Cpv analysis case solution

Download as PPTX, PDF0 likes183 views

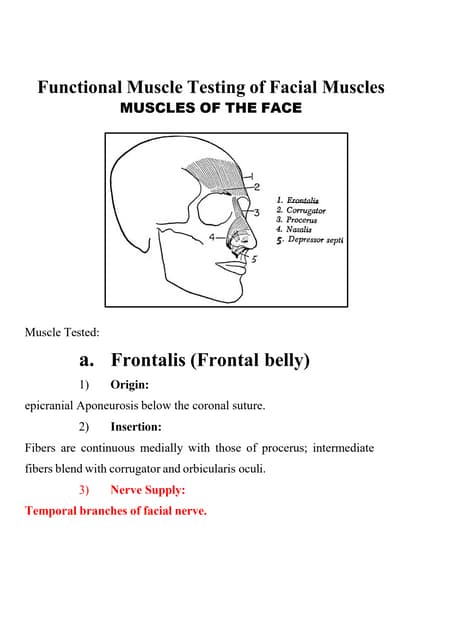

The document summarizes production and sales data for two candy products: chocolate candy and coffee candy. It calculates the break-even point in units to be 332,273 based on total fixed costs of $7.75 million and total contribution margin of $22,000. It then determines the sales mix needed for each product to reach the break-even point and calculates sales volumes, revenues, costs, and margins. The document also calculates the company's tolerance for decreases in sales before losses are incurred, which is 22.11% below expected sales volume.

1 of 7

Download to read offline

Recommended

Export price list haikower consumer care june 2013

Export price list haikower consumer care june 2013Abdul Buckus

Ěý

This document lists export products in categories including technical, personal care, salon, treatment, accessories and advertising, colouring products, finishing, a line with pure argan oil, sanitizing, and a hydra protect system. It provides information on product names, volumes, prices, and quantities per box for over 100 cosmetic and hair care items.goodals chocolate

goodals chocolateguddals

Ěý

The document lists various gift items being sold by Goodals Chocolate, including towel baskets, flasks, kettles, chocolate boxes, baskets containing chocolates, trays of chocolates, and cotton bed sheets. Each item includes a product code, MRP price, and discounted GC price. The items are intended as gifts and many contain chocolates or dry fruits.Catalogo Navidad bombones y chocolates 2017-18

Catalogo Navidad bombones y chocolates 2017-18Roshen Iberia S.L.

Ěý

This document provides information about Christmas candy and chocolates including figures of Santa Claus. It lists different types of bonbons in boxes and bulk. It then describes three Santa Claus chocolate figure products that come in boxes ready for store shelves, providing the weight and number of pieces per box as well as barcodes and pallet information.Nature view farm

Nature view farmPranjal Dixit

Ěý

This case study summarizes the history and growth of Natureview Farm yogurt company from 1989 to 2000. It discusses expanding into new product lines, packaging sizes, flavors and retail channels. Three expansion options for 2001 are considered: 1) introduce 8oz cups into eastern/western supermarkets, 2) launch 32oz cups nationally, or 3) add children's multipacks to natural food stores. Option 1 is chosen for its potential to generate the highest revenue of $31.06 million while gaining first mover advantage in supermarkets. Though risky, it could yield long term profits of 200% growth.HBS case analysis of Nature view farm

HBS case analysis of Nature view farmAswinShankharan1

Ěý

This is done by Aswin Shankharan of VIT vellore for his marketing managament internship during december 2017 under prof sameer mathur of iim lucknowNatureview Farm Case

Natureview Farm CaseSWAPNIL GOYAL

Ěý

Natureview Farm produces yogurt using natural ingredients. In 2001, it needed to grow revenue over 50% to $20 million for its VC investors. It considered three options: 1) Expanding 6 8-oz yogurt SKUs in eastern and western supermarkets, 2) Expanding 4 32-oz SKU nationally in supermarkets, or 3) Introducing 2 children's multipacks in natural food stores. Option 1 was chosen as it could exceed the revenue target, 8-oz yogurt had highest demand, and it allowed exposure to more supermarket customers as the first natural yogurt brand, though it carried higher risks.Natureview farm

