Decision tree

- 1. DECISION TREE Bayesian Approach DR. KALPNA SHARMA, D E PA R T M E N T O F M AT H E M AT I C S M A N I PA L U N I V E R S I T Y J A I P U R 1

- 2. DECISION TREES ïķ A decision tree is a chronological representation of the decision problem. ïķ Each decision tree has two types of nodes; round nodes correspond to the states of nature while square nodes correspond to the decision alternatives. ïķ The branches leaving each round node represent the different states of nature while the branches leaving each square node represent the different decision alternatives. ïķ At the end of each limb of a tree are the payoffs attained from the series of branches making up that limb. 2 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 3. FIVE STEPS TO DECISION TREE ANALYSIS 1. Define the problem. 2. Structure or draw the decision tree. 3. Assign probabilities to the states of nature. 4. Estimate payoffs for each possible combination of alternatives and states of nature. 5. Solve the problem by computing expected monetary values (EMVs) for each state of nature node. 3 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 4. EXAMPLE A developer must decide how large a luxury condominium complex to build â small, medium, or large. The profitability of this complex depends upon the future level of demand for the complexâs condominiums. 4 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 5. ELEMENTS OF DECISION THEORY States of nature: The states of nature could be defined as low demand and high demand. Alternatives: Developer could decide to build a small, medium, or large condominium complex. Payoffs: The profit for each alternative under each potential state of nature is going to be determined. We develop different models for this problem on the following slides. 5 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 6. PAYOFF TABLE THIS IS A PROFIT PAYOFF TABLE States of Nature Alternatives Low High Small 8 8 Medium 5 15 Large -11 22 (payoffs in millions) DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR 6

- 7. DECISION TREE 8 8 5 Medium Complex 15 -11 7 22 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

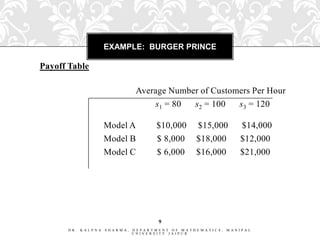

- 8. EXAMPLE: BURGER PRINCE Burger Prince Restaurant is contemplating opening a new restaurant on Main Street. It has three different models, each with a different seating capacity. Burger Prince estimates that the average number of customers per hour will be 80, 100, or 120. The payoff table (profits) for the three models is on the next slide. 8 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 9. EXAMPLE: BURGER PRINCE Payoff Table Average Number of Customers Per Hour s1 = 80 s2 = 100 s3 = 120 Model A $10,000 $15,000 $14,000 Model B $ 8,000 $18,000 $12,000 Model C $ 6,000 $16,000 $21,000 9 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 10. EXAMPLE: BURGER PRINCE Expected Value Approach Calculate the expected value for each decision. The decision tree on the next slide can assist in this calculation. Here d1, d2, d3 represent the decision alternatives of models A, B, C, and s1, s2, s3 represent the states of nature of 80, 100, and 120. 10 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 11. EXAMPLE: BURGER PRINCE Payoffs s1 .4 10,000 s2 .2 2 s3 15,000 .4 d1 14,000 s1 .4 d2 8,000 1 s2 .2 3 18,000 d3 s3 .4 12,000 s1 .4 6,000 s2 .2 4 16,000 s3 .4 21,000 11 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 12. EXAMPLE: BURGER PRINCE Expected Value For Each Decision EMV = .4(10,000) + .2(15,000) + .4(14,000) = $12,600 d1 2 Model A EMV = .4(8,000) + .2(18,000) + .4(12,000) Model B d2 = $11,600 1 3 d3 EMV = .4(6,000) + .2(16,000) + .4(21,000) Model C = $14,000 4 Choose the model with largest EV, Model C. DR. KALPNA SHARMA, 12 DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

