CREDIT APPRAISAL PROCESS OF HDB FINANCIAL SERVICES ppts

- 1. ŌĆ£A Study of Credit Appraisal Policy in HDB Financial Services & Analysis on Customer Perception towards HDB FundingŌĆØ 1Source HDB portal SUMMER INTERNSHIP PRESENTATION Presented by- Harpreet Singh (PGFA1521)

- 2. Source Self 2 FLOW OF PRESENTATION 1 ŌĆó About the Industry 2. ŌĆó About the Company 3. ŌĆó Objectives 4. ŌĆó About credit appraisal 5. ŌĆó Research Study 6. ŌĆó Findings 7. ŌĆó SUGGESTIONS & RECOMMENDATIONS 8. ŌĆó Conclusion

- 3. NBFC ’üČA Non Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 of India, engaged in the business of loans and advances, acquisition of shares, stock, bonds, insurance business or chit business but does not include any institution whose principal business is that includes agriculture or industrial activity or the sale, purchase or construction of immovable property. ’üČ Regulated by the Reserve Bank of India (RBI) 3 Source google

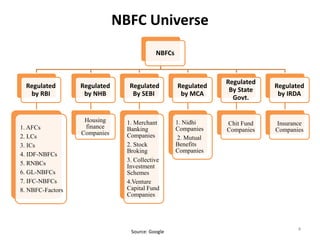

- 4. NBFC Universe NBFCs Regulated by RBI 1. AFCs 2. LCs 3. ICs 4. IDF-NBFCs 5. RNBCs 6. GL-NBFCs 7. IFC-NBFCs 8. NBFC-Factors Regulated by NHB Housing finance Companies Regulated By SEBI 1. Merchant Banking Companies 2. Stock Broking 3. Collective Investment Schemes 4.Venture Capital Fund Companies Regulated by MCA 1. Nidhi Companies 2. Mutual Benefits Companies Regulated By State Govt. Chit Fund Companies Regulated by IRDA Insurance Companies Source: Google 4

- 5. Company Profile Industry Non Banking Financial Institution (NBFC) Founded In2007 , HDFC 16508, Employees Headquarters Mumbai, India Area served India Key people Ramesh G, chairman & MD Products Personal loan, Business loan, Loan against shares, Loan against property, Loan against gold 5Source HDB portal

- 6. Products offered by HDB HDB LOANS Secured loans 1. Loan against securities 2. Loan against Shares 3. Loan against Property 4. Loan against Gold 5. Car Loans 6. Enterprise Business Loan 7. Equipment Loans Unsecured loans 1.Personal loans 2.Business Loans INSURANCE 1.Life Insurance 2.GeneraInsurance 6Source HDB portal

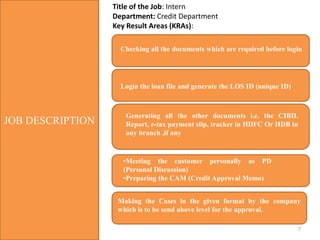

- 7. 7 JOB DESCRIPTION Title of the Job: Intern Department: Credit Department Key Result Areas (KRAs): Checking all the documents which are required before login Login the loan file and generate the LOS ID (unique ID) Generating all the other documents i.e. the CIBIL Report, e-tax payment slip, tracker in HDFC Or HDB in any branch ,if any ŌĆóMeeting the customer personally as PD (Personal Discussion) ŌĆóPreparing the CAM (Credit Approval Memo) Making the Cases in the given format by the company which is to be send above level for the approval.

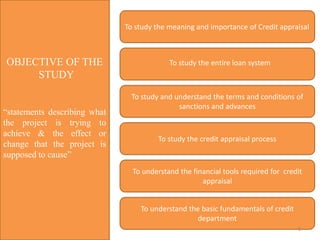

- 8. OBJECTIVE OF THE STUDY ŌĆ£statements describing what the project is trying to achieve & the effect or change that the project is supposed to causeŌĆØ To study the meaning and importance of Credit appraisal To study the credit appraisal process To understand the financial tools required for credit appraisal To understand the basic fundamentals of credit department To study and understand the terms and conditions of sanctions and advances To study the entire loan system 8

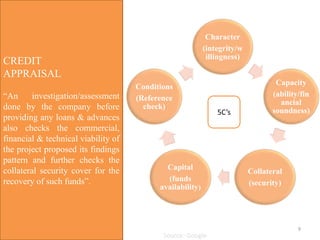

- 9. Character (integrity/w illingness) Capacity (ability/fin ancial soundness) Collateral (security) Capital (funds availability) Conditions (Reference check) 5CŌĆÖs CREDIT APPRAISAL ŌĆ£An investigation/assessment done by the company before providing any loans & advances also checks the commercial, financial & technical viability of the project proposed its findings pattern and further checks the collateral security cover for the recovery of such fundsŌĆØ. Source: Google 9

