1 of 1

Download to read offline

Ad

Recommended

Market Demand function

Market Demand functionICAB

╠²

The document discusses the concept of demand in mathematical terms. It states that the amount consumers demand of a product (Qx) is a function of the price of the product (Px), the price of other goods (Py), consumer tastes and preferences (T), consumer income (M), and the number of consumers (N). It provides examples of linear and nonlinear demand curves expressed as mathematical equations, and explains how to calculate the total market demand by adding individual demand curves.40215240 law-of-demand

40215240 law-of-demandRakesh Rajdev

╠²

The document discusses the laws of demand and supply. It defines the law of demand as consumers buying more of a good when its price decreases and less when its price increases, with other factors held constant. The law of supply states that with other factors held constant, the higher the price of a commodity, the greater the quantity supplied. The document also discusses the concepts of elasticity of demand, including price elasticity of demand, income elasticity of demand, and cross elasticity of demand.Demand function - ENGINEERING ECONOMICS & FINANCIAL ACCOUNTING - DR.K.BARANID...

Demand function - ENGINEERING ECONOMICS & FINANCIAL ACCOUNTING - DR.K.BARANID...Barani Dharan

╠²

The document discusses the concept of demand functions, which describe the relationship between the quantity of goods purchased and various influencing factors such as price and income levels. It emphasizes that these functions are essential in understanding consumer demand during specific periods. A mathematical representation of the demand function is also provided.Monopolistic competition & oligopoly

Monopolistic competition & oligopolyCarmela Grace Gavino

╠²

Monopolistic competition and oligopoly are two market structures between perfect competition and monopoly. Monopolistic competition is characterized by many firms with differentiated products. Firms have some market power but no barriers to entry or exit. Oligopoly is characterized by a few dominant firms where the behavior of one firm depends on its competitors. Game theory is used to analyze strategic interactions among oligopolistic firms.oligopoly

oligopolyPARUL GUPTA

╠²

This document discusses market structure and provides examples of the oligopoly market structure through Pepsi and Coca-Cola. It defines market structure and identifies the key characteristics of an oligopoly including there being a handful of sellers, high barriers to entry, and interdependent decision making. It then explains the kinked demand curve model of oligopoly behavior and price stability. Finally, it summarizes the characteristics of Pepsi and Coca-Cola as examples of an oligopoly including their industry rivalry, threat of new entrants, threat of substitutes, supplier and buyer bargaining power.Chapter 10 monopolistic competition & oligopoly

Chapter 10 monopolistic competition & oligopolytelliott876

╠²

This document provides an overview of monopolistic competition and oligopoly market structures. It discusses key characteristics of each including:

1) Monopolistic competition is characterized by many small sellers, differentiated products, and easy entry and exit. Firms compete through non-price factors like advertising and product quality.

2) Oligopoly is dominated by a few large firms producing either homogeneous or differentiated products. Entry is difficult due to barriers like economies of scale. Firms must consider competitors' potential reactions in their pricing decisions.

3) Game theory, such as the prisoner's dilemma, can model strategic interactions between oligopolistic competitors who are mutually interdependent. Firms must choose strategies without communicating directly with rivals.demand and its determinants

demand and its determinantsSakshi Agarwal

╠²

The document explains the concept of demand in economics, defining it as the quantity of a commodity consumers are willing to purchase at a given price over a specific period. It discusses market demand, the demand curve, and introduces the law of demand, which states that price and quantity demanded are inversely related, along with exceptions like Giffen and Veblen goods. Additionally, various factors influencing demand, such as consumer income, tastes, price of related goods, expectations, advertising, and population growth are outlined.Inflation types and causes

Inflation types and causesQuaid e Azam college of commerce (university of peshawar)

╠²

Creeping inflation refers to a very low rise in prices like that of a snail or creeper. Moderate inflation occurs when prices rise moderately, while runway or galloping inflation describes rapidly rising prices at double or triple digit rates. The main theories of inflation are the quantity theory, demand pull theory, and cost push theory. The quantity theory states that too much money in the economy leads to inflation. Demand pull inflation occurs when aggregate demand increases more than supply, and cost push inflation happens when production costs rise, automatically increasing prices. Both monetary and fiscal measures can be used to reduce inflation.Monopolistic Competition

Monopolistic Competitionaizellbernal

╠²

This document discusses monopolistic competition, including its key characteristics: many firms sell differentiated but substitutable products; there is free entry and exit in the long run; and firms have some market power over price. It provides examples of industries that exhibit monopolistic competition, like clothing, restaurants, and soap. The document also notes both advantages, like diversity and choice for consumers, and disadvantages, like unnecessary advertising spending.Monopolistic Competition and Oligopoly

