E auction - cash remittance

- 1. ÓĄćÓ┤ĢÓ┤░Ó┤│ Ó┤ĄÓ┤©Ó┤éÓ┤ĄÓ┤ĢÓĄü ÓĄŹ, Ó┤żÓ┤¤Ó┤┐ Ó┤ĄÓ┤┐ÓĄĮ Ó┤©Ó┤ĄÓ┤┐Ó┤ŁÓ┤ŠÓ┤ŚÓ┤é, ÓĄćÓ┤ĢÓ┤ŠÓ┤┤Ó┤┐ÓĄć Ó┤ŠÓ┤¤ÓĄŹ Ó┤żÓ┤¤Ó┤┐ÓĄćÓ┤▓Ó┤▓ Ó┤┐ÓĄĮ Ó┤ĖÓĄ╝ Ó┤ŠÓ┤▒Ó┤┐ÓĄćÓ┤▓ ÓĄŹ Ó┤¬Ó┤ŻÓ┤é Ó┤ÆÓ┤¤ÓĄü ÓĄü Ó┤ĄÓ┤┐Ó┤¦Ó┤é 1. Ó┤©Ó┤┐Ó┤░Ó┤ż Ó┤”Ó┤Ą Ó┤é (EMD) : http://etreasury.kerala.gov.in Ó┤Ä ÓĄåÓ┤ĄÓ┤¼ÓĄŹÓĄłÓ┤Ė ÓĄŹ Ó┤ĄÓ┤┤Ó┤┐ Ó┤ōÓĄ║ÓĄłÓ┤▓ÓĄ╗ Ó┤åÓ┤»Ó┤┐ Ó┤©Ó┤┐Ó┤░Ó┤ż Ó┤”Ó┤Ą Ó┤é Ó┤ÆÓ┤¤ÓĄü Ó┤ŠÓ┤é. Ó┤ģÓ┤żÓ┤┐Ó┤©Ó┤ŠÓ┤»Ó┤┐ ÓĄåÓ┤ĄÓ┤¼ÓĄŹÓĄłÓ┤Ė ÓĄŹ Ó┤żÓĄüÓ┤▒ ÓĄŹ Ó┤ćÓ┤¤Ó┤żÓĄŹ Ó┤«ÓĄüÓ┤ĢÓĄŠ Ó┤ŁÓ┤ŠÓ┤ŚÓĄå Departmental Receipts Ó┤Ä Ó┤▓Ó┤┐ Ó┤┐ÓĄĮ Ó┤ĢÓ┤┐ ÓĄŹ ÓĄåÓ┤Ü Ó┤ŻÓ┤é. ÓĄćÓ┤ČÓ┤ĘÓ┤é Ó┤ĄÓ┤░ÓĄü Ó┤ĖÓĄŹ Ó┤ĢÓĄĆÓ┤©Ó┤┐ÓĄĮ Ó┤ćÓ┤¤Ó┤żÓĄŹ Ó┤ŁÓ┤ŠÓ┤Ś ÓĄŹ Department Ó┤Ä Ó┤½ÓĄĆÓĄĮÓ┤ĪÓ┤┐ÓĄĮ Forest ÓĄåÓ┤żÓ┤░ÓĄå Ó┤¤ÓĄü Ó┤ŻÓ┤é. Remittance Type Ó┤Ä Ó┤½ÓĄĆÓĄĮÓ┤ĪÓ┤┐ÓĄĮ ÓĄćÓ┤ż ÓĄŹ (Teak) / Ó┤ĄÓĄĆ Ó┤┐(Rosewood)/Ó┤« ÓĄŹ Ó┤«Ó┤░ ÓĄŠ(Other Species) Ó┤Ä Ó┤┐Ó┤ĄÓ┤»Ó┤┐ÓĄĮ Ó┤ČÓ┤░Ó┤┐Ó┤»Ó┤ŠÓ┤»Ó┤żÓĄŹ ÓĄåÓ┤żÓ┤░ÓĄå Ó┤¤ÓĄü Ó┤ŻÓ┤é. ÓĄćÓ┤ČÓ┤ĘÓ┤é Ó┤£Ó┤┐Ó┤▓ Kozhikkode Ó┤Ä ÓĄŹ ÓĄåÓ┤żÓ┤░ÓĄå Ó┤¤ÓĄü Ó┤ŠÓĄĮ Ó┤ĄÓ┤░ÓĄü Ó┤ōÓ┤½ÓĄĆÓ┤ĖÓĄüÓ┤ĢÓ┤│ÓĄüÓĄåÓ┤¤ Ó┤▓Ó┤┐Ó┤ĖÓĄŹ Ó┤┐ÓĄĮ Ó┤©Ó┤┐ ÓĄüÓ┤é DFO TIMBER SALES KOZHIKODE Ó┤Ä Ó┤żÓĄŹ ÓĄåÓ┤żÓ┤░ÓĄå Ó┤¤ÓĄü ÓĄüÓ┤Ģ. ÓĄćÓ┤ČÓ┤ĘÓ┤é Ó┤żÓĄüÓ┤Ģ ÓĄłÓ┤¤ ÓĄŹ ÓĄåÓ┤Ü Ó┤ŻÓ┤é. Ó┤ĄÓ┤▓Ó┤żÓĄü Ó┤ĄÓ┤Č ÓĄŹ Ó┤¬Ó┤ŻÓ┤é Ó┤ÆÓ┤¤ÓĄü ÓĄü Ó┤åÓ┤│ÓĄüÓĄåÓ┤¤ ÓĄćÓ┤¬Ó┤░ÓĄŹ, PAN (Ó┤©Ó┤┐ÓĄ╝Ó┤¼ Ó┤«Ó┤┐Ó┤▓), Ó┤ģ Ó┤ĪÓ┤ĖÓĄŹ, Ó┤¬Ó┤┐ÓĄ╗ ÓĄćÓ┤ĢÓ┤ŠÓ┤ĪÓĄŹ(Ó┤©Ó┤┐ÓĄ╝Ó┤¼ Ó┤«Ó┤┐Ó┤▓), Ó┤¬Ó┤ŻÓ┤é Ó┤ģÓ┤¤ ÓĄü Ó┤żÓ┤┐ÓĄå Ó┤ēÓĄć Ó┤Č Ó┤é Ó┤Ä Ó┤┐Ó┤Ą ÓĄłÓ┤¤ ÓĄŹ ÓĄåÓ┤ÜÓ┤»ÓĄŹÓ┤żÓĄü ÓĄåÓ┤ĢÓ┤ŠÓ┤¤ÓĄü Ó┤ŠÓ┤é. Dept Ref No. Ó┤Ä Ó┤½ÓĄĆÓĄĮÓ┤ĪÓ┤┐ÓĄĮ Buyer No ÓĄłÓ┤¤ ÓĄŹ ÓĄåÓ┤Ü Ó┤ŠÓ┤é. Purpose Ó┤Ä Ó┤½ÓĄĆÓĄĮÓ┤ĪÓ┤┐ÓĄĮ Ó┤¬Ó┤ŻÓ┤é Ó┤ģÓ┤¤ ÓĄü Ó┤żÓ┤┐ÓĄå Ó┤ēÓĄć Ó┤Č Ó┤é Ó┤ÜÓĄüÓ┤░ÓĄü Ó┤┐ ÓĄłÓ┤¤ ÓĄŹ ÓĄåÓ┤Ü Ó┤ŠÓ┤é. Ó┤ēÓ┤”Ó┤ŠÓ┤╣Ó┤░Ó┤Ż Ó┤┐Ó┤©ÓĄŹ 18.04.2018Ó┤©ÓĄŹ Ó┤ÜÓ┤ŠÓ┤▓Ó┤┐Ó┤»Ó┤é Ó┤ĪÓ┤┐ÓĄć Ó┤ŠÓ┤»Ó┤┐ÓĄĮ Ó┤©Ó┤¤ ÓĄü Ó┤żÓ┤¤Ó┤┐ ÓĄćÓ┤▓Ó┤▓ Ó┤┐ÓĄĮ Ó┤¬ÓĄå Ó┤¤ÓĄü Ó┤ŠÓĄ╗ ÓĄćÓ┤Ą Ó┤┐Ó┤»Ó┤ŠÓ┤ŻÓĄŹ EMD Ó┤ģÓ┤¤ ÓĄü ÓĄåÓ┤ż Ó┤┐ÓĄĮ EMD for auction at Chaliyam on 18.04.2018 Ó┤Ä ÓĄŹ ÓĄłÓ┤¤ ÓĄŹ ÓĄåÓ┤Ü Ó┤ŠÓ┤é. ÓĄćÓ┤ČÓ┤ĘÓ┤é Ó┤żÓ┤ŠÓĄåÓ┤┤ Ó┤ćÓ┤¤Ó┤żÓĄŹ Ó┤ĄÓ┤Č ÓĄŹ Ó┤Ä Ó┤¬Ó┤ĢÓ┤ŠÓ┤░Ó┤«Ó┤ŠÓ┤ŻÓĄŹ Ó┤ĢÓ┤ŠÓ┤ĘÓĄŹ Ó┤ģÓ┤¤ ÓĄü ÓĄåÓ┤ż ÓĄŹ ÓĄåÓ┤ĢÓ┤ŠÓ┤¤ÓĄü ÓĄüÓ┤Ģ. Internet Banking Ó┤ĖÓĄŚÓ┤ĢÓ┤░ Ó┤«Ó┤┐Ó┤▓Ó┤Š Ó┤ĄÓĄ╝ ÓĄŹ ATM / Debit Card Ó┤ĄÓ┤┤Ó┤┐ Ó┤¬Ó┤ŻÓ┤é Ó┤ģÓ┤¤Ó┤»ÓĄŹ Ó┤ŠÓ┤é. Submit Ó┤ĢÓ┤┐ ÓĄŹ ÓĄåÓ┤ÜÓ┤»ÓĄŹÓ┤żÓ┤ŠÓĄĮ Ó┤ĄÓ┤░ÓĄü Ó┤ĖÓĄŹ Ó┤ĢÓĄĆÓ┤©Ó┤┐ÓĄĮ Ó┤ĄÓ┤┐Ó┤ĄÓ┤░ ÓĄŠ Ó┤¬Ó┤░Ó┤┐ÓĄćÓ┤ČÓ┤ŠÓ┤¦Ó┤┐ ÓĄŹ Proceed for payment Ó┤Ä Ó┤▓Ó┤┐ Ó┤┐ÓĄĮ Ó┤ĢÓ┤┐ ÓĄŹ ÓĄåÓ┤Ü ÓĄüÓ┤Ģ. Ó┤ģÓĄć Ó┤ŠÓĄŠ Ó┤ÆÓ┤░ÓĄü Ó┤▒Ó┤½Ó┤▒ÓĄ╗Ó┤ĖÓĄŹ Ó┤© ÓĄ╝ (GRN) Ó┤ĢÓ┤┐ ÓĄüÓ┤é (Ó┤ćÓ┤żÓĄŹ Ó┤ÄÓ┤┤ÓĄüÓ┤żÓ┤┐ ÓĄåÓ┤Ą ÓĄü Ó┤żÓĄŹ Ó┤©Ó┤▓Ó┤żÓ┤ŠÓ┤ŻÓĄŹ). ÓĄćÓ┤ČÓ┤ĘÓ┤é Ó┤ģÓ┤żÓ┤ŠÓ┤żÓĄŹ Ó┤¼Ó┤Š Ó┤┐ÓĄå internet banking ÓĄłÓ┤Ė Ó┤┐ÓĄå Ó┤▓Ó┤┐ ÓĄŹ Ó┤żÓĄüÓ┤▒ ÓĄŹ Ó┤ĄÓ┤░ÓĄü Ó┤żÓ┤ŠÓ┤ŻÓĄŹ. Ó┤ģÓ┤żÓ┤┐ÓĄĮ User ID, Password Ó┤Ä Ó┤┐Ó┤Ą ÓĄåÓ┤ĢÓ┤ŠÓ┤¤ÓĄü ÓĄŹ ÓĄćÓ┤¬Ó┤»ÓĄŹÓĄåÓ┤« ÓĄŹ Ó┤©Ó┤¤ Ó┤ŠÓ┤é. ÓĄćÓ┤©Ó┤░ÓĄå ÓĄåÓ┤ĪÓ┤¼Ó┤┐ ÓĄŹ Ó┤ĢÓ┤ŠÓĄ╝Ó┤ĪÓĄŹ Ó┤ĄÓ┤┤Ó┤┐Ó┤»ÓĄü ÓĄćÓ┤¬Ó┤»ÓĄŹÓĄåÓ┤« ÓĄŹ Ó┤åÓ┤ŻÓĄŹ ÓĄåÓ┤ĖÓ┤▓Ó┤ĢÓĄŹ ÓĄŹ ÓĄåÓ┤ÜÓ┤»ÓĄŹÓ┤żÓĄåÓ┤ż Ó┤┐ÓĄĮ ÓĄåÓ┤½Ó┤ĪÓ┤▒ÓĄĮ Ó┤¼Ó┤Š Ó┤┐ÓĄå ÓĄćÓ┤¬Ó┤»ÓĄŹÓĄåÓ┤« ÓĄŹ ÓĄćÓ┤Ś ÓĄŹÓĄćÓ┤Ą (Fed E Gate) Ó┤żÓĄüÓ┤▒ ÓĄŹ Ó┤ĄÓ┤░ÓĄüÓ┤é. Ó┤ģÓ┤ĄÓ┤┐ÓĄåÓ┤¤ Ó┤ĢÓ┤ŠÓĄ╝Ó┤ĪÓĄŹ Ó┤© Ó┤▒ÓĄüÓ┤é Ó┤« ÓĄŹ Ó┤ĄÓ┤┐Ó┤ĄÓ┤░ Ó┤│ÓĄüÓ┤é Ó┤©ÓĄĮÓ┤ĢÓ┤┐ ÓĄćÓ┤¬Ó┤»ÓĄŹÓĄåÓ┤« ÓĄŹ Ó┤©Ó┤¤ Ó┤ŠÓ┤é. Ó┤ÅÓ┤żÓĄŹ Ó┤¼Ó┤Š Ó┤┐ÓĄå Ó┤ĢÓ┤ŠÓĄ╝Ó┤ĪÓĄüÓ┤é Ó┤ēÓ┤¬ÓĄćÓ┤»Ó┤ŠÓ┤ŚÓ┤┐ Ó┤ŠÓ┤é. ÓĄćÓ┤¬Ó┤»ÓĄŹÓĄåÓ┤« ÓĄŹ Ó┤©Ó┤¤ Ó┤┐ Ó┤┤Ó┤┐ Ó┤ŠÓĄĮ Ó┤ć- Ó┤¤Ó┤ĘÓ┤▒Ó┤┐ ÓĄłÓ┤Ė Ó┤┐ÓĄćÓ┤▓ ÓĄŹ Ó┤żÓ┤┐Ó┤░Ó┤┐ÓĄåÓ┤Ģ Ó┤Ä ÓĄü Ó┤żÓ┤ŠÓ┤ŻÓĄŹ. Ó┤ćÓ┤ĄÓ┤┐ÓĄåÓ┤¤ Ó┤©Ó┤┐ ÓĄüÓ┤é Ó┤ÜÓ┤▓Ó┤ŠÓĄ╗ Ó┤░Ó┤ČÓĄĆÓ┤żÓ┤┐ Ó┤¬Ó┤┐ ÓĄŹ ÓĄåÓ┤Ü Ó┤ŠÓ┤é. 2. Ó┤żÓ┤¤Ó┤┐Ó┤»ÓĄüÓĄåÓ┤¤ Ó┤ĄÓ┤┐Ó┤▓ (Material Cost / BSV): ÓĄćÓ┤▓Ó┤▓Ó┤é Ó┤Ė Ó┤┐Ó┤░ÓĄå Ó┤¤ÓĄü Ó┤┐Ó┤»Ó┤żÓ┤ŠÓ┤» Ó┤ģÓ┤▒Ó┤┐Ó┤»Ó┤┐ ÓĄŹ (acceptance letter) Ó┤ĢÓ┤┐ Ó┤┐ Ó┤┤Ó┤┐ Ó┤ŠÓĄĮ Ó┤żÓ┤¤Ó┤┐Ó┤»ÓĄüÓĄåÓ┤¤ Ó┤ĄÓ┤┐Ó┤▓Ó┤»ÓĄüÓ┤é Ó┤©Ó┤┐Ó┤ĢÓĄüÓ┤żÓ┤┐Ó┤ĢÓ┤│ÓĄüÓ┤é Ó┤ģÓ┤¤ÓĄć Ó┤żÓĄü ÓĄŹ. Ó┤ćÓ┤żÓ┤┐ÓĄĮ ÓĄćÓ┤©Ó┤░ÓĄå Ó┤ģÓ┤¤ Ó┤©Ó┤┐Ó┤░Ó┤ż Ó┤”Ó┤Ą Ó┤é Ó┤ĢÓ┤┐Ó┤┤Ó┤┐ ÓĄŹ Ó┤¼Ó┤Š Ó┤┐ Ó┤ĄÓ┤┐Ó┤▓ Ó┤ģÓ┤¤ Ó┤ŠÓĄĮ Ó┤«Ó┤żÓ┤┐Ó┤»Ó┤ŠÓ┤ĢÓĄüÓ┤é. Ó┤ćÓ┤żÓĄŹ Ó┤«ÓĄüÓ┤ĢÓ┤│Ó┤┐ÓĄĮ ÓĄåÓ┤ĢÓ┤ŠÓ┤¤ÓĄü ÓĄćÓ┤¬Ó┤ŠÓĄåÓ┤▓ Ó┤żÓĄå Ó┤ōÓĄ║ÓĄłÓ┤▓ÓĄ╗ Ó┤åÓ┤»Ó┤┐ Ó┤ģÓ┤¤ Ó┤ŠÓ┤é. Purpose Ó┤Ä Ó┤½ÓĄĆÓĄĮÓ┤ĪÓ┤┐ÓĄĮ Ó┤ĄÓ┤┐Ó┤│Ó┤┐ÓĄå Ó┤¤ÓĄü Ó┤żÓ┤¤Ó┤┐Ó┤ĢÓ┤│ÓĄüÓĄåÓ┤¤ ÓĄćÓ┤▓Ó┤Š ÓĄŹ Ó┤© ÓĄ╝ Ó┤ĢÓĄéÓ┤¤Ó┤┐ Ó┤ĖÓĄéÓ┤ÜÓ┤┐ Ó┤┐ ÓĄü Ó┤żÓĄŹ Ó┤© Ó┤ŠÓ┤»Ó┤┐Ó┤░Ó┤┐ ÓĄüÓ┤é. Ó┤ēÓ┤”Ó┤Š:- BSV for auction at Chaliyam on 18.04.2018. Lot 125/17 and 54/18 (BSV ŌĆō Balance Sale Value)

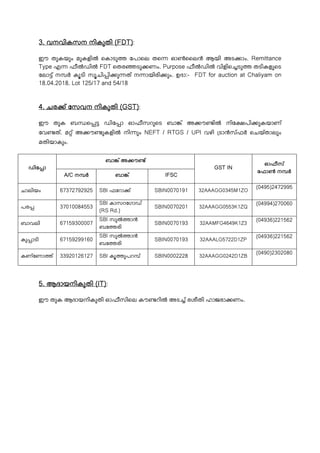

- 2. 3. Ó┤ĄÓ┤©Ó┤ĄÓ┤┐Ó┤ĢÓ┤ĖÓ┤© Ó┤©Ó┤┐Ó┤ĢÓĄüÓ┤żÓ┤┐ (FDT): Ó┤ł Ó┤żÓĄüÓ┤ĢÓ┤»ÓĄüÓ┤é Ó┤«ÓĄüÓ┤ĢÓ┤│Ó┤┐ÓĄĮ ÓĄåÓ┤ĢÓ┤ŠÓ┤¤ÓĄü ÓĄćÓ┤¬Ó┤ŠÓĄåÓ┤▓ Ó┤żÓĄå Ó┤ōÓĄ║ÓĄłÓ┤▓ÓĄ╗ Ó┤åÓ┤»Ó┤┐ Ó┤ģÓ┤¤ Ó┤ŠÓ┤é. Remittance Type Ó┤Ä Ó┤½ÓĄĆÓĄĮÓ┤ĪÓ┤┐ÓĄĮ FDT ÓĄåÓ┤żÓ┤░ Ó┤¤ÓĄü Ó┤ŻÓ┤é. Purpose Ó┤½ÓĄĆÓĄĮÓ┤ĪÓ┤┐ÓĄĮ Ó┤ĄÓ┤┐Ó┤│Ó┤┐ÓĄå Ó┤¤ÓĄü Ó┤żÓ┤¤Ó┤┐Ó┤ĢÓ┤│ÓĄüÓĄåÓ┤¤ ÓĄćÓ┤▓Ó┤Š ÓĄŹ Ó┤© ÓĄ╝ Ó┤ĢÓĄéÓ┤¤Ó┤┐ Ó┤ĖÓĄéÓ┤ÜÓ┤┐ Ó┤┐ ÓĄü Ó┤żÓĄŹ Ó┤© Ó┤ŠÓ┤»Ó┤┐Ó┤░Ó┤┐ ÓĄüÓ┤é. Ó┤ēÓ┤”Ó┤Š:- FDT for auction at Chaliyam on 18.04.2018. Lot 125/17 and 54/18 4. Ó┤ÜÓ┤░ ÓĄŹ ÓĄćÓ┤ĖÓ┤ĄÓ┤© Ó┤©Ó┤┐Ó┤ĢÓĄüÓ┤żÓ┤┐ (GST): Ó┤ł Ó┤żÓĄüÓ┤Ģ Ó┤¼ ÓĄå Ó┤ĪÓ┤┐ÓĄć Ó┤Š Ó┤ōÓ┤½ÓĄĆÓ┤ĖÓ┤▒ÓĄüÓĄåÓ┤¤ Ó┤¼Ó┤Š ÓĄŹ Ó┤ģ ÓĄŚ Ó┤┐ÓĄĮ Ó┤©Ó┤┐ÓĄć Ó┤¬Ó┤┐ ÓĄüÓ┤ĢÓ┤»Ó┤ŠÓ┤ŻÓĄŹ ÓĄćÓ┤Ą Ó┤żÓĄŹ. Ó┤« ÓĄŹ Ó┤ģ ÓĄŚ ÓĄüÓ┤ĢÓ┤│Ó┤┐ÓĄĮ Ó┤©Ó┤┐ ÓĄüÓ┤é NEFT / RTGS / UPI Ó┤ĄÓ┤┤Ó┤┐ Ó┤¤Ó┤ŠÓĄ╗Ó┤ĖÓĄŹÓ┤½ÓĄ╝ ÓĄåÓ┤ÜÓ┤»ÓĄŹÓ┤żÓ┤ŠÓ┤▓ÓĄüÓ┤é Ó┤«Ó┤żÓ┤┐Ó┤»Ó┤ŠÓ┤ĢÓĄüÓ┤é. Ó┤ĪÓ┤┐ÓĄć Ó┤Š Ó┤¼Ó┤Š ÓĄŹ Ó┤ģ ÓĄŚ ÓĄŹ GST IN Ó┤ōÓ┤½ÓĄĆÓ┤ĖÓĄŹ ÓĄćÓ┤½Ó┤ŠÓĄ║ Ó┤© ÓĄ╝ A/C Ó┤© ÓĄ╝ Ó┤¼Ó┤Š ÓĄŹ IFSC Ó┤ÜÓ┤ŠÓ┤▓Ó┤┐Ó┤»Ó┤é 67372792925 SBI Ó┤½ÓĄćÓ┤▒Ó┤Š ÓĄŹ SBIN0070191 32AAAGG0345M1ZO (0495)2472995 Ó┤¬Ó┤░ 37010084553 SBI Ó┤ĢÓ┤ŠÓ┤ĖÓ┤▒ÓĄćÓ┤ŚÓ┤ŠÓ┤ĪÓĄŹ (RS Rd.) SBIN0070201 32AAAGG0553K1ZQ (04994)270060 Ó┤¼Ó┤ŠÓ┤ĄÓ┤▓Ó┤┐ 67159300007 SBI Ó┤ĖÓĄüÓĄĮ Ó┤ŠÓĄ╗ Ó┤¼ÓĄć Ó┤░Ó┤┐ SBIN0070193 32AAMFG4649K1Z3 (04936)221562 Ó┤ĢÓĄü Ó┤ŠÓ┤¤Ó┤┐ 67159299160 SBI Ó┤ĖÓĄüÓĄĮ Ó┤ŠÓĄ╗ Ó┤¼ÓĄć Ó┤░Ó┤┐ SBIN0070193 32AAALG5722D1ZP (04936)221562 Ó┤ĢÓ┤ŻÓĄŹÓĄćÓ┤ŻÓ┤Š ÓĄŹ 33920126127 SBI Ó┤ĢÓĄé ÓĄüÓ┤¬Ó┤▒ ÓĄŹ SBIN0002228 32AAAGG0242D1ZB (0490)2302080 5. Ó┤åÓ┤”Ó┤ŠÓ┤»Ó┤©Ó┤┐Ó┤ĢÓĄüÓ┤żÓ┤┐ (IT): Ó┤ł Ó┤żÓĄüÓ┤Ģ Ó┤åÓ┤”Ó┤ŠÓ┤»Ó┤©Ó┤┐Ó┤ĢÓĄüÓ┤żÓ┤┐ Ó┤ōÓ┤½ÓĄĆÓ┤ĖÓ┤┐ÓĄåÓ┤▓ Ó┤ĢÓĄŚ Ó┤▒Ó┤┐ÓĄĮ Ó┤ģÓ┤¤ ÓĄŹ Ó┤░Ó┤ČÓĄĆÓ┤żÓ┤┐ Ó┤╣Ó┤ŠÓ┤£Ó┤░Ó┤Š Ó┤ŻÓ┤é.