Create Your Success

- 1. Create Your Success A Transamerica Company

- 2. The best way to predict your future is to create it. - Abraham Lincoln

- 3. 1 This presentation provides you with an overview of: What we believe at World Financial Group How we help people create success How the WFG business works There is no expectation for you to make a decision today.

- 4. 2 Three Questions Whom do you know who could benefit from our message? Could this information help you or your family financially? Are you intrigued by this business? Characteristics of Successful WFG Associates Many of WFG’s successful associates have these traits: People skills and a desire to learn Coachability A willingness to follow a proven business platform

- 5. 3 Our Goals Create generations of people who know how to better manage and protect their money. Provide a business platform to associates, which gives the support and systems they need to build strong businesses and create better lives for themselves.

- 6. 4 An Exceptional Business Opportunity An overwhelming need for our products and services An effective business platform Powerful compensation Great timing Strong core values

- 7. 5 1 “2014 Insurance Barometer Study,” Ashley Durham, LIFE and LIMRA, 2014. 2 “Facts from LIMRA: Life Insurance Awareness Month, September 2014,” LIMRA. September 2014. 3. 2014 RCS Fact Sheet #6 - Preparing for Retirement in America, 2014 Retirement Confidence Survey, Employee Benefit Research Institute and Greenwald Associates The Dramatic Need Many financial services companies focus only on the wealthy few, thus many middle-income individuals and families are grossly underserved. People Need Help There is a gap between the number of people who say they need life insurance (65%) and those who say they are extremely or very likely to purchase it in the next year (3% and 7% respectively)1 The middle market represents the largest segment of uninsured households2 There is a need for education: Less than a quarter of middle-market consumers are comfortable with their level of financial knowledge and more than three quarters believe they would benefit from a financial services professional’s guidance.2 Six in 10 workers report they and/or their spouse have less than $25,000 in total savings and investments, excluding their home and defined benefit plans, which includes 36% who have less than $1,000. However, of those workers with annual household income of less than $35,000, 68% report having saved less than $1,000, compared with 23% with incomes between $35,000–$74,999 and just 3 percent of those with $75,000 or more a year in income.3

- 8. 6 Where Most Families Are Today What’s the price? Without financial security there is: No peace of mind Stress and frustration A negative impact on the family Lost opportunities Lack of confidence Lack of hope Lowered expectations Lack of dreams What’s the impact? We believe that many families: Live with insufficient protection and too much debt Have no savings, or do not know why or how much money they should save to reach their goals Do not have a strategy for their futures, do not make enough money and are not sure what to do about either

- 9. 7 To provide individuals and families with a better quality of life, we have to help this change.

- 10. 8 A Different Kind of Company There is a need for a different kind of company in financial services. WFG believes that we are that company. WFG associates: Reach out to middle-income individuals and families instead of just the wealthy few Help clients establish goals and give them a clear strategy on how to reach them Help people build a stronger, more sound financial foundation

- 11. 9 Some people believe wealth is: Extravagant lifestyle: celebrities, high-salaried sports stars, etc. Exotic sports cars, expensive homes, designer brands But most people who try to live a “wealthy” lifestyle: Spend the money they earn or more Don’t attain wealth but, instead, accumulate large amounts of debt Financial security requires discipline It’s necessary to develop discipline, and the ability to determine needs versus wants. The discipline to determine needs versus wants is necessary to achieve financial security. What is Wealth?

- 12. 10 True financial independence means to: Save more and spend less Live within one’s means Protect loved ones should the “worst-case scenario” occur Reduce and eliminate debt Save sufficient funds to cover expenses for six months to a year Build long-term savings that protect you and your family for life Financial independence offers peace of mind.

- 13. 11 WFG and its associates believe in a respectful, no-pressure process. How WFG Associates Conduct Business On the first visit, the associate discusses concepts, gathers data and information, and makes a follow-up appointment. The associate performs a financial needs analysis for the client. The associate returns to present the analysis and recommendations.

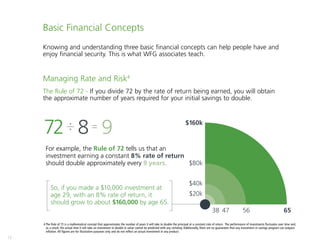

- 14. 12 Basic Financial Concepts Knowing and understanding three basic financial concepts can help people have and enjoy financial security. This is what WFG associates teach. Managing Rate and Risk4 The Rule of 72 - If you divide 72 by the rate of return being earned, you will obtain the approximate number of years required for your initial savings to double. 4 The Rule of 72 is a mathematical concept that approximates the number of years it will take to double the principal at a constant rate of return. The performance of investments fluctuates over time and, as a result, the actual time it will take an investment to double in value cannot be predicted with any certainty. Additionally, there are no guarantees that any investment or savings program can outpace inflation. All figures are for illustrative purposes only and do not reflect an actual investment in any product. $20k 38 47 56 65 $40k $80k $160k For example, the Rule of 72 tells us that an investment earning a constant 8% rate of return should double approximately every 9 years. So, if you made a $10,000 investment at age 29, with an 8% rate of return, it should grow to about $160,000 by age 65.

