CONVERTIBLE BOND

Download as PPTX, PDF1 like3,667 views

A convertible bond is a hybrid security that can be converted into shares of the issuing company's equity at a predetermined price. It gives the bondholder the option to exchange the bond for a set number of shares. Convertible bonds offer upside potential if the stock price rises through conversion while also providing downside protection through interest payments and repayment of principal. They are attractive to companies with high growth potential but also high risk, as the conversion feature allows the company to strengthen its equity base if its stock price appreciates.

1 of 8

Downloaded 68 times

Recommended

Convertible Bonds

Convertible BondsSasan Mansouri

Ã˝

This document provides an overview of convertible bonds, including:

1) Key terms like conversion ratio and conversion price as well as how the price of a convertible bond is calculated.

2) The hybrid characteristics of convertibles that provide downside protection like bonds and upside potential like equities.

3) Metrics used to analyze convertibles such as delta, gamma, and cheapness.

4) An example of a hypothetical Concerto-FS convertible bond is presented to demonstrate these concepts.Risk and Return

Risk and ReturnMuzzamil Shaikh

Ã˝

This document defines key concepts related to risk and return in investments. It discusses components of return including yields and capital gains. It also defines expected return, relative return, and real rate of return. The document outlines several types of risk that can impact investments such as market risk, interest rate risk, liquidity risk, and foreign exchange risk. It also discusses standard deviation and the coefficient of variation as measures of risk. Finally, the capital asset pricing model is introduced as relating expected return on an asset to its systematic risk.Arbitrage pricing theory (apt)

Arbitrage pricing theory (apt)Dr. Satyanarayan Pandey

Ã˝

The document discusses the Arbitrage Pricing Theory (APT), which assumes an asset's return depends on various macroeconomic, market, and security-specific factors. The APT model estimates the expected return of an asset based on its sensitivity to common risk factors like inflation, interest rates, and market indices. It was developed by Stephen Ross in 1976 as an alternative to the Capital Asset Pricing Model. The APT formula predicts an asset's return based on factor risk premiums and the asset's sensitivity to each factor.Pecking Order Theory - components

Pecking Order Theory - components Sundar B N

Ã˝

The pecking order theory suggests that firms prefer internal financing over external financing and debt over equity. Under this theory, firms will first use retained earnings to finance projects and needs before considering external funds. If additional funds are needed, firms will take on debt before issuing new equity. The pecking order theory is based on the ideas that internal funds are cheapest, debt is cheaper than equity, and managers have more information about their firm than outside investors.Bond valuation

Bond valuationshekhar sharma

Ã˝

The document discusses various bond valuation concepts like coupon rate, current yield, spot interest rate, yield to maturity, yield to call, and realized yield. It provides examples to calculate these measures and explains how bond prices are determined based on factors like interest rates, time to maturity, and cash flows. Bond duration is introduced as a measure of interest rate risk exposure, and bond risks from default and changes in interest rates are explained.ASSET ALLOCATION

ASSET ALLOCATION Shanson Shaji

Ã˝

Asset allocation involves dividing investments among different asset classes to reduce risk through diversification. The key steps are determining an appropriate risk profile based on goals and time horizon, then allocating funds across stocks, bonds, and other assets. The main strategies are strategic asset allocation, which assigns long-term weights, and tactical asset allocation, which allows short-term deviations. The optimal mix depends on an individual's risk tolerance and time horizon.Capital Asset pricing model- lec6

Capital Asset pricing model- lec6University of Balochistan

Ã˝

Capital asset pricing model, risk return, beta, variance, standard deviation, assumption of model, implication of the modelCost of capital

Cost of capitalNirmal PR

Ã˝

The document discusses the cost of capital, which is the rate of return a firm requires to increase its market value. It has three components: return at zero risk, business risk premium, and financial risk premium. Cost of capital is classified as historical vs future, specific vs composite, average vs marginal, and explicit vs implicit. Specific costs include cost of debt, preference shares, equity shares, and retained earnings. Composite cost is the weighted average cost of different sources. Cost of capital is computed using book value weights or market value weights to determine the weighted average cost of capital (WACC).Cost of capital ppt

Cost of capital pptRICHA BHUSHAN

Ã˝

The document defines the cost of capital as the minimum required rate of return on invested funds. It discusses how the cost of capital is helpful for capital budgeting and structure decisions. It then outlines the different components of cost of capital - cost of debt, preferred shares, equity shares, and retained earnings. Various formulas are provided for calculating the costs of redeemable and irredeemable debt, preferred shares, and equity shares. The cost of retained earnings is said to equal the cost of equity shares.Options contract

Options contractShamsudeen Tukur

Ã˝

This document defines and explains options contracts. It discusses that an options contract is an agreement that gives the buyer the right, but not the obligation, to buy or sell an asset at a future date at an agreed upon price. It outlines key features of options contracts including the underlying instrument, contract size, premium, strike price, and expiration date. It also defines put and call options and discusses concepts like moneyness, intrinsic and time value, and examples of calculating these values. Finally, it covers advantages like making money and hedging risk, and disadvantages like options being a wasting asset and complexity.BONDS, BOND VALUATION, AND INTEREST RATES

