Esdt

- 1. Early ╠²Stage ╠²Digital ╠²Technology ╠²Fund ╠² A ╠²discre7onary ╠²EIS ╠²Fund ╠²

- 2. Important ╠²No+ce ╠² ╠² C&P ╠²Capital ╠²LLP ╠²and ╠²Prosper ╠²Cap7al ╠²LLP ╠²are ╠²communica7ng ╠²this ╠²presenta7on ╠²on ╠²a ╠²con’¼üden7al ╠²basis ╠²only ╠²to ╠²a ╠²limited ╠²number ╠²of ╠²’¼ürms ╠² authorised ╠²by ╠²the ╠²Financial ╠²Services ╠²Authority ╠²of ╠²the ╠²United ╠²Kingdom ╠²(the ╠²"FSA") ╠²for ╠²the ╠²sole ╠²purpose ╠²of ╠²providing ╠²informa7on ╠²about ╠²the ╠²Early ╠² Stage ╠²Digital ╠²Technology ╠²Fund ╠²(ŌĆ£The ╠²FundŌĆØ). ╠²Promo7on ╠²of ╠²an ╠²investment ╠²in ╠²the ╠²Partnership ╠²is ╠²regulated ╠²under ╠²the ╠²Financial ╠²Services ╠²and ╠² Markets ╠²Act ╠²2000 ╠²("FSMA") ╠²and, ╠²in ╠²par7cular, ╠²under ╠²the ╠²FSMA ╠²(Financial ╠²Promo7on) ╠²Order ╠²2005 ╠²(ŌĆ£FPO"). ╠²Accordingly, ╠²this ╠²presenta7on ╠²is ╠²being ╠² communicated ╠²to ╠²persons ╠²having ╠²professional ╠²experience ╠²in ╠²maSers ╠²rela7ng ╠²to ╠²investments ╠²who ╠²are ╠²"investment ╠²professionals" ╠²within ╠²the ╠² meaning ╠²given ╠²in ╠²ar7cle ╠²19 ╠²of ╠²the ╠²FPO ╠²and ╠²speci’¼ücally ╠²’¼ürms ╠²authorised ╠²by ╠²the ╠²FSA. ╠²The ╠²distribu7on ╠²of ╠²this ╠²presenta7on ╠²to ╠²persons ╠²who ╠²are ╠²not ╠² investment ╠²professionals ╠²or ╠²are ╠²not ╠²’¼ürms ╠²authorised ╠²by ╠²the ╠²FSA ╠²is ╠²unauthorised ╠²and ╠²contravenes ╠²FSMA, ╠²and ╠²such ╠²persons ╠²should ╠²not ╠²act ╠²or ╠²rely ╠² on ╠²this ╠²presenta7on ╠²or ╠²any ╠²of ╠²its ╠²contents ╠²for ╠²any ╠²purpose. ╠² ╠² This ╠²presenta7on ╠²is ╠²intended ╠²to ╠²be ╠²a ╠²brief ╠²summary ╠²overview ╠²of ╠²an ╠²investment ╠²in ╠²the ╠²Fund. ╠²Any ╠²recipient ╠²of ╠²this ╠²presenta7on ╠²must ╠²read ╠²this ╠² presenta7on ╠²in ╠²conjunc7on ╠²with ╠²the ╠²informa7on ╠²memorandum ╠²of ╠²the ╠²Partnership, ╠²once ╠²available, ╠²which ╠²sets ╠²out ╠²the ╠²detailed ╠²terms ╠²and ╠²risks ╠² involved ╠²in ╠²inves7ng ╠²in ╠²a ╠²business ╠²of ╠²this ╠²nature ╠²prior ╠²to ╠²any ╠²decision ╠²to ╠²invest ╠²being ╠²made. ╠² ╠² Any ╠²projec7ons, ╠²forecasts ╠²and ╠²es7mates ╠²contained ╠²in ╠²this ╠²presenta7on ╠²are ╠²forward-┬ŁŌĆÉlooking ╠²statements ╠²and ╠²are ╠²based ╠²upon ╠²certain ╠² assump7ons ╠²considered ╠²by ╠²the ╠²Fund ╠²to ╠²be ╠²reasonable. ╠²Projec7ons ╠²are ╠²necessarily ╠²specula7ve ╠²in ╠²nature ╠²and ╠²it ╠²can ╠²be ╠²expected ╠²that ╠²some ╠²or ╠²all ╠² of ╠²the ╠²assump7ons ╠²underlying ╠²the ╠²projec7ons ╠²will ╠²not ╠²materialise ╠²or ╠²will ╠²vary ╠²signi’¼ücantly ╠²from ╠²actual ╠²results. ╠²Accordingly, ╠²the ╠²projec7ons ╠²are ╠² only ╠²an ╠²es7mate. ╠²Actual ╠²results ╠²may ╠²vary ╠²from ╠²the ╠²projec7ons ╠²and ╠²the ╠²varia7ons ╠²may ╠²be ╠²material. ╠²Some ╠²important ╠²factors ╠²that ╠²could ╠²cause ╠² actual ╠²results ╠²to ╠²di’¼Ćer ╠²materially ╠²from ╠²those ╠²in ╠²any ╠²forward-┬ŁŌĆÉlooking ╠²statements ╠²include ╠²changes ╠²in ╠²interest ╠²rates ╠²and ╠²market, ╠²’¼ünancial ╠²or ╠²legal ╠² uncertain7es, ╠²among ╠²others. ╠²Consequently, ╠²the ╠²inclusion ╠²of ╠²projec7ons ╠²herein ╠²should ╠²not ╠²be ╠²regarded ╠²as ╠²a ╠²representa7on ╠²by ╠²the ╠²Fund ╠²or ╠²any ╠² other ╠²person ╠²or ╠²en7ty ╠²of ╠²the ╠²results ╠²that ╠²will ╠²actually ╠²be ╠²achieved ╠²by ╠²the ╠²Fund. ╠² ╠² This ╠²presenta7on ╠²should ╠²not ╠²be ╠²construed ╠²as ╠²a ╠²recommenda7on ╠²or ╠²as ╠²legal, ╠²tax ╠²or ╠²’¼ünancial ╠²advice ╠²in ╠²rela7on ╠²to ╠²the ╠²subscrip7on, ╠²purchase, ╠² holding ╠²or ╠²disposi7on ╠²of ╠²shares ╠²in ╠²the ╠²Fund. ╠²Prospec7ve ╠²investors ╠²should ╠²accordingly ╠²consult ╠²their ╠²own ╠²professional ╠²advisers ╠²

