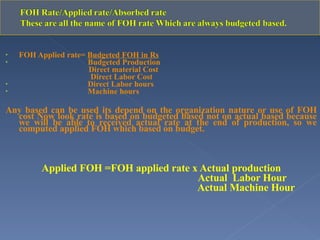

Factory Overhead Rate

- 1. FOH Applied rate= Budgeted FOH in Rs Budgeted Production Direct material Cost Direct Labor Cost Direct Labor hours Machine hours Any based can be used its depend on the organization nature or use of FOH cost Now look rate is based on budgeted based not on actual based because we will be able to received actual rate at the end of production, so we computed applied FOH which based on budget. Applied FOH =FOH applied rate x Actual production Actual Labor Hour Actual Machine Hour

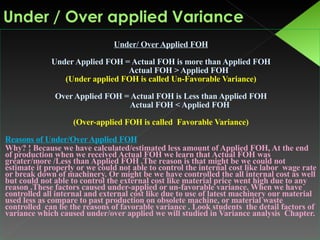

- 2. Under/ Over Applied FOH Under Applied FOH = Actual FOH is more than Applied FOH Actual FOH > Applied FOH (Under applied FOH is called Un-Favorable Variance) Over Applied FOH = Actual FOH is Less than Applied FOH Actual FOH < Applied FOH (Over-applied FOH is called Favorable Variance) Reasons of Under/Over Applied FOH Why? ! Because we have calculated/estimated less amount of Applied FOH, At the end of production when we received Actual FOH we learn that Actual FOH was greater/more /Less than Applied FOH .The reason is that might be we could not estimate it properly or we could not able to control the internal cost like labor wage rate or break down of machinery. Or might be we have controlled the all internal cost as well but could not able to control the external cost like material price went high due to any reason .These factors caused under-applied or un-favorable variance. When we have controlled all internal and external cost like due to use of latest machinery our material used less as compare to past production on obsolete machine, or material waste controlled can be the reasons of favorable variance . Look students the detail factors of variance which caused under/over applied we will studied in Variance analysis Chapter.