BONDS, BOND VALUATION, AND INTEREST RATESSalah A. Skaik - MBA-PMP®

Ã˝

This document discusses key topics related to bonds, bond valuation, and interest rates. It begins by outlining topics that will be covered in the chapter, including who issues bonds, bond characteristics, bond valuation, and determinants of market interest rates. The document then defines what a bond is and provides examples of different bond classifications. Several key bond characteristics are defined, such as par value, coupon payment, maturity date, call provisions, and sinking funds. The document also discusses bond valuation methodology and how bond prices are affected by changes in market interest rates. It provides examples to illustrate these concepts. The remainder of the document covers additional topics like bonds with semiannual coupons and different methods for calculating bond yields.Secondary market ppt

Secondary market pptDharmik

Ã˝

The document discusses key aspects of secondary markets. It defines secondary markets as markets where securities are traded after being initially offered to the public in primary markets. The majority of trading occurs in secondary markets, which comprise equity and debt markets. Secondary markets offer both sellers and buyers advantages, such as sellers recouping a portion of the original purchase price, though they can also reduce sales for original sellers. Key products traded in secondary markets include equity shares, government securities, debentures, and bonds.Risk And Return

Risk And ReturnAl Razaq Muhammad

Ã˝

The document discusses the relationship between risk and return when investing. It states that there is a trade-off between expected risk and expected return, with higher risk investments typically offering higher returns to compensate investors for taking on more risk. It also discusses how diversification across multiple assets can reduce the non-systematic/diversifiable risk in a portfolio, but not the systematic/market risk that is related to movements in the overall market. The document defines beta as a measure of a stock's systematic risk relative to the market.6. bond valuation

6. bond valuationAfiqEfendy Zaen

Ã˝

The document summarizes key concepts about bonds from Chapter 7. It defines different types of bonds like debentures, mortgage bonds, and convertible bonds. It also explains important bond terminology such as par value, coupon interest rate, maturity, and bond ratings. Finally, it discusses methods of valuing bonds and factors that influence their value and ratings.Stock Valuation

Stock ValuationBimarsh Giri

Ã˝

The presentation slide is on stock valuation. We have tried to present the various techniques to stock valuation under which different methods are discussed with illustrations. Key concepts:

Zero Growth Model

Balance sheet Technique

Constant Growth Model

Two-stage growth Model

Feel Free to comment.Portfolio selection final

Portfolio selection finalsumit payal

Ã˝

1. The document discusses portfolio selection using the Markowitz model.

2. The Markowitz model aims to find the optimal portfolio, which provides the highest return and lowest risk. It does this by analyzing different combinations of securities to identify efficient portfolios.

3. The document provides details on the tools and steps used in the Markowitz model for portfolio selection, including analyzing expected returns, variance, standard deviation, and coefficients of correlation between securities.Forfaiting

Forfaiting17791

Ã˝

Forfaiting is a mechanism where an exporter's rights to export receivables such as letters of credit or bills of exchange are purchased by a financial intermediary called a forfaiter without recourse to the exporter. This converts the exporter's credit sale into a cash sale, absolving the exporter of political or conversion risks while providing up to 100% financing without recourse. The key parties involved are the exporter, importer, forfaiting agency which is typically the exporter's bank, the importer's guaranteeing bank, and domestic export-import banks. Forfaiting provides liquidity to exporters, fixes the financing rate, and keeps the transactions confidential.Investment Analysis and Portfolio Management

Investment Analysis and Portfolio ManagementBabasab Patil

Ã˝

This document summarizes key points about investment analysis and portfolio management. It discusses the module website resources, gains and losses from past investments, markets and security types, brokers, returns and risks, and the investment process. The essential topics covered are types of markets and securities, factors that influence investment returns and risks, and the basic steps in analyzing investments and constructing a portfolio.Financial derivatives ppt

Financial derivatives pptVaishnaviSavant

Ã˝

A derivative is a financial instrument whose value is derived from the value of another asset, known as the underlying. There are three main types of traders in the derivatives market: hedgers who use derivatives to reduce risk, speculators who trade for profits, and arbitrageurs who take advantage of price discrepancies across markets. Derivatives can be traded over-the-counter (OTC) or on an exchange, and provide various economic benefits such as risk reduction and enhanced market liquidity.Formula Plan in Securities Analysis and Port folio Management

