Dexit Case Study

- 2. Our Team: “Team last but One” Nachiappan.PL Nagesh Kashyap Neeraj Dureja Prashanth Pattamatta Rahul Seshadri Vaibhav Vardhan

- 3. Dexit Inc. A Bird’s Eye View

- 4. The Product Fast Secure Light Easy

- 5. The Market

- 6. First to burn their Fingers • Mondex Canada • Mondex Canada Again…. • Scotia Bank along with Visa Cash

- 7. The Blue Print • Customer • Merchant Solution Solution

- 8. The Revenue Model • Customer Service • Merchant Service • Equipment Sales • Others

- 9. Did we miss ≤ı¥«≥æ±≥Ÿ≥Ûæ±≤‘≤µ‚Ķ‚∂ƒ¶‚∂ƒ¶‚∂ƒ¶

- 10. Objectives • Determine the target market • Plan an appropriate marketing mix • Push or Pull strategy • National or local launch • Sustainability, Scalability • learning

- 11. SWOT Analysis Strengths Weakness • Easy to lose • Easy to use • Novice • Knowledge about • Investment size both market for • Utility of product product and service • Concentrating on many things • Security and technical issues

- 12. SWOT Analysis Opportunities Threats • Pioneer, capture the • Earlier failures market • Time to Break Even • Market for Low cost • Credit/Debit/Gift cards transaction • Competitive Advantage

- 13. Target Market Customer • Students • Proletariat Class • Bulk deals in industries

- 14. Target Market Merchant • retail outlets, stationeries located near schools colleges • Coffee shops, restaurants especially near bus stops • Auto vending machines • Grocery stores, MLPL

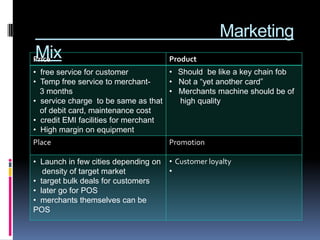

- 15. Marketing Mix Price Product • free service for customer • Should be like a key chain fob • Temp free service to merchant- • Not a “yet another card” 3 months • Merchants machine should be of • service charge to be same as that high quality of debit card, maintenance cost • credit EMI facilities for merchant • High margin on equipment Place Promotion • Launch in few cities depending on • Customer loyalty density of target market • • target bulk deals for customers • later go for POS • merchants themselves can be POS

- 16. Push & Pull approach Customer Approach Merchant Approach

- 17. National & Local launch Influenced by Cost of equipment + service Identity of company Pull approach for merchant

- 18. Sustainability & Scalability Diversified utility of product Early player Its not only product, its service

- 19. Learnings