Cost accounting

- 2. Accountants define cost as a resource sacrificed or forgone to achieve a specific objective. A cost (such as direct materials or advertising) is usually measured as the monetary amount that must be paid to acquire goods or services.

- 3. Measures, analyzes and reports financial and non-financial information relating to the costs of acquiring or using recourses in an organization. For Example: Oil Refining. The process costing collects information about all costs during an accounting period and divides those costs by total quantity output

- 4. Following are the main elements involved in the manufacturing process where process costing method is adopted. ïą Direct Material ï§ Secondary Material ï§ Primary Material ïą Direct Labor ïą Direct Expenses ïą Production Overheads

- 5. The methods of costing refer to the techniques and processes employed in the ascertainment of costs. Many methods have been designed to suit the needs of different industries. These methods can be summarized as follows: It should be noted that two basic methods of costing are 1. Job costing 2. Process Costing

- 6. Cost Sheet is a presentation of cost data incorporating its various components in a systematic way. Cost Sheet or a cost statement is a document which provides for the assembly of the detailed cost of a cost Centre or cost unit.

- 7. ïą Fixation of Selling Price ïą Help in cost control ïą Cost ascertainment ïą Facilities the managerial decisions ïą Break-up of total cost by elements and sub-divisions

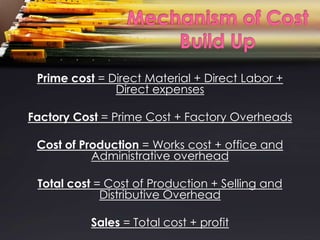

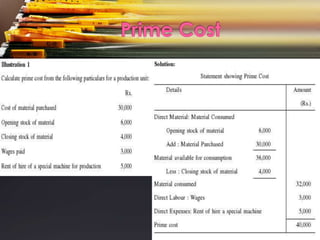

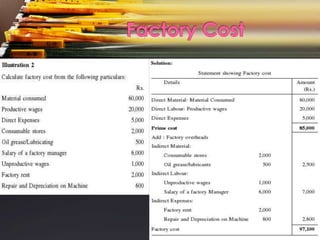

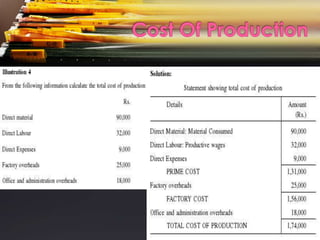

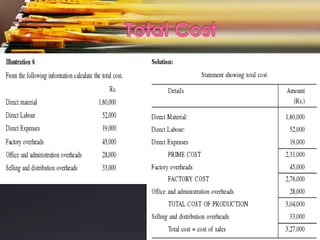

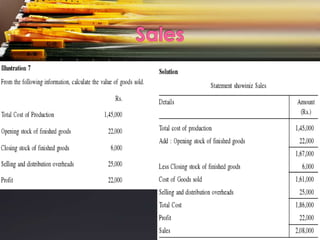

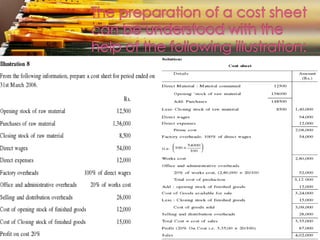

- 8. Prime cost = Direct Material + Direct Labor + Direct expenses Factory Cost = Prime Cost + Factory Overheads Cost of Production = Works cost + office and Administrative overhead Total cost = Cost of Production + Selling and Distributive Overhead Sales = Total cost + profit

- 14. The various components of cost explained above are presented in the form of a statement. Such a statement of cost consists of prime cost, works/factory cost, cost of production, total cost and sales, is termed as cost sheet.

- 16. ïą It helps us to ascertain the costs of goods produced. ïą It provides required information to the management ïą It classifies the cost into material, labor, fixed overhead or variable overhead. ïą Cost sheet is the main format of cost accounting. ïą Profit or loss estimated on specific product, branch, department or job. ïą It is an effective control device.