Extended withholdingtaxconfiguration

- 2. www.sapficoconsultant.com Page 2 of 57 ? 2005 -2006 sapficoconsultant.com. All rights reserved. No part of this e-book should be reproduced or transmitted in any form, or by any means, electronic or mechanical including photocopying, recording or by any information storage retrieval system without permission in writing from www.sapficoconsultant.com Ī░SAPĪ▒ is a trademark of SAP AG, Neurottstrasse 16, 69190 Walldorf, Germany. SAP AG is not the publisher of this e-book and is not responsible for it under any aspect.

- 3. www.sapficoconsultant.com Page 3 of 57 TABLE OF CONTENTS INTRODUCTION.........................................................................................................4 1. Basic Settings ...............................................................................................6 1.1 Check Withholding Tax Countries .............................................................6 1.2 Define Official Withholding Tax Codes .....................................................7 1.3 Define Reasons for Exemption ............................................................... 10 1.4 Check Recipient Types ............................................................................ 11 1.5 Define Business Places............................................................................ 12 2. Calculation.................................................................................................. 16 2.1 Withholding Tax Type ............................................................................... 16 2.1.1 Define Withholding Tax Type for Invoice Posting....................... 16 2.1.2 Define Withholding Tax Type for Payment Posting .................... 19 2.1.3 Define Exchange Rate Type for Withholding Tax Type............. 20 2.1.4 Define Rounding Rule for Withholding Tax Type ........................ 22 2.2 Withholding Tax Codes ............................................................................ 23 2.2.1 Define Withholding Tax Codes ....................................................... 23 2.2.2 Define Formulas for Calculating Withholding Tax....................... 29 2.3 Withholding Tax Base Amount................................................................ 31 2.3.1 Define Processing Key for Modified Net Amount ........................ 31 2.3.2 Define Processing Key for Modified Tax Amount........................ 32 2.2.3 Portray Dependencies between Withholding Tax Types............... 33 2.4 Minimum and Maximum Amounts .......................................................... 35 2.4.1 Define Min/Max Amounts for Withholding Tax Types................ 35 2.2.2 Define Min/Max Amounts for Withholding Tax Codes................ 36 3. Company Code.......................................................................................... 38 3.1 Assign Withholding Tax Types to Company Codes ............................ 38 3.2 Activate Extended Withholding Tax........................................................ 40 4. Postings ...................................................................................................... 41 4.1 Define Accounts for Withholding Tax to be Paid Over........................ 41 5. Generic Withholding Tax Reporting ....................................................... 43 5.1 Define Output Groups............................................................................... 43 5.2 Define Forms for Withholding Tax Reporting........................................ 44 5.3 Define Certificate Numbering for Extended Withholding Tax............. 46 6. Vendor Master Data Maintenance.......................................................... 48 6.1 Update withholding tax codes in the vendor master............................ 48 6.2 Change Field Status used in the down payment account.................. 51 7. Go live checks when uploading Vendor Master Data and Vendor open items.................................................................................................. 57

- 4. www.sapficoconsultant.com Page 4 of 57 INTRODUCTION Withholding tax is applicable in few countries. Some of the countries which have withholding tax are United Kingdom, Slovakia, Turkey, Argentina, Brazil, Chile, Colombia, Mexico, India, Philippines, Thailand and South Korea. SAP has given an excellent solution to map the withholding tax scenario. What is a withholding tax? Withholding tax is an Income tax which is deducted at the source of the revenue. The party that is subject to tax does not remit the withholding tax to the tax authorities himself. In any business transaction there are 2 parties involved. One is the customer and another is the vendor. A customer is authorized to deduct withholding tax for services rendered by the vendor. When the vendor raises the invoice on the customer, the customer deducts the withholding tax as per the rates specified by the tax authorities and pays the balance money to the vendor. The tax deducted by the vendor is remitted to the tax authorities on specified due dates. The vendor gives a Withholding tax certificate to the customer for the withholding tax deducted. The customer can claim this withholding tax (as advance income tax paid) in his annual returns to Income tax authorities. In some countries (like India) the withholding tax is deducted on Invoice or payment whichever is earlier. Thus when an advance is paid to the vendor the customer is required to deduct withholding tax on the advance payment. When the Vendor submits an Invoice the customer is now required to deduct tax on the Invoice amount reduced by the advance amount. To calculate pay and report the withholding tax, the SAP system provides two functions:- Classic Withholding tax Extended Withholding tax Extended Withholding tax includes all the functions of classic withholding tax; SAP therefore recommends the use of extended withholding tax. We will cover the Extended withholding tax functionality in this e-book. We will try to cover the broad configuration aspects of extended withholding tax, without getting into each country specifics. Since each country has its own forms and different reporting requirements.

