CSR ppt

- 2. Section 135 of CompaniesAct, 2013 Rulesand in consonancewith theCompaniesAmendment Act, 2019 1

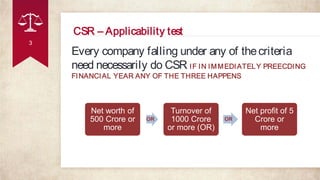

- 3. CSR â Applicability test Every company falling under any of thecriteria need necessarily do CSR IF IN IMMEDIATELY PREECDING FINANCIAL YEAR ANY OF THE THREE HAPPENS 3 Net worth of 500 Crore or more OR Turnover of 1000 Crore or more (OR) OR Net profit of 5 Crore or more

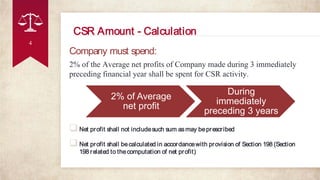

- 4. Company must spend: 2% of the Average net profits of Company made during 3 immediately preceding financial year shall be spent for CSR activity. ïąNet profit shall not includesuch sum asmay beprescribed ïąNet profit shall becalculated in accordancewith provision of Section 198 (Section 198 related to thecomputation of net profit) CSR Amount - Calculation 4 2% of Average net profit During immediately preceding 3 years

- 5. PreviousCSR Law on unspent fund : MandateErstwhile IF, thecompany failed to meet itsCSR obligations, the reasonsfor not spending theCSR amountswererequired to bedisclosed in thedirectors' report. Lately, Government of India has come up with the Amendments in the CSR Law which is still to be notified. 5

- 6. New Law: UNSPENT AMOUNT at theend of financial year Not related to ongoing project Company must transfer unspent amount to afund specified in scheduleVII, within aperiod of 6 monthsof theexpiry of that Financial year. ** CompaniesAct, 2013 ScheduleVII (ix) specifiesfunds 6

- 7. CSR fund: Unspent (ScheduleVII) CompaniesAct, 2013 ScheduleVII (ix) specifiesfunds: ïą contribution to the Prime Minister's National Relief Fund ïą or any other fund set up by the Central Government ïą or the State Governments for socio-economic development and relief and funds for the welfare of the Scheduled Castes, the Scheduled Tribes, other backward classes, minorities and women 7

- 8. New Law: UNSPENT AMOUNT at theend of financial year Related to ongoing project ïą Company has to transfer such amount within 30 from the end of FY to a special account in bank known as Unspent CSR Account. ïą Unspent CSR Account will have to be spent by the company towards the CSR projects (under its CSR policy) within 3 (three) financial years from the date of such transfer. ïą If the company is unable to spend the sum in the Unspent CSR Account within the prescribed period of 3 (three) financial years, then, such unspent amount should be transferred to a fund specified under Schedule VII of the Companies Act (Schedule VII Fund) within 6 (six) months from the end of the relevant financial year. 8

- 9. Simplified Treatment 2% of net profit shall betransferred to aspecial account to becalled Unspent Corporate Social Responsibility Account within a period of 30 days from theend of financial year Company must spend such amount for CSR within a period of 3 financial year from thedateof such transfer If company failsto spend within aperiod of 3 years, it isan obligation to transfer thesameto afund specified in Schedule VII within aperiod of 30 daysafter completion of 3rd FY 9

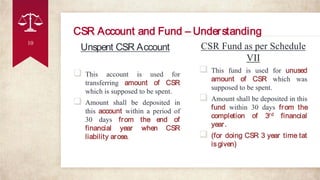

- 10. CSR Account and Fund â Understanding Unspent CSR Account ïą This account is used for transferring amount of CSR which is supposed to be spent. ïą Amount shall be deposited in this account within a period of 30 days from the end of financial year when CSR liability arose. CSR Fund as per Schedule VII ïą This fund is used for unused amount of CSR which was supposed to be spent. ïą Amount shall be deposited in this fund within 30 days from the completion of 3rd financial year. ïą (for doing CSR 3 year time tat isgiven) 10

- 12. Penal Provision : Liability 12 If a company Contravenes Penalty on Company: > Minimum 50 Thousand > Maximum 25 Lac Penalty on officer in default: > Fine of 50 thousand up to 5 Lac (and/or) > Imprisonment may extend up to 3 years

- 13. 13 Thank You! Any questions? Submitted by: Shraddha Singhi âŽĐ Company Secretary âŽĐ 3rd Oct, 2019