Monopolistic Competition and OligopolyNoel Buensuceso

╠²

This document provides an overview of monopolistic competition and oligopoly market structures. It discusses key characteristics of monopolistic competition, including many firms, no barriers to entry, and product differentiation. Under monopolistic competition, firms have some market power due to differentiated products and can earn profits in the short run but will break even in the long run. The document also examines models of oligopoly behavior, including collusion and Cournot models. It provides examples of industries exhibiting monopolistic competition and high concentration.INFLATION

INFLATIONpraveensureshpai

╠²

This document provides an overview of inflation presented by Praveen Suresh. It defines inflation as a rise in the general price level and discusses its causes such as increases in demand or decreases in supply. The effects of inflation like rising costs of living are explained. Different types of inflation like demand-pull and cost-push are covered. Examples of major historical inflations and the high rates seen in countries like Zimbabwe and Germany are given. Methods to control inflation including monetary and fiscal measures are outlined. The document also discusses how inflation is calculated in India using the Wholesale Price Index and current inflation rates and food price rises in the country. It raises issues with solely relying on WPI for measuring consumer inflation.Monopolistic Competition

Monopolistic CompetitionJohan

╠²

This document discusses monopolistic competition, including its key characteristics, assumptions, and how firms determine costs, revenues, and profits in the short and long run. Some key aspects of monopolistic competition include firms differentiating their similar products through branding and advertising, barriers to entry being relatively low, and both consumers and producers having some degree of sovereignty. In the short run, firms can earn supernormal profits, but long-run profits tend towards normal as competition increases. Examples given include soft drink companies and sports shoe brands.Estimation Of Production And Cost Function

Estimation Of Production And Cost FunctionPradeep Awasare

╠²

Estimation of production and cost functions involves collecting data, assuming a mathematical form for the functions, and using estimation methods like regression analysis to determine parameter values. While data collection can be difficult due to issues like measuring capital usage, functions like the Cobb-Douglas and quadratic forms are commonly used in empirical work due to their flexibility and ability to capture concepts like diminishing returns. Long-run cost functions estimated via regression analysis or engineering methods are used for investment planning to determine optimal scale.Oligopoly

OligopolyKeem Quevedo

╠²

This document provides an overview of monopolistic competition and oligopoly market structures. It discusses key concepts such as product differentiation, advertising, pricing and output determination under monopolistic competition. It also examines oligopoly models including collusion, Cournot, and kinked demand curve models. It notes that oligopolies can be inefficient due to pricing above marginal cost, strategic behavior wasting resources, and potential for advertising waste. Government regulation aims to limit mergers that reduce competition.Determinants of demand

Determinants of demandzakir farooqui

╠²

This document discusses factors that affect demand, including price, income, prices of other goods, number of buyers, future prices, tastes, and quality. Price is the most important determinant of demand, as a change in price causes a shift along the demand curve. Changes in other factors like income, population, or tastes can cause the entire demand curve to shift. An increase in demand shifts the curve to the right, raising price and quantity demanded, while a decrease shifts it left, lowering price and quantity.Determinants Of Demand

Determinants Of DemandVijay A Raj

╠²

This document discusses the economic concepts of supply, demand, and market equilibrium. It provides details on:

1) How supply and demand curves model the relationship between price, quantity supplied, and quantity demanded in a competitive market, resulting in an equilibrium price and quantity.

2) The key determinants that influence supply and demand curves, including price, income, tastes, population, and prices of substitutes and complements.

3) How shifts in supply or demand curves due to changes in these determinants impact the market equilibrium price and quantity.Law of demand

Law of demandabhi23agrawal

╠²

1) Demand is defined as the desire, ability, and willingness to purchase a good or service. It is influenced by factors like price, income, utility, habits, fashion, weather, advertising, taxation, and speculation.

2) The law of demand states that, all else equal, demand decreases when price increases as consumers will purchase less of a good, and demand increases when price decreases as consumers will buy more.

3) For the law of demand to hold true, there should be no changes in consumer income, preferences, prices of related goods, expectations of future prices, or other economic conditions like the quantity of money, taxes, or climate.Monopolistic Competition

Monopolistic Competitiontutor2u

╠²

1) Monopolistic competition describes an imperfect market structure where many small businesses produce differentiated products. Examples include coffee shops, hair salons, and pizza delivery services.