- 5. www.sapficoconsultant.com Page 5 of 57 With Extended Withholding tax, we can process withholding tax from both the vendor and customer view. From the Accounts Payable perspective, the vendor is the person subject to tax and the company code is obligated to deduct withholding tax and pay to tax authorities. From the Accounts Receivable perspective the company code itself is subject to tax and the customers that do business with the company deduct withholding tax and pay to the tax authorities. Generally the Accounts Payable perspective is used by majority of the implementing companies. Let us proceed for the configuration.

- 6. www.sapficoconsultant.com Page 6 of 57 1. Basic Settings 1.1 Check Withholding Tax Countries For configuration we use the following path on the SAP application screen:- SAP Menu ©ż Tools ©ż Customizing ©ż IMG ©ż SPRO ©C Edit Project ©ż IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Basic Settings ©ż Check Withholding Tax Countries The withholding tax country is needed for printing the withholding tax form and also for maintaining the tax codes in the vendor master and customer master Update the withholding tax country. Click on Click on

- 7. www.sapficoconsultant.com Page 7 of 57 1.2 Define Official Withholding Tax Codes IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Basic Settings ©ż Define Official Withholding Tax Codes If the national tax authorities use official withholding tax keys to identify the different withholding tax types, you can define these official names for your tax codes here. Here we configure the various tax keys which are applicable in different scenarios. For example:- Withholding tax code on Contractors, Withholding tax code on Commission and brokerage Withholding tax code on Professional & Technical service Withholding tax is also called TDS (Tax deducted at source) in some countries. Update the following:-

- 8. www.sapficoconsultant.com Page 8 of 57

- 9. www.sapficoconsultant.com Page 9 of 57 Click on Update the following:- Click on

- 10. www.sapficoconsultant.com Page 10 of 57 1.3 Define Reasons for Exemption IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Basic Settings ©ż Define Reasons for Exemption Here we define reasons for exemption from withholding tax. This indicator can be entered in the vendor master record or in the company code withholding tax master record information. Click on Click on

- 11. www.sapficoconsultant.com Page 11 of 57 1.4 Check Recipient Types IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Basic Settings ©ż Check Recipient Types This is required to categorize the vendor. For example:- If the vendor is a company or, Other than a company. This configuration can be done after step number 2.1.2 Click on

- 12. www.sapficoconsultant.com Page 12 of 57 Click on 1.5 Define Business Places IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Basic Settings ©ż India ©ż Define Business Places Business places are the location where tax is deducted. A company has various offices at Head Office, Regional offices etc. Tax can be deducted at any of these places. Withholding tax tracking is thus done based on business places. The use of business places is mandatory. Create a business place for each tax deduction account number (TAN) that your company has. Update the following:- Click on

- 13. www.sapficoconsultant.com Page 13 of 57 Update the following:- Click

- 14. www.sapficoconsultant.com Page 14 of 57 Click Click on Click Click on Update the following:-

- 15. www.sapficoconsultant.com Page 15 of 57 Click

- 16. www.sapficoconsultant.com Page 16 of 57 Click Click on 2. Calculation 2.1 Withholding Tax Type The withholding tax type controls the essential calculation options for extended withholding tax. While the withholding tax code only controls the percentage rate of the withholding tax. You must enter the withholding tax type in the customer/vendor withholding tax master data and in the company code master data. 2.1.1 Define Withholding Tax Type for Invoice Posting IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Withholding Tax Type ©ż Define Withholding Tax Type for Invoice Posting Here you define the withholding tax type for the posting at the time of entering an invoice. This withholding tax type does not have any effect on the payment. All calculations for extended withholding tax are made in the first local currency of the respective company code. Update the following:-