- 3. ’éŚŌĆł Overview ╠² ’éŚŌĆł What ╠² ’éŚŌĆł Why ╠² ’éŚŌĆł How ╠² ’éŚŌĆł Who ╠² ’éŚŌĆł Fees ╠² ’éŚŌĆł Funnel ╠²extract ╠² ╠²

- 4. overview ╠² ’éŚŌĆł Target ╠²fundraise: ╠²┬Ż15m ╠² ’éŚŌĆł Minimum ╠²fundraise: ╠²┬Ż10m ╠² ’éŚŌĆł Minimum ╠²investment: ╠²┬Ż25,000 ╠² ’éŚŌĆł Maximum ╠²investment: ╠²┬Ż1,000,000 ╠² ’éŚŌĆł Target ╠²return: ╠²30% ╠²IRR ╠² ’éŚŌĆł Investment ╠²term: ╠²5 ╠²years ╠²(with ╠²the ╠²op7on ╠²of ╠²a ╠²further ╠²two, ╠²one ╠²year ╠²increments). ╠² ’éŚŌĆł Closing ╠²Date: ╠²April ╠²2013 ╠² ’éŚŌĆł Fund ╠²Structure: ╠²Discre7onary ╠²EIS ╠²porbolio ╠² ’éŚŌĆł Investor ╠²Repor7ng: ╠²Investors ╠²will ╠²receive ╠²a ╠²quarterly ╠²leSer ╠²and ╠²full ╠²annual ╠²report. ╠²

- 5. what ╠² ’éŚŌĆł A ╠²discre7onary ╠²EIS ╠²fund ╠²inves7ng ╠²in ╠²early ╠²stage ╠²internet ╠² companies, ╠²ran ╠²& ╠²advised ╠²by ╠²successful ╠²internet ╠² entrepreneurs ╠²and ╠²experienced ╠²investment ╠²professionals. ╠² ’éŚŌĆł A ╠²fund ╠²seeking ╠²to ╠²invest ╠²in ╠²the ╠²value ╠²created ╠²by ╠²disrup7ve ╠² internet ╠²technologies. ╠² ’éŚŌĆł A ╠²fund ╠²that ╠²is ╠²using ╠²historical ╠²data ╠²to ╠²guide ╠²an ╠²investment ╠² strategy ╠²to ╠²manage ╠²downsize ╠²risk, ╠²while ╠²leaving ╠²an ╠² opportunity ╠²for ╠²substan7al ╠²returns. ╠² ’éŚŌĆł In ╠²fact, ╠²a ╠²target ╠²IRR ╠²of ╠²30 ╠²over ╠²5 ╠²years. ╠² ╠² ╠²