Natureview farmShreyashWadbudhe

Ěý

Natureview Farm produces yogurt and is considering expansion options to increase revenue to $20 million by 2001. Option 1 is to expand 6 SKU's of 8oz cups into eastern and western supermarket regions, which would increase revenue to $24.76 million and achieve the goal. Option 2 is to expand 4 SKU's of 32oz cups nationally in supermarkets, increasing revenue to $21.28 million and achieving the goal. Option 3 is introducing 2 children's multipacks into natural food stores, but this would only increase revenue to $15.73 million, failing to achieve the goal. Based on the analysis, Natureview should pursue Option 1 to maximize revenue expansion into supermarkets.Make or Buy? Serving Great Products at an Affordable Price

Make or Buy? Serving Great Products at an Affordable PriceProfitable Hospitality

Ěý

Hear first-hand how a successful club does more of its food production in- house, including butchery and baking. They use rigorous costing and create a product that customers love…including the meat trays! NatureView Farm Case Study

NatureView Farm Case StudyRohan Roy

Ěý

I prepared this case analysis of Harvard Business School Case Study under the guidance of Professor Sameer Mathur from IIM Lucknow.Marketing Plan of HWIC

Marketing Plan of HWICSharon Rose Tabunag

Ěý

For Those who are interested on HWIC Product.. You must see this Product presentation. Thank you!!!

Cost - Chapter 6, Cost Allocation Joint Cost.pptx

Cost - Chapter 6, Cost Allocation Joint Cost.pptxetebarkhmichale

Ěý

So next time you want something done in a certain way, rather than telling people what to do, show them the behaviour you expect from them. This way, you will have more engaged, happier employees and clients.

6.Speaking of change, embrace it!

And one of my favourites — embrace change! Being a leader means knowing and accepting that nothing is forever. Even liking the idea: Change is a given in anything we do in life. In business, change brings with it opportunities and challenges more than it brings trouble.

So be flexible, be adaptable, enjoy change when it comes, and from time to time, search for it yourself — it will be worth it.

Misconceptions About Leadership

Like so many other things, leadership has its own myths and misconceptions.

I have found 3:

1.You can not be a leader if you aren’t in an authority position.

False! You can be a leader if you are a manager, but if you are a leader, you don’t have to be a manager as well. Setting positive examples, guiding the people around you, being their voice when the situation arises — that is the job of a true leader, no matter his daily job description.

2.You can not be a leader if you are an introvert.

False! Character traits are so different in people that we simply can not put a label on it and say that introverts aren’t good leaders. Sometimes, thinking more on the inside than on the outside proves even more beneficial than we think. Introverts aren’t masters of public speech, but that doesn’t mean they can not guide and inspire people toward great goals.

3.If everyone is a leader, who will follow?

False! The truth is, nobody leads in everything. The best leaders have their „specialties” and also, they step in and out of their role as leader gracefully.

The best estimates offered by research are that leadership is about one-third born and two-thirds made. How does this reflect into real life? Well, we can consider that leadership is a set of innate traits, completed by another set of qualities that are refined and perfected in time, with education, training, and experience.

I believe being a leader isn’t usually a job that you find, but rather one that finds you. Although it is not easy, it has a certain *je ne sais quoi* that draws one like a moth to a flame. As a leader, you need to make smart decisions about products and services, marketing, financing, and other operational issues, but you also have to maximize the full potential of your employees. There is a lot to do, but allow me to let you in on another little secret — leadership skills are great even for those who don’t want to lead. All the qualities I have depicted above will serve you well no matter your position at a job and in your personal life — you will be ready to step in, lead and make things smoother and better for many other people.

Once again remember “…be not afraid of greatness. Some are born great, some achieve greatness, and some have greatness thrust upon them”. Get your five buckets filled, and that wi7. Profit Reporting for Managerial Analysis

7. Profit Reporting for Managerial AnalysisLeonardo Figueroa

Ěý

The document discusses various costing methods and contribution margin analysis techniques used for managerial decision making. It provides examples of calculating income statements and contribution margins under absorption costing and variable costing. It also illustrates how contribution margin analysis can be used to evaluate performance by market segment, product line, salesperson, and route for various companies including a fragrance producer and airline.Cigar Box Method Presentation

Cigar Box Method PresentationBakery_Initiatives

Ěý

The Cigar Box® is a unique toolkit. It consists of simple, yet concise spreadsheets which help the entrepreneur to calculate his/her cost of goods, margins, contribution, break-even volumes and profitability. For a single product or a complete portfolio of products.Logistics component Dark Chocolate butter

