Facts about Banking in Kenya

Download as pptx, pdf1 like917 views

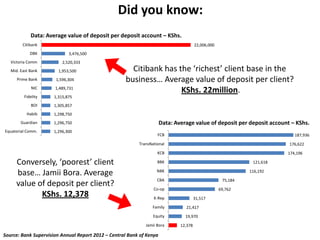

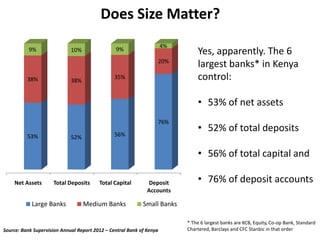

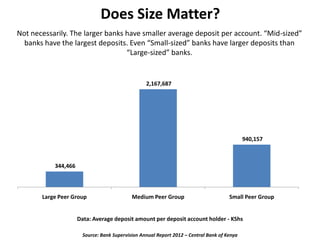

The document contains data on average deposit values per account for various Kenyan banks. Citibank has the highest average deposit value at KShs. 22 million per account, while Jamii Bora Bank has the lowest at KShs. 12,378. The six largest banks by assets, deposits, capital, and accounts are KCB, Equity, Co-op Bank, Standard Chartered, Barclays and CFC Stanbic. However, mid-sized banks have larger average deposits per account than large or small banks.

1 of 3

Download to read offline

Ad

Recommended

AFR Articles copy

AFR Articles copyChristopher Foster-Ramsay

?

- Owner-occupiers may face small increases in home loan interest rates of 0.25-0.3% over the next 6-12 months as banks are expected to start raising rates. This could mean an extra $86-171 per month in repayments for borrowers.

- There is debate among analysts over whether rates will rise or fall further. Some believe rates need to rise to sustain bank profits, while others think competition and a weak economy could lead to more cuts.

- Tougher lending standards for property investors recently introduced by banks are causing delays in processing home loan applications for both investors and owner-occupiers switching lenders.UKĪ»S LARGEST BANKS TO CHARGE NEGATIVE INTEREST RATES; MERIT OF BITCOIN?

UKĪ»S LARGEST BANKS TO CHARGE NEGATIVE INTEREST RATES; MERIT OF BITCOIN?Steven Rhyner

?

Major UK banks, including Santander UK and NatWest, are notifying customers about potential negative interest rates on current accounts, with Santander cutting its interest rate from 3% to 2%, impacting millions. Financial analysts have expressed concern over these changes, particularly for savers and small businesses, which may seek alternatives like Bitcoin for better cash management. The shift towards negative interest rates could push businesses and individuals away from traditional banks and toward decentralized digital currencies.Money and Banking hs

Money and Banking hsDonna Miller

?

Money serves as a medium of exchange, unit of account, and store of value. Throughout history, various commodities and currencies have been used as money, including shells, metals, paper money, and today's fiat currencies which have value by government decree. Banks play a key role in the economy by accepting deposits, making loans, and engaging in fractional reserve banking to create new money through the money multiplier effect. The Federal Reserve System implements monetary policy to influence the money supply and interest rates in order to promote economic growth and stability.You May Be Paying Too Much for Your Mortgage

You May Be Paying Too Much for Your MortgageDawn Hicks

?

This document discusses how mortgage rates and terms can vary greatly between lenders and that some borrowers may qualify for better terms now that could save them thousands. It provides an example showing that on a $200,000, 30-year fixed rate mortgage, the monthly payment for a borrower with a 700 credit score and 6.2% rate would be $1,227, while a borrower with a 620 credit score and 9.4% rate would pay $1,671 per month, a difference of $444 per month or $5,328 per year. It advises readers to check their credit history and score, ask if their mortgage rate is over 7%, and consider refinancing or modifying their loanHow to deal with increasing bank charges on chequing accounts

How to deal with increasing bank charges on chequing accountseverythingpro

?

The document discusses the increasing bank charges on chequing accounts in Canada, highlighting that large banks are raising fees and minimum balance requirements, making it difficult for customers to avoid deductions. It suggests strategies for customers to deal with these fees, including negotiating with banks and considering digital bank options. Additionally, it provides tips on backing up an Apple Watch, emphasizing the importance of syncing with the connected iPhone for data retention.Meaning of Standby Letter of Credit

Meaning of Standby Letter of Credit hansongroupus

?

A standby letter of credit (SBLC) is a financial instrument used by businesses to facilitate national and international trade, acting as a safety net in case a transaction goes wrong. It is provided by a bank, assuring payment to the vendor under specified circumstances, which helps build trust and improve credibility. There are two types of SBLCs, financial and performance, and acquiring one requires a discussion with your bank and payment of an annual fee based on a percentage.Canadian banking and lending 2013: A mid-year pulse check

Canadian banking and lending 2013: A mid-year pulse checkDeloitte Canada

?

In 2013, the Canadian credit market showed strong signs of growth with increasing demand for term loans and asset-backed lending, although capital requirements and consumer debt levels present challenges. Canadian banks are more willing to lend as competition grows, leading to a slight loosening of lending criteria, while high-yield markets have expanded significantly. However, with potential corrections in the real estate market and changing consumer borrowing habits, banks may need to adapt their strategies to maintain profitability.Global economic crisis

Global economic crisisJyoti Sahoo

?

The global economic crisis in 2008 originated from the lucrative real estate market that attracted many investors. Investment bankers packaged mortgages into complex financial products and sold them to investors to earn profits. When homeowners began defaulting on their subprime mortgages, housing prices dropped significantly. This caused prime borrowers to also default, leaving many properties vacant. With so many vacancies, housing prices plummeted further. The investment bankers were left with huge debts they could no longer pay off since the financial products had lost much of their value. This led to the bankruptcy of major institutions like Lehman Brothers and triggered a worldwide economic crisis.Lending Policy of Banks in Canada

Lending Policy of Banks in Canadak_khetarpal

?