- 15. 13 The Power of Time Time can be your greatest ally or your worst enemy. If you haven’t started saving for your future, start now. Reduce the Impact of Taxes6 When saving, you want to ensure to consider the effect that taxes can have on your income. 5 All figures are for illustrative purposes only and do not reflect an actual investment in any product. Additionally, they do not reflect the performance risks, taxes, expenses or charges associated with any actual investment, which would lower performance. This illustration is not an indication or guarantee of future performance. Contributions are made at the end of the period. Total accumulation figures are rounded to the nearest dollar. 6 Tax and/or legal advice are not offered by World Financial Group, Inc., its affiliated companies or its independent associates. Please consult with your personal tax and/or legal professional for further guidance. Age of Investor 30 $87,500 $677,561 $411,235 $266,326 $75,000 $12,500 35 5 years Principal Invested Total Accumulation Person A Person B Difference An example of saving $2,500 per year, until age 65, in a tax-deferred account earning 10% per year.5 Taxable • Savings Accounts • Certificates of Deposit (CDs) • 401(K)s • IRAs • Fixed Annuities • Savings Bonds • Roth IRAs • Cash Accumulation in a Life Insurance Policy Tax Deferred Tax Exempt

- 16. 14 7 Tax and/or legal advice are not offered by World Financial Group, Inc., its affiliated companies nor its independent associates. Please consult with your personal tax and/or legal professional for further guidance. The WFG Financial Needs Analysis A WFG associate can help answer these questions: How do I create a workable savings plan that I can stick to? What goals should I set, and how much do I need to save to reach these goals? Are there products available that can provide guarantees against loss? What products can allow my money to grow but still allow me to have access to it without a penalty or being taxed?7 How much insurance do I need? What types of insurance should I consider? Will a professional work with me even if I don’t have a lot of money? Build Wealth • Strive to outpace inflation reduce taxes • Professional money management Proper Protection • Protect against loss of income • Protect family assets Debt Management • Consolidate debt • Strive to eliminate debt Emergency Fund • Save 3-6 months’ income • Prepare for unexpected expenses Cash Flow • Earn additional income • Manage expenses Preserve Wealth • Reduce taxation • Build a family legacy When investing, there are certain risks, fees and charges, and limitations that one must take into consideration.

- 17. 15 Our Product Solutions8 Term Insurance Universal Life Fixed Annuities IRAs Retirement11 College Savings12 9,10 10 10 8 Providers listed maintain current selling agreements with World Financial Group Insurance Agency, Inc. or its subsidiaries. Associates must be properly licensed and/or appointed to sell insurance. 9 Transamerica Premier Life Insurance Company, Transamerica Life Insurance Company, World Financial Group, Inc., and World Financial Group Insurance Agency, Inc. and its subsidiaries are affiliated companies. 10 The full names, city and state locations of these entities are: Transamerica Premier Life Insurance Company, Cedar Rapids, Iowa; Transamerica Life Insurance Company, Cedar Rapids, Iowa; Pacific Life Insurance Company, Newport Beach, California; Voya Insurance and Annuity Company, Des Moines, Iowa; Nationwide Life Insurance Company, Columbus, Ohio. 11 If the cash value of a life insurance policy is withdrawn for retirement then please note that money withdrawals from the cash-value part of the insurance policy can be treated as a form of income. The withdrawals can also reduce the insurance policy’s death benefit. Unpaid loans taken by the life insurance policy owner can also reduce the death benefit paid to the beneficiaries. 12 If the cash value of a life insurance policy is used for college savings then please note that money withdrawals from the cash-value part of the insurance policy can be as a form of income and does count against needs-based financial aid in the following year. The withdrawals can also reduce the insurance policy’s death benefit. Returns within an insurance policy may not keep pace with rising college cost and surrender charges in the life insurance policy’s early years may reduce the cash value. A cost-benefit analysis should be performed to determine if this long-term college savings strategy makes financial sense for a particular family. 9,10 1010

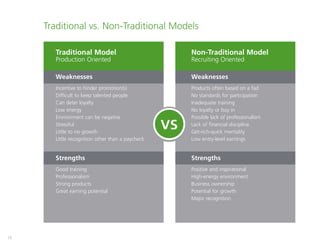

- 18. 16 Traditional vs. Non-Traditional Models Traditional Model Production Oriented Weaknesses Incentive to hinder promotion(s) Difficult to keep talented people Can deter loyalty Low energy Environment can be negative Stressful Little to no growth Little recognition other than a paycheck Strengths Good training Professionalism Strong products Great earning potential Non-Traditional Model Recruiting Oriented Weaknesses Products often based on a fad No standards for participation Inadequate training No loyalty or buy in Possible lack of professionalism Lack of financial discipline Get-rich-quick mentality Low entry-level earnings Strengths Positive and inspirational High-energy environment Business ownership Potential for growth Major recognition VS

- 19. 17 The WFG platform offers: Excellent, high-quality training programs A high-standard of professionalism Top-rated products Excellent earnings potential An energetic and positive working environment Inspiration and motivation Exciting growth potential Mentoring from top leadership Business ownership The WFG Business Platform WFG has taken the best of both the production- and recruiting-focused models and created a business platform that rewards both production and leadership development.