Logistics component Dark Chocolate butter MAX GALARZA HERNANDEZ

Ěý

Is a dark chocolate butter called "Choco Darky" made of organic chocolate. It doesn´t contain artificial ingredients or chemicals and is a healthy food sort for everybody.Exercises with solutions CHAPTER 0104 (1).pdf

Exercises with solutions CHAPTER 0104 (1).pdfMohamedAbdi347025

Ěý

Exercises with solutions CHAPTER 0104 (1).pdfBusiness Plan

Business PlanRakibul Rubel

Ěý

The document provides information on the functions, members, vision, mission, objectives, address, and organizational structure of a bakery business called SPICK & SPAN.

The key points are:

- SPICK & SPAN is a private bakery shop located in Bangkok, Thailand that produces cupcakes.

- Its vision is to be a creative and innovative leader in the cupcake market and its mission is to introduce new designs and flavors.

- The business address and contact details are provided.

- An organizational chart shows the general manager oversees departments headed by managers of administration, marketing, operations, and finance.

- Job responsibilities and salaries of personnel are outlined.Micro 12

Micro 12Gale Pooley

Ěý

This document discusses production costs and costs of operating a pizza business. It outlines the variable costs per pizza of labor ($2), ingredients ($0.75), and electricity ($0.25) and the fixed costs of rent ($2,800 per month) and insurance ($200 per month). If the business produces 1,000 pizzas, the total costs would be $6,000. The breakeven point is calculated at 750 pizzas. Marginal cost, total cost, and other cost concepts are also defined.Natureview Farm Harward Business Case Study

Natureview Farm Harward Business Case StudyMayankUpadhyay32

Ěý

Created by MAYANK UPADHYAY

VIT VELLORE,

Harward business case study during marketing intership

Under Sameer Mathur

IIM lucknow2014 data show livestock data

2014 data show livestock datanconverse

Ěý

This document provides information on livestock enterprises in Minnesota, with a focus on dairy data. It includes statistics on the average and median number of dairy cows on farms from 2005 to 2014, as well as milk production and returns per cow. The data is broken down by herd size, and also looks at costs, gross margins, and returns per cow for different sized dairy operations. Additional sections analyze dairy costs and prices from 2012 to 2015, compare robotic versus traditional and 3x milking operations, and break down dairy farm statistics by different categories and initiatives.Business plan for vintage bakery

Business plan for vintage bakeryMukeshKumar2728

Ěý

The business plan proposes establishing a bakery called The Vintage Bakery in Karachi, Pakistan. The plan outlines objectives to provide affordable cakes and establish a bakery cafe. It details the marketing strategy targeting residents, weekend visitors, and youth. Financial projections estimate annual sales of $78,000 with net annual profit of $1,900. The operational plan describes cake production, equipment needs, and a staff hierarchy to oversee the bakery's operations.Natureview farm – A case study

Natureview farm – A case studyVisnu Sasindran

Ěý

Natureview Farm is considering options to grow its revenue beyond $20 million by 2001. Option 1 is to expand its 8-oz yogurt cups into supermarket regions, which could generate $16.1 million in revenue in 2000 and $19.3 million in 2001. Option 2 is launching a national rollout of its 32-oz cups, projected to earn $9.2 million in 2000 and $9.2 million in 2001. Option 3 is introducing children's multipacks in natural food stores, with potential revenues of $3.8 million in 2000 and $3.3 million in 2001. The recommendation is to combine Options 1 and 3 to leverage the revenue growth of supermarkets while maintaining relationships in natural food stores.Natureview Farm Case Analysis

Natureview Farm Case AnalysisBharat .

Ěý

This case study examines options for increasing revenues at Natureview Farm, an organic yogurt manufacturer. The company is facing pressure from venture capitalists to increase revenues by 50% to $20 million. Three options are considered: 1) Expanding 8-oz cup offerings into supermarket channels, 2) Expanding 32-oz cup sizes nationally, and 3) Launching children's multi-packs in natural food stores. Option 1 is selected as it provides the highest net revenue, allows entering the larger supermarket market, and maintains their first-mover advantage.Nature view

Nature viewBiswajeet Sahu

Ěý

This was prepared during 4-week Marketing Internship under Prof. Sameer Mathur.