2) In the short run, firms in monopolistically competitive markets can earn supernormal profits by producing at a quantity where marginal cost equals marginal revenue. In the long run, free entry and exit of competitors drives profits down to normal levels.

3) Monopolistically competitive markets are not perfectly efficient. Prices exceed marginal costs, leading to allocative inefficiency. Advertising spending may also represent an inefficient use of resources.Pricing strategies & practices

Pricing strategies & practicesVineet Sansare

╠²

This document discusses various pricing strategies and concepts that companies use to set prices, including penetration pricing, market skimming, value pricing, loss leader pricing, psychological pricing, price leadership, tender pricing, price discrimination, predatory pricing, absorption pricing, marginal cost pricing, contribution pricing, target pricing, and cost-plus pricing. It also covers the influence of price elasticity on pricing decisions.6 monopolistic competition

6 monopolistic competitionRajesh Neithilath

╠²

Monopolistic competition is an imperfect market structure between perfect competition and pure monopoly. It is characterized by many small sellers offering differentiated products, free entry and exit into the market, and firms facing downward-sloping demand curves. In the short run, firms can make profits or losses, but in the long run free entry and exit will cause the number of firms to adjust until all firms earn zero economic profits and price equals average total cost.Monopolistic Competition

Monopolistic Competitionanneclaireramser

╠²

Monopolistic competition is a market structure with many small businesses that sell similar but differentiated products. While firms have some control over pricing, they face significant competition and low profit margins due to the elastic demand curve and ease of market entry. To be successful, businesses must focus on cost efficiency, advertising, and differentiating their unique product offerings from competitors.Micro Economic: Demand and demand function

Micro Economic: Demand and demand functioneconomicsharbour

╠²

This document discusses the concepts of demand, demand function, demand curve, individual demand, market demand, factors that affect demand, and exceptions to the law of demand. It defines key terms like quantity demanded, demand schedule, utility, and explains the inverse relationship between price and quantity demanded as reflected in the downward sloping demand curve under the law of demand. The document also discusses causes of change in demand and how they result in a shift of the demand curve, as well as features of demand for durable goods and derived demand.Aggregate demand &supply

Aggregate demand &supplyKinnar Majithia

╠²

The document discusses key macroeconomic concepts including aggregate demand, aggregate supply, the consumption function, investment function, and the multiplier. It provides details on how each of these factors impact macroeconomic variables like output, employment, prices, and trade. It also examines the relationship between aggregate demand and supply using the AD-AS framework and how this intersection determines macroeconomic equilibrium.Demand Curve

Demand CurveRehan Akhtar

╠²

The document discusses demand curves and the factors that affect demand functions. It defines demand as the amount of goods and services consumers are willing and able to purchase within a given time period. A demand function expresses quantity demanded as a function of price and can be written as an equation with quantity demanded on the left and price and other factors on the right. These other factors include income, price of related goods, tastes, expected future prices, and number of consumers - and each factor has a defined relationship to quantity demanded whether positive or negative. The demand function uses a linear equation format where quantity demanded is equal to the intercept plus the slope multiplied by price plus slopes for each additional factor.Inflation And Types of Inflation

Inflation And Types of InflationMumtaz Ali Panhwar

╠²

The document discusses inflation, defining it as a sustained increase in prices and a decrease in money's value, along with its causes, effects, and remedies. It categorizes inflation into types such as demand-pull and cost-push, and outlines various causes including population growth and political instability. Finally, it offers remedies, highlighting monetary and fiscal measures, and notes that Pakistan is currently facing high inflation rates.Demand forecasting techniques ppt

Demand forecasting techniques pptpcte

╠²

This document discusses various techniques for demand forecasting. It outlines factors that affect demand forecasting such as the time horizon and level of forecasting (macro, industry, or firm). Short-term forecasts are used for production scheduling and inventory management, while long-term forecasts are for strategic planning of new projects. Demand is determined by factors like income, price, demographics, and product characteristics. The document also describes qualitative methods like expert opinion and quantitative methods like time series analysis and regression for forecasting demand.Microlesson sa paikot na daloy

Microlesson sa paikot na daloyMygie Janamike

╠²

Ang dokumento ay naglalaman ng mga layunin at hakbang upang matukoy ang mga dahilan ng di pag-unlad ng isang komunidad at mga solusyon upang mapanatili ang balanseng ekonomiya. Ipinapahayag nito ang pagsasagawa ng mga aktibidad tulad ng paggawa ng fishbone graphic at circular flow diagram upang ipaliwanag ang mga problema at solusyon sa ekonomiya ng komunidad. Ang mga grupo ay hinihimok na magtulungan at bumuo ng mga disenyo ng graphic organizer upang mas madali itong maipahayag sa buong komunidad.Mga Modelo ng Paikot na Daloy ng Ekonomiya

