Divestment Convergence Nov. 8 2014

- 1. Divestment & Reinvestment Nov 8, 2014 @timenash

- 2. Key Messages • Anyone Can Do It • Speak Their Language • No Need to Sacrifice Returns @timenash • Risk Mitigation

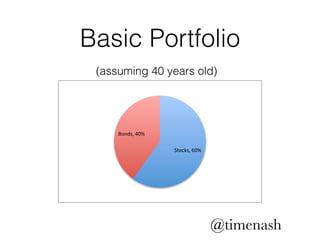

- 3. Basic Portfolio (assuming 40 years old) Stocks,(60%( Bonds,(40%( @timenash

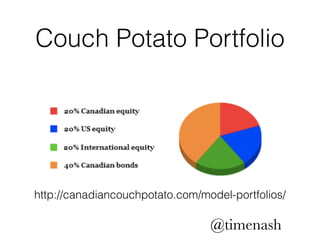

- 4. Couch Potato Portfolio http://canadiancouchpotato.com/model-portfolios/ @timenash

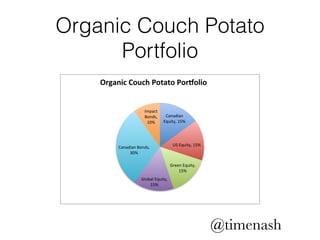

- 5. Organic Couch Potato Portfolio Organic(Couch(Potato(Por/olio( Canadian& Equity,&15%& US&Equity,&15%& Green&Equity,& 15%& Canadian&Bonds,& Global&Equity,& 15%& 30%& Impact& Bonds,& 10%& @timenash

- 7. Epiphany

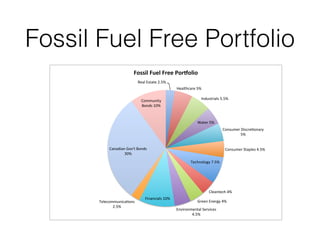

- 8. Fossil Fuel Free Portfolio Fossil&Fuel&Free&Por+olio& Real%Estate%2.5%% Healthcare%5%% Industrials%5.5%% Water%5%% Consumer%Discre;onary% 5%% Consumer%Staples%4.5%% Technology%7.5%% Cleantech%4%% Green%Energy%4%% Environmental%Services% 4.5%% Canadian%Gov't%Bonds% Financials%10%% Telecommunica;ons% 2.5%% 30%% Community% Bonds%10%%

- 9. Fossil Fuel Free Portfolio • Every sector except Energy, Materials, Utilities, Infrastructure • Includes Green Energy, Water Infrastructure, Cleantech, and Environmental Services • Also includes Community Bonds offered by solar co-operatives in Ontario (Impact Investments) @timenash

- 10. Investment Committees • Different from the Board of Directors • Financial Decision Makers • Fiduciary Duty to Maximize Returns • Status Quo Bias & Risk Aversion @timenash

- 11. Investment Committees • Usually older men with finance background • Often volunteer on other boards • Identify champions, opposers, & swing votes • Need to connect with them as humans

- 12. Objections Handling • Returns Will be Lower • Loss of Diversification • What else? @timenash

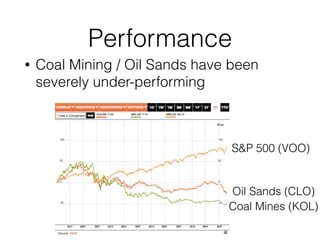

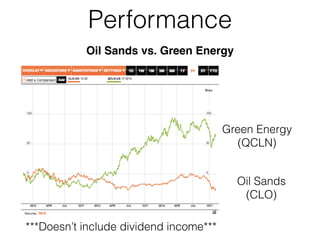

- 13. Performance • Coal Mining / Oil Sands have been severely under-performing S&P 500 (VOO) Oil Sands (CLO) Coal Mines (KOL)

- 14. Performance Oil Sands vs. Green Energy Green Energy (QCLN) Oil Sands (CLO) ***Doesn’t include dividend income***

- 15. Risk-Adjusted Returns • Measures of Beta (volatility) ignore systemic risks • Unburnable carbon is a HUGE systemic risk • Canadian economy (banks, etc.) is highly exposed • Committee is putting the endowment at risk @timenash

- 16. Diversification • Modern Portfolio Theory • Excluding any sector will increase volatility • Can be offset by investing in alternative energy @timenash

- 17. Diversification • Most boards have zero exposure to emerging green sectors and impact investments. Turn this argument on its head by asking them to better diversify by investing in these sectors! @timenash

- 18. Re-investment • PowerShares Cleantech Portfolio (PZD) • iShares Global Water Index ETF (CWW) • Market Vectors Environmental Services Fund (EVX) • NASDAQ CleanEdge Green Energy Fund (QCLN) @timenash

- 19. YieldCos Lower risk options for investors looking for income instead of growth

- 20. Green Bonds

- 21. Compromise • If the board is not ready to divest they should start by underweight & hedge • Lower exposure to carbon risk, and hedge by investing in green companies • This is a win because a large endowment doing this has the same impact as a small endowment divesting

- 22. Keep it up!! nash@sustainableeconomist.com