The document discusses the lending policies of Canadian banks, noting that banks provide over half of business lending in Canada and make lending decisions on a case-by-case basis considering borrowers' ability to repay. It outlines new policies from regulators and one bank (TD Canada Trust) tightening lending standards, like discontinuing certain equity lending programs, increasing minimum down payments, and changing policies for US residents. The conclusion emphasizes that Canadian banks take a prudent approach to lending to protect depositors' money while still providing credit to viable businesses.Funding Options and Funding Circle webinar

Funding Options and Funding Circle webinarFunding Options

?

The document discusses peer-to-peer lending as a solution for small businesses struggling to access financing. It provides an overview of Funding Circle, a peer-to-peer lending platform that has facilitated over ?165 million in loans to more than 3,000 small businesses since 2010. The document outlines Funding Circle's application process, loan terms, eligibility criteria, and fees. It also shares a case study of a property company that obtained a ?300,000 loan through 4576 lenders on the Funding Circle platform at an interest rate of 9.98%.Unit 5a Mortgages

Unit 5a MortgagesAndrew Hingston

?

This document discusses various aspects of taking out a mortgage, including:

1. The importance of getting pre-approval from a bank before making offers on properties and the process involved in getting pre-approval.

2. The types of lenders available, including major retail banks, smaller banks and lenders, and mortgage brokers.

3. How to calculate mortgage payments using online calculators or Excel functions.

4. That payments are made up of both interest and principal, with interest making up most of early payments.Presentation

Presentationtucktaylor

?

The document discusses bank bailouts during the 2008-2009 economic crisis. It provides arguments both for and against bank bailouts. Supporters argue that bailing out banks was necessary to prevent further economic decline, while critics argue that bailouts do not actually help consumers or the overall economy, and may encourage risky behavior in the future. The housing bubble and subsequent collapse is identified as a key factor that led to the need for bank bailouts.Better than Loan Modification

Better than Loan Modificationscottbenson

?

The document discusses loan modifications, detailing their definition, how they work, and the rationale for banks' willingness to offer them, particularly to avoid the financial burden of foreclosures. It presents an example of how a modification can significantly reduce monthly payments and mentions alternatives like note purchases, which can alleviate debt for homeowners. The presentation also highlights the potential benefits to both banks and borrowers through strategic negotiations and financial restructuring.Understanding Credit - NMLS# 267431

Understanding Credit - NMLS# 267431Mark Moyes

?

The document discusses credit scores and what they mean. It provides details on:

1. Credit scores range from 300 to 850 and are generated by analyzing a consumer's credit report, with higher scores indicating a lower risk of loan default.

2. The odds of consumer default vary significantly depending on credit score, from 1 in 15 for scores below 620 to 1 in 1,485 for scores above 800.

3. The five main components that determine a credit score and their relative weights are: payment history (35%), debt ratio (30%), age of credit (15%), credit mix (10%), and inquiries (10%).Payday Lending in Louisiana

Payday Lending in Louisianalafairlending

?

This document discusses payday lending in Louisiana and its trapping of working families in cycles of debt. It notes that payday loans typically range from $50-$350 for 2 weeks at an annual percentage rate of 520% for a $100 loan. There are over 900 payday lenders in Louisiana, disproportionately located in low-income communities and communities of color. The document argues payday lending leads to long-term indebtedness and bankruptcy for many borrowers and proposes capping interest rates at 36% APR and limiting repeat loans to curb predatory lending practices.Funding Options: How You Can Get the Money You Need

Funding Options: How You Can Get the Money You NeedCenter Street Lending

?

The document discusses various funding options for real estate investments, particularly focusing on fix-and-flip projects. It highlights the pros and cons of financing through friends and family, mortgage companies, cash purchases, and hard money loans, emphasizing that hard money loans are often the most flexible and suitable for such projects. Each option presents unique advantages and drawbacks, influencing investors' decisions based on their financial situations and project goals.Samir Desai / Funding Circle / Building a Better Financial World

Samir Desai / Funding Circle / Building a Better Financial WorldJames by CrowdProcess

?

Funding Circle is a leading global marketplace lender for small businesses, having lent over $700 million since its inception in the UK in 2010 and the US in 2013, with impressive growth metrics and significant backing from notable venture capitalists. The document outlines key insights into borrower similarities across geographies, customer satisfaction, expected net returns, and the evolving landscape of alternative finance, highlighting the varying degrees of market sophistication and transparency in the UK and US. Additionally, it emphasizes the growth potential in the alternative lending space and the need for innovation and partnership between banks and marketplace lenders.DeVry BUSN379 - Week 2 homework es sample

DeVry BUSN379 - Week 2 homework es sampleKim4142

?

This document provides a sample quiz for a finance course, containing 8 multiple choice questions testing concepts related to time value of money, loans, and interest calculations. Key details covered include calculating annual loan payments, effective annual rates for loans with different compounding periods, present value of a series of cash flows, factors that affect future value of investments, calculating loan payments with a portion going to principal vs interest, and examples of applying time value of money concepts. The document suggests studying these questions will better prepare students for the material than the author was.How Mortgage Rates for Refinance Works

How Mortgage Rates for Refinance WorksEllen Liu

?

Mortgages are loans secured against real estate properties, often used for purchasing homes, but can lead to financial insecurity due to variable payments. Mortgage refinancing allows borrowers to pay off an existing loan with another, potentially offering better terms or lower rates, but it requires careful consideration of fees and tax implications. Consulting a mortgage broker can help navigate refinancing options to secure the best financial deal.St. Louis Chart of the Week

St. Louis Chart of the WeekBlaise Tomazic

?

Loan delinquencies in the St. Louis metro area have reached a new low, showing a significant decline since 2012. As banks increase lending, total loans as a percentage of total assets at local banks have risen to the highest level in five years. This increase in access to capital is beneficial for business investment in the region.Why Support a DC Public Bank, Part 1

Why Support a DC Public Bank, Part 1sseuser

?

