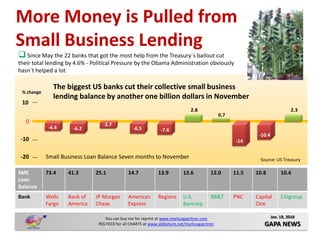

Econchart Smelending 012010

- 1. More Money is Pulled from Small Business Lending  Since May the 22 banks that got the most help from the Treasury´s bailout cut their total lending by 4.6% - Political Pressure by the Obama Administration obviously hasn´t helped a lot The biggest US banks cut their collective small business % change lending balance by another one billion dollars in November 10 2.8 2.3 0.7 0 -3.7 -4.4 -6.2 -6.5 -7.6 -10.4 -10 -14 -20 Small Business Loan Balance Seven months to November Source: US Treasury SME 73.4 41.3 25.1 14.7 13.9 12.6 12.0 11.5 10.8 10.4 Loan Balance Bank Wells Bank of JP Morgan American Regions U.S. BB&T PNC Capital Citigroup Fargo America Chase Express Bancorp One You can buy me for reprint at www.markusgaertner.com Jan. 19, 2010 RSS FEED for all CHARTS at www.slideshare.net/markusgaertner GAPA NEWS