- 17. www.sapficoconsultant.com Page 17 of 57 Click on Update the following:- Here we want the base amount for calculation of the tax as the Gross amount. Rounding rules can be selected based on 3 options available above. We do not want any accumulation of the base amount for calculation of the withholding tax. This is particularly important if the withholding tax is to be deducted only if the gross amount on accumulation reaches a specified figure. Click

- 18. www.sapficoconsultant.com Page 18 of 57 We can define the minimum and maximum amounts for the calculation either at the withholding tax code level or the withholding tax type level. We will define it at the withholding tax code level. Click on

- 19. www.sapficoconsultant.com Page 19 of 57 2.1.2 Define Withholding Tax Type for Payment Posting IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Withholding Tax Type ©ż Define Withholding Tax Type for Payment Posting Here we define the withholding tax type for posting at the time of payment. We also have to enter the withholding tax information when entering the document for this withholding tax type. Update the following:- Click on Update the following:-

- 20. www.sapficoconsultant.com Page 20 of 57 Click Click on 2.1.3 Define Exchange Rate Type for Withholding Tax Type IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Withholding Tax Type ©ż Define Exchange Rate Type for Withholding Tax Type

- 21. www.sapficoconsultant.com Page 21 of 57 Here we define the exchange rate type for individual withholding tax types that is to be used for calculating withholding tax. When calculating withholding tax for payments, theexchange rate of the payment is usually used, if the withholding tax amount has to be translated from a foreign currency into the local currency. Some countries have legal requirements that specify which exchange rate is to be used. We do not want any different exchange rate type, therefore we leave it blank.

- 22. www.sapficoconsultant.com Page 22 of 57 2.1.4 Define Rounding Rule for Withholding Tax Type IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Withholding Tax Type ©ż Define Rounding Rule for Withholding Tax Type Here we define rounding rules for the individual withholding tax types. Click on Click on

- 23. www.sapficoconsultant.com Page 23 of 57 2.2 Withholding Tax Codes The withholding tax code determines the withholding tax percentage. 2.2.1 Define Withholding Tax Codes IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Withholding Tax Codes ©ż Define Withholding Tax Codes Currently the withholding tax rate is same for company and a firm which is not a company. But in future the rates will differ; therefore we create the 2 codes one for company andanother for other than company Let us create 2 withholding tax codes for Contractors (Companies & other than companies) for Invoice posting and 2 tax codes for Payment posting (Companies & other than companies) Let us create 2 withholding tax codes for Professional & Technical services for Invoice posting (Companies & other than companies) Click on Update the following:- Take a drop down in the field Post. Indic Select 1

- 24. www.sapficoconsultant.com Page 24 of 57 Click on Click on Update the following:-

- 25. www.sapficoconsultant.com Page 25 of 57 Click on Click on

- 26. www.sapficoconsultant.com Page 26 of 57 Update the following:- Click on Click on

- 27. www.sapficoconsultant.com Page 27 of 57 Click on Let us now create withholding tax code for Professional services Click on Update the following:-

- 28. www.sapficoconsultant.com Page 28 of 57 Click on Click Click on Update the following:-

- 29. www.sapficoconsultant.com Page 29 of 57 Click on Similarly you can create codes A3 and A4 for Prof Services for Advance payments 2.2.2 Define Formulas for Calculating Withholding Tax IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Withholding Tax Codes ©ż Define Formulas for Calculating Withholding Tax Here you define formulas (scales) for calculating withholding tax. This formulas are used where the calculation is quite complex. Our calculation is quite simple; therefore we do not configure anything here.