The document discusses the establishment of a public bank in Washington D.C. as a solution to issues such as lack of affordable credit, job shortages, and government deposit safety concerns. It highlights how public banking can create jobs, enhance financial security, and promote sustainable goals, citing successful models like the Bank of North Dakota. Moreover, it emphasizes the risks posed to government deposits under current regulations, advocating for public banking as a more stable financial alternative.Economic Crisis

Economic Crisisguest07559a

?

The document discusses tips for borrowing money responsibly. It recommends only borrowing if you can afford the repayments and that it's cheaper to save up for wants rather than paying interest. For needs like a car, saving is still better if possible. A home is typically the only major purchase most people need to borrow for. When borrowing, choose the loan with the lowest interest rate and beware of introductory offers that could become more expensive later.Why Support the DC Public Bank? Part 2

Why Support the DC Public Bank? Part 2sseuser

?

The document advocates for the establishment of a DC public bank, a publicly owned financial institution aimed at supporting local businesses, affordable housing, and sustainable development. It highlights the bank's role in partnering with local lenders to provide loans, manage government deposits, and enhance the city's financial health without competing with existing financial institutions. Community input will be encouraged through neighborhood meetings, and residents can support this initiative through advocacy and participating in events.Basic interest calculations

Basic interest calculationsedenstarposh

?

This document discusses banks and calculating interest. It provides examples of how to calculate simple and compound interest earned on deposits at different banks. The examples show a customer depositing ?250 at Northern Bank with a 5% interest rate, and calculating their balance after 1 and 2 years including the interest earned each year. Customers may consider interest rates and returns when choosing between banks for savings.Integrating Development and Finance

Integrating Development and FinanceBlackbaud

?

This document summarizes a presentation about integrating development and finance offices. The presenter describes the key needs and concerns of each office, such as acknowledging donors and reporting gifts for development versus accurately recording revenue and expenses for finance. Common challenges that can arise with separate databases and a lack of communication are outlined. Best practices for integration emphasize having each system perform its core functions, establishing clear gift recording policies, reconciling accounts regularly, and ensuring open communication between the two offices.Money

MoneyVikas Rajput

?

This document discusses money, its types and functions. It begins by defining money as a medium of exchange, unit of account, and store of value. It then describes four types of money: commercial money like bank deposits; commodity money where commodities function as money; fiat money which is paper currency issued by governments; and fiduciary money like bank checks. The document notes functions of money include facilitating transactions, solving the problem of barter, and acting as a standard of value and store of wealth. It also provides an example of a couple, Lisa and Joel, setting up a central cash management account to efficiently monitor their savings for goals like their children's education. This allowed them to see activity from their mortgage, investments,BFWG Grants

BFWG Grantsjolie111

?

An installment loan is a loan that is paid back through fixed regular payments over time. For example, borrowing ?100 with 3 monthly payments of ?50.60 each would result in a total repayment of ?151.79. Installment loans involve borrowing a sum and repaying it in pre-agreed fixed amounts at set intervals, usually monthly, until the full amount plus interest is paid off.Kenya tourism

Kenya tourismcheergalsal

?

Tourism in Kenya has increased over the years as more tourists arrive. This has led to both benefits and drawbacks for Kenya. Some of the main attractions that draw tourists to Kenya are safari parks where they can see animals like lions and elephants, experiencing the culture of tribes like the Maasai, and beaches and scuba diving along the Indian Ocean coast. However, the focus on rare wildlife has also led to increased game hunting that threatens some animals. The Maasai tribe has also seen exploitation of their cultural traditions for tourist shows.Facts about Tourism in Kenya

Facts about Tourism in KenyaRedBrick Africa

?

Business tourism to Kenya has more than doubled compared to 5 years ago, growing 116% between 2008 and 2012, much higher than the 30% growth in holiday tourism. Business tourism in neighboring Uganda also grew substantially, by 45%, compared to 65% growth in holiday tourism between 2007 and 2011. Business tourism to Kenya from Asia grew most significantly between 2010 and 2012 at 51%, compared to 12% growth each from Europe, North America, and Africa. Domestic tourists accounted for the largest share of hotel bed nights in Kenya in 2012 at 41%.What Are The Advantages

What Are The Advantagesigrant

?

The document discusses tourism in Kenya, defining eco-tourism and providing an example of Kigio Conservancy. Eco-tourism aims to minimize environmental damage, help social justice by buying locally, and generate income for local people while protecting wildlife and communities. Kigio Conservancy was established in 1997 as an eco-tourism destination, using local materials for cottages without electricity. Kigio partners with communities and schools, employs local guides, and conducts conservation activities like relocating giraffes.More Related Content

What's hot (19)

Lending Policy of Banks in Canada

Lending Policy of Banks in Canadak_khetarpal

?

The document discusses the lending policies of Canadian banks, noting that banks provide over half of business lending in Canada and make lending decisions on a case-by-case basis considering borrowers' ability to repay. It outlines new policies from regulators and one bank (TD Canada Trust) tightening lending standards, like discontinuing certain equity lending programs, increasing minimum down payments, and changing policies for US residents. The conclusion emphasizes that Canadian banks take a prudent approach to lending to protect depositors' money while still providing credit to viable businesses.Funding Options and Funding Circle webinar

Funding Options and Funding Circle webinarFunding Options

?

The document discusses peer-to-peer lending as a solution for small businesses struggling to access financing. It provides an overview of Funding Circle, a peer-to-peer lending platform that has facilitated over ?165 million in loans to more than 3,000 small businesses since 2010. The document outlines Funding Circle's application process, loan terms, eligibility criteria, and fees. It also shares a case study of a property company that obtained a ?300,000 loan through 4576 lenders on the Funding Circle platform at an interest rate of 9.98%.Unit 5a Mortgages

Unit 5a MortgagesAndrew Hingston

?