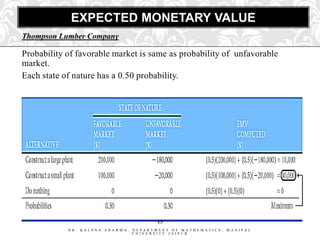

- 13. EXAMPLE PROBLEM: THOMPSON LUMBER COMPANY Thompson Lumber Company is trying to decide whether to expand its product line by manufacturing and marketing a new product which is âbackyard storage sheds.â The courses of action that may be chosen include: (1) large plant to manufacture storage sheds, (2) small plant to manufacture storage sheds, or (3) build no plant at all. 13 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 14. THOMPSON LUMBER COMPANY Probability 0.5 0.5 14 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 15. EXPECTED MONETARY VALUE Thompson Lumber Company Probability of favorable market is same as probability of unfavorable market. Each state of nature has a 0.50 probability. 15 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 16. CALCULATING THE EVPI Best outcome for state of nature "favorable market" is "build a large plant" with a payoff of $200,000. Best outcome for state of nature "unfavorable market" is "do nothing," with payoff of $0. Therefore, Expected profit with perfect information EPPI = ($200,000)(0.50) + ($0)(0.50) = $ 100,000 If one had perfect information, an average payoff of $100,000 could be achieved in the long run. However, the maximum EMV (EV BEST) or expected value without perfect information, is $40,000. 16 Therefore, EVPI = $100,000 - $40,000 = $60,000. DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, UNIVERSITY JAIPUR MANIPAL

- 17. TO TEST OR NOT TO TEST Often, companies have the option to perform market tests/surveys, usually at a price, to get additional information prior to making decisions. However, some interesting questions need to be answered before this decision is made: How will the test results be combined with prior information? How much should you be willing to pay to test? The good news is that Bayesâ Theorem can be used to combine the information, and we can use our decision tree to find EVSI, the Expected Value of Sample Information. In order to perform these calculations, we first need to know how reliable the potential test may be. 17 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 18. MARKET SURVEY RELIABILITY IN PREDICTING ACTUAL STATES OF NATURE Assuming that the above information is available, we can combine these conditional probabilities with our prior probabilities using Bayesâ Theorem. 18 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 19. MARKET SURVEY RELIABILITY IN PREDICTING ACTUAL STATES OF NATURE 19 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 20. PROBABILITY REVISIONS GIVEN POSITIVE SURVEY Alternatively, the following table will produce the same results: 20 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 21. PROBABILITY REVISIONS GIVEN NEGATIVE SURVEY 21 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 22. PLACING POSTERIOR PROBABILITIES ON THE DECISION TREE The bottom of the tree is the âno testâ part of the analysis; therefore, the prior probabilities are assigned to these events. P(favorable market) = P(FM) = 0.5 P(unfavorable market) = P(UM) = 0.5 The calculations here will be identical to the EMV calculations performed without a decision tree. The top of the tree is the âtestâ part of the analysis; therefore, the posterior probabilities are assigned to these events. DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR 22

