Corn copi finance eng

- 1. Key forecast indicators and financial benchmarks (all sums are indicated in US dollars, according to the current market price, with the rounding upwards, the amplitude does not exceed 10%)

- 2. 1)Investmentandexpenditures Ð) INITIAL STAGE Start-up investments for beginning the activity: 1. Registration of the company (depending on the jurisdiction and its features), TM, intellectual property, servers, permits and licensing documentation, other legal issues - approximately between $ 10 000 and $ 30 000 2. Office rent (initial payments, guarantee) - $ 60,000 3. Purchase of necessary equipment (laptops, furniture, routers, office and stationery stuff, etc.) - $ 100,000 4. Creating of Identity, corporate style, site and original graphic materials of the company - $ 10,000 (in the case of starting the activity before the recruitment of skillful workers)

- 3. 1)Investmentandexpenditures 5. Creation of the beta- prototype of the IT platform and mobile application - $ 50,000 (approximate and initial cost of the base version) 6. Start-up communication and investment and fundraising campaign - $ 250,000 (promotional tours, video-rollicks, road shows for investors and donors, participation in international events and exhibitions, PR activities, etc.) 7. Other (small decoration stuff, transport, unpredictable expenditures, etc.) - $ 10 000 -$ 30 000 8. Investments for providing annual full-fledged office activity + 6 months additionally as "financial security pillow" (be used only in the case of necessary conditions, in the planned scenario â would be used as an additional share capital):

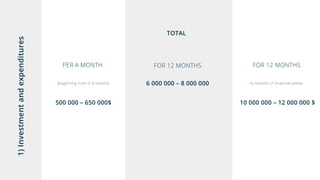

- 4. 1)Investmentandexpenditures B) PERMANENT OPERATING EXPENSES (PER A MONTH): - Office rent and related expenditures (utility and operating payments) - $ 20 000 - $ 30 000 - Development and support of the IT platform â $20 000 - $ 50 000 - Tax payments and other financial obligations (depending upon income, excluding taxes on FOPs (Man enterpreuner) and credit payments - they should be close to zero) - $ 10 000 - $ 30 000

- 5. 1)Investmentandexpenditures - The team salary (gross, together with taxes and all other additional charges, the specified average level of sallary for each work-position is indicated). From the beginning, due to appropriate structure for 2-4 months from the beginning of the companysâ activity, with a gradual increase to the specified number:

- 6. 1)Investmentandexpenditures ÐĄÐÐ: COO (Executive / Operational Director): Technical & Product Director: ÐĄÐÐ: Communications and CSR Director: Chief Financial Officer: Director for Development and Global Expansion: GR director: IR director: HR Director: RD director (recruiting): Head of Legal Department: Director of Security Department: Director of the department of cooperation with partners (this definition will include also clients) 6 000$ 6 000$ 6 000$ 6 000$ 6 000$ 6 000$ 6 000$ 6 000$ 6 000$ 6 000$ 6 000$ 6 000$ 6 000$ 6 000$ Fundraiser : 3500$ Ņ 2 Investment Manager / Specialist of attracting venture capital, investment and loan capital: 4000$ Ņ 3 Technical / product experts: 4000$ Ņ 5 Partner / Client / Contract Manager: 4000$ Ņ 10 Experts for development, analysis and working on new markets / products: 4000$ Ņ 5 IT Professionals: 4000$ Ņ 5 7 000$ 12 000$ 20 000 40 000$ 20 000$ 20 000$

- 7. 1)Investmentandexpenditures System Administrator / Technical Support (support and maintenance both for the office and for the company's digital resources at the star-up activity, its IT platform, mobile application, CRM system and site, further monitoring of the performance of this function by the outsourcing company): 3500$ Ņ 4 PR & creative specialist including official speaker: 3500$ Ņ 3 Marketer (brand management, market analyst / customer / environment / product / services / perspectives / creative quality: 3500$ Ņ 2 SMM: 2500$ Ņ 2 Digital Marketing expert: 3500$ Ņ 2 Office Administrator: 1500$ Ņ 3 HR Manager: 3500$ Ņ 4 14 000$ 10 500$ 7 000$ 5 000$ 7 000$ 4 500$ 14 000$