Mga Modelo ng Paikot na Daloy ng EkonomiyaMygie Janamike

╠²

Ang dokumento ay naglalarawan ng isang simpleng modelo ng ekonomiya kung saan ang sambahayan at bahay-kalakal ay nagtutulungan. Ang sambahayan ay bumibili ng mga produkto mula sa bahay-kalakal, habang ang bahay-kalakal ay lumilikha ng mga produkto. Ipinapakita nito ang ugnayan sa pagitan ng pagkonsumo at produksiyon sa ekonomiya.Ikatlong modelo

Ikatlong modeloMygie Janamike

╠²

Ang dokumento ay naglalarawan ng ikatlong modelo ng pananalapi na nag-uugnay sa paggasta ng sambahayan at kita ng bahay-kalakal sa pamilihan ng kalakal at paglilingkod. Ipinapakita nito ang proseso ng pagbili at pagbebenta ng mga kalakal at serbisyo, pati na rin ang pag-input sa produksyon mula sa pamilihan ng salik ng produksyon. Tinatalakay din ng dokumento ang relasyon ng pamilihang pinansyal kung saan ang sambahayan ay nag-iimpok at ang bahay-kalakal ay umuutang para sa pamumuhunan.Ikalimang modelo

Ikalimang modeloMygie Janamike

╠²

Ang dokumento ay nagpapakita ng kalakaran sa panlabas na sektor, kasama ang interaksyon sa pagitan ng bahay-kalakal at sambahayan sa pamilihan ng kalakal at serbisyo. Isinasalaysay nito ang proseso ng pagbili at pagbebenta, pati na rin ang mga transaksyon sa pamilihang pinansyal at pamahalaan, kabilang ang pagbabayad ng buwis at mga subsidyo. Ang kalakaran na ito ay nagtutukoy sa paggalaw ng kita at mga serbisyo sa ekonomiya, pati na rin ang pakikilahok sa pandaigdigang pamilihan.More Related Content

Viewers also liked (18)

Monopolistic Competition

Monopolistic Competitionaizellbernal

╠²

This document discusses monopolistic competition, including its key characteristics: many firms sell differentiated but substitutable products; there is free entry and exit in the long run; and firms have some market power over price. It provides examples of industries that exhibit monopolistic competition, like clothing, restaurants, and soap. The document also notes both advantages, like diversity and choice for consumers, and disadvantages, like unnecessary advertising spending.Monopolistic Competition and Oligopoly

Monopolistic Competition and OligopolyNoel Buensuceso

╠²

This document provides an overview of monopolistic competition and oligopoly market structures. It discusses key characteristics of monopolistic competition, including many firms, no barriers to entry, and product differentiation. Under monopolistic competition, firms have some market power due to differentiated products and can earn profits in the short run but will break even in the long run. The document also examines models of oligopoly behavior, including collusion and Cournot models. It provides examples of industries exhibiting monopolistic competition and high concentration.INFLATION

INFLATIONpraveensureshpai

╠²

This document provides an overview of inflation presented by Praveen Suresh. It defines inflation as a rise in the general price level and discusses its causes such as increases in demand or decreases in supply. The effects of inflation like rising costs of living are explained. Different types of inflation like demand-pull and cost-push are covered. Examples of major historical inflations and the high rates seen in countries like Zimbabwe and Germany are given. Methods to control inflation including monetary and fiscal measures are outlined. The document also discusses how inflation is calculated in India using the Wholesale Price Index and current inflation rates and food price rises in the country. It raises issues with solely relying on WPI for measuring consumer inflation.Monopolistic Competition

Monopolistic CompetitionJohan

╠²

This document discusses monopolistic competition, including its key characteristics, assumptions, and how firms determine costs, revenues, and profits in the short and long run. Some key aspects of monopolistic competition include firms differentiating their similar products through branding and advertising, barriers to entry being relatively low, and both consumers and producers having some degree of sovereignty. In the short run, firms can earn supernormal profits, but long-run profits tend towards normal as competition increases. Examples given include soft drink companies and sports shoe brands.Estimation Of Production And Cost Function