- 6. what ╠² ’éŚŌĆł A ╠²fund ╠²that ╠²draws ╠²analogue ╠²to ╠²successful ╠²US ╠²ŌĆśmicro-┬ŁŌĆÉVCŌĆÖ ╠²models ╠² ’éŚŌĆł ŌĆ£[This ╠²kind ╠²of ╠²fund] ╠²want ╠²to ╠²reinvigorate ╠²venture ╠²capital ╠²by ╠²taking ╠² it ╠²back ╠²to ╠²its ╠²roots, ╠²when ╠²’¼ürms ╠²were ╠²smaller, ╠²more ╠²nimble, ╠²and ╠² more ╠²likely ╠²to ╠²help ╠²startups ╠²get ╠²o’¼Ć ╠²the ╠²ground.ŌĆØ ╠²ŌĆō ╠²Business ╠²Week ╠² ’éŚŌĆł ŌĆ£The ╠²fact ╠²that ╠²start-┬ŁŌĆÉups ╠²today ╠²can ╠²do ╠²a ╠²lot ╠²with ╠²so ╠²much ╠²less ╠² capital ╠²will ╠²conCnue ╠²to ╠²put ╠²pressure ╠²on ╠²VCs ╠²to ╠²look ╠²at ╠²smaller ╠² investment ╠²opportuniCes.ŌĆØ ╠²ŌĆō ╠²Greg ╠²Foster ╠² ’éŚŌĆł ŌĆ£This ╠²ŌĆśboomŌĆÖ ╠²in ╠²seed ╠²and ╠²Micro-┬ŁŌĆÉVC ╠²acCvity ╠²is ╠²not ╠²so ╠²much ╠²a ╠²boom ╠² as ╠²it ╠²is ╠²a ╠²seismic ╠²shiI ╠²in ╠²how ╠²technology ╠²companies ╠²will ╠²be ╠² founded ╠²and ╠²funded ╠²for ╠²the ╠²forseeable ╠²future ╠²ŌĆ£ŌĆō ╠²Jonathan ╠²Tower, ╠² MD, ╠²Citron ╠²Capital ╠²

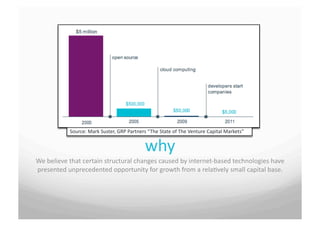

- 7. Source: ╠²Mark ╠²Suster, ╠²GRP ╠²Partners ╠²ŌĆ£ The ╠²State ╠²of ╠²The ╠²Venture ╠²Capital ╠²MarketsŌĆØ ╠² why ╠² We ╠²believe ╠²that ╠²certain ╠²structural ╠²changes ╠²caused ╠²by ╠²internet-┬ŁŌĆÉbased ╠²technologies ╠²have ╠² presented ╠²unprecedented ╠²opportunity ╠²for ╠²growth ╠²from ╠²a ╠²rela7vely ╠²small ╠²capital ╠²base. ╠²

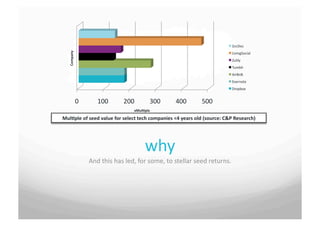

- 8. ZocDoc ╠² Company ╠² LivingSocial ╠² Zulily ╠² Tumblr ╠² AirBnB ╠² Evernote ╠² Dropbox ╠² 0 ╠² 100 ╠² 200 ╠² 300 ╠² 400 ╠² 500 ╠² xMul+ple ╠² Mul+ple ╠²of ╠²seed ╠²value ╠²for ╠²select ╠²tech ╠²companies ╠²<4 ╠²years ╠²old ╠²(source: ╠²C&P ╠²Research) ╠² why ╠² And ╠²this ╠²has ╠²led, ╠²for ╠²some, ╠²to ╠²stellar ╠²seed ╠²returns. ╠²

- 9. why ╠²

- 10. why ╠² And ╠²this ╠²gap ╠²hasnŌĆÖt ╠²yet ╠²been ╠²’¼ülled ╠²in ╠²UK/Euro ╠²VC ╠²

- 11. Sample ╠²Euro ╠²Startups ╠²by ╠²value ╠²($) ╠²(Source:Business ╠²Insider) ╠² shazam ╠² miniclip ╠² Mind ╠²Candy ╠² Habbo ╠² Ozon.ru ╠² spo7fy ╠² Rovio ╠² Vente-┬ŁŌĆÉprivee ╠² 0 ╠² 500,000,000 ╠² 1,000,000,000 ╠² 1,500,000,000 ╠² 2,000,000,000 ╠² 2,500,000,000 ╠² 3,000,000,000 ╠² 3,500,000,000 ╠² why ╠² Yet ╠²UK/Europe ╠²are ╠²fully ╠²capable ╠²of ╠²crea7ng ╠²blockbuster ╠²start-┬ŁŌĆÉups ╠²

