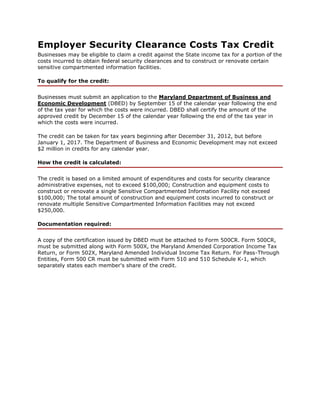

Employer Security Clearance Costs Tax Credit

- 1. Employer Security Clearance Costs Tax Credit Businesses may be eligible to claim a credit against the State income tax for a portion of the costs incurred to obtain federal security clearances and to construct or renovate certain sensitive compartmented information facilities. To qualify for the credit: Businesses must submit an application to the Maryland Department of Business and Economic Development (DBED) by September 15 of the calendar year following the end of the tax year for which the costs were incurred. DBED shall certify the amount of the approved credit by December 15 of the calendar year following the end of the tax year in which the costs were incurred. The credit can be taken for tax years beginning after December 31, 2012, but before January 1, 2017. The Department of Business and Economic Development may not exceed $2 million in credits for any calendar year. How the credit is calculated: The credit is based on a limited amount of expenditures and costs for security clearance administrative expenses, not to exceed $100,000; Construction and equipment costs to construct or renovate a single Sensitive Compartmented Information Facility not exceed $100,000; The total amount of construction and equipment costs incurred to construct or renovate multiple Sensitive Compartmented Information Facilities may not exceed $250,000. Documentation required: A copy of the certification issued by DBED must be attached to Form 500CR. Form 500CR, must be submitted along with Form 500X, the Maryland Amended Corporation Income Tax Return, or Form 502X, Maryland Amended Individual Income Tax Return. For Pass-Through Entities, Form 500 CR must be submitted with Form 510 and 510 Schedule K-1, which separately states each member's share of the credit.

- 2. Contact: Maryland Department of Business and Economic Development Division of Business Development, Tax Incentives Group World Trade Center 401 East Pratt Street, 17th Floor Baltimore, MD 21202 Phone: 1-888-ChooseMD or 410-767-4980 E-mail: taxincentives@choosemaryland.org http://www.choosemaryland.org/businessresources/Pages/MarylandESCCTaxCre dit.aspx McMillan Consulting 828A E. Baltimore St. Baltimore, MD 21202 Phone: 410-775-6226 Web: http://mcmillancos.com E-mail: info@mcmillancos.com McMillan Consulting is not affiliated with the state of Maryland. This document is for informational purposes. Contact us, the appropriate agency for this credit or your tax professional for further assistance. You can view Maryland's tax credits by visiting http://macadvises.net/mdtaxsignal.php and clicking on the MD Business Tax Credits link. We can send you a hard copy of this or any of our info sheets for Maryland tax credits.