It is a Havard Bussiness Review Case Study on Nature View.Galleta del valle 2010 s

Galleta del valle 2010 sfrancisliao

Ěý

Galleta del Valle is a cookie company founded in Silicon Valley that donates profits to peace initiatives. They present sample recipes and cost analysis for their White Chocolate Chip & Macadamia Nut cookies. Production tasks are split between two chefs who develop measurements and analyze costs together. They aim to improve quality, lower costs, and increase sales volume to further their goals of donations and world peace.A piece of pie in Bucharest-2

A piece of pie in Bucharest-2Irina Vasilescu

Ěý

This document provides information about baking a chocolate pie, including:

- Ingredients and quantities needed to make one pie and one portion. Flour, butter, sugar, cocoa, eggs, and other ingredients are listed.

- Calculations of the costs to make one pie and one portion based on prices of ingredients in Bucharest, Romania. The cost per portion is approximately 1.735 lei.

- Comparisons of the cost per portion in other cities involved in the project, ranging from 0.91 times to 1.66 times the Bucharest cost.

- The average cost per portion across all cities is approximately 2.37 lei.

- An indication that the pie wasGroup Six - Just Married Budget

Group Six - Just Married BudgetChrissyYCDSB

Ěý

This document summarizes the monthly budget of a newly married couple, John and Nicole. It details their individual incomes, totaling $6,390 monthly. It then outlines their monthly living expenses, including $1,901.97 for rent and utilities, $301.97 for groceries, $49.25 for household items, $600 for clothing, $160.46 for transportation, $857.09 for entertainment, and $3,438.81 in miscellaneous expenses including $2,198.81 in monthly savings.Group Six - Just Married Budget

Group Six - Just Married BudgetChrissyYCDSB

Ěý

This document summarizes the monthly budget of a newly married couple, John and Nicole. It details their individual incomes, totaling $6,390 monthly. It then outlines their expenses, including $1,901.97 for living expenses like rent, $857.09 for entertainment like cell phones and internet, $160.46 for transportation via public transit passes, and $3,438.81 in miscellaneous expenses including $2,198.81 in monthly savings.Hannah Borhan and Pietro Gagliardi OECD present 'From classroom to community ...

Hannah Borhan and Pietro Gagliardi OECD present 'From classroom to community ...EduSkills OECD

Ěý

Hannah Borhan, Research Assistant, OECD Education and Skills Directorate and Pietro Gagliardi, Policy Analyst, OECD Public Governance Directorate present at the OECD webinar 'From classroom to community engagement: Promoting active citizenship among young people" on 25 February 2025. You can find the recording of the webinar on the website https://oecdedutoday.com/webinars/

More Related Content

Similar to Cpv analysis case solution (20)

NatureView Farm Case Study

NatureView Farm Case StudyRohan Roy

Ěý

I prepared this case analysis of Harvard Business School Case Study under the guidance of Professor Sameer Mathur from IIM Lucknow.Marketing Plan of HWIC

Marketing Plan of HWICSharon Rose Tabunag

Ěý

For Those who are interested on HWIC Product.. You must see this Product presentation. Thank you!!!

Cost - Chapter 6, Cost Allocation Joint Cost.pptx

Cost - Chapter 6, Cost Allocation Joint Cost.pptxetebarkhmichale

Ěý

So next time you want something done in a certain way, rather than telling people what to do, show them the behaviour you expect from them. This way, you will have more engaged, happier employees and clients.

6.Speaking of change, embrace it!

And one of my favourites — embrace change! Being a leader means knowing and accepting that nothing is forever. Even liking the idea: Change is a given in anything we do in life. In business, change brings with it opportunities and challenges more than it brings trouble.

So be flexible, be adaptable, enjoy change when it comes, and from time to time, search for it yourself — it will be worth it.

Misconceptions About Leadership

Like so many other things, leadership has its own myths and misconceptions.

I have found 3:

1.You can not be a leader if you aren’t in an authority position.

False! You can be a leader if you are a manager, but if you are a leader, you don’t have to be a manager as well. Setting positive examples, guiding the people around you, being their voice when the situation arises — that is the job of a true leader, no matter his daily job description.

2.You can not be a leader if you are an introvert.

False! Character traits are so different in people that we simply can not put a label on it and say that introverts aren’t good leaders. Sometimes, thinking more on the inside than on the outside proves even more beneficial than we think. Introverts aren’t masters of public speech, but that doesn’t mean they can not guide and inspire people toward great goals.