- 12. why ╠² Because ╠²angel-┬ŁŌĆÉlevel ╠²investments ╠²ŌĆō ╠²by ╠²investment ╠²groups ╠²ŌĆō ╠²are ╠²solid ╠²performers ╠² ╠²

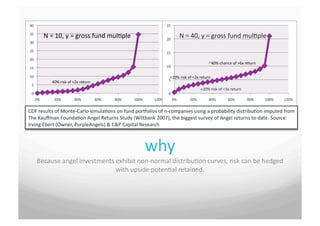

- 13. 40 ╠² 25 ╠² N ╠²= ╠²10, ╠²y ╠²= ╠²gross ╠²fund ╠²mul7ple ╠² 35 ╠² N ╠²= ╠²10, ╠²y ╠²= ╠²gross ╠²fund ╠²mul7ple ╠² 20 ╠² N ╠²= ╠²40, ╠²y ╠²= ╠²gross ╠²fund ╠²mul7ple ╠² 30 ╠² 25 ╠² 15 ╠² 20 ╠² ~40% ╠²chance ╠²of ╠²>6x ╠²return ╠² 15 ╠² 10 ╠² 10 ╠² <10% ╠²risk ╠²of ╠²<2x ╠²return ╠² 5 ╠² 40% ╠²risk ╠²of ╠²<2x ╠²return ╠² 5 ╠² <20% ╠²risk ╠²of ╠²<3x ╠²return ╠² 0 ╠² 0 ╠² 0% ╠² 20% ╠² 40% ╠² 60% ╠² 80% ╠² 100% ╠² 120% ╠² 0% ╠² 20% ╠² 40% ╠² 60% ╠² 80% ╠² 100% ╠² 120% ╠² CDF ╠²results ╠²of ╠²Monte-┬ŁŌĆÉCarlo ╠²simula7ons ╠²on ╠²fund ╠²porbolios ╠²of ╠²n-┬ŁŌĆÉcompanies ╠²using ╠²a ╠²probability ╠²distribu7on ╠²imputed ╠²from ╠² The ╠²Kau’¼Ćman ╠²Founda7on ╠²Angel ╠²Returns ╠²Study ╠²(Wiltbank ╠²2007), ╠²the ╠²biggest ╠²survey ╠²of ╠²Angel ╠²returns ╠²to-┬ŁŌĆÉdate. ╠²Source: ╠² Irving ╠²Ebert ╠²(Owner, ╠²PurpleAngels) ╠²& ╠²C&P ╠²Capital ╠²Research ╠² why ╠² Because ╠²angel ╠²investments ╠²exhibit ╠²non-┬ŁŌĆÉnormal ╠²distribu7on ╠²curves, ╠²risk ╠²can ╠²be ╠²hedged ╠² with ╠²upside ╠²poten7al ╠²retained. ╠²

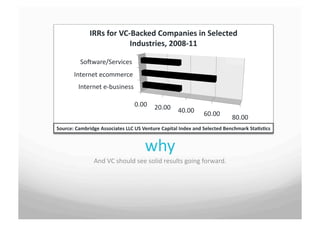

- 14. IRRs ╠²for ╠²VC-┬ŁŌĆÉBacked ╠²Companies ╠²in ╠²Selected ╠² Industries, ╠²2008-┬ŁŌĆÉ11 ╠² Sovware/Services ╠² Internet ╠²ecommerce ╠² Internet ╠²e-┬ŁŌĆÉbusiness ╠² 0.00 ╠² 20.00 ╠² 40.00 ╠² 60.00 ╠² 80.00 ╠² Source: ╠²Cambridge ╠²Associates ╠²LLC ╠²US ╠²Venture ╠²Capital ╠²Index ╠²and ╠²Selected ╠²Benchmark ╠²Sta+s+cs ╠² ╠² why ╠² And ╠²VC ╠²should ╠²see ╠²solid ╠²results ╠²going ╠²forward. ╠²

- 15. how ╠² Tapping ╠²into ╠²our ╠²mature ╠²and ╠²expansive ╠² networks ╠²to ╠²generate ╠²deal’¼éow. ╠²We ╠² already ╠²have ╠²a ╠²strong ╠²funnel. ╠² Using ╠²published ╠²term ╠²sheets ╠²& ╠² standardised ╠²legal ╠²documents ╠² By ╠²being ╠²ŌĆśpublicŌĆÖ: ╠²blogging, ╠²twee7ng ╠²and ╠² aSending ╠²the ╠²myriad ╠²of ╠²conferences ╠²and ╠² meetups. ╠² We ╠²too ╠²will ╠²seek ╠²to ╠²be ╠²nimble, ╠²hard ╠² Paul ╠²Singh, ╠²500Ventures: ╠² working ╠²& ╠²disrup7ve, ╠²just ╠²like ╠²our ╠² ╠²ŌĆ£Moneyball: ╠²A ╠²Quan7ta7ve ╠²Approach ╠²to ╠²Angel ╠²Inves7ngŌĆØ ╠² startups. ╠²

- 16. how ╠² By ╠²leading ╠²~15-┬ŁŌĆÉ20 ╠²of ╠²the ╠²best ╠² investments. ╠² By ╠²giving ╠²that ╠²~15-┬ŁŌĆÉ20 ╠²direct ╠²opera7onal ╠² and ╠²board ╠²level ╠²support. ╠² And ╠²ŌĆśfollowingŌĆÖ ╠²or ╠²ŌĆśsilent ╠²partnerŌĆÖ ╠² inves7ng ╠²for ╠²the ╠²rest. ╠²

- 17. who ╠² ’éŚŌĆł Fund ╠²manager: ╠²Prosper ╠²Capital ╠²LLP ╠² ╠² ╠² ╠² ’éŚŌĆł Technology ╠²Adviser: ╠²C&P ╠²Capital ╠²LLP ╠² ╠² ╠² ’éŚŌĆł Custodian: ╠²Woodside ╠²Securi7es ╠² ╠² ╠² ’éŚŌĆł Audit ╠²and ╠²accounts: ╠²Nyman ╠²Libson ╠²Paul ╠² ╠² ╠² ’éŚŌĆł Solicitors ╠²to ╠²o’¼Ćer: ╠²Davenport ╠²Lyons ╠² ╠² ╠²

- 18. who ╠² David ╠²Hickson ╠²ŌĆō ╠²Chief ╠² Dylan ╠²Collins ╠²ŌĆō ╠²Chairman ╠² Investment ╠²O’¼ācer ╠² Investment ╠²CommiSee ╠² David ╠²Hickson ╠²is ╠²a ╠²seasoned ╠²digital ╠²media/Internet ╠² Dylan ╠²Collins ╠²is ╠²one ╠²of ╠²the ╠²most ╠²experienced ╠²online ╠² veteran ╠²and ╠²entrepreneur. ╠² gaming ╠²entrepreneurs ╠²in ╠²Europe, ╠²building ╠²three ╠² companies ╠²with ╠²three ╠²successful ╠²exits ╠²over ╠²the ╠²last ╠² decade. ╠² ╠²He ╠²was ╠²commercial ╠²& ╠²legal ╠²director ╠²at ╠² lastminute.com ╠²PLC, ╠²where ╠²he ╠²was ╠²a ╠²key ╠²part ╠²of ╠²its ╠² ╠²He ╠²is ╠²Execu7ve ╠²Chairman ╠²of ╠²Fight ╠²My ╠²Monster ╠²the ╠²leading ╠² ┬Ż577m ╠²exit ╠²to ╠²Travelocity ╠²Europe ╠²Limited. ╠² online ╠²game ╠²for ╠²boys ╠²in ╠²the ╠²UK. ╠² ╠² ╠²Head ╠²of ╠²Corporate ╠²Development ╠²at ╠²mydeco.com ╠² Dylan ╠²is ╠²also ╠²an ╠²angel ╠²investor ╠²in ╠²several ╠²Internet ╠²and ╠² where ╠²he ╠²raised ╠²over ╠²┬Ż12.5m ╠²of ╠²venture ╠²capital,. ╠² technology ╠²companies ╠²in ╠²the ╠²UK ╠²and ╠²Ireland. ╠² ╠² ╠² Co-┬ŁŌĆÉfounder ╠²and ╠²Chief ╠²Strategy ╠²O’¼ācer ╠²at ╠² He ╠²serves ╠²as ╠²Ambassador ╠²to ╠²the ╠²Irish ╠²GovernmentŌĆÖs ╠² Tribesports.com ╠²that ╠²has ╠²recently ╠²announced ╠²over ╠² Interna7onal ╠²Startup ╠²Fund. ╠² ┬Ż2m ╠²worth ╠²of ╠²venture ╠²capital ╠²and ╠²has ╠²seen ╠²1200% ╠²user ╠² growth ╠²since ╠²January ╠²ŌĆś12. ╠² Accolades: ╠² ╠²He ╠²is ╠²a ╠²partner ╠²at ╠²C&P ╠²Capital ╠²LLP ╠² ╠²Finalist ╠²in ╠²last ╠²yearŌĆÖs ╠²Ernst ╠²& ╠²Young ╠²Entrepreneur ╠²of ╠² the ╠²Year ╠² He ╠²sat ╠²on ╠²the ╠²Jury ╠²Panel ╠²at ╠²the ╠²Tech ╠²Entrepreneurs ╠² ╠²Winner ╠²Irish ╠²Internet ╠²Associa7on ╠²ŌĆśInternet ╠²HeroŌĆÖ ╠² Week ╠²with ╠²Jimmy ╠²Wales, ╠²founder ╠²of ╠²Wikipedia. ╠² award ╠²