This document discusses various aspects of taking out a mortgage, including:

1. The importance of getting pre-approval from a bank before making offers on properties and the process involved in getting pre-approval.

2. The types of lenders available, including major retail banks, smaller banks and lenders, and mortgage brokers.

3. How to calculate mortgage payments using online calculators or Excel functions.

4. That payments are made up of both interest and principal, with interest making up most of early payments.Presentation

Presentationtucktaylor

?

The document discusses bank bailouts during the 2008-2009 economic crisis. It provides arguments both for and against bank bailouts. Supporters argue that bailing out banks was necessary to prevent further economic decline, while critics argue that bailouts do not actually help consumers or the overall economy, and may encourage risky behavior in the future. The housing bubble and subsequent collapse is identified as a key factor that led to the need for bank bailouts.Better than Loan Modification

Better than Loan Modificationscottbenson

?

The document discusses loan modifications, detailing their definition, how they work, and the rationale for banks' willingness to offer them, particularly to avoid the financial burden of foreclosures. It presents an example of how a modification can significantly reduce monthly payments and mentions alternatives like note purchases, which can alleviate debt for homeowners. The presentation also highlights the potential benefits to both banks and borrowers through strategic negotiations and financial restructuring.Understanding Credit - NMLS# 267431

Understanding Credit - NMLS# 267431Mark Moyes

?

The document discusses credit scores and what they mean. It provides details on:

1. Credit scores range from 300 to 850 and are generated by analyzing a consumer's credit report, with higher scores indicating a lower risk of loan default.

2. The odds of consumer default vary significantly depending on credit score, from 1 in 15 for scores below 620 to 1 in 1,485 for scores above 800.

3. The five main components that determine a credit score and their relative weights are: payment history (35%), debt ratio (30%), age of credit (15%), credit mix (10%), and inquiries (10%).Payday Lending in Louisiana

Payday Lending in Louisianalafairlending

?

This document discusses payday lending in Louisiana and its trapping of working families in cycles of debt. It notes that payday loans typically range from $50-$350 for 2 weeks at an annual percentage rate of 520% for a $100 loan. There are over 900 payday lenders in Louisiana, disproportionately located in low-income communities and communities of color. The document argues payday lending leads to long-term indebtedness and bankruptcy for many borrowers and proposes capping interest rates at 36% APR and limiting repeat loans to curb predatory lending practices.Funding Options: How You Can Get the Money You Need

Funding Options: How You Can Get the Money You NeedCenter Street Lending

?

The document discusses various funding options for real estate investments, particularly focusing on fix-and-flip projects. It highlights the pros and cons of financing through friends and family, mortgage companies, cash purchases, and hard money loans, emphasizing that hard money loans are often the most flexible and suitable for such projects. Each option presents unique advantages and drawbacks, influencing investors' decisions based on their financial situations and project goals.Samir Desai / Funding Circle / Building a Better Financial World

Samir Desai / Funding Circle / Building a Better Financial WorldJames by CrowdProcess

?

Funding Circle is a leading global marketplace lender for small businesses, having lent over $700 million since its inception in the UK in 2010 and the US in 2013, with impressive growth metrics and significant backing from notable venture capitalists. The document outlines key insights into borrower similarities across geographies, customer satisfaction, expected net returns, and the evolving landscape of alternative finance, highlighting the varying degrees of market sophistication and transparency in the UK and US. Additionally, it emphasizes the growth potential in the alternative lending space and the need for innovation and partnership between banks and marketplace lenders.DeVry BUSN379 - Week 2 homework es sample

DeVry BUSN379 - Week 2 homework es sampleKim4142

?

This document provides a sample quiz for a finance course, containing 8 multiple choice questions testing concepts related to time value of money, loans, and interest calculations. Key details covered include calculating annual loan payments, effective annual rates for loans with different compounding periods, present value of a series of cash flows, factors that affect future value of investments, calculating loan payments with a portion going to principal vs interest, and examples of applying time value of money concepts. The document suggests studying these questions will better prepare students for the material than the author was.How Mortgage Rates for Refinance Works

How Mortgage Rates for Refinance WorksEllen Liu

?

Mortgages are loans secured against real estate properties, often used for purchasing homes, but can lead to financial insecurity due to variable payments. Mortgage refinancing allows borrowers to pay off an existing loan with another, potentially offering better terms or lower rates, but it requires careful consideration of fees and tax implications. Consulting a mortgage broker can help navigate refinancing options to secure the best financial deal.St. Louis Chart of the Week

St. Louis Chart of the WeekBlaise Tomazic

?

Loan delinquencies in the St. Louis metro area have reached a new low, showing a significant decline since 2012. As banks increase lending, total loans as a percentage of total assets at local banks have risen to the highest level in five years. This increase in access to capital is beneficial for business investment in the region.Why Support a DC Public Bank, Part 1

Why Support a DC Public Bank, Part 1sseuser

?

The document discusses the establishment of a public bank in Washington D.C. as a solution to issues such as lack of affordable credit, job shortages, and government deposit safety concerns. It highlights how public banking can create jobs, enhance financial security, and promote sustainable goals, citing successful models like the Bank of North Dakota. Moreover, it emphasizes the risks posed to government deposits under current regulations, advocating for public banking as a more stable financial alternative.Economic Crisis

Economic Crisisguest07559a

?

The document discusses tips for borrowing money responsibly. It recommends only borrowing if you can afford the repayments and that it's cheaper to save up for wants rather than paying interest. For needs like a car, saving is still better if possible. A home is typically the only major purchase most people need to borrow for. When borrowing, choose the loan with the lowest interest rate and beware of introductory offers that could become more expensive later.Why Support the DC Public Bank? Part 2

Why Support the DC Public Bank? Part 2sseuser

?