- 20. 18 Personal production Override the production of the associates you help develop Residual income from renewals and/or trails How to Earn Income at WFG A WFG associate can earn income in one of three ways:

- 21. 19 Promotions WFG associates can develop their full potential as leaders and business owners while building their organization. The guidelines for an associate’s next promotion are clearly stated and easily accessible from his/her first moment with the company. An associate’s personal production and hard work, as well as that of his/her organization, are among the factors that help determine when the associate achieves his/her next promotion. Powerful. Motivational. Inspirational.

- 22. 20 Your Earning Potential WFG offers an excellent income opportunity. The following example shows how helping a family results in a $2,220 commission paid to the field, with the commission based on an average Life Insurance Policy sale to a 40-year-old male who is contributing $185 per month to the policy.13,14 Per Month Per Year Associate15,16 $3,996 $47,952 (Helps four families per month) Senior Marketing Director15,16 $7,104 $85,248 (Helps four families per month) Senior Marketing Director leading a five-person organization15,16,17 Only Senior Marketing Director’s associates17 help four families each per month $15,540 $186,480 Senior Marketing Director and each member17 of the organization help four families per month $22,644 $271,728 Many people have experienced different levels of success with World Financial Group. However, individual member experiences may vary. This is not intended to, nor does it, represent that any current member’s individual results are representative of what all participants achieve when following the World Financial Group system. 13 Opportunities to build other income may be achieved by qualifying for additional compensation and by qualifying for bonus pools. 14 Commission amount may vary based on product type and size of purchase. 15 This is a hypothetical scenario for illustrative purposes only. There is no assurance that these results can or will be achieved. Income is earned from sales of World Financial Group authorized products and services. No income is earned for recruiting. See the current World Financial Group Field Manual for compensation percentages on all diversified product lines. All compensation plans subject to change. Promotional criteria/designations are determined and offered by or through World Financial Group. Personal percentages earned on products may vary based on promotional level with WFG. WFG Associate contract level of 36%, Senior Marketing Director contract level of 64%,Senior Marketing Director override level of 28%. 16 Associates of World Financial Group are independent contractors, regardless of field title/designation. 17 Example assumes all Senior Marketing Director’s team members are at the Associate level.

- 23. 21 In difficult economic times, there is: A greater demand for financial education and guidance A heightened demand to earn extra income Increased motivation to ensure security Timing Is Everything Now is a perfect time to consider WFG.

- 24. 22 Essential Values The strength of a business begins with strength of character. In life and in business, especially financial services, a person should have integrity, honesty, dependability, and be worthy of someone’s trust. These traits help to build long-lasting relationships. WFG believes in family. WFG wants our associates’ families to be supported and involved in the business. It’s important to have teamwork both at home and at work. WFG believes that involving family helps create a more positive and effectual environment. Our associates are encouraged to always remain positive and to never give up on their dreams.

- 25. 23 The WFG Business Is WFG right for you? Typically, people who are considering becoming an associate with our company look to do so: Part Time They like their current jobs but would like to earn extra income. They are frustrated or dissatisfied with where they are in their career/ life, and would like more control over their time and income. They feel less secure or have recently lost a job, and are looking for options. Full Time They are looking to change careers or want to own a business.

- 26. 24 Consider WFG Let’s overview the three questions we asked you to consider when contemplating a career with WFG. Next Steps Consider the reasons why you may want to become a WFG associate and discuss them with your spouse/family. Who do you know who could benefit from our message? Could this information help you or your family financially? Are you intrigued by this business? In the next one to two days, meet with a WFG associate for a follow up meeting. If you set an appointment with an associate, please keep it.

- 27. 25 There is a need and WFG is here to meet it.

- 28. 26 WFGOpportunity.com World Financial Group, Inc. (WFG) is a financial services marketing company whose affiliates offer a broad array of financial products and services. Insurance products offered through World Financial Group Insurance Agency, Inc., World Financial Group Insurance Agency of Hawaii, Inc., World Financial Group Insurance Agency of Massachusetts, Inc., World Financial Group Insurance Agency of Wyoming, Inc., World Financial Insurance Agency, Inc. and/or WFG Insurance Agency of Puerto Rico, Inc. - collectively WFGIA. California #0679300 WFG and WFGIA are affiliated companies. Headquarters: 11315 Johns Creek Parkway, Johns Creek, GA 30097-1517. Phone: 770.453.9300. WorldFinancialGroup.com For use in the United States only. World Financial Group and the WFG logo are registered trademarks of World Financial Group, Inc. ©2015 World Financial Group, Inc. 2585/6.15