Exporters- How to get your GST refund

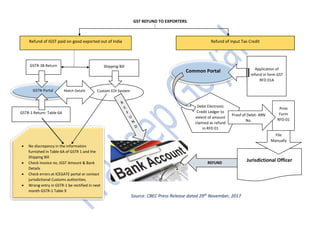

- 1. GST REFUND TO EXPORTERS Source: CBEC Press Release dated 29th November, 2017 Refund of IGST paid on good exported out of India Refund of Input Tax Credit GSTN Portal GSTR-3B Return GSTR-1 Return- Table 6A Custom EDI System Shipping Bill Match Details ’éĘ No discrepancy in the information furnished in Table 6A of GSTR 1 and the Shipping Bill ’éĘ Check Invoice no, IGST Amount & Bank Details ’éĘ Check errors at ICEGATE portal or contact jurisdictional Customs authorities. ’éĘ Wrong entry in GSTR-1 be rectified in next month GSTR-1 Table 9 Common Portal Application of refund in form GST RFD 01A Debit Electronic Credit Ledger to extent of amount claimed as refund in RFD 01 Print Form RFD-01 Proof of Debit- ARN No. Jurisdictional Officer File Manually REFUND