Formula Plan in Securities Analysis and Port folio ManagementSuryadipta Dutta

Ã˝

This document discusses different types of formula plans for portfolio management. It introduces constant ratio plans, variable ratio plans, and constant rupee value plans. Constant ratio plans maintain a fixed ratio between aggressive and defensive portfolios. Variable ratio plans adjust the ratio based on market price fluctuations. Constant rupee value plans force selling when prices rise and buying when they fall to maintain a constant rupee value of the aggressive portfolio. Formula plans provide rules for buying and selling securities and help investors make better use of market fluctuations.motive for holding cash

motive for holding cashsanju Sanjupc90

Ã˝

This document discusses the different motives for holding cash in a business, including the transaction motive, precautionary motive, and speculative motive. The transaction motive refers to needing cash for day-to-day operations like purchases, expenses, taxes, and dividends. The precautionary motive means holding cash in reserve for contingencies like floods, strikes, slow collections, or increases in costs. The speculative motive refers to holding cash for investing in profitable opportunities as they arise, such as anticipated price declines or interest rate changes.Securities market

Securities marketPrabhakar Murugesan

Ã˝

The document discusses various aspects of securities markets and financial markets. It describes the key components and participants in primary and secondary markets. The primary market, also called the new issue market, deals with the initial sale of new securities to investors. Major functions of the primary market include origination, underwriting, and distribution of new securities issues. Common methods to float new issues include public issues, rights issues, and private placements. The secondary market provides for the trading of previously-issued securities among investors.Portfolio selection, markowitz model

Portfolio selection, markowitz modelaarthi ramakrishnan

Ã˝

PORTFOLIO, financial assets, Physical Assets, investment purpose, maximize his returns, and minimize the risk, optimal portfolio., MARKOWITZ MODEL, statistical procedures, risk-return tradeoff, return on investment, risk-averse., monetary inflow, variance of return, efficient frontier, Investment objective, portfolio manager, DIVERSIFICATION, consistent return, Lower risk, portfolio, securities by industry, Systematic risk, unsystematic risk, riskless borrowing, preference for returninterest rate parity

interest rate parityvijukrish

Ã˝

This document discusses interest rate parity theory. It begins by defining spot and forward rates. Spot rates are prices for immediate settlement, while forward rates refer to rates for future currency delivery adjusted for cost of carry. Interest rate parity theory states that interest rate differentials between currencies will be reflected in forward premiums or discounts. The theory prevents arbitrage opportunities by making returns equal whether investing domestically or abroad when measured in the home currency. The document provides an example of covered and uncovered interest rate parity. Covered parity involves hedging exchange rate risk while uncovered parity does not. Empirical evidence shows uncovered parity often fails while covered parity generally holds for major currencies over short time horizons.valuation of bonds and share

valuation of bonds and sharePANKAJ PANDEY

Ã˝

This chapter discusses the valuation of bonds and shares. It explains the characteristics of different types of bonds and shares and how to value them using present value concepts. The chapter focuses on the linkage between share values, earnings, and dividends. It also covers bond valuation, including the impact of interest rate changes on bond prices. Credit ratings help assess the default risk of different bonds.Portfolio management ppt

Portfolio management pptJiyas K

Ã˝

Portfolio management is a process that aims to optimize investment returns while reducing risk. It involves five phases: security analysis, portfolio analysis, portfolio selection, portfolio revision, and portfolio evaluation. The security analysis phase involves classifying and examining individual securities. Portfolio analysis identifies possible portfolio combinations and assesses their risks and returns. The optimal portfolio is then selected during the portfolio selection phase. Portfolio revision makes changes due to funds or risk adjustments. Finally, portfolio evaluation compares objectives and performance to improve the process.Financial Derivatives and Options

Financial Derivatives and OptionsVincent Wedelich, PE MBA

Ã˝

This document summarizes information about financial derivatives, with a focus on options. It defines key terms like forwards, futures, swaps, and provides details on call and put options. It explains how options work, including factors that influence pricing and examples of trading options on exchanges. The document also discusses an example where some option traders profited from their positions before an announcement that News Corp was offering to buy Dow Jones & Co. for $60 per share, sending the stock price up 50%. It concludes with some option strategies and examples of financial engineering techniques.Stock Valuation

Stock ValuationHarish Lunani

Ã˝

The document discusses various methods for valuing common stock, including calculating the present value of future dividends using the dividend discount model. It outlines three cases for the pattern of future dividends: zero growth, constant growth, and non-constant growth. Key valuation formulas and an example are provided. Additional stock features and components of the required return such as the dividend yield and capital gains yield are also examined.Contingent Convertible Bonds

Contingent Convertible BondsCRISIL Limited

Ã˝

Contingent convertible (CoCo) bond issuance has exceeded $20 billion annually since 2012. CoCo bonds can absorb losses when a bank's capital falls below certain levels. While CoCo bonds are an evolving asset class, regulations like the EU's CRD IV will recognize them as additional tier 1 capital. Valuation challenges exist due to unique bond features and lack of market data. Risks include uncertainty around triggers, pricing dependence on models, and rollover risks near maturity.Arbitrage value of convertible bonds

Arbitrage value of convertible bondsPhilip Corsano

Ã˝

This document discusses convertible bonds and their valuation. It begins by covering Modigliani & Miller's propositions on capital structure and the irrelevance of capital structure absent taxes. It then discusses how taxes create value from leverage through interest tax shields. Various pricing models for convertible bonds are presented, including the Black-Scholes model. The document also discusses hedging strategies using convertible bonds and their associated Greeks.More Related Content

