ETF Operational Considerations and Developments Webinar

- 1. www.nicsa.org ETF Operational Considerations and Developments July 24, 2013

- 2. www.nicsa.org TodayŌĆÖs Panel ŌĆó Moderator: Bill Donahue ŌĆō PwC ŌĆó Panelists: ŌĆó Frank Koudelka ŌĆō State Street Global Services ŌĆó Shawn McNinch ŌĆō Brown Brothers Harriman

- 3. www.nicsa.org Discussion Topics ŌĆó ETF Market Trends ŌĆó Active ETFs ŌĆó ETF 101 - Mechanics ŌĆó ETF Launch Considerations ŌĆó ETF Operations

- 5. www.nicsa.org Polling Question 1 Please let us know your knowledge and experience with ETFs. 1. I donŌĆÖt understand ETFs or how ETFs work 2. I have a good understanding of how ETFs work 3. I have a very good understanding of how ETFs works 4. I have significant knowledge and experience with ETFs

- 7. www.nicsa.org What Are Some of The Drivers of ETF Growth?

- 9. www.nicsa.org Active ETF Landscape Assets as of June 30, 2013

- 10. www.nicsa.org 2009-2013 Active ETF Exemptive Relief Filings

- 12. www.nicsa.org ETF 101 - Mechanics

- 13. www.nicsa.org

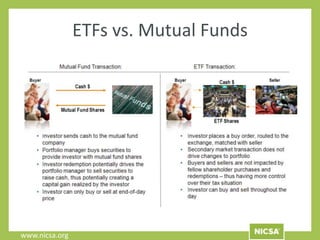

- 14. www.nicsa.org ETFs vs. Mutual Funds

- 16. www.nicsa.org ETF Pre-Launch Process Additional Launch Considerations

- 17. www.nicsa.org Polling Question 2 Global ETF AUM is approximately $2.1 trillion at the end of June 2013. I predict Global ETF AUM will be as follows as of June 30, 2018. 1. $ 2.1 trillion 2. $ 2.5 trillion 3. $3.0 trillion 4. $4 trillion 5. More than $ 5 trillion

- 23. www.nicsa.org Panel Contact Information ŌĆó Bill Donahue Bill.J.Donahue@us.pwc.com ŌĆó Frank Koudelka Francis.Koudelka@statestreet.com ŌĆó Shawn McNinch Shawn.McNinch@bbh.com

Editor's Notes

- #7: ~ Comparing growth for ETFs and Mutual Funds; ETFs have enjoyed 7 straight years of $100 billion plus positive net inflows~ Mutual Fund growth has been unsteady over the same period with strong growth in 2007, the year before the financial crisis, followed by tempered growth and net negative flows for 3 of the 6 years that followed. Flows have stabilized during the last 3 ŌĆō 4 quarters~ Much of the outflows have been a result of flows from short-term money market instruments as a result of historically low yields, the Reserve fund concerns and the unsettled regulatory environment

- #10: ~ Turning to actively-managed ETFs, the market is still in its infancy ŌĆō with the first product not launching until 2008 ŌĆō the YYY from Bear Stearns~ The first several products and years provided little excitement with products from Bear Stearns, PowerShares and Grail raising minimal assets or excitement~ Entries by WisdomTree and PIMCO have begun to change the landscape with products including PIMCO BOND and MINT, as well as WisdomTree ELD~ Actively-manged ETFs still represent a very small component of the ETF market, with less than 1% of the assets ~ Out of the current 13 ETF managers with products, PIMCO and WisdomTree account for 85% of the $15 billion in AUM to date

- #15: Illustrating the differences of Mutual Fund and ETFs. A mutual fund investor is sending cash directly to the mutual fund. The portfolio manager is putting the cash to work by purchasing securities as a part of the portfolio. When selling, the portfolio manager is selling securities to raise cash. This has the opportunity to create a capital gain in the portfolio, which is passed on to all of the investors of the fund. A mutual fund investor receives the end of day NAV for their purchase or sale.An ETF investor can purchase or sell shares throughout the exchange trading day. Buyers and sellers are matched to facilitate the order in the secondary market. Since the portfolio securities are not being bought or sold (remember the ŌĆ£in kindŌĆØ process discussed earlier) capital gains from the portfolio are not being passed on to investors. Investors are subject to their personal capital gains or losses based on the appreciation or depreciation of the share price from purchase to redemption.