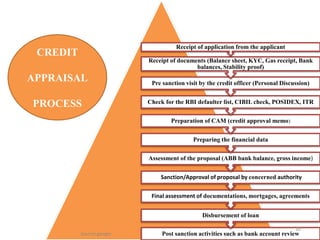

- 10. CREDIT APPRAISAL PROCESS Post sanction activities such as bank account review Disbursement of loan Final assessment of documentations, mortgages, agreements Sanction/Approval of proposal by concerned authority Assessment of the proposal (ABB bank balance, gross income) Preparing the financial data Preparation of CAM (credit approval memo) Check for the RBI defaulter list, CIBIL check, POSIDEX, ITR Pre sanction visit by the credit officer (Personal Discussion) Receipt of documents (Balance sheet, KYC, Gas receipt, Bank balances, Stability proof) Receipt of application from the applicant 10 Source google

- 11. SURVEY ŌĆ£procedure for collecting data to be analyzedŌĆØ ŌĆóTo study consumer perception towards HDB financial services funding ŌĆóThe Research Design used is descriptive research design ŌĆóPrimary data ŌĆóSurvey ŌĆóInterview ŌĆóSample size-50 ŌĆóRandomly Loan Applicant OBJECTIVE RESEARCH DESIGN DATA COLLECTION SAMPLING SIZE & METHOD 11

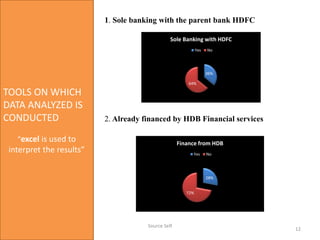

- 12. TOOLS ON WHICH DATA ANALYZED IS CONDUCTED ŌĆ£excel is used to interpret the resultsŌĆØ 1. Sole banking with the parent bank HDFC 36% 64% Sole Banking with HDFC Yes No 2. Already financed by HDB Financial services 28% 72% Finance from HDB Yes No 12 Source Self

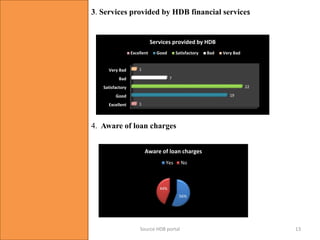

- 13. 3. Services provided by HDB financial services Excellent Good Satisfactory Bad Very Bad 1 19 22 7 1 Services provided by HDB Excellent Good Satisfactory Bad Very Bad 4. Aware of loan charges 56% 44% Aware of loan charges Yes No 13Source HDB portal

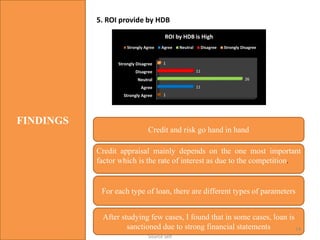

- 14. FINDINGS 5. ROI provide by HDB Strongly Agree Agree Neutral Disagree Strongly Disagree 1 11 26 11 1 ROI by HDB is High Strongly Agree Agree Neutral Disagree Strongly Disagree Credit and risk go hand in hand For each type of loan, there are different types of parameters After studying few cases, I found that in some cases, loan is sanctioned due to strong financial statements Credit appraisal mainly depends on the one most important factor which is the rate of interest as due to the competition. 14 Source self

- 15. SUGGESTIONS & RECOMMENDATIONS Branch credit limit should be exceeded as it helps to reduce the work load of all the related people Moderate rate of interest Policies and norms should be strictly followed for any cases by everyone Credit and other departments should work independently; no other departments should interfere in each other work Login of cases to be done with complete documents, incomplete documents will stretch the work and time of credit team Data Authentication 15 Source Self

- 16. CONCLUSIONS Credit appraisal should be based upon ’üČ Financial performance ’üČBusiness performance ’üČIndustry outlook ’üČQuality of management Usually, it is seen that the credit appraisal is basically done on the basis of fundamental soundness. But after seeing different types of cases , it can be concluded that credit appraisal system is not looking on the financial parameters, there are other factors also. In all, the viability of the project from every aspects analyzed, as well as type of the business, promoters past records, experience, long term plans plays a crucial role in increasing chances of getting project approved for loan. 16Source Self

- 17. Questions & Comments? Contact Details: Harpreet Singh PGFA 1521 MOB. No: +91 9675297500 Email Id: harpreet.singh@jaipuria.ac.in 17