What's hot (20)

Cost of capital ppt

Cost of capital pptRICHA BHUSHAN

Ã˝

The document defines the cost of capital as the minimum required rate of return on invested funds. It discusses how the cost of capital is helpful for capital budgeting and structure decisions. It then outlines the different components of cost of capital - cost of debt, preferred shares, equity shares, and retained earnings. Various formulas are provided for calculating the costs of redeemable and irredeemable debt, preferred shares, and equity shares. The cost of retained earnings is said to equal the cost of equity shares.Options contract

Options contractShamsudeen Tukur

Ã˝

This document defines and explains options contracts. It discusses that an options contract is an agreement that gives the buyer the right, but not the obligation, to buy or sell an asset at a future date at an agreed upon price. It outlines key features of options contracts including the underlying instrument, contract size, premium, strike price, and expiration date. It also defines put and call options and discusses concepts like moneyness, intrinsic and time value, and examples of calculating these values. Finally, it covers advantages like making money and hedging risk, and disadvantages like options being a wasting asset and complexity.BONDS, BOND VALUATION, AND INTEREST RATES

BONDS, BOND VALUATION, AND INTEREST RATESSalah A. Skaik - MBA-PMP®

Ã˝

This document discusses key topics related to bonds, bond valuation, and interest rates. It begins by outlining topics that will be covered in the chapter, including who issues bonds, bond characteristics, bond valuation, and determinants of market interest rates. The document then defines what a bond is and provides examples of different bond classifications. Several key bond characteristics are defined, such as par value, coupon payment, maturity date, call provisions, and sinking funds. The document also discusses bond valuation methodology and how bond prices are affected by changes in market interest rates. It provides examples to illustrate these concepts. The remainder of the document covers additional topics like bonds with semiannual coupons and different methods for calculating bond yields.Secondary market ppt

Secondary market pptDharmik

Ã˝

The document discusses key aspects of secondary markets. It defines secondary markets as markets where securities are traded after being initially offered to the public in primary markets. The majority of trading occurs in secondary markets, which comprise equity and debt markets. Secondary markets offer both sellers and buyers advantages, such as sellers recouping a portion of the original purchase price, though they can also reduce sales for original sellers. Key products traded in secondary markets include equity shares, government securities, debentures, and bonds.Risk And Return

Risk And ReturnAl Razaq Muhammad

Ã˝

The document discusses the relationship between risk and return when investing. It states that there is a trade-off between expected risk and expected return, with higher risk investments typically offering higher returns to compensate investors for taking on more risk. It also discusses how diversification across multiple assets can reduce the non-systematic/diversifiable risk in a portfolio, but not the systematic/market risk that is related to movements in the overall market. The document defines beta as a measure of a stock's systematic risk relative to the market.6. bond valuation

6. bond valuationAfiqEfendy Zaen

Ã˝

The document summarizes key concepts about bonds from Chapter 7. It defines different types of bonds like debentures, mortgage bonds, and convertible bonds. It also explains important bond terminology such as par value, coupon interest rate, maturity, and bond ratings. Finally, it discusses methods of valuing bonds and factors that influence their value and ratings.Stock Valuation

Stock ValuationBimarsh Giri

Ã˝

The presentation slide is on stock valuation. We have tried to present the various techniques to stock valuation under which different methods are discussed with illustrations. Key concepts:

Zero Growth Model

Balance sheet Technique

Constant Growth Model

Two-stage growth Model

Feel Free to comment.Portfolio selection final

Portfolio selection finalsumit payal

Ã˝

1. The document discusses portfolio selection using the Markowitz model.

2. The Markowitz model aims to find the optimal portfolio, which provides the highest return and lowest risk. It does this by analyzing different combinations of securities to identify efficient portfolios.

3. The document provides details on the tools and steps used in the Markowitz model for portfolio selection, including analyzing expected returns, variance, standard deviation, and coefficients of correlation between securities.Forfaiting

Forfaiting17791

Ã˝

Forfaiting is a mechanism where an exporter's rights to export receivables such as letters of credit or bills of exchange are purchased by a financial intermediary called a forfaiter without recourse to the exporter. This converts the exporter's credit sale into a cash sale, absolving the exporter of political or conversion risks while providing up to 100% financing without recourse. The key parties involved are the exporter, importer, forfaiting agency which is typically the exporter's bank, the importer's guaranteeing bank, and domestic export-import banks. Forfaiting provides liquidity to exporters, fixes the financing rate, and keeps the transactions confidential.Investment Analysis and Portfolio Management

Investment Analysis and Portfolio ManagementBabasab Patil

Ã˝

This document summarizes key points about investment analysis and portfolio management. It discusses the module website resources, gains and losses from past investments, markets and security types, brokers, returns and risks, and the investment process. The essential topics covered are types of markets and securities, factors that influence investment returns and risks, and the basic steps in analyzing investments and constructing a portfolio.Financial derivatives ppt