- 8. 1)Investmentandexpenditures Accountant-manager: 3500$(ÐģÐūÐŧÐūÐēÐ―ÐļÐđ)+2500$ Writer/Copywriter (multilingual content, with translation function: 3000$ Ņ 2 Graphic designer and illustrator: 3500$ Ņ 2 Corporate photographer and video-production specialist (2 persons - shooting and installation, partly outsourced): 2500$ + 3500 + 3000 6 000$ 6 000$ 7 000$ 9 000$ Recruiter (including search / management options for freelancers involved and cloud solutions: 3500$ Ņ 3 Administrative manager (processing, purchases, quality control): 3500$ Ņ 3 Lawyer: 3500$ Ņ 3 Security officers (including cybersecurity): 3500$ + 3000$ + 3000$ 10 500$ 10 500$ 10 500$ 9 000$

- 9. 1)Investmentandexpenditures Together per a month, the Wages (Salary fund): Approximately $ 200,000 - $ 300,000 (we will count by the meridian model: 250,000 - since not all the staff will work from the beginning, the implementation of linear positions will be made step by step) (Total for 12 months: Approximately $ 3,000,000 Together for 12 months + 6 months of "financial pillow": approximately $ 5,000,000) With the development of the company and the emergence of new customers, the quantity of linear managers working with partners / consumers, IT and tech and product specialists will grow first of all. With the start of geographical expansion - the opening of additional branches - local offices in other countries / cities. In addition to wages, all employees will be additionally involved in the option program.

- 10. 1)Investmentandexpenditures - Communication and marketing activity (absence of ordered and paid materials, a resource for creating video-content, participation in exhibitions, organization of events, PR events, international attractions, representation expenses, work with the opinion of leaders, POS materials, etc. Of course, it is not obligatory to use the whole monthly budget, in the case of the moment we donât spend the monthly budget - funds are accumulated as a financial reserve). - $ 150,000 - Other (investments for the development and expansion of activities, contractors' fees, administrative expenses, telephone fees, business trips, bying office stuff, transport and representation expenses, unpredictable small payments, etc. Of course, it is not obligatory to use the whole monthly budget, in the case of the moment we donât spend the monthly budget - funds are accumulated as a financial reserve). - $ 150,000

- 11. 1)Investmentandexpenditures TOTAL PER A MONTH (beginning from 2-4 month): 500Ėý000 â 650Ėý000$ FOR 12 MONTHS +6 months of financial pillow: 10Ėý000Ėý000 â 12Ėý000Ėý000 $ FOR 12 MONTHS 6Ėý000Ėý000 â 8Ėý000 000

- 12. 1)Investmentandexpenditures Project activity On order to implement the project activity and products / services of the company to clients (roof power plants, charging, etc.) we should spend attracted grant or loan financing)

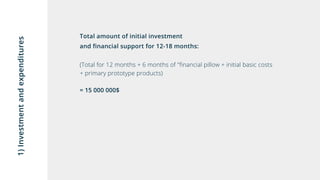

- 13. 1)Investmentandexpenditures 9. Cost of creating the first prototypes (due to exit plan, the exit and real projects should be financed by grant or credit money. But , we should take into consideration, we will implement the projects by share capital in the case of the most negative scenario. Just now, the cost of production of a single 1kW of electricity is about 1 thousand dollars, 1mW â approximately 1 million dollars. The cost of electricity storage systems is at the appropriate level. Very important moment - the cost of the needed components is constantly decreasing, which will increase the profitability of the products, but we will mentioned and calculate all numbers due to the most negative scenario (when they will not decrease, and the price of one kW will not increase, and group discount will be not take consideration); As an indicative prototype, we recommend to create 10-15 objects of different directions as the company's version of the product (accent on b2b, but also at least two working variants should be for the cottage, OTG, condominium apartments, united territorial community, apartments) with a total power of 1-3 mW, which means value of 2-5 millions of dollars. Cost of the charging station is 300-1000 dollars, depending upon the power, technical characteristics and brand (it is suggested to choose individually, under the owner of the electric car and his individual request). In the case of own generation / accumulation of 3-5 thousand, depending on power, it is proposed to create about 50-100 charging stations / complexes of each type, which together will cost a sum of 100-200 thousands dollars We need to spend $ 3-5 million together for the creation of primary products for consumers and existing prototypes ("show room" for potential investors and customers).