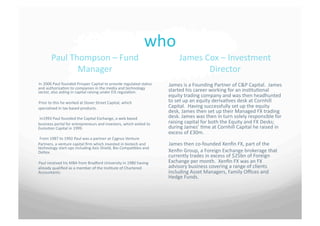

- 19. who ╠² Paul ╠²Thompson ╠²ŌĆō ╠²Fund ╠² James ╠²Cox ╠²ŌĆō ╠²Investment ╠² Manager ╠² Director ╠² In ╠²2006 ╠²Paul ╠²founded ╠²Prosper ╠²Capital ╠²to ╠²provide ╠²regulated ╠²status ╠² James ╠²is ╠²a ╠²Founding ╠²Partner ╠²of ╠²C&P ╠²Capital. ╠² ╠²James ╠² and ╠²authorisa7on ╠²to ╠²companies ╠²in ╠²the ╠²media ╠²and ╠²technology ╠² started ╠²his ╠²career ╠²working ╠²for ╠²an ╠²ins7tu7onal ╠² sector, ╠²also ╠²aiding ╠²in ╠²capital ╠²raising ╠²under ╠²EIS ╠²regula7on. ╠² ╠² equity ╠²trading ╠²company ╠²and ╠²was ╠²then ╠²headhunted ╠² Prior ╠²to ╠²this ╠²he ╠²worked ╠²at ╠²Dover ╠²Street ╠²Capital, ╠²which ╠² to ╠²set ╠²up ╠²an ╠²equity ╠²deriva7ves ╠²desk ╠²at ╠²Cornhill ╠² specialised ╠²in ╠²tax ╠²based ╠²products. ╠² Capital. ╠² ╠²Having ╠²successfully ╠²set ╠²up ╠²the ╠²equity ╠² desk, ╠²James ╠²then ╠²set ╠²up ╠²their ╠²Managed ╠²FX ╠²trading ╠² ╠²In1993 ╠²Paul ╠²founded ╠²the ╠²Capital ╠²Exchange, ╠²a ╠²web ╠²based ╠² desk. ╠²James ╠²was ╠²then ╠²in ╠²turn ╠²solely ╠²responsible ╠²for ╠² business ╠²portal ╠²for ╠²entrepreneurs ╠²and ╠²investors, ╠²which ╠²exited ╠²to ╠² raising ╠²capital ╠²for ╠²both ╠²the ╠²Equity ╠²and ╠²FX ╠²Desks; ╠² Evolu7on ╠²Capital ╠²in ╠²1999. ╠² during ╠²JamesŌĆÖ ╠²7me ╠²at ╠²Cornhill ╠²Capital ╠²he ╠²raised ╠²in ╠² excess ╠²of ╠²┬Ż30m. ╠² ╠²From ╠²1987 ╠²to ╠²1992 ╠²Paul ╠²was ╠²a ╠²partner ╠²at ╠²Cygnus ╠²Venture ╠² Partners, ╠²a ╠²venture ╠²capital ╠²’¼ürm ╠²which ╠²invested ╠²in ╠²biotech ╠²and ╠² James ╠²then ╠²co-┬ŁŌĆÉfounded ╠²Xen’¼ün ╠²FX, ╠²part ╠²of ╠²the ╠² technology ╠²start-┬ŁŌĆÉups ╠²including ╠²Axis ╠²Shield, ╠²Bio ╠²Compa7bles ╠²and ╠² Deltex. ╠² Xen’¼ün ╠²Group, ╠²a ╠²Foreign ╠²Exchange ╠²brokerage ╠²that ╠² currently ╠²trades ╠²in ╠²excess ╠²of ╠²$25bn ╠²of ╠²Foreign ╠² Paul ╠²received ╠²his ╠²MBA ╠²from ╠²Bradford ╠²University ╠²in ╠²1980 ╠²having ╠² Exchange ╠²per ╠²month. ╠² ╠²Xen’¼ün ╠²FX ╠²was ╠²an ╠²FX ╠² already ╠²quali’¼üed ╠²as ╠²a ╠²member ╠²of ╠²the ╠²Ins7tute ╠²of ╠²Chartered ╠² advisory ╠²business ╠²covering ╠²a ╠²range ╠²of ╠²clients ╠² Accountants. ╠² including ╠²Asset ╠²Managers, ╠²Family ╠²O’¼āces ╠²and ╠² Hedge ╠²Funds. ╠²