Financial derivatives pptVaishnaviSavant

Ã˝

A derivative is a financial instrument whose value is derived from the value of another asset, known as the underlying. There are three main types of traders in the derivatives market: hedgers who use derivatives to reduce risk, speculators who trade for profits, and arbitrageurs who take advantage of price discrepancies across markets. Derivatives can be traded over-the-counter (OTC) or on an exchange, and provide various economic benefits such as risk reduction and enhanced market liquidity.Formula Plan in Securities Analysis and Port folio Management

Formula Plan in Securities Analysis and Port folio ManagementSuryadipta Dutta

Ã˝

This document discusses different types of formula plans for portfolio management. It introduces constant ratio plans, variable ratio plans, and constant rupee value plans. Constant ratio plans maintain a fixed ratio between aggressive and defensive portfolios. Variable ratio plans adjust the ratio based on market price fluctuations. Constant rupee value plans force selling when prices rise and buying when they fall to maintain a constant rupee value of the aggressive portfolio. Formula plans provide rules for buying and selling securities and help investors make better use of market fluctuations.motive for holding cash

motive for holding cashsanju Sanjupc90

Ã˝

This document discusses the different motives for holding cash in a business, including the transaction motive, precautionary motive, and speculative motive. The transaction motive refers to needing cash for day-to-day operations like purchases, expenses, taxes, and dividends. The precautionary motive means holding cash in reserve for contingencies like floods, strikes, slow collections, or increases in costs. The speculative motive refers to holding cash for investing in profitable opportunities as they arise, such as anticipated price declines or interest rate changes.Securities market

Securities marketPrabhakar Murugesan

Ã˝

The document discusses various aspects of securities markets and financial markets. It describes the key components and participants in primary and secondary markets. The primary market, also called the new issue market, deals with the initial sale of new securities to investors. Major functions of the primary market include origination, underwriting, and distribution of new securities issues. Common methods to float new issues include public issues, rights issues, and private placements. The secondary market provides for the trading of previously-issued securities among investors.Portfolio selection, markowitz model

Portfolio selection, markowitz modelaarthi ramakrishnan

Ã˝

PORTFOLIO, financial assets, Physical Assets, investment purpose, maximize his returns, and minimize the risk, optimal portfolio., MARKOWITZ MODEL, statistical procedures, risk-return tradeoff, return on investment, risk-averse., monetary inflow, variance of return, efficient frontier, Investment objective, portfolio manager, DIVERSIFICATION, consistent return, Lower risk, portfolio, securities by industry, Systematic risk, unsystematic risk, riskless borrowing, preference for returninterest rate parity

interest rate parityvijukrish

Ã˝

This document discusses interest rate parity theory. It begins by defining spot and forward rates. Spot rates are prices for immediate settlement, while forward rates refer to rates for future currency delivery adjusted for cost of carry. Interest rate parity theory states that interest rate differentials between currencies will be reflected in forward premiums or discounts. The theory prevents arbitrage opportunities by making returns equal whether investing domestically or abroad when measured in the home currency. The document provides an example of covered and uncovered interest rate parity. Covered parity involves hedging exchange rate risk while uncovered parity does not. Empirical evidence shows uncovered parity often fails while covered parity generally holds for major currencies over short time horizons.valuation of bonds and share

valuation of bonds and sharePANKAJ PANDEY

Ã˝

This chapter discusses the valuation of bonds and shares. It explains the characteristics of different types of bonds and shares and how to value them using present value concepts. The chapter focuses on the linkage between share values, earnings, and dividends. It also covers bond valuation, including the impact of interest rate changes on bond prices. Credit ratings help assess the default risk of different bonds.Portfolio management ppt

Portfolio management pptJiyas K

Ã˝

Portfolio management is a process that aims to optimize investment returns while reducing risk. It involves five phases: security analysis, portfolio analysis, portfolio selection, portfolio revision, and portfolio evaluation. The security analysis phase involves classifying and examining individual securities. Portfolio analysis identifies possible portfolio combinations and assesses their risks and returns. The optimal portfolio is then selected during the portfolio selection phase. Portfolio revision makes changes due to funds or risk adjustments. Finally, portfolio evaluation compares objectives and performance to improve the process.Financial Derivatives and Options

Financial Derivatives and OptionsVincent Wedelich, PE MBA

Ã˝

This document summarizes information about financial derivatives, with a focus on options. It defines key terms like forwards, futures, swaps, and provides details on call and put options. It explains how options work, including factors that influence pricing and examples of trading options on exchanges. The document also discusses an example where some option traders profited from their positions before an announcement that News Corp was offering to buy Dow Jones & Co. for $60 per share, sending the stock price up 50%. It concludes with some option strategies and examples of financial engineering techniques.Stock Valuation

Stock ValuationHarish Lunani

Ã˝

The document discusses various methods for valuing common stock, including calculating the present value of future dividends using the dividend discount model. It outlines three cases for the pattern of future dividends: zero growth, constant growth, and non-constant growth. Key valuation formulas and an example are provided. Additional stock features and components of the required return such as the dividend yield and capital gains yield are also examined.Viewers also liked (6)