- 30. www.sapficoconsultant.com Page 30 of 57

- 31. www.sapficoconsultant.com Page 31 of 57 2.3 Withholding Tax Base Amount 2.3.1 Define Processing Key for Modified Net Amount IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Withholding Tax Base Amount ©ż Define Processing Key for Modified Net Amount Here we define the transaction keys for calculating the modified net amount. Modified - means an extra amount is added to the net amount. This extra amount is determined using one or more transaction keys which we define here. This configuration is not relevant for us.

- 32. www.sapficoconsultant.com Page 32 of 57 2.3.2 Define Processing Key for Modified Tax Amount IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Withholding Tax Base Amount ©ż Define Processing Key for Modified Tax Amount Here we maintain the transaction keys for calculating the tax base amount based on the modified tax amount. This configuration is not relevant for us.

- 33. www.sapficoconsultant.com Page 33 of 57 2.2.3 Portray Dependencies between Withholding Tax Types IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Withholding Tax Base Amount ©ż Portray Dependenciesbetween Withholding Tax Types Here we can represent dependencies between withholding tax categories. Double click

- 34. www.sapficoconsultant.com Page 34 of 57 We do not want any dependency between the withholding tax types.

- 35. www.sapficoconsultant.com Page 35 of 57 2.4 Minimum and Maximum Amounts Here we define the minimum and maximum amounts for the withholding tax or for the withholding tax base amount. In withholding tax type Customizing step 2.1.1 we define whether we want to maintain the minimums and maximums at withholding tax type level or at withholding tax code level. At withholding tax type level, the minimums and maximums are chosen independently of the specific withholding tax code of the relevant line item. At withholding tax code level, we can adapt the minimums and maximums independently to meet our individual requirements for each combination of withholding tax type and withholding tax code. 2.4.1 Define Min/Max Amounts for Withholding Tax Types IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Minimum and Maximum Amounts ©ż Define Min/Max Amounts for Withholding Tax Types

- 36. www.sapficoconsultant.com Page 36 of 57 We do not want any minimum or maximum amount therefore the configuration is not relevant for us. 2.2.2 Define Min/Max Amounts for Withholding Tax Codes IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Calculation©ż Minimum and Maximum Amounts ©ż Define Min/Max Amounts for Withholding Tax Codes Here we define minimum and maximum amounts for withholding tax codes. .

- 37. www.sapficoconsultant.com Page 37 of 57 This configuration is also not relevant for us.

- 38. www.sapficoconsultant.com Page 38 of 57 3. Company Code 3.1 Assign Withholding Tax Types to Company Codes IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Company Code©ż Assign Withholding Tax Types to Company Codes Here we assign the withholding tax types to the company code. Click on Update the following:-

- 39. www.sapficoconsultant.com Page 39 of 57 Click on Click Click on Update the following:- Click on

- 40. www.sapficoconsultant.com Page 40 of 57 3.2 Activate Extended Withholding Tax IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Company Code©ż Activate Extended Withholding Tax Select Click

- 41. www.sapficoconsultant.com Page 41 of 57 Click on 4. Postings 4.1 Define Accounts for Withholding Tax to be Paid Over IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Postings©ż Accounts for Withholding Tax ©ż Define Accounts for Withholding Tax to be Paid Over Update the following:- Click

- 42. www.sapficoconsultant.com Page 42 of 57 Update the following:- Click on Update the following:-

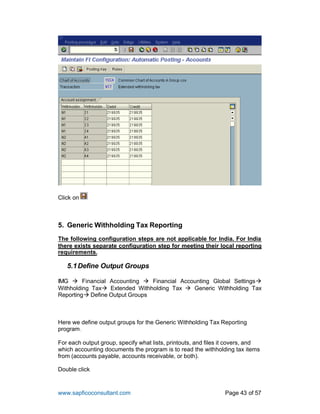

- 43. www.sapficoconsultant.com Page 43 of 57 Click on 5. Generic Withholding Tax Reporting The following configuration steps are not applicable for India. For India there exists separate configuration step for meeting their local reporting requirements. 5.1Define Output Groups IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Generic Withholding Tax Reporting©ż Define Output Groups Here we define output groups for the Generic Withholding Tax Reporting program. For each output group, specify what lists, printouts, and files it covers, and which accounting documents the program is to read the withholding tax items from (accounts payable, accounts receivable, or both). Double click

