X in State X is seconded to enterprise Y in State Y; he continues on the payroll of enterprise X Employee resides and renders services in State Y; he reports to enterprise Y The employee may continue to be paid by enterprise X who in turn is reimbursed by enterprise Y Critical parameters in determining the existence of a PE or otherwise Commercial justification Enterprise which exercises control over the employee Existence or otherwise of a lien on employment with enterprise X for the employee All rights reserved | Concept of Permanent Establishment | 27 PLACE OF PROVISION OF SERVICES The persons rendering the services and the persons availing the services may be in different locations For example: The employee is present in the state where the services are being rendered (ie, Enterprise X in State X provides services to Enterprise Y in State Y) The employee is not present in the state where the services are being rendered (ie, An employee of Enterprise X in State X is present in State Z for rendering services to Enterprise Y in State Y The employee is present neither in the state where the services are being rendered nor in the state where the services are utilized (ie, an Employee of Enterprise X in State X who is present in State Z for rendering services to Enterprise Y of State Y and the services are to be utilized in State Y) All rights reserved | Concept of Permanent Establishment | 28 14

- 15. OTHER PERSONNEL According to OECD, the business of an enterprise is carried on mainly by the entrepreneur or persons who are in paid employment relationship with the enterprise. These personnel include employees and other persons receiving instructions from the enterprise The interpretation of ŌĆśother personsŌĆÖ referred to above is based on the principle of noscitur a sociis Some issues arising in interpreting ŌĆśother personsŌĆÖ are: Whether non-individuals are included ? Whether employees of another enterprise included ? Should the personnel be dependent on the enterprise ? Is there an overlap between service PE and agency PE or are they mutually exclusive ? All rights reserved | Concept of Permanent Establishment | 29 AGENCY PE All rights reserved | Concept of Permanent Establishment | 30 15

- 16. AGENCY Under Indian contract law, agency can be created in the following ways: Actual express or implied authority Ratification Ostensible authority Necessity The primary test for an agency is the legal ability of the agent to bind the principal to a third party Origin : The first modern DTA between Prussia and Austria/Hungary, 1899 All rights reserved | Concept of Permanent Establishment | 31 AGENCY UNDER TREATY Replaces requirement of fixed place of business Independent agent ŌĆō no PE Legal and economic independence Only dependent agent constitutes a PE who- Acts on behalf of enterprise Has authority to conclude contracts Has no authority but habitually maintains stock of goods and regularly delivers goods for the enterprise No PE if agent acts in ordinary course of business PE in the State would be only in respect of activities which the agent undertakes for the enterprise All rights reserved | Concept of Permanent Establishment | 32 16

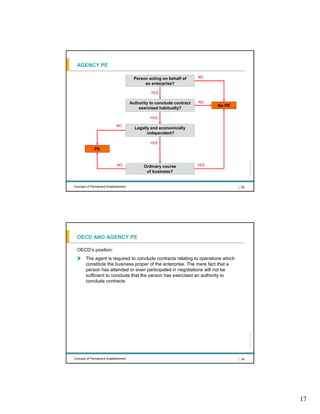

- 17. AGENCY PE Person acting on behalf of NO an enterprise? YES Authority to conclude contract NO No PE exercised habitually? YES NO Legally and economically independent? YES PE All rights reserved | NO Ordinary course YES of business? Concept of Permanent Establishment | 33 OECD AND AGENCY PE OECDŌĆÖs position: The agent is required to conclude contracts relating to operations which constitute the business proper of the enterprise. The mere fact that a person has attended or even participated in negotiations will not be sufficient to conclude that the person has exercised an authority to conclude contracts All rights reserved | Concept of Permanent Establishment | 34 17

- 18. AGENCY PE: INDIAŌĆÖS POSITION Even if a person has attended or participated in negotiations it can, in certain circumstances, be sufficient, to conclude that he has exercised an authority to conclude contracts in the name of the enterprise. A person, who is authorized to negotiate the essential elements of the contract, and not necessarily all the elements and details of the contract, on behalf of a foreign resident, can also be said to exercise the authority to conclude contracts and hence constitute a PE India reserves its right to treat an enterprise of a Contracting State as having a PE in India if a person habitually secures orders in India wholly or almost wholly for the enterprise India reserves its right to make it clear that an agent whose activities are conducted wholly or almost wholly on behalf of a single enterprise will not be considered an agent of an independent status All rights reserved | Concept of Permanent Establishment | 35 CHALLENGES TO PE CONCEPT All rights reserved | Concept of Permanent Establishment | 36 18

- 19. CHALLENGES TO FIXED PLACE PE Website by itself creates a PE for a foreign enterprise? Location of server to be considered? Can access in India to a website hosted outside India create a PE ? Problem area especially for ecommerce portals Website hosted on server located in India may create a PE PE could exist even if website not accessed from India Independent activities completed through a vessel / ship be considered as a fixed place PE? Website by itself creates a PE for a foreign enterprise? Presence of property in the other contracting state can lead to the creation of a PE? All rights reserved | Concept of Permanent Establishment | 37 CHALLENGES TO INSTALLATION PE Whether series of short term unrelated contracts covered ? Whether Subcontractor days should be counted towards main contractor days? Treatment to be give to temporary gaps? All rights reserved | Concept of Permanent Establishment | 38 19

- 20. CHALLENGES TO SERVICE PE The period of six months within a twelve month period : Month as a calendar month ? Month as a period of thirty days? How should the word ŌĆśmonthŌĆÖ be interpreted for twelve month calculation? Should the services be rendered for a continuous period of six months? Outsourcing of services to any other enterprise- whether service PE ? All rights reserved | Concept of Permanent Establishment | 39 CHALLENGES TO AGENCY PE Dependent agent ŌĆō Separate for each function ? Attendance or participation in negotiations - sufficient to create PE ? Actual concluding of contracts not essential Minutes of meetings with clients/document trail assume importance Negotiation of which elements (essential or all) can be considered as adequate to create PE ? Processing and subsequent delivery directly by processor to customers - PE ? All rights reserved | Concept of Permanent Establishment | 40 20

- 21. DARPAN MEHTA BMR Advisors darpan.mehta@bmradvisors.com Mob: +91 9769249148 Off: +91 022 30217135 All rights reserved | Challenge Us Concept of Permanent Establishment Tax Update ŌĆō India| 41 | 21

![FIXED PLACE PE

All rights reserved |

Concept of Permanent Establishment | 7

FIXED PLACE PE - CONCEPT

There must be a fixed place of business (situs test);

The fixed place of business must be located [in a] certain territorial area

(locus test);

The use of the fixed place of business must last for a certain period of time

(tempus test);

The taxpayer must have a certain right of use [over] the fixed place of

business (ius test);

The activities performed through the fixed place of business must be of a

business character (business activity test)

All rights reserved |

Concept of Permanent Establishment | 8

4](https://image.slidesharecdn.com/conceptofpewirc-12593875160279-phpapp02/85/Concept-of-Permanent-Establishment-4-320.jpg)