Contingent Convertible Bonds

Contingent Convertible BondsCRISIL Limited

Ã˝

Contingent convertible (CoCo) bond issuance has exceeded $20 billion annually since 2012. CoCo bonds can absorb losses when a bank's capital falls below certain levels. While CoCo bonds are an evolving asset class, regulations like the EU's CRD IV will recognize them as additional tier 1 capital. Valuation challenges exist due to unique bond features and lack of market data. Risks include uncertainty around triggers, pricing dependence on models, and rollover risks near maturity.Arbitrage value of convertible bonds

Arbitrage value of convertible bondsPhilip Corsano

Ã˝

This document discusses convertible bonds and their valuation. It begins by covering Modigliani & Miller's propositions on capital structure and the irrelevance of capital structure absent taxes. It then discusses how taxes create value from leverage through interest tax shields. Various pricing models for convertible bonds are presented, including the Black-Scholes model. The document also discusses hedging strategies using convertible bonds and their associated Greeks.The Case for Contingent Convertible Debt for Sovereigns

The Case for Contingent Convertible Debt for SovereignsStavros A. Zenios

Ã˝

Presentation at Bank of England of the sovereign contingent debt design.

Full paper posted here http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2694973

Policy column posted at VoxEU http://www.voxeu.org/article/sovereign-contingent-debt-proposalConvertible Bond Arbitrage| ArbitragePortfolio.com

Convertible Bond Arbitrage| ArbitragePortfolio.comLEADHACKS | DESIGNATION

Ã˝

Free Application Download: http://www.arbitrageportfolio.com/Convertible-Bond-Arbitrage-Calculator.xlsx

Full Article: http://www.arbitrageportfolio.com/convertible-bond-arbitrage/Convertible Basics

Convertible Basicssai karry

Ã˝

This document provides an overview of convertible bonds, including:

- Convertible bonds offer bond-like coupon payments but also allow conversion to equity, giving bondholders choice.

- Terminology around conversion ratios, prices, and premiums is explained.

- Convertible bonds take on characteristics of bonds or equities depending on whether the underlying share price rises or falls.

- Various convertible bond structures are discussed, ranging from equity-like to debt-like.Rights Issue

Rights Issuekunalkrishna

Ã˝

The document discusses the costs and benefits of rights issues versus other forms of capital raising for banks. It provides details on why banks are raising capital, including improving leverage, recapitalizing balance sheets, funding growth, and meeting Basel II requirements. It then examines sources of capital such as equity financing through placements, rights issues, and open offers. The advantages of rights issues for existing shareholders are outlined, but disadvantages like high costs and dilution effects are also discussed. Alternatives like sovereign wealth funds and asset sales are mentioned. Overall rights issues are concluded to be the best method when large quantities of capital are needed and market conditions hamper debt raising.Similar to CONVERTIBLE BOND (20)

8 (1).ppt

8 (1).pptShamitShetty

Ã˝

This document discusses various topics related to bond portfolio management including:

- Types of straight bonds such as callable and putable bonds

- Bond pricing formulas and how bond prices are affected by factors like yield to maturity, coupon rate, and time to maturity

- Active and passive portfolio strategies for managing bond portfolios including duration matching and immunization techniques

- Bond concepts like premium and discount bonds, yield measures, and interest rate riskSources of capital/ Cost of Capital

Sources of capital/ Cost of Capital Joshua Obeng Boadi

Ã˝

the cost of capital of a company describes the return expected by creditors of funds to companies. It includes the cost of equity, debt, hybrid and WACCValuation of bonds

Valuation of bondsvinvns

Ã˝

Bonds and shares can be valued using various approaches such as book value, replacement value, liquidation value, and market value. Bond values are determined by factors like face value, interest rate, maturity, redemption value, and market yield. The yield to maturity considers interest payments and capital gains/losses, while current yield only considers annual interest. Duration measures a bond's price sensitivity to interest rate changes. The term structure of interest rates, as shown by the yield curve, can be normal upward sloping or inverted. The expectation, liquidity premium, and segmented markets theories seek to explain the typical upward sloping yield curve. Credit ratings factor in default risk.2. bond valuation_and_interest_rates

2. bond valuation_and_interest_ratesEzgi Kurt

Ã˝

This document provides an overview of bond valuation and the structure of interest rates. It defines key bond concepts like yield to maturity, effective annual yield, and bond price calculation. It also discusses how bond prices are affected by interest rate changes and risk characteristics like default risk, call provisions, and term to maturity. The shape of the yield curve is determined by the real interest rate, expected inflation, and interest rate risk premium.417Chapter 04

417Chapter 04Rena Krouse

Ã˝

This document discusses mutual funds and other managed investments. It defines mutual funds as investment vehicles that pool money from shareholders to invest in a portfolio of stocks, bonds, and other securities. The document outlines how mutual fund performance is measured by changes in their net asset value per share. It also describes the various fees and expenses associated with mutual funds and factors investors should consider, such as loads, management fees, and portfolio turnover. The document compares mutual funds to other investment vehicles like closed-end funds, exchange-traded funds, and variable annuities.Unit-3Lec-8.pptx business student project report