Estimation Of Production And Cost FunctionPradeep Awasare

╠²

Estimation of production and cost functions involves collecting data, assuming a mathematical form for the functions, and using estimation methods like regression analysis to determine parameter values. While data collection can be difficult due to issues like measuring capital usage, functions like the Cobb-Douglas and quadratic forms are commonly used in empirical work due to their flexibility and ability to capture concepts like diminishing returns. Long-run cost functions estimated via regression analysis or engineering methods are used for investment planning to determine optimal scale.Oligopoly

OligopolyKeem Quevedo

╠²

This document provides an overview of monopolistic competition and oligopoly market structures. It discusses key concepts such as product differentiation, advertising, pricing and output determination under monopolistic competition. It also examines oligopoly models including collusion, Cournot, and kinked demand curve models. It notes that oligopolies can be inefficient due to pricing above marginal cost, strategic behavior wasting resources, and potential for advertising waste. Government regulation aims to limit mergers that reduce competition.Determinants of demand

Determinants of demandzakir farooqui

╠²

This document discusses factors that affect demand, including price, income, prices of other goods, number of buyers, future prices, tastes, and quality. Price is the most important determinant of demand, as a change in price causes a shift along the demand curve. Changes in other factors like income, population, or tastes can cause the entire demand curve to shift. An increase in demand shifts the curve to the right, raising price and quantity demanded, while a decrease shifts it left, lowering price and quantity.Determinants Of Demand

Determinants Of DemandVijay A Raj

╠²

This document discusses the economic concepts of supply, demand, and market equilibrium. It provides details on:

1) How supply and demand curves model the relationship between price, quantity supplied, and quantity demanded in a competitive market, resulting in an equilibrium price and quantity.

2) The key determinants that influence supply and demand curves, including price, income, tastes, population, and prices of substitutes and complements.

3) How shifts in supply or demand curves due to changes in these determinants impact the market equilibrium price and quantity.Law of demand

Law of demandabhi23agrawal

╠²

1) Demand is defined as the desire, ability, and willingness to purchase a good or service. It is influenced by factors like price, income, utility, habits, fashion, weather, advertising, taxation, and speculation.

2) The law of demand states that, all else equal, demand decreases when price increases as consumers will purchase less of a good, and demand increases when price decreases as consumers will buy more.

3) For the law of demand to hold true, there should be no changes in consumer income, preferences, prices of related goods, expectations of future prices, or other economic conditions like the quantity of money, taxes, or climate.Monopolistic Competition

Monopolistic Competitiontutor2u

╠²

1) Monopolistic competition describes an imperfect market structure where many small businesses produce differentiated products. Examples include coffee shops, hair salons, and pizza delivery services.

2) In the short run, firms in monopolistically competitive markets can earn supernormal profits by producing at a quantity where marginal cost equals marginal revenue. In the long run, free entry and exit of competitors drives profits down to normal levels.

3) Monopolistically competitive markets are not perfectly efficient. Prices exceed marginal costs, leading to allocative inefficiency. Advertising spending may also represent an inefficient use of resources.Pricing strategies & practices

Pricing strategies & practicesVineet Sansare

╠²

This document discusses various pricing strategies and concepts that companies use to set prices, including penetration pricing, market skimming, value pricing, loss leader pricing, psychological pricing, price leadership, tender pricing, price discrimination, predatory pricing, absorption pricing, marginal cost pricing, contribution pricing, target pricing, and cost-plus pricing. It also covers the influence of price elasticity on pricing decisions.6 monopolistic competition

6 monopolistic competitionRajesh Neithilath

╠²

Monopolistic competition is an imperfect market structure between perfect competition and pure monopoly. It is characterized by many small sellers offering differentiated products, free entry and exit into the market, and firms facing downward-sloping demand curves. In the short run, firms can make profits or losses, but in the long run free entry and exit will cause the number of firms to adjust until all firms earn zero economic profits and price equals average total cost.Monopolistic Competition

Monopolistic Competitionanneclaireramser

╠²

Monopolistic competition is a market structure with many small businesses that sell similar but differentiated products. While firms have some control over pricing, they face significant competition and low profit margins due to the elastic demand curve and ease of market entry. To be successful, businesses must focus on cost efficiency, advertising, and differentiating their unique product offerings from competitors.Micro Economic: Demand and demand function