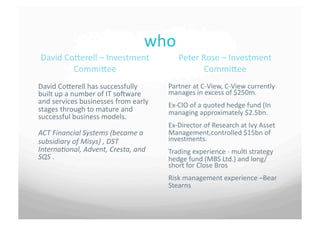

- 20. who ╠² David ╠²CoSerell ╠²ŌĆō ╠²Investment ╠² Peter ╠²Rose ╠²ŌĆō ╠²Investment ╠² CommiSee ╠² CommiSee ╠² David ╠²CoSerell ╠²has ╠²successfully ╠² Partner ╠²at ╠²C-┬ŁŌĆÉView, ╠²C-┬ŁŌĆÉView ╠²currently ╠² built ╠²up ╠²a ╠²number ╠²of ╠²IT ╠²sovware ╠² manages ╠²in ╠²excess ╠²of ╠²$250m. ╠² and ╠²services ╠²businesses ╠²from ╠²early ╠² Ex-┬ŁŌĆÉCIO ╠²of ╠²a ╠²quoted ╠²hedge ╠²fund ╠²(In ╠² stages ╠²through ╠²to ╠²mature ╠²and ╠² managing ╠²approximately ╠²$2.5bn. ╠² ╠² successful ╠²business ╠²models. ╠² Ex-┬ŁŌĆÉDirector ╠²of ╠²Research ╠²at ╠²Ivy ╠²Asset ╠² ACT ╠²Financial ╠²Systems ╠²(became ╠²a ╠² Management,controlled ╠²$15bn ╠²of ╠² subsidiary ╠²of ╠²Misys) ╠², ╠²DST ╠² investments. ╠² ╠² InternaConal, ╠²Advent, ╠²Cresta, ╠²and ╠² Trading ╠²experience ╠²-┬ŁŌĆÉ ╠²mul7 ╠²strategy ╠² SQS ╠². ╠² hedge ╠²fund ╠²(MBS ╠²Ltd.) ╠²and ╠²long/ short ╠²for ╠²Close ╠²Bros ╠² Risk ╠²management ╠²experience ╠²ŌĆōBear ╠² Stearns ╠²

- 21. who ╠² David ╠²Kelly ╠²ŌĆō ╠²Special ╠²Advisor ╠² COO/VP ╠²Opera7ons ╠²at ╠²ebay ╠² COO ╠²of ╠²lasminute.com ╠² ╠² Director ╠²at ╠²Amazon, ╠² ╠² Founder/CEO ╠²of ╠²mydeco.com ╠² SVP/Managing ╠²Director ╠²of ╠² Rackspace ╠²ŌĆō ╠²the ╠²US ╠²hos7ng ╠²and ╠² cloud ╠²plaborm ╠²ŌĆō ╠²during ╠²a ╠²7me ╠²it ╠² put ╠²on ╠²$5 ╠²billion ╠²of ╠²market ╠²cap. ╠²