Unit-3Lec-8.pptx business student project reportRohitGuleria14

Ã˝

business proj ppt for business studentPortfolio revision and evaluation

Portfolio revision and evaluationaarthi ramakrishnan

Ã˝

Portfolio revision, securities, New securities, existing securities, purchases and sales of securities, maximizing the return, minimizing the risk, Transaction cost, Taxes, Statutory stipulations, Intrinsic difficulty, commission and brokerage, push up transaction costs, reducing the gains, constraint, Taxes, capital gains, long-term capital, lower rate, Frequent sales, short-term capital gains, investment companies, constraints, established, objectives, skill, resources and time, substantial adjustments, mispriced, excess returns, heterogeneous expectations, better estimates, generate excess returns, market efficiency, little incentive, predetermined rules, changes in the securities market, Performance measurement, Performance evaluation, superior or inferior, small investors, better performance, prompt liquidity, comparative performance, purchase and sale of securities.bonds.ppt

bonds.pptJRajeshNSUJamshedpur

Ã˝

Bond prices are determined by evaluating the expected cash flows of the bond discounted at the yield to maturity. The yield to maturity incorporates the interest payments and expected capital gains or losses. Bonds with higher yields have higher risks. Duration is an important measure of bond risk as it indicates how sensitive the bond price will be to changes in interest rates. Investors must consider factors like bond type, yield, and duration when choosing bonds for their portfolio.Investment Securities. alternatives & attributes

Investment Securities. alternatives & attributesASAD ALI

Ã˝

This document discusses investment alternatives and their attributes. It describes direct and indirect investing. Direct investing includes non-marketable assets like savings deposits and money market securities like T-bills. Capital market securities include fixed income bonds and equity securities like stocks. Indirect investing is through investment companies like mutual funds. The document also discusses different types of stocks and attributes investors should consider like risk, return, marketability and taxes to evaluate investments.Lecture 9 - Stocks (1).pptx

Lecture 9 - Stocks (1).pptxJakaZhusubalieva

Ã˝

Common stock represents ownership in a corporation and gives shareholders voting rights and a claim on profits. Preferred stock has a senior claim to earnings and assets over common stock. It pays a fixed dividend that must be paid before common dividends. Stocks are valued based on expected future cash flows like dividends. The Gordon model values stocks assuming constant dividend growth over time as P0 = D1 / (rs - g), where D1 is next period's dividend, rs is the required rate of return, and g is the constant dividend growth rate.L3.pptx

L3.pptxMsSanaAmjad

Ã˝

he financing decision is a strategic process that involves evaluating different sources of capital, considering their costs and risks, and determining the optimal mix to achieve the company's financial objectives.Cost of capital

Cost of capitalSaurabh Verma

Ã˝

Cost of Capital,Meaning,Computation of Specific Costs,Cost of Debt,Cost of Preference Shares,Cost of Equity Capital,Cost of Retained Earnings ,Weighted Average Cost of CapitalSECTION IV - CHAPTER 22 - Equities

SECTION IV - CHAPTER 22 - EquitiesProfessional Training Academy

Ã˝

Equities represent ownership in a company through shares of stock. When a company issues stock, it receives money in exchange that it can use for operations or expansion. In turn, stockholders receive potential benefits like capital gains if the stock price increases, dividends, and voting rights. Technical analysts examine factors like price, volume, market capitalization and corporate actions to evaluate individual stocks and sectors.Investment Securities

Investment SecuritiesASAD ALI

Ã˝

Securities that are purchased in order to be held for investment. This is in contrast to securities that are purchased by a broker-dealer or other intermediary for resale. Banks often purchase marketable securities to hold in their portfolios. 9 dan 10 Intepreting Financial Statement and Marketing Decision.pdf

9 dan 10 Intepreting Financial Statement and Marketing Decision.pdfBambangPamungkas32

Ã˝

Pembelajaran Ilmu Akutansi Untuk ManajerSECTION IV - CHAPTER 21 - Market Instruments , Data & The Technical Analyst

SECTION IV - CHAPTER 21 - Market Instruments , Data & The Technical AnalystProfessional Training Academy

Ã˝

This document provides an overview of equities (stocks) including:

- Equities represent ownership in a company after debts are paid off and include benefits like capital gains, dividends, and voting rights.

- Common types of equities include warrants, preferred stocks, and convertible bonds.

- Corporate actions like stock splits, dividends, and secondary offerings impact stock holders.

- Technical analysts examine factors like price, volume, market capitalization to evaluate stocks.