The document advocates for the establishment of a DC public bank, a publicly owned financial institution aimed at supporting local businesses, affordable housing, and sustainable development. It highlights the bank's role in partnering with local lenders to provide loans, manage government deposits, and enhance the city's financial health without competing with existing financial institutions. Community input will be encouraged through neighborhood meetings, and residents can support this initiative through advocacy and participating in events.Basic interest calculations

Basic interest calculationsedenstarposh

?

This document discusses banks and calculating interest. It provides examples of how to calculate simple and compound interest earned on deposits at different banks. The examples show a customer depositing ?250 at Northern Bank with a 5% interest rate, and calculating their balance after 1 and 2 years including the interest earned each year. Customers may consider interest rates and returns when choosing between banks for savings.Integrating Development and Finance

Integrating Development and FinanceBlackbaud

?

This document summarizes a presentation about integrating development and finance offices. The presenter describes the key needs and concerns of each office, such as acknowledging donors and reporting gifts for development versus accurately recording revenue and expenses for finance. Common challenges that can arise with separate databases and a lack of communication are outlined. Best practices for integration emphasize having each system perform its core functions, establishing clear gift recording policies, reconciling accounts regularly, and ensuring open communication between the two offices.Money

MoneyVikas Rajput

?

This document discusses money, its types and functions. It begins by defining money as a medium of exchange, unit of account, and store of value. It then describes four types of money: commercial money like bank deposits; commodity money where commodities function as money; fiat money which is paper currency issued by governments; and fiduciary money like bank checks. The document notes functions of money include facilitating transactions, solving the problem of barter, and acting as a standard of value and store of wealth. It also provides an example of a couple, Lisa and Joel, setting up a central cash management account to efficiently monitor their savings for goals like their children's education. This allowed them to see activity from their mortgage, investments,BFWG Grants

BFWG Grantsjolie111

?

An installment loan is a loan that is paid back through fixed regular payments over time. For example, borrowing ?100 with 3 monthly payments of ?50.60 each would result in a total repayment of ?151.79. Installment loans involve borrowing a sum and repaying it in pre-agreed fixed amounts at set intervals, usually monthly, until the full amount plus interest is paid off.Viewers also liked (7)

Kenya tourism

Kenya tourismcheergalsal

?

Tourism in Kenya has increased over the years as more tourists arrive. This has led to both benefits and drawbacks for Kenya. Some of the main attractions that draw tourists to Kenya are safari parks where they can see animals like lions and elephants, experiencing the culture of tribes like the Maasai, and beaches and scuba diving along the Indian Ocean coast. However, the focus on rare wildlife has also led to increased game hunting that threatens some animals. The Maasai tribe has also seen exploitation of their cultural traditions for tourist shows.Facts about Tourism in Kenya

Facts about Tourism in KenyaRedBrick Africa

?

Business tourism to Kenya has more than doubled compared to 5 years ago, growing 116% between 2008 and 2012, much higher than the 30% growth in holiday tourism. Business tourism in neighboring Uganda also grew substantially, by 45%, compared to 65% growth in holiday tourism between 2007 and 2011. Business tourism to Kenya from Asia grew most significantly between 2010 and 2012 at 51%, compared to 12% growth each from Europe, North America, and Africa. Domestic tourists accounted for the largest share of hotel bed nights in Kenya in 2012 at 41%.What Are The Advantages

What Are The Advantagesigrant

?

The document discusses tourism in Kenya, defining eco-tourism and providing an example of Kigio Conservancy. Eco-tourism aims to minimize environmental damage, help social justice by buying locally, and generate income for local people while protecting wildlife and communities. Kigio Conservancy was established in 1997 as an eco-tourism destination, using local materials for cottages without electricity. Kigio partners with communities and schools, employs local guides, and conducts conservation activities like relocating giraffes.Kenya tourism

Kenya tourismTalal Ala-eddine

?

This document discusses a plan to market tourism in Kenya to the Arab world. It begins by providing background on the outbound tourism potential and preferences of the Middle East market. It then outlines a strategy to build Kenya's hospitality and travel infrastructure by empowering local travel agents and integrating local tourism providers and airlines. Key aspects of the plan include developing country and city profiles, hosting seminars and tours, and representing Kenya at Arab travel exhibitions. Metrics like increased tourism revenues, employment, and economic growth are cited as benefits of successfully implementing the marketing strategy.Kenya Tourism

Kenya TourismRik Bhattacharjee

?

Kenya has several national parks that protect important ecosystems and wildlife. Nairobi National Park is located just outside the capital city of Nairobi and allows wildlife viewing alongside urban skylines. Mount Kenya National Park surrounds Mount Kenya and contains important forests, earning it designations as a biosphere reserve and World Heritage Site. Lake Nakuru National Park protects Lake Nakuru, an important wetland habitat for birds, and the surrounding savannah grasslands. Amboseli National Park lies near the Tanzania border and offers exceptional wildlife viewing, especially of over 400 bird species. The Maasai Mara National Reserve, contiguous with the Serengeti National Park in Tanzania, is famous for its population of lions, leThe Impacts Of Tourism In Kenya

The Impacts Of Tourism In Kenyawhiskeyhj

?

Tourism is an important industry in Kenya, providing jobs and foreign income. Popular tourist attractions include wildlife reserves like the Maasai Mara and coastal beaches. While tourism has economic benefits, it also has social and environmental costs like disturbing wildlife, pollution, and forcing some tribes off their lands. Some efforts are being made for more sustainable eco-tourism like the Bamburi Nature Trail and Basecamp Masai Mara which support local communities and conservation.Tourism in kenya©C good or bad

Tourism in kenya©C good or badtudorgeog

?

This document discusses tourism in Kenya, including both positive and negative impacts. It provides background on why Kenya has been able to attract mass tourism and the economic benefits it provides. However, it also notes environmental and social issues that have arisen, such as damage to parks from overtourism. Strategies discussed include diversifying tourism activities, reducing numbers in some parks, and increasing involvement of local tribes and conservation efforts.Ad

Recently uploaded (20)

Macroeconomic Study of the country - Vietnam.pptx

Macroeconomic Study of the country - Vietnam.pptxAnkush Upadhyay

?