3.If everyone is a leader, who will follow?

False! The truth is, nobody leads in everything. The best leaders have their „specialties” and also, they step in and out of their role as leader gracefully.

The best estimates offered by research are that leadership is about one-third born and two-thirds made. How does this reflect into real life? Well, we can consider that leadership is a set of innate traits, completed by another set of qualities that are refined and perfected in time, with education, training, and experience.

I believe being a leader isn’t usually a job that you find, but rather one that finds you. Although it is not easy, it has a certain *je ne sais quoi* that draws one like a moth to a flame. As a leader, you need to make smart decisions about products and services, marketing, financing, and other operational issues, but you also have to maximize the full potential of your employees. There is a lot to do, but allow me to let you in on another little secret — leadership skills are great even for those who don’t want to lead. All the qualities I have depicted above will serve you well no matter your position at a job and in your personal life — you will be ready to step in, lead and make things smoother and better for many other people.

Once again remember “…be not afraid of greatness. Some are born great, some achieve greatness, and some have greatness thrust upon them”. Get your five buckets filled, and that wi7. Profit Reporting for Managerial Analysis

7. Profit Reporting for Managerial AnalysisLeonardo Figueroa

Ěý

The document discusses various costing methods and contribution margin analysis techniques used for managerial decision making. It provides examples of calculating income statements and contribution margins under absorption costing and variable costing. It also illustrates how contribution margin analysis can be used to evaluate performance by market segment, product line, salesperson, and route for various companies including a fragrance producer and airline.Cigar Box Method Presentation

Cigar Box Method PresentationBakery_Initiatives

Ěý

The Cigar Box® is a unique toolkit. It consists of simple, yet concise spreadsheets which help the entrepreneur to calculate his/her cost of goods, margins, contribution, break-even volumes and profitability. For a single product or a complete portfolio of products.Logistics component Dark Chocolate butter

Logistics component Dark Chocolate butter MAX GALARZA HERNANDEZ

Ěý

Is a dark chocolate butter called "Choco Darky" made of organic chocolate. It doesn´t contain artificial ingredients or chemicals and is a healthy food sort for everybody.Exercises with solutions CHAPTER 0104 (1).pdf

Exercises with solutions CHAPTER 0104 (1).pdfMohamedAbdi347025

Ěý

Exercises with solutions CHAPTER 0104 (1).pdfBusiness Plan

Business PlanRakibul Rubel

Ěý

The document provides information on the functions, members, vision, mission, objectives, address, and organizational structure of a bakery business called SPICK & SPAN.

The key points are:

- SPICK & SPAN is a private bakery shop located in Bangkok, Thailand that produces cupcakes.

- Its vision is to be a creative and innovative leader in the cupcake market and its mission is to introduce new designs and flavors.

- The business address and contact details are provided.

- An organizational chart shows the general manager oversees departments headed by managers of administration, marketing, operations, and finance.

- Job responsibilities and salaries of personnel are outlined.Micro 12

Micro 12Gale Pooley

Ěý

This document discusses production costs and costs of operating a pizza business. It outlines the variable costs per pizza of labor ($2), ingredients ($0.75), and electricity ($0.25) and the fixed costs of rent ($2,800 per month) and insurance ($200 per month). If the business produces 1,000 pizzas, the total costs would be $6,000. The breakeven point is calculated at 750 pizzas. Marginal cost, total cost, and other cost concepts are also defined.Natureview Farm Harward Business Case Study

Natureview Farm Harward Business Case StudyMayankUpadhyay32

Ěý

Created by MAYANK UPADHYAY

VIT VELLORE,

Harward business case study during marketing intership

Under Sameer Mathur

IIM lucknow2014 data show livestock data

2014 data show livestock datanconverse

Ěý

This document provides information on livestock enterprises in Minnesota, with a focus on dairy data. It includes statistics on the average and median number of dairy cows on farms from 2005 to 2014, as well as milk production and returns per cow. The data is broken down by herd size, and also looks at costs, gross margins, and returns per cow for different sized dairy operations. Additional sections analyze dairy costs and prices from 2012 to 2015, compare robotic versus traditional and 3x milking operations, and break down dairy farm statistics by different categories and initiatives.Business plan for vintage bakery

