Ec Vat Changes 2010 final

- 1. ec VAT changes 2010

- 2. reverse charge on purchases under the reverse charge mechanism, purchaser of the goods is liable to account for the VAT on the supply purchaser will account for VAT as if purchasing in their own country supplier will not charge nor account for VAT on the supply supplier must state on the invoice that VAT is to be accounted for by the purchaser under reverse charge maconomy.com

- 3. reverse charge wording on sales precise wording is not prescribed in law but HMRC website suggest keeping the annotation short suggested forms of words are: reverse charge supply - customer to pay the VAT Customer to pay VAT under EC VAT reversal VAT reverse charge procedure is applicable for customers within the EC maconomy.com

- 4. reverse charge example: uk receiving invoice from an EC country maconomy.com

- 5. customer recording invoice VAT has to be recorded as if you are purchasing in your own country e.g. in UK postings in maconomy: Assume EUR 1 = GBP 1 maconomy.com

- 6. tax set up change in maconomy EU purchase vat code needs to be changed: Menu: general ledger > tax > gl tax codes maconomy.com

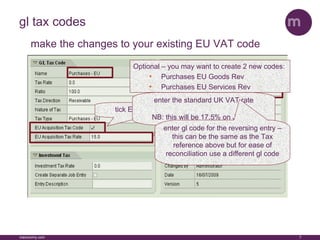

- 7. gl tax codes maconomy.com Optional â you may want to create new codes e.g.: Purchases EU Rev make the changes to your existing EU VAT code

- 8. gl tax codes maconomy.com make the changes to your existing EU VAT code tick EU Acquisition box

- 9. gl tax codes maconomy.com make the changes to your existing EU VAT code enter the standard UK VAT rate NB: this will be 17.5% on Jan 1st

- 10. gl tax codes maconomy.com make the changes to your existing EU VAT code enter gl code for the reversing entry â this can be the same as the Tax reference above but for ease of reconciliation use a different gl code

- 11. VAT return credit your VAT account with an amount of output tax calculated on the full value of intraâEC taxable supplies same time debit your VAT account with the input tax on VAT return: the amount of output tax in box 2 VAT due on EU acquisitions the amount of input tax in box 4 VAT reclaimed on purchases including EU acquisitions the full value of the supply in box 6 total value of sales the full value of the supply in box 7 total value of purchases maconomy.com

- 12. VAT return maconomy.com 0.00 150.00 150.00 150.00 0 0 1,000.00 0 1,000.00

- 13. expense sheets expenses generally come under âUse & Enjoymentâ VAT rules exempt from the reverse charge process maconomy.com

- 14. your action list set up required EU VAT codes MPLâs change to add the âreverse chargeâ wording for EC services customer VAT number collect and validate the VAT numbers: http://ec.europa.eu/taxation_customs/vies/ if no VAT number, must charge UK VAT review contracts check customer contracts regarding charging reversing VAT staff training prepare accounts payable and billing staff for the changes maconomy.com

- 15. one last thing to remember... uk VAT standard rate returns to 17.5% on 1 st January 2010 maconomy.com

- 16. hmrc 2010 advise line... 0845 010 9000 will need your VAT registration number maconomy.com

- 17. vat good / services change new field is included in Tax Code window to enable Sales Invoices to be marked as âGoodsâ or âServicesâ VX1 - included in SP7 (released in Oct 2009) VX+ - included in SP19 (released in Oct 2009) VX â included in SP scheduled for Dec 2009 Maconomy to amend and issue appropriate VAT Sales Day Book reports for each release in coming weeks maconomy.com

- 18. ec sales list following steps to be undertaken to accommodate new requirement: clients to populate âCustomer Vat Noâ field on all Customer records (EC clients only and only if thereâs no VAT no. then UK VAT no. must be changed) clients to amend Sales Invoice MPLâs to include âCustomer Vat Noâ field where invoices are sent to EC customers amended SDB to be exported and entries to be sorted in Excel to assist with the new EC Sales List reporting requirement current SDB report to be changed to include âCustomer Vat Noâ field â date tbc by Maconomy ( standard RGL VAT reports will help in exporting the data but clients are responsible for exporting, sorting and reporting this data themselves) maconomy.com