PPT summarises our study of the economy as a whole of VietnamHow Zenko Properties Streamlined Financial Operations and Scaled Efficiently ...

How Zenko Properties Streamlined Financial Operations and Scaled Efficiently ...Ratiobox Limited

?

Zenko Properties, a dynamic and fast-growing real estate agency based in the UK, faced mounting operational challenges as its portfolio and client base expanded. Managing financial workflows across multiple property types, client accounts, and compliance requirements had become increasingly complex. Manual bookkeeping, fragmented systems, and limited in-house financial oversight were slowing down growth and exposing the company to potential compliance risks.

Recognising the need for a scalable, technology-driven solution, Zenko Properties partnered with Ratiobox to transform its financial operations. This case study explores how Ratiobox enabled Zenko to achieve greater operational efficiency, compliance assurance, and real-time financial clarity Ī¬ all without the burden of maintaining a full in-house finance team.

Through a tailored combination of outsourced accounting services, automated bookkeeping, and integrated reporting tools, Ratiobox provided Zenko Properties with an end-to-end financial management solution. Our team began by conducting a deep-dive assessment of ZenkoĪ»s legacy accounting practices, identifying critical inefficiencies and opportunities for automation. We then implemented a streamlined accounting framework using cloud-based platforms such as Xero, integrated with ZenkoĪ»s CRM and property management systems.

Key improvements included:

Automated transaction processing, eliminating manual errors and reducing month-end closing time by over 50%.

Real-time financial dashboards, giving directors clear visibility into cash flow, revenue streams, and liabilities.

Fully managed payroll and HMRC submissions, ensuring Zenko stayed compliant and up to date with the latest tax regulations.

Scalable support for property acquisitions, enabling the finance function to grow in lockstep with ZenkoĪ»s portfolio.

Beyond day-to-day accounting, Ratiobox also delivered strategic insights through periodic reporting and advisory input, helping Zenko's leadership make data-backed decisions on expansion, cost control, and investment timing.

As a result, Zenko Properties not only improved operational efficiency but also gained a future-proof financial infrastructure that supports long-term growth. With fewer internal resources tied up in routine tasks, the team was free to focus on delivering exceptional service to clients and exploring new market opportunities.

Analytical procedures for audit and assurance

Analytical procedures for audit and assuranceNguytHi7

?

Didu nay iluoc sua.d6i theo-quy dinh tai Dieu 1 cua euytit dinh s6 t146l2004/eDN[{NN vd vi6c sua a6i oiau z quyciainl s6 +lstzooatqo NHt[\r 2gt4t2oo4 cira thdng ioc

Ngan hang Nhd nu6c ban hdnh HO th5ng tiri khoan k6 toan c6c T6 chric tin dung, c6 hi0u luc

kd tu ngdy 04 thaag 10 nlm 2004Shakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24

Shakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24Business Analysis

?

Qualitative Fundamental Analysis of Shakti Pumps (India) share for its future growth potential (based on the Annual Report FY2024)

Get a sense of the Shakti Pumps (India)'s business activities, by understanding its values, business and risks.

YouTube video: https://youtu.be/lx5SxXcu90g

Order a printed copy of this presentation: BusinessAnalysis.BA.info@gmail.com

--

Disclaimer:

We are not SEBI RIAs. This presentation is not an investment advice. It is only for study and reference purposes.Family Governance Presentation by Dinesh Kanabar

Family Governance Presentation by Dinesh Kanabarimccci

?

Family Governance Presentation by Dinesh Kanabar 15 2024ę╗▒╚ę╗įŁ░µ(▓č▒╩▒ŽęĄųż)─½Č¹▒Š└Ē╣żč¦į║▒ŽęĄųż╚ń║╬░ņ└Ē

ę╗▒╚ę╗įŁ░µ(▓č▒╩▒ŽęĄųż)─½Č¹▒Š└Ē╣żč¦į║▒ŽęĄųż╚ń║╬░ņ└Ē taqyed

?

MP─½Č¹▒Š└Ē╣żč¦į║▒ŽęĄųż╩ķČÓ╔┘Ū«ĪŠq▐▒1954292140Ī┐1:1įŁ░µ─½Č¹▒Š└Ē╣żč¦į║▒ŽęĄųż+MP│╔╝©ĄźĪŠq▐▒1954292140Ī┐═Ļ├└╗╣įŁ║Ż═ŌĖ„┤¾č¦▒ŽęĄ▓─┴Ž╔ŽĄ─╣żęšŻ║╦«ėĪŻ¼ę§ė░Ąū╬ŲŻ¼ĖųėĪLOGO╠╠Į╠╠ę°Ż¼LOGO╠╠Į╠╠ę°Ė┤║ŽųžĄ■ĪŻ╬─ūų═╝░ĖĖĪĄ±Īó╝ż╣Ō└ž╔õĪóūŽ═Ōė½╣ŌĪó╬┬ĖąĪóĖ┤ėĪĘ└╬▒Ą╚Ę└╬▒╣żęšĪŻ

ĪŠų„ė¬ŽŅ─┐Ī┐

ę╗Īó╣żū„╬┤╚ĘČ©Ż¼╗ž╣·ąĶŽ╚Ė°ĖĖ─ĖĪóŪūŲ▌┼¾ėč┐┤Ž┬╬─ŲŠĄ─Ūķ┐÷Ż¼░ņ└Ē▒ŽęĄųż|░ņ└Ē╬─ŲŠ: ┬“┤¾č¦▒ŽęĄųż|┬“┤¾č¦╬─ŲŠĪŠq▐▒1954292140Ī┐č¦╬╗ųż├„╩ķ╚ń║╬░ņ└Ē╔ĻŪļŻ┐