- 44. www.sapficoconsultant.com Page 44 of 57 Click 5.2 Define Forms for Withholding Tax Reporting IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Generic Withholding Tax Reporting©ż Printouts ©ż Define Forms for Withholding Tax Reporting

- 45. www.sapficoconsultant.com Page 45 of 57 Here we define the Smart Forms for the printouts (for example, withholding tax certificates and withholding tax returns) that we want to create using the Generic Withholding Tax Reporting program. This can be defined as per the local reporting requirements. Use this predefined form IDWTCERT_UK_CIS23Ias a template. This forms needs to be assigned in the output group in printout 1 Smart form field.

- 46. www.sapficoconsultant.com Page 46 of 57 5.3 Define Certificate Numbering for Extended Withholding Tax IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Withholding Tax©ż Extended Withholding Tax ©ż Generic Withholding Tax Reporting©ż Printouts ©ż Define Forms for Withholding Tax Reporting Here we define the number ranges for your withholding tax certificates. We define the company code and fiscal year for each number range. This only applies to the withholding tax certificates created periodically. Update the following:- Click Click

- 47. www.sapficoconsultant.com Page 47 of 57 Click Click on

- 48. www.sapficoconsultant.com Page 48 of 57 6. Vendor Master Data Maintenance 6.1 Update withholding tax codes in the vendor master We assume that the vendor master is already created. We are changing the vendor master data with the withholding tax codes details. Use transaction code FK02 Update the following:- Update the following:-

- 49. www.sapficoconsultant.com Page 49 of 57 Here for payment postings we only update the withholding tax type. We must not update the withholding tax code. The reason being system always automatically calculate taxes even in the case of final payment. Click on You get the following message Double click on it to display the long text

- 50. www.sapficoconsultant.com Page 50 of 57 After you have changed the relevant withholding tax types, you have to adjust the open items for the current relevant withholding tax types. For new withholding tax types, new withholding tax information has to be generated and for withholding tax types that are no longer relevant, the withholding tax code must be deleted in the existing withholding tax information. You can use report RFWT0010 to adjust the withholding tax information to the relevant withholding tax types.

- 51. www.sapficoconsultant.com Page 51 of 57 Click and Click on 6.2 Change Field Status used in the down payment account The down payment account for special GL indicator A is defined in the configuration which can be seen below using the transaction code OBYR Let us see the field status maintained in the down payment account 119820 using transaction code FS00

- 52. www.sapficoconsultant.com Page 52 of 57 Double click on

- 53. www.sapficoconsultant.com Page 53 of 57 Double click

- 54. www.sapficoconsultant.com Page 54 of 57 Withholding tax code and tax amounts are suppressed. Therefore when you make a down payment system will not show you a screen for entering the withholding tax code. IMG ©ż Financial Accounting ©ż Financial Accounting Global Settings©ż Document ©ż Line Item ©ż Controls ©ż Maintain Field Status Variants Select Double click Double click

- 55. www.sapficoconsultant.com Page 55 of 57 Double click

- 56. www.sapficoconsultant.com Page 56 of 57 Change to Click on

- 57. www.sapficoconsultant.com Page 57 of 57 7. Go live checks when uploading Vendor Master Data and Vendor open items 1. Vendor master must be first uploaded in to the Production system without the withholding tax master data. The reason being when Vendor open items are uploaded into the production system if withholding tax information exists on the vendor master, system will calculate withholding tax for each and every item uploaded into the system. 2. Upload Vendor open items into the Production system. 3. After completely uploading vendor open items upload the withholding tax information on the vendor master in the change mode. 4. Execute report RFWT0010 using transaction code SA38 to adjust the withholding tax information on the vendor open items If you have liked the configuration material, please circulate it to your friends and colleagues. Further you can take hold of the entire SAP FICO (e-book) by visiting our website http://www.sapficoconsultant.com