Business plan for vintage bakeryMukeshKumar2728

Ěý

The business plan proposes establishing a bakery called The Vintage Bakery in Karachi, Pakistan. The plan outlines objectives to provide affordable cakes and establish a bakery cafe. It details the marketing strategy targeting residents, weekend visitors, and youth. Financial projections estimate annual sales of $78,000 with net annual profit of $1,900. The operational plan describes cake production, equipment needs, and a staff hierarchy to oversee the bakery's operations.Natureview farm – A case study

Natureview farm – A case studyVisnu Sasindran

Ěý

Natureview Farm is considering options to grow its revenue beyond $20 million by 2001. Option 1 is to expand its 8-oz yogurt cups into supermarket regions, which could generate $16.1 million in revenue in 2000 and $19.3 million in 2001. Option 2 is launching a national rollout of its 32-oz cups, projected to earn $9.2 million in 2000 and $9.2 million in 2001. Option 3 is introducing children's multipacks in natural food stores, with potential revenues of $3.8 million in 2000 and $3.3 million in 2001. The recommendation is to combine Options 1 and 3 to leverage the revenue growth of supermarkets while maintaining relationships in natural food stores.Natureview Farm Case Analysis

Natureview Farm Case AnalysisBharat .

Ěý

This case study examines options for increasing revenues at Natureview Farm, an organic yogurt manufacturer. The company is facing pressure from venture capitalists to increase revenues by 50% to $20 million. Three options are considered: 1) Expanding 8-oz cup offerings into supermarket channels, 2) Expanding 32-oz cup sizes nationally, and 3) Launching children's multi-packs in natural food stores. Option 1 is selected as it provides the highest net revenue, allows entering the larger supermarket market, and maintains their first-mover advantage.Nature view

Nature viewBiswajeet Sahu

Ěý

This was prepared during 4-week Marketing Internship under Prof. Sameer Mathur.

It is a Havard Bussiness Review Case Study on Nature View.Galleta del valle 2010 s

Galleta del valle 2010 sfrancisliao

Ěý

Galleta del Valle is a cookie company founded in Silicon Valley that donates profits to peace initiatives. They present sample recipes and cost analysis for their White Chocolate Chip & Macadamia Nut cookies. Production tasks are split between two chefs who develop measurements and analyze costs together. They aim to improve quality, lower costs, and increase sales volume to further their goals of donations and world peace.A piece of pie in Bucharest-2

A piece of pie in Bucharest-2Irina Vasilescu

Ěý

This document provides information about baking a chocolate pie, including:

- Ingredients and quantities needed to make one pie and one portion. Flour, butter, sugar, cocoa, eggs, and other ingredients are listed.

- Calculations of the costs to make one pie and one portion based on prices of ingredients in Bucharest, Romania. The cost per portion is approximately 1.735 lei.

- Comparisons of the cost per portion in other cities involved in the project, ranging from 0.91 times to 1.66 times the Bucharest cost.

- The average cost per portion across all cities is approximately 2.37 lei.

- An indication that the pie wasGroup Six - Just Married Budget

Group Six - Just Married BudgetChrissyYCDSB

Ěý

This document summarizes the monthly budget of a newly married couple, John and Nicole. It details their individual incomes, totaling $6,390 monthly. It then outlines their monthly living expenses, including $1,901.97 for rent and utilities, $301.97 for groceries, $49.25 for household items, $600 for clothing, $160.46 for transportation, $857.09 for entertainment, and $3,438.81 in miscellaneous expenses including $2,198.81 in monthly savings.Group Six - Just Married Budget

Group Six - Just Married BudgetChrissyYCDSB

Ěý

This document summarizes the monthly budget of a newly married couple, John and Nicole. It details their individual incomes, totaling $6,390 monthly. It then outlines their expenses, including $1,901.97 for living expenses like rent, $857.09 for entertainment like cell phones and internet, $160.46 for transportation via public transit passes, and $3,438.81 in miscellaneous expenses including $2,198.81 in monthly savings.Recently uploaded (20)

Hannah Borhan and Pietro Gagliardi OECD present 'From classroom to community ...