Micro Economic: Demand and demand functioneconomicsharbour

╠²

This document discusses the concepts of demand, demand function, demand curve, individual demand, market demand, factors that affect demand, and exceptions to the law of demand. It defines key terms like quantity demanded, demand schedule, utility, and explains the inverse relationship between price and quantity demanded as reflected in the downward sloping demand curve under the law of demand. The document also discusses causes of change in demand and how they result in a shift of the demand curve, as well as features of demand for durable goods and derived demand.Aggregate demand &supply

Aggregate demand &supplyKinnar Majithia

╠²

The document discusses key macroeconomic concepts including aggregate demand, aggregate supply, the consumption function, investment function, and the multiplier. It provides details on how each of these factors impact macroeconomic variables like output, employment, prices, and trade. It also examines the relationship between aggregate demand and supply using the AD-AS framework and how this intersection determines macroeconomic equilibrium.Demand Curve

Demand CurveRehan Akhtar

╠²

The document discusses demand curves and the factors that affect demand functions. It defines demand as the amount of goods and services consumers are willing and able to purchase within a given time period. A demand function expresses quantity demanded as a function of price and can be written as an equation with quantity demanded on the left and price and other factors on the right. These other factors include income, price of related goods, tastes, expected future prices, and number of consumers - and each factor has a defined relationship to quantity demanded whether positive or negative. The demand function uses a linear equation format where quantity demanded is equal to the intercept plus the slope multiplied by price plus slopes for each additional factor.Inflation And Types of Inflation

Inflation And Types of InflationMumtaz Ali Panhwar

╠²

The document discusses inflation, defining it as a sustained increase in prices and a decrease in money's value, along with its causes, effects, and remedies. It categorizes inflation into types such as demand-pull and cost-push, and outlines various causes including population growth and political instability. Finally, it offers remedies, highlighting monetary and fiscal measures, and notes that Pakistan is currently facing high inflation rates.Demand forecasting techniques ppt

Demand forecasting techniques pptpcte

╠²

This document discusses various techniques for demand forecasting. It outlines factors that affect demand forecasting such as the time horizon and level of forecasting (macro, industry, or firm). Short-term forecasts are used for production scheduling and inventory management, while long-term forecasts are for strategic planning of new projects. Demand is determined by factors like income, price, demographics, and product characteristics. The document also describes qualitative methods like expert opinion and quantitative methods like time series analysis and regression for forecasting demand.More from Mygie Janamike (20)

Microlesson sa paikot na daloy

Microlesson sa paikot na daloyMygie Janamike

╠²

Ang dokumento ay naglalaman ng mga layunin at hakbang upang matukoy ang mga dahilan ng di pag-unlad ng isang komunidad at mga solusyon upang mapanatili ang balanseng ekonomiya. Ipinapahayag nito ang pagsasagawa ng mga aktibidad tulad ng paggawa ng fishbone graphic at circular flow diagram upang ipaliwanag ang mga problema at solusyon sa ekonomiya ng komunidad. Ang mga grupo ay hinihimok na magtulungan at bumuo ng mga disenyo ng graphic organizer upang mas madali itong maipahayag sa buong komunidad.Mga Modelo ng Paikot na Daloy ng Ekonomiya

Mga Modelo ng Paikot na Daloy ng EkonomiyaMygie Janamike

╠²

Ang dokumento ay naglalarawan ng isang simpleng modelo ng ekonomiya kung saan ang sambahayan at bahay-kalakal ay nagtutulungan. Ang sambahayan ay bumibili ng mga produkto mula sa bahay-kalakal, habang ang bahay-kalakal ay lumilikha ng mga produkto. Ipinapakita nito ang ugnayan sa pagitan ng pagkonsumo at produksiyon sa ekonomiya.Ikatlong modelo

Ikatlong modeloMygie Janamike

╠²

Ang dokumento ay naglalarawan ng ikatlong modelo ng pananalapi na nag-uugnay sa paggasta ng sambahayan at kita ng bahay-kalakal sa pamilihan ng kalakal at paglilingkod. Ipinapakita nito ang proseso ng pagbili at pagbebenta ng mga kalakal at serbisyo, pati na rin ang pag-input sa produksyon mula sa pamilihan ng salik ng produksyon. Tinatalakay din ng dokumento ang relasyon ng pamilihang pinansyal kung saan ang sambahayan ay nag-iimpok at ang bahay-kalakal ay umuutang para sa pamumuhunan.Ikalimang modelo