- Markets can be segmented by sector, company size, geography and other criteria for analysis.Ch 03

Ch 03kpserver

Ã˝

This chapter discusses the valuation of bonds and shares. It explains the characteristics of ordinary shares, preference shares, and bonds. It shows how present value concepts are used to value these securities. The chapter focuses on the price-earnings ratio and its proper and improper uses in valuation. It also covers the determinants of bond values such as maturity, yield to maturity, current yield, and sensitivity to interest rate changes.Mutual fund

Mutual fundProfessional Training Academy

Ã˝

Mutual funds pool money from many investors and invest it in stocks, bonds, and other securities. They are professionally managed collective investment schemes. In India, there are over 1000 mutual fund schemes from 44 companies with over Rs. 5 lakh crore in assets under management. Mutual funds have a sponsor, trustees to ensure rules are followed, and an asset management company that does the investing. They offer various types of funds across equity, debt, and hybrid categories for different investment needs and risk appetites.Meeting 4 - Valuation Market Ratios (Financial Reporting and Analysis)

Meeting 4 - Valuation Market Ratios (Financial Reporting and Analysis)Albina Gaisina

Ã˝

This document discusses various valuation market ratios used to evaluate companies, including earnings per share (EPS), dividend per share (DPS), dividend payout ratio, dividend yield, price to earnings (P/E) ratio, and market to book value ratio. It provides the formulas and explanations for how to calculate and interpret each ratio. Key points include that dividends are reported on the statement of cash flows and statement of changes in stockholders' equity, and that ratios should only be used to compare companies within the same industry due to differences in business models and growth rates across sectors.equity valuation CH 5.pptx

equity valuation CH 5.pptxhenokmetaferia1

Ã˝

This document outlines various methods for valuing stocks and equity, including:

1) Balance sheet valuation methods like book value, liquidation value, and replacement cost.

2) Dividend discount models that value a stock based on the present value of expected future dividends.

3) Free cash flow models that value a company based on the present value of expected future free cash flows discounted at the weighted average cost of capital.

4) Earnings multiplier approaches that value stocks based on price-to-earnings or enterprise value-to-EBITDA multiples.SECTION IV - CHAPTER 21 - Market Instruments , Data & The Technical Analyst

SECTION IV - CHAPTER 21 - Market Instruments , Data & The Technical AnalystProfessional Training Academy

Ã˝

CONVERTIBLE BOND

- 1. CONVERTIBLE BOND • Convertible bond have been issued and traded since 1880s • A convertible bond is a bond that can be converted into a predetermined amount of the company's equity at certain times during its life, usually at the discretion of the bondholder. • Convertible bonds, or converts, give the holder the option to exchange the bond for a predetermined number of shares in the issuing company.

- 2. • It is a hybrid security with debt and equity • A convertible bond typically has a coupon rate lower than that of similar non-convertible debt • The investor receives the potential upside of conversion into equity while protecting downside with cash flow from the coupon payments and the return of principal upon maturity • These properties lead naturally to the idea of convertible arbitrage, where a long position in the convertible bond is balanced by a short position in the underlying equity.

- 3. 3 Convertible bonds • Various features in convertible bonds • Issuance of convertibles - perspectives of corporate treasurers - conversion into shares - call (hard and soft provisions) - put - reset on conversion number . Decomposition of convertibles into different components • Valuation of convertibles - interest rate sensitivities (duration analysis) - binomial tree calculations

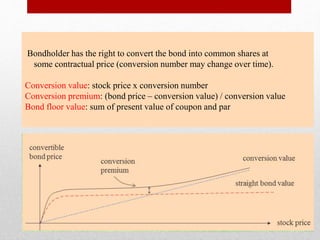

- 4. Bondholder has the right to convert the bond into common shares at some contractual price (conversion number may change over time). Conversion value: stock price x conversion number Conversion premium: (bond price – conversion value) / conversion value Bond floor value: sum of present value of coupon and par

- 5. 5 Analytics of convertible bonds figures (hypothetical figures) stock price $30.00 per share stock dividend $0.50 per share convertible market price $1,000 coupon rate 7.00% maturity 20 years conversion price $36.37 Stock dividend yield = annual dividend rate / current stock price = $0.50 / $30.00 = 1.67%

- 6. 6 Conversion ratio = number of shares for which one bond may be exchanged = par / conversion price = $1,000 / $36.37 = 27.50 shares Conversion value = equity value or stock value of the convertible = stock price x conversion ratio = $30.00 x 27.50 = $825.00 Conversion premium = (convertible price – conversion value) / conversion value = ($1,000 – $825) / $825.00 = 21.21%

- 7. 7 Types of companies as convertible issuers Companies that are characterized by strong performing, high- visibility, sub-investment grade, high-growth potential have comparative advantage in the convertible market versus the fixed income market. • They lack a long-term track record and have volatile capital structures – high coupon must be offered. • They can transform the high volatility into a benefit since the warrant is more expensive. • When the company grows, they may call the bonds. This in turn will strengthen the company’s equity base at the moment when it is most needed.

- 8. Analysis of a convertible bond • Conversion value • Minimum value of a convertible bond • Market conversion price • Market conversion premium per share • Market conversion premium ratio • Downside risk with a convertible bond • Upside potential of a convertible bond