- 14. 1)Investmentandexpenditures Total amount of initial investment and financial support for 12-18 months: (Total for 12 months + 6 months of "financial pillow + initial basic costs + primary prototype products) = 15Ėý000Ėý000$

- 15. 2.Operatingincomeand profitabilityofthecompany Income: If we will choose Ukraine as a primary market for the company, then the current price of 1kW of electricity fluctuate from 0.03 to 0.08 dollars. We should mention that the price is higher for legal entities and the development of b2b direction is a priority. With a very high probability, it can be said about the growth of electricity and gas cost (in this case, electricity will be a serious competition for heating), but we will take into consider the most negative scenario, for which the cost of 1kW will not increase.

- 16. 2.Operatingincomeand profitabilityofthecompany Profitability and the EBITDA of the enterprises: Today, one 1 kW of installed generation will generate about 1000 KW / h per a year, depending upon the location and weather conditions and will bring about 50-100 dollars of income per year. Due to these data - 1 mW will earn 50-100 thousand dollars (with a tendency to a minor increase along with a power, because of reduced cost due to the effect of scale. Operating costs are minimal and will be covered by the cost of the equipment supplier (as an option to buy a lot and long-term work), or by the clientâs expense as a basic fixed subscription option and access to the IT platform with its solutions and options (depending on the size and kind of an object, it will be flexible) In order to increase the profitability of the company, fix its profitability and opportunities for intensive development and by the cost of donor funds involved in venture / equity capital (various stages, including IPOs) and / or interest-free loans Surely, just now it is the widespread and even trendy practical. In order to cover the basic operational monthly expenses of the company, we must operate facilities with a total capacity not less than - 100 mW (we take into consideration the smallest, most negative indicator of income from 1 mW, since we plan to deliver the service by 20% below the market value. In order to maintain the payback rate of fixed capital and maintain the profitability at the average annual level of 7-12%, the company has to develop exponentially, increasing its own power of at least 100 MW during the first 3 years, to at least 300 MW during the next two, and no less than 1 gW per year during the next 5 years. Electric charges will generate approximately from 15 till 40 dollars per customer per a month, it means - they will have a 3-4 year return on investments (ROI) with a further 20-35% EBITDA (but the share of this revenue will be no more than 10% total revenue and will be actually niche, related service) More detailed information about planned prices and service options are described in the document with the basic concept of the company.

- 17. 2.Operatingincomeand profitabilityofthecompany ROI period of investments: It will depend on both the sales structure / customer and the percentage of funds involved in the implementation of the donor financing, which will not require a refund. According to the conservative scenario, this term will last 8-12 years, for an optimistic 4-7 years.

- 18. 2.Operatingincomeand profitabilityofthecompany Forecast for the capitalization and cost of assets: It will consist of existing power, prevalence and popularity of the IT platform, brand value and other components (including additional services), but for the general understanding, we will use the most negative scenario when the company's value is deducted without multipliers and is actually equal to the available power. We plan that the company's own power (+ its assets) should be not less than 1 GVT in the period of 5-6 operationsâ years, the market capitalization should be not less than 1 000 000 000 $ (1 billion USD), therefore the planned rate of return on initial investment will be in a range of 3-10 times multiplicity over 6 years, or 50% -150% per a year.

- 19. 3.Additional,includingnon-marketfactorsfor themonetizationofthecompany'sactivitiesandrevenues. IT platform will bring the system's growing cash flow and profits in the period 3-4 years after the start of working. Also it will develop the better contact with its customers by expanding services, at significantly better service than electricity sales. Payments from corporations, cities and countries for emission reductions, contributions to decarbonising the economy, improving the quality of life, preserving the environment, reducing the level of illnesses, etc. can be a significant source of income. According to today's level, it may be the amount that doubles revenues. You can find more detailed information about these options and aspects in the document with the general concept of the company. Cofounder&Partner +38 067 501 78 20 kirill.patrick@gmail.com facebook.com/kirill.patrick linkedin.com/in/kirillpatrick