Č■Īó╗ž╣·Į°╦ĮŲ¾Īó═ŌŲ¾Īóūį╝║ū÷╔·ęŌĄ─Ūķ┐÷Ż¼šŌą®Ąź╬╗╩Ū▓╗▓ķč»▒ŽęĄųżšµ╬▒Ą─Ż¼Č°Ūę╣·─┌├╗ėąŪ■Ą└╚ź▓ķč»╣·═Ō╬─ŲŠĄ─šµ╝┘Ż¼ę▓▓╗ąĶę¬╠ß╣®šµ╩ĄĮ╠ė²▓┐╚ŽųżĪŻ╝°ė┌┤╦Ż¼░ņ└Ē─½Č¹▒Š└Ē╣żč¦į║▒ŽęĄųż|MP│╔╝©ĄźĪŠq▐▒1954292140Ī┐╣·═Ō┤¾č¦▒ŽęĄųż, ╬─ŲŠ░ņ└Ē, ╣·═Ō╬─ŲŠ░ņ└Ē, ┴¶ą┼═°╚Žųż

╚².▓─┴Žū╔č»░ņ└ĒĪó╚Žųżū╔č»░ņ└ĒŪļ╝ėč¦└·╣╦╬╩ĪŠ╬óą┼:1954292140Ī┐▒ŽęĄųż╣║┬“ųĖ┤¾č¦╬─ŲŠ╣║┬“Ż¼▒ŽęĄųż░ņ└Ē║═╬─ŲŠ░ņ└ĒĪŻč¦į║╬─ŲŠČ©ųŲŻ¼č¦ąŻįŁ░µ╬─ŲŠ▓╣░ņŻ¼╔©├Ķ╝■╬─ŲŠČ©ū÷Ż¼100%╬─ŲŠĖ┤┐╠ĪŻūŅą┬░µęŌ┤¾└¹▓╝└ū╬„čŪ┤¾č¦▒ŽęĄųżŻ©Ą■ĖķĘĪ│¦░õ▒§┤Ī▒ŽęĄųż╩ķŻ®įŁ░µČ©ųŲ

ūŅą┬░µęŌ┤¾└¹▓╝└ū╬„čŪ┤¾č¦▒ŽęĄųżŻ©Ą■ĖķĘĪ│¦░õ▒§┤Ī▒ŽęĄųż╩ķŻ®įŁ░µČ©ųŲtaqyea

?

2025įŁ░µ▓╝└ū╬„čŪ┤¾č¦▒ŽęĄųż╩ķpdfĄńūė░µĪŠq▐▒1954292140Ī┐ęŌ┤¾└¹▒ŽęĄųż░ņ└ĒBRESCIA▓╝└ū╬„čŪ┤¾č¦▒ŽęĄųż╩ķČÓ╔┘Ū«Ż┐ĪŠq▐▒1954292140Ī┐║Ż═ŌĖ„┤¾č¦Diploma░µ▒ŠŻ¼ę“╬¬ę▀Ūķ覹Ż═Ų│┘ĘóĘ┼ųż╩ķĪóųż╩ķįŁ╝■Ȭ╩¦▓╣░ņĪó├╗ėąš²│Ż▒ŽęĄ╬┤─▄╚Žųżč¦└·├µ┴┘Š═ęĄ╠ß╣®ĮŌŠ÷░ņĘ©ĪŻĄ▒įŌė÷╣ę┐ŲĪó┐§┐╬Ą╝ų┬╬▐Ę©ą▐┬·č¦ĘųŻ¼╗“š▀ų▒Įė▒╗覹Ż═╦覯¼ūŅ║¾╬▐Ę©▒ŽęĄ─├▓╗ĄĮ▒ŽęĄųżĪŻ┤╦╩▒Ą──Ńę╗Č©╩ųūŃ╬▐┤ļŻ¼ę“╬¬┴¶č¦ę╗│ĪŻ¼├╗ėą╗±Ą├▒ŽęĄųżęį╝░č¦└·ųż├„┐ŽČ©╩Ū╬▐Ę©Ė°ūį╝║║═ĖĖ─Ėę╗Ė÷Į╗┤·Ą─ĪŻ

ĪŠĖ┤┐╠▓╝└ū╬„čŪ┤¾č¦│╔╝©Ąźą┼ĘŌ,Buy Universit©ż degli Studi di BRESCIA TranscriptsĪ┐

╣║┬“╚š║½│╔╝©ĄźĪóėó╣·┤¾č¦│╔╝©ĄźĪó├└╣·┤¾č¦│╔╝©ĄźĪó░─ų▐┤¾č¦│╔╝©ĄźĪó╝ė─├┤¾┤¾č¦│╔╝©ĄźŻ©q╬ó1954292140Ż®ą┬╝ėŲ┬┤¾č¦│╔╝©ĄźĪóą┬╬„└╝┤¾č¦│╔╝©ĄźĪó░«Č¹└╝│╔╝©ĄźĪó╬„░Óč└│╔╝©ĄźĪóĄ┬╣·│╔╝©ĄźĪŻ│╔╝©ĄźĄ─ęŌęÕų„ę¬╠ÕŽųį┌ųż├„覎░─▄┴”ĪóŲ└╣└č¦╩§▒│Š░Īóš╣╩Šū█║Ž╦žų╩Īó╠ßĖ▀┬╝╚Ī┬╩Ż¼ęį╝░╩Ūū„╬¬┴¶ą┼╚Žųż╔ĻŪļ▓─┴ŽĄ─ę╗▓┐ĘųĪŻ