Ikalimang modeloMygie Janamike

╠²

Ang dokumento ay nagpapakita ng kalakaran sa panlabas na sektor, kasama ang interaksyon sa pagitan ng bahay-kalakal at sambahayan sa pamilihan ng kalakal at serbisyo. Isinasalaysay nito ang proseso ng pagbili at pagbebenta, pati na rin ang mga transaksyon sa pamilihang pinansyal at pamahalaan, kabilang ang pagbabayad ng buwis at mga subsidyo. Ang kalakaran na ito ay nagtutukoy sa paggalaw ng kita at mga serbisyo sa ekonomiya, pati na rin ang pakikilahok sa pandaigdigang pamilihan.Ikaapat na modelo

Ikaapat na modeloMygie Janamike

╠²

Ang dokumento ay naglalarawan ng ikatlong modelo ng ekonomiya kung saan ang bahay-kalakal ay nagbebenta ng mga kalakal at serbisyo sa sambahayan. Ang sambahayan naman ay bumibili ng mga produkto at nag-iimpok ng kita, na ginagasta para sa pamumuhunan. Ang gobyerno ay nangongolekta ng buwis mula sa bahay-kalakal at sambahayan upang magbigay ng mga pampublikong produkto at serbisyo.Ikalawang modelo

Ikalawang modeloMygie Janamike

╠²

Ang ikalawang modelo ng pamilihan ay naglalarawan ng ugnayan sa pagitan ng bahay-kalakal at sambahayan sa pagbili at pagbebenta ng kalakal at serbisyo. Ang bahay-kalakal ay nagbebenta ng mga produkto at serbisyo habang ang sambahayan ay bumibili nito. Ang modelo ay naka-focus din sa mga salik ng produksyon at kita na nakuha mula sa sahod, upa, at tubo.Mga batas sa pagkonsumo

Mga batas sa pagkonsumoMygie Janamike

╠²

Ang dokumento ay naglalarawan ng mga batas sa pagkonsumo na nag-uugnay sa kasiyahan ng mga tao sa mga produkto at serbisyo. Kabilang dito ang mga batas ng imitative, variety, economic order, harmony, at diminishing utility. Ang bawat batas ay nagbibigay-diin sa iba't ibang aspeto ng kasiyahan na nauugnay sa pagkonsumo.Mga batas ng pagkonsumo

Mga batas ng pagkonsumoMygie Janamike

╠²

Ang dokumento ay naglalarawan ng limang mahahalagang batas kaugnay ng pagkonsumo. Kabilang dito ang batas ng imitasyon, pagkakaiba-iba, pagpapasyang ekonomiko, pagkakabagay-bagay, at bumababang kasiyahan. Ang bawat batas ay naglalarawan kung paano nakakaapekto ang mga uri ng produkto at serbisyo sa kasiyahan ng mga mamimili.Paghahanda

PaghahandaMygie Janamike

╠²

Ang dokumento ay naglalarawan ng isang halimbawa ng demand ng ponkan kung saan ang isang tindera ay nag-aalok ng 50 piraso sa nagbabagong presyo. Ipinapakita nito ang mga presyo mula P25.00 pababa hanggang P10.00 at nagtatanong kung anong pagbabago ang mangyayari sa demand sa bawat pagbaba ng presyo. Kinakailangan ang pagtutukoy ng solusyon o pagtutuos batay sa mga ibinigay na value.Microlesson for demand

Microlesson for demandMygie Janamike

╠²

Ang dokumento ay naglalarawan ng sitwasyon ni Mr. Dela Cruz na may fruit stand na nahaharap sa problema ng mababang benta matapos siyang mailipat ng puwesto. Kailangan niyang malaman ang demand ng kanyang mga prutas, lalo na ang bayabas, upang makapagpasya sa tamang presyo na makatutulong sa kanyang kita. Tinutukso nito ang mga mambabasa na maging eksperto sa ekonomiks at tulungan si Mr. Dela Cruz na mabawi ang kanyang puhunan.Mga paraan ng paglalarawan sa demand

Mga paraan ng paglalarawan sa demandMygie Janamike

╠²

Ang dokumento ay naglalarawan ng demand function bilang isang mathematical equation na nagpapakita ng relasyon ng quantity demand (qd) at presyo (p) kung saan ang qd ay nakabatay sa pagbabago ng p. Ipinapahayag nito na ang demand ay bumababa habang tumataas ang presyo, na nailalarawan sa pamamagitan ng halimbawa ng demand schedule at demand curve. Ang halimbawa ay nagpapakita ng mga pagbabago sa dami ng demand ng produkto batay sa iba't ibang presyo.Interpretasyon sa demand