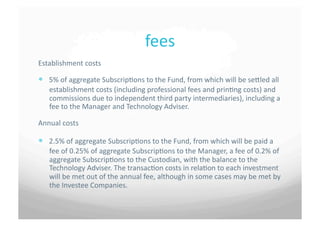

- 22. fees ╠² Establishment ╠²costs ╠² ’éŚŌĆł 5% ╠²of ╠²aggregate ╠²Subscrip7ons ╠²to ╠²the ╠²Fund, ╠²from ╠²which ╠²will ╠²be ╠²seSled ╠²all ╠² establishment ╠²costs ╠²(including ╠²professional ╠²fees ╠²and ╠²prin7ng ╠²costs) ╠²and ╠² commissions ╠²due ╠²to ╠²independent ╠²third ╠²party ╠²intermediaries), ╠²including ╠²a ╠² fee ╠²to ╠²the ╠²Manager ╠²and ╠²Technology ╠²Adviser. ╠² Annual ╠²costs ╠² ╠² ’éŚŌĆł 2.5% ╠²of ╠²aggregate ╠²Subscrip7ons ╠²to ╠²the ╠²Fund, ╠²from ╠²which ╠²will ╠²be ╠²paid ╠²a ╠² fee ╠²of ╠²0.25% ╠²of ╠²aggregate ╠²Subscrip7ons ╠²to ╠²the ╠²Manager, ╠²a ╠²fee ╠²of ╠²0.2% ╠²of ╠² aggregate ╠²Subscrip7ons ╠²to ╠²the ╠²Custodian, ╠²with ╠²the ╠²balance ╠²to ╠²the ╠² Technology ╠²Adviser. ╠²The ╠²transac7on ╠²costs ╠²in ╠²rela7on ╠²to ╠²each ╠²investment ╠² will ╠²be ╠²met ╠²out ╠²of ╠²the ╠²annual ╠²fee, ╠²although ╠²in ╠²some ╠²cases ╠²may ╠²be ╠²met ╠²by ╠² the ╠²Investee ╠²Companies. ╠² ╠²

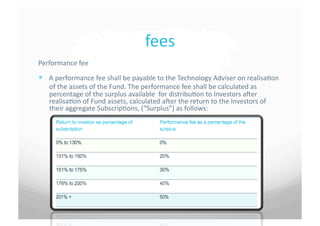

- 23. fees ╠² Performance ╠²fee ╠² ╠² ’éŚŌĆł A ╠²performance ╠²fee ╠²shall ╠²be ╠²payable ╠²to ╠²the ╠²Technology ╠²Adviser ╠²on ╠²realisa7on ╠² of ╠²the ╠²assets ╠²of ╠²the ╠²Fund. ╠²The ╠²performance ╠²fee ╠²shall ╠²be ╠²calculated ╠²as ╠² percentage ╠²of ╠²the ╠²surplus ╠²available ╠² ╠²for ╠²distribu7on ╠²to ╠²Investors ╠²aver ╠² realisa7on ╠²of ╠²Fund ╠²assets, ╠²calculated ╠²aver ╠²the ╠²return ╠²to ╠²the ╠²Investors ╠²of ╠² their ╠²aggregate ╠²Subscrip7ons, ╠²(ŌĆ£SurplusŌĆØ) ╠²as ╠²follows: ╠²

- 25. contact ╠² ’éŚŌĆł James@candpcapital.com ╠² ’éŚŌĆł David@candpcapital.com ╠² Or ╠²call: ╠²0203 ╠²6518181 ╠²

![what

╠²

’éŚŌĆł A

╠²fund

╠²that

╠²draws

╠²analogue

╠²to

╠²successful

╠²US

╠²ŌĆśmicro-┬ŁŌĆÉVCŌĆÖ

╠²models

╠²

’éŚŌĆł ŌĆ£[This

╠²kind

╠²of

╠²fund]

╠²want

╠²to

╠²reinvigorate

╠²venture

╠²capital

╠²by

╠²taking

╠²

it

╠²back

╠²to

╠²its

╠²roots,

╠²when

╠²’¼ürms

╠²were

╠²smaller,

╠²more

╠²nimble,

╠²and

╠²

more

╠²likely

╠²to

╠²help

╠²startups

╠²get

╠²o’¼Ć

╠²the

╠²ground.ŌĆØ

╠²ŌĆō

╠²Business

╠²Week

╠²

’éŚŌĆł ŌĆ£The

╠²fact

╠²that

╠²start-┬ŁŌĆÉups

╠²today

╠²can

╠²do

╠²a

╠²lot

╠²with

╠²so

╠²much

╠²less

╠²

capital

╠²will

╠²conCnue

╠²to

╠²put

╠²pressure

╠²on

╠²VCs

╠²to

╠²look

╠²at

╠²smaller

╠²

investment

╠²opportuniCes.ŌĆØ

╠²ŌĆō

╠²Greg

╠²Foster

╠²

’éŚŌĆł ŌĆ£This

╠²ŌĆśboomŌĆÖ

╠²in

╠²seed

╠²and

╠²Micro-┬ŁŌĆÉVC

╠²acCvity

╠²is

╠²not

╠²so

╠²much

╠²a

╠²boom

╠²

as

╠²it

╠²is

╠²a

╠²seismic

╠²shiI

╠²in

╠²how

╠²technology

╠²companies

╠²will

╠²be

╠²

founded

╠²and

╠²funded

╠²for

╠²the

╠²forseeable

╠²future

╠²ŌĆ£ŌĆō

╠²Jonathan

╠²Tower,

╠²

MD,

╠²Citron

╠²Capital

╠²](https://image.slidesharecdn.com/esdt-121119040857-phpapp02/85/Esdt-6-320.jpg)