Hannah Borhan and Pietro Gagliardi OECD present 'From classroom to community ...EduSkills OECD

Ěý

Hannah Borhan, Research Assistant, OECD Education and Skills Directorate and Pietro Gagliardi, Policy Analyst, OECD Public Governance Directorate present at the OECD webinar 'From classroom to community engagement: Promoting active citizenship among young people" on 25 February 2025. You can find the recording of the webinar on the website https://oecdedutoday.com/webinars/

RRB ALP CBT 2 Mechanic Motor Vehicle Question Paper (MMV Exam MCQ)

RRB ALP CBT 2 Mechanic Motor Vehicle Question Paper (MMV Exam MCQ)SONU HEETSON

Ěý

RRB ALP CBT 2 Mechanic Motor Vehicle Question Paper. MMV MCQ PDF Free Download for Railway Assistant Loco Pilot Exam.Entity Framework Interview Questions PDF By ScholarHat

Entity Framework Interview Questions PDF By ScholarHatScholarhat

Ěý

Entity Framework Interview Questions PDF By ScholarHatASP.NET Web API Interview Questions By Scholarhat

ASP.NET Web API Interview Questions By ScholarhatScholarhat

Ěý

ASP.NET Web API Interview Questions By ScholarhatBlind spots in AI and Formulation Science, IFPAC 2025.pdf

Blind spots in AI and Formulation Science, IFPAC 2025.pdfAjaz Hussain

Ěý

The intersection of AI and pharmaceutical formulation science highlights significant blind spots—systemic gaps in pharmaceutical development, regulatory oversight, quality assurance, and the ethical use of AI—that could jeopardize patient safety and undermine public trust. To move forward effectively, we must address these normalized blind spots, which may arise from outdated assumptions, errors, gaps in previous knowledge, and biases in language or regulatory inertia. This is essential to ensure that AI and formulation science are developed as tools for patient-centered and ethical healthcare.Functional Muscle Testing of Facial Muscles.pdf

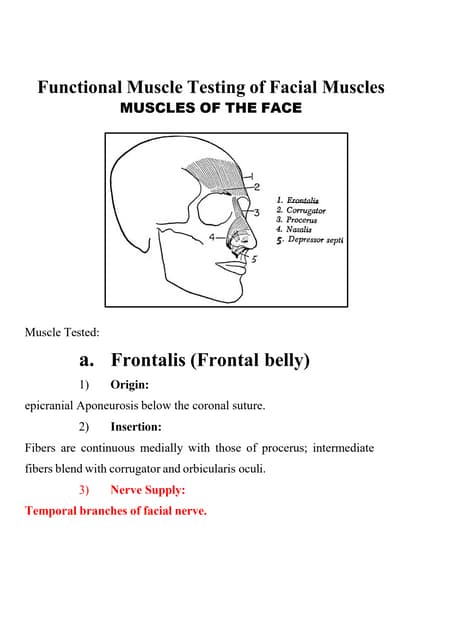

Functional Muscle Testing of Facial Muscles.pdfSamarHosni3

Ěý

Functional Muscle Testing of Facial Muscles.pdfUnit 1 Computer Hardware for Educational Computing.pptx

Unit 1 Computer Hardware for Educational Computing.pptxRomaSmart1

Ěý

Computers have revolutionized various sectors, including education, by enhancing learning experiences and making information more accessible. This presentation, "Computer Hardware for Educational Computing," introduces the fundamental aspects of computers, including their definition, characteristics, classification, and significance in the educational domain. Understanding these concepts helps educators and students leverage technology for more effective learning.RRB ALP CBT 2 RAC Question Paper MCQ (Railway Assistant Loco Pilot)

RRB ALP CBT 2 RAC Question Paper MCQ (Railway Assistant Loco Pilot)SONU HEETSON

Ěý

RRB ALP CBT 2 RAC Question Paper MCQ PDF Free Download. Railway Assistant Loco Pilot Mechanic Refrigeration and Air Conditioning Important Questions.Oral exam Kenneth Bech - What is the meaning of strategic fit?