- 23. DECISION TREES FOR TEST/NO TEST MULTI-STAGE DECISION PROBLEMS 23 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 24. DECISION TREE SOLUTION Thompson Lumber Company 24 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 25. IN-CLASS PROBLEM 3 Leo can purchase a historic home for $200,000 or land in a growing area for $50,000. There is a 60% chance the economy will grow and a 40% change it will not. If it grows, the historic home will appreciate in value by 15% yielding a $30,00 profit. If it does not grow, the profit is only $10,000. If Leo purchases the land he will hold it for 1 year to assess the economic growth. If the economy grew during the first year, there is an 80% chance it will continue to grow. If it did not grow during the first year, there is a 30% chance it will grow in the next 4 years. After a year, if the economy grew, Leo will decide either to build and sell a house or simply sell the land. It will cost Leo $75,000 to build a house that will sell for a profit of $55,000 if the economy grows, or $15,000 if it does not grow. Leo can sell the land for a profit of $15,000. If, after a year, the economy does not grow, Leo will either develop the land, which will cost $75,000, or sell the land for a profit of $5,000. If he develops the land and the economy begins to grow, he will make $45,000. If he develops the land and the economy does not grow, he will make $5,000. 25 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 26. IN-CLASS PROBLEM 3: 2 SOLUTION Economy grows (.6) No growth (.4) Purchase Economy grows historic home (.8) Build house 6 No growth (.2) 1 4 Sell Economy grows land Purchase land (.6) 3 Economy grows (.3) No growth (.4) Develop land 7 No growth (.7) 5 Sell land 26 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 27. IN-CLASS PROBLEM 3: SOLUTION $22,000 Economy grows (.6) $30,000 2 No growth (.4) $10,000 Purchase Economy grows historic home $55,000 $47,000 (.8) Build house 6 $35,000 No growth (.2) $15,000 1 4 Sell $15,000 Economy grows $47,000 land Purchase land (.6) 3 Economy grows $45,000 $17,000 (.3) $35,000 No growth (.4) Develop land 7 No growth (.7) $5,000 5 Sell land $5,000 $17,000 27 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 28. SIMPLE EXAMPLE: UTILITY THEORY Letâs say you were offered $2,000,000 right now on a chance to win $5,000,000. The $5,000,000 is won only if you flip a coin and get tails. If you get heads you lose and get $0. What should you do? $2,000,000 $0 Heads (0.5) Tails (0.5) $5,000,000 28 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 29. Decision Trees 29 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 30. Planning Tool 30 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 31. DECISION TREES Enable a business to quantify decision making Useful when the outcomes are uncertain Places a numerical value on likely or potential outcomes Allows comparison of different possible decisions to be made 31 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 32. DECISION TREES Limitations: How accurate is the data used in the construction of the tree? How reliable are the estimates of the probabilities? Data may be historical â does this data relate to real time? Necessity of factoring in the qualitative factors â human resources, motivation, reaction, relations with suppliers and other stakeholders 32 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 33. Process 33 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 34. THE PROCESS Economic growth rises Expected outcome 0.7 ÂĢ300,000 Expand by opening new outlet Economic growth declines Expected outcome -ÂĢ500,000 0.3 Maintain current status ÂĢ0 The circle denotes the point where different outcomes could occur. The estimates of the probability and the knowledge of the expected outcome allow theadenotes the pointuncertainty is maintain thethe economy â quo! This wouldcontinuesoutcome of is: A square firm to make a calculation of the likely return. In this example it where a decision is made, In this example, a business is contemplating There is also the outlet. The nothing and the state of current status if the economy have an to grow opening new option to do ÂĢ0. healthily the option is estimated to yield profits of ÂĢ300,000. However, if the economy fails to grow as Economicthe potentialrises:estimatedÂĢ300,000 = ÂĢ210,000 expected, growth loss is 0.7 x at ÂĢ500,000. Economic growth declines: 0.3 x ÂĢ500,000 = -ÂĢ150,000 34 The calculation would suggest it is wise to go ahead with the decision ( a net âbenefitâ figure. ofA +ÂĢ60,000)A , U N IPVAERRTSMI E Y TJ A IFP U RA T H E M A T I C S , M A N I P A L DR K LPNA SHARM DE T N O M

- 35. The Process Economic growth rises Expected outcome 0.5 ÂĢ300,000 Expand by opening new outlet Economic growth declines Expected outcome -ÂĢ500,000 0.5 Maintain current status ÂĢ0 Look what happens however if the probabilities change. If the firm is unsure of the potential for growth, it might estimate it at 50:50. In this case the outcomes will be: Economic growth rises: 0.5 x ÂĢ300,000 = ÂĢ150,000 Economic growth declines: 0.5 x -ÂĢ500,000 = -ÂĢ250,000 35 In this instance,D the A L P N benefit A , D E P A R T M E N T â Fthe TdecisionS ,looksPless favourable! R. K net A S H A R M is -ÂĢ100,000 O M A H E M A T I C M A N I A L UNIVERSITY JAIPUR

- 36. Advantages 36 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 37. Disadvantages 37 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR

- 38. 38 DR. KALPNA SHARMA, DEPARTMENT OF MATHEMATICS, MANIPAL UNIVERSITY JAIPUR