Forecasting Financial Freedom

- 2. RAIN OR SHINE, WHETHER THE OUTLOOK IS SUNNY OR BLEAK, WE’RE HERE TO HELP.

- 3. FOR YOUR CLIENTS & FOR YOU: LIFE SETTLEMENTS FROM THE LIFELINE PROGRAM® AN OPTION THAT MAKES SENSE THE IDEA BEHIND THE CONCEPT Senior Life Settlements are a new and innovative estate-planning vehicle Each year, millions of Americans purchase life insurance, sometimes for that offers both you and your clients significant benefits and advantages. reasons as unique as they are, and sometimes simply to plan for the unthinkable. However, very few individuals understand that life insurance is a By providing your clients the opportunity to sell their existing life insurance financial asset that can deliver value to them while they are alive to enjoy it. policies, Life Settlements can help them benefit from assets that aren’t living up to their expectations, meeting their current needs or bringing Just like homes, cars, and collectibles, life insurance policies have intrinsic them closer to achieving their goals and dreams. monetary value, which means that they can be purchased and that they can also be sold. A Life Settlement simply involves the sale of a life insurance Life Settlements can truly make a difference in the lives of your clients policy to a third party for less than its expected death benefit but more than while also providing you with a lucrative means to increase your income its surrender value, and it’s an idea whose day has come. and diversify your business. By introducing this opportunity, you can help your clients gain financial benefits they may never have realized were available to them.

- 4. WHY LIFE SETTLEMENTS WORK

- 5. HOW HELPING YOUR CLIENT CAN BENEFIT YOU

- 6. WATCH OUR EDUCATIONAL VIDEO FEATURING BETTY WHITE

- 7. WORK WITH AN INDUSTRY LEADER

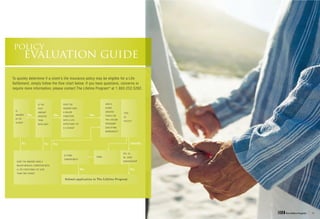

- 8. POLICY EVALUATION GUIDE To quickly determine if a client’s life insurance policy may be eligible for a Life Settlement, simply follow the flow chart below. If you have questions, concerns or require more information, please contact The Lifeline Program ® at 1.800.252.5282. IS THE DOES THE HAVE A FACE INSURED HAVE SCORE IS GREATER AMOUNT A MAJOR TYPE INSURED THAN 6 ON GREATER CONDITION OF 65 OR THE LIFELINE THAN WITH A LIFE POLICY? OLDER? PROGRAM ® $250,000? EXPECTANCY OF 2-6 YEARS? QUALIFYING WORKSHEET? VUL, UL, IS TERM TERM WL JOINT CONVERTIBLE? DOES THE INSURED HAVE A SURVIVORSHIP MAJOR MEDICAL CONDITION WITH A LIFE EXPECTANCY OF LESS THAN TWO YEARS?

- 9. HOW TO MAKE IT HAPPEN 1 Use our Policy Evaluation Guide to help pre-qualify your client. If your client meets our pre-qualification criteria, complete our Pre-Qualifying Worksheet with information about your client and submit that to us. 2 If we pre-qualify your client, have your client sign authorization forms and provide those to us, along with a copy of the insurance policy itself. 3 Once we have those signed authorizations, we request medical records from the insured’s physician and provide those to an independent specialist to obtain a life expectancy estimate, while we also verify policy coverage through the insured’s insurance carrier. 4 If the policy meets our purchasing criteria, we will make an offer to purchase the policy. 5 If the policyowner accepts the offer, we issue a settlement contract package to the policyseller for completion & signatures. 6 Once we receive the settlement contract package properly completed and signed, we place the contract proceeds into escrow and then send a change of ownership and beneficiary request to the insurance carrier while continuing to prepare the transaction for closing. 7 Within 72 hours of receipt of written confirmation from the insurer that policy ownership and beneficiaries have been changed as we request, the transaction closes and escrow is released. 8 Any commissions or fees which we have agreed to pay to you for closing the transaction are paid after the rescission period available to the policyseller expires, if there is no rescission.

- 10. 1979 LAKESIDE PARKWAY SECOND FLOOR ATLANTA, GA 30084