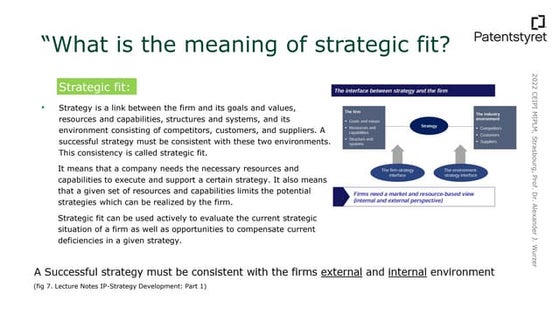

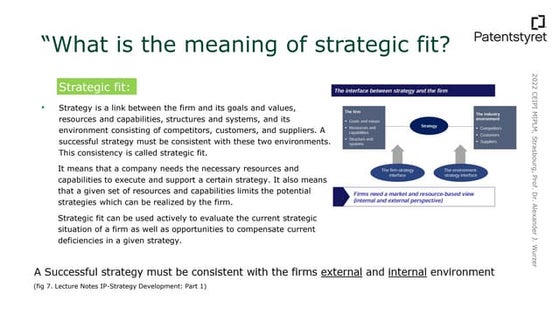

Oral exam Kenneth Bech - What is the meaning of strategic fit?MIPLM

Ěý

Presentation of the CEIPI DU IPBA oral exam of Kenneth Bech - What is the meaning of strategic fit? Meeting the needs of modern students?, Selina McCoy

Meeting the needs of modern students?, Selina McCoyEconomic and Social Research Institute

Ěý

NAPD Annual Symposium

“Equity in our Schools: Does the system deliver for all young people?”Azure Data Engineer Interview Questions By ScholarHat

Azure Data Engineer Interview Questions By ScholarHatScholarhat

Ěý

Azure Data Engineer Interview Questions By ScholarHatOne Click RFQ Cancellation in Odoo 18 - Odoo şÝşÝߣs

One Click RFQ Cancellation in Odoo 18 - Odoo şÝşÝߣsCeline George

Ěý

In this slide, we’ll discuss the one click RFQ Cancellation in odoo 18. One-Click RFQ Cancellation in Odoo 18 is a feature that allows users to quickly and easily cancel Request for Quotations (RFQs) with a single click.Interim Guidelines for PMES-DM-17-2025-PPT.pptx

Interim Guidelines for PMES-DM-17-2025-PPT.pptxsirjeromemanansala

Ěý

This is the latest issuance on PMES as replacement of RPMS. Kindly message me to gain full access of the presentation. Cpv analysis case solution

- 1. GROUP 6

- 2. Chocolate Candy Coffee Candy Production Sales 3.000.000 packs 3.000.000 packs 2.000.000 packs 3.000.000 packs Production cost Direct materials cost $1.5 $ 1.25 Direct labor cost 1 1 Variable factory OH cost Fixed factory OH cost Total cost Variable marketing & adm Fixed cost Direct fixed cost Common fixed cost Both candy 6.500.000 0.5 0.75 $ 3.75 $ 2 $ 750.000 0.25 0.5 $ 3 $ 1 $ 500.000

- 3. Chocolate candy sales Coffee candy 3.000.000 = 3/2 2.000.000

- 4. product Price/uni t Variable cost Contribution margin Sales mix Total CM Chocolate candy $ 10 5 5 3 15 Coffee candy TOTAL $15 4 3.5 2 7 22 BEP=TOTAL FC = (750.000+500.000+6.500.000) = 7.750.000= 332.273 pc TOTAL CM 22 22 SALES BEP CHOCOLATE CANDY = 3 x 332.273 = 1.056.819 pc COFFEE CANDY = 2 x 332. 273 = 704. 346 pcSales mix

- 5. BEP = Total FC + Targeted profit bf tax CM/unit = (7.750.000 + 2.200.000)/22 =9.950.000/22= 452.273 pc Chocolate candy = 1.356.819 pc 3 x 452.273 Coffee candy = 904.546 pc 2 x 452.273

- 6. CHOCOLATE CANDY COFFEE CANDY TOTAL SALES 10.568.190 5.284.095 15.852.285 VARIABLE COST (5.284.095) (2.818.184) (8.102.279) CONTRIBUTION MARGIN 5.284.095 2.465.911 7.750.006 LESS DIRECT FIXED COST (750.000) (500.000) (1.250.000) PRODUCT MARGIN 4.534.095 1.965.911 6.500.006 COMMON FIXWD COST (6.500.000) OPERATING INCOME 0

- 7. In Pack = 22.11 % x 452. 2773 = 99.998 packs Its mean if the salesvolume decrease 22.11 % of the expected volume then sales will bw break even point . In other word a decrease in sales that can still be tolerated so company not get loss as high MoS = Xe-Xb x 100% Xe = (452.273-352.273) x 100% 423.273 =22.11 %