Interpretasyon sa demandMygie Janamike

╠²

Nagsasaad ang dokumento ng mga kinakailangan para sa pagsusuri ng demand function sa porma ng tsart at grap. Dapat ipaliwanag ang mga interpretasyon mula sa mga datos na ito. Ang interpretasyon ay dapat patunayan ang batas ng demand.Demand curve

Demand curveMygie Janamike

╠²

This document shows a demand curve graph with price on the y-axis and quantity demanded on the x-axis. It plots the relationship between various price points and the corresponding quantity demanded, showing that as price increases, quantity demanded decreases, following the inverse relationship defined by the demand function Qd=50-2P. The demand curve captures the negative slope between price and quantity demanded.Demand activity sheet.docx

Demand activity sheet.docxMygie Janamike

╠²

Ang dokumento ay naglalaman ng mga tanong at tagubilin kaugnay ng demand function at graphing, partikular sa pagsasagawa ng mga halimbawa mula sa isang PowerPoint presentation. Ito ay nagpapakita ng isang demand schedule at hinihimok ang mga gumagamit na bigyang-pansin ang mga detalye ng talahanayan at ipaliwanag ang kanang graph. Kinakailangan ang mga estudyante na kumpletuhin ang kanilang impormasyon at iskor sa mga ibinigay na blangkong bahagi.Demand activity sheet

Demand activity sheetMygie Janamike

╠²

Ang dokumento ay tila isang form na naglalaman ng impormasyon tulad ng pangalan, seksyon, petsa, at iskor. Mayroon ding bahagi para sa komputasyon na dapat punan. Wala itong karagdagang detalye o nilalaman sa ibinigay na teksto.Tsart at grap ng demand activity

Tsart at grap ng demand activityMygie Janamike

╠²

This document appears to be a score sheet containing a chart with points ranging from 0 to 35 on the x-axis. The y-axis contains pricing and profit information. There are 7 items labeled A through G with corresponding point values, prices, and current profits which are all listed as 0. The total points, pricing and profits are also listed as 0.Mga batas ng pagkonsumo

Mga batas ng pagkonsumoMygie Janamike

╠²

Ang dokumento ay naglalarawan ng limang batas ng pagkonsumo na nakakaapekto sa kasiyahan ng mga tao sa paggamit ng mga produkto at serbisyo. Kabilang dito ang batas ng imitasyon, pagkakaiba-iba, pagpapasyang ekonomiko, pagkakabagay-bagay, at bumababang kasiyahan. Bawat batas ay nagpapakita ng mga salik na nakakaimpluwensya sa desisyon ng mga mamimili at sa kanilang karanasang pang-ekonomiya.Bahaging ginagampanan ng Industriya

Bahaging ginagampanan ng IndustriyaMygie Janamike

╠²

Ang dokumento ay tumatalakay sa mga aspeto ng industriya, kabilang ang konstruksyon, pagmamanupaktyur, pagmimina, at serbisyo. Itinatampok nito ang kahalagahan ng industriya sa pagproseso ng hilaw na materyales, pagbibigay ng trabaho, at mga isyu tulad ng kakulangan sa puhunan at proteksyon mula sa pamahalaan. Tinalakay din ang mga hakbang na maaaring gawin upang masolusyunan ang mga suliranin sa sektor ng industriya, pati na rin ang mga karapatan at kapakanan ng mga manggagawa.Patkaran sa Pananalapi

Patkaran sa PananalapiMygie Janamike

╠²

Ang dokumento ay nagbibigay ng detalyadong impormasyon tungkol sa sektor ng pananalapi at mga institusyong pinansyal sa Pilipinas. Tinalakay ang mga uri ng bangko, tungkulin ng Bangko Sentral, at ang sistema ng salapi at kredito. Nakatuon din ito sa kasaysayan at kahalagahan ng salapi at ang mga pagbabago sa mga peak ng ekonomiya.Ad

Demand function

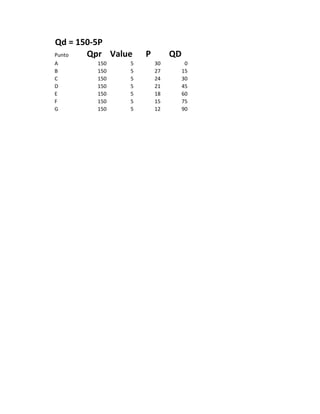

- 1. Qd = 150-5P Punto Qpr Value P QD A 150 5 30 0 B 150 5 27 15 C 150 5 24 30 D 150 5 21 45 E 150 5 18 60 F 150 5 15 75 G 150 5 12 90