▓╝└ū╬„čŪ┤¾č¦│╔╝©Ąź─▄╣╗╠ÕŽų─·Ą─Ą─覎░─▄┴”Ż¼░³└©▓╝└ū╬„čŪ┤¾č¦┐╬│╠│╔╝©Īóū©ęĄ─▄┴”Īó蹊┐─▄┴”ĪŻŻ©q╬ó1954292140Ż®Š▀╠Õ└┤╦ĄŻ¼│╔╝©▒©ĖµĄź═©│Ż░³║¼č¦╔·Ą─覎░╝╝─▄ėļŽ░╣▀ĪóĖ„┐Ų│╔╝©ęį╝░└Ž╩”Ų└ė’Ą╚▓┐ĘųŻ¼ę“┤╦Ż¼│╔╝©Ąź▓╗Į÷╩Ūč¦╔·č¦╩§─▄┴”Ą─ųż├„Ż¼ę▓╩ŪŲ└╣└č¦╔·╩Ūʱ╩╩║Ž─│Ė÷Į╠ė²ŽŅ─┐Ą─ųžę¬ę└Š▌ŻĪ

╬ę├Ū│ą┼Ą▓╔ė├Ą─╩Ū覹ŻįŁ░µųĮš┼Ż©įŁ░µųĮų╩ĪóĄū╔½Īó╬Ų┬ĘŻ®╬ę├Ū╣ż│¦ėĄėą╚½╠ūĮ°┐┌įŁū░╔Ķ▒ĖŻ¼╠ž╩Ō╣żęšČ╝╩Ū▓╔ė├▓╗═¼╗·Ų„ųŲū„Ż¼Ę┬šµČ╚╗∙▒Š┐╔ęį┤’ĄĮ100%Ż¼╦∙ėą│╔ŲĘęį╝░╣żęšą¦╣¹Č╝┐╔╠ßŪ░Ė°┐═╗¦š╣╩ŠŻ¼▓╗┬·ęŌ┐╔ęįĖ∙Š▌┐═╗¦ę¬Ū¾Į°ąąĄ„š¹Ż¼ų▒ĄĮ┬·ęŌ╬¬ų╣ŻĪ

ĪŠų„ė¬ŽŅ─┐Ī┐

ę╗Īó╣żū„╬┤╚ĘČ©Ż¼╗ž╣·ąĶŽ╚Ė°ĖĖ─ĖĪóŪūŲ▌┼¾ėč┐┤Ž┬╬─ŲŠĄ─Ūķ┐÷Ż¼░ņ└Ē▒ŽęĄųż|░ņ└Ē╬─ŲŠ: ┬“┤¾č¦▒ŽęĄųż|┬“┤¾č¦╬─ŲŠĪŠq▐▒1954292140Ī┐▓╝└ū╬„čŪ┤¾č¦č¦╬╗ųż├„╩ķ╚ń║╬░ņ└Ē╔ĻŪļŻ┐

Č■Īó╗ž╣·Į°╦ĮŲ¾Īó═ŌŲ¾Īóūį╝║ū÷╔·ęŌĄ─Ūķ┐÷Ż¼šŌą®Ąź╬╗╩Ū▓╗▓ķč»▒ŽęĄųżšµ╬▒Ą─Ż¼Č°Ūę╣·─┌├╗ėąŪ■Ą└╚ź▓ķč»╣·═Ō╬─ŲŠĄ─šµ╝┘Ż¼ę▓▓╗ąĶę¬╠ß╣®šµ╩ĄĮ╠ė²▓┐╚ŽųżĪŻ╝°ė┌┤╦Ż¼░ņ└ĒęŌ┤¾└¹│╔╝©Ąź▓╝└ū╬„čŪ┤¾č¦▒ŽęĄųżĪŠq▐▒1954292140Ī┐╣·═Ō┤¾č¦▒ŽęĄųż, ╬─ŲŠ░ņ└Ē, ╣·═Ō╬─ŲŠ░ņ└Ē, ┴¶ą┼═°╚ŽųżShocks and Inequality An Empirical Exploration

Shocks and Inequality An Empirical ExplorationGRAPE

?

We study the contribution of supply and demand shocks to income inequality in a panel setting. In particular, we exploit the newly created Global Repository of Income Dynamics to study how unanticipated supply and demand shocks identified using long-run restrictions affect income inequality as measured by Gini. We find that demand shocks originating in the United States, on average, increase income dispersion, which we interpret as the impact of changes to US consumption of foreign goods and services. Supply shocks also tend to increase income dispersion, but have a much weaker and short-lived impact. A comparison with responses to domestic shocks reveals that demand shocks exhibit a similar dynamic. Domestic supply shocks are linked to declines in income dispersion. Making Heritage Inclusive at Shivsrushti - How a single donation made cultura...

Making Heritage Inclusive at Shivsrushti - How a single donation made cultura...Raj Kumble

?

Learn how Shivsrushti, with support from the Abhay Bhutada Foundation, is blending storytelling and technology for inclusive cultural education.

C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 202...

C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 202...imccci

?

C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 2025-26

Adrien Matray - A Prominent Macroeconomist

Adrien Matray - A Prominent MacroeconomistAdrien Matray

?

Adrien Matray is an applied macroeconomist whose research examines how finance shapes economic growth and economic inequality. Growing up in the less affluent suburbs of Paris, where economic disparities were stark, sparked his interest in understanding how financial systems affect well-being. His work addresses critical issues like income inequality and lack of access to formal financial institutions, aiming to inform policies that better regulate alternative financial services and promote equitable economic outcomes, especially for low-income communities.USE AND IMPACT OF INSECTICIDES IN MEALYBUG CONTROL.

USE AND IMPACT OF INSECTICIDES IN MEALYBUG CONTROL.ijab2

?

Mealy bugs infests anumber of crop plants and results a serious economic loss. Although, there are a

number of insecticides to overcome the yeild losses in crop plants. But, the presence of waxy layer around

its body that make them so difficult to control by means of insecticides. How Abhay Bhutada Foundation Strengthens Cultural Education at Shivsrushti.pdf

How Abhay Bhutada Foundation Strengthens Cultural Education at Shivsrushti.pdfSwapnil Pednekar

?

This presentation highlights how the Abhay Bhutada Foundation is actively strengthening cultural education through its long-term support of Shivsrushti, a heritage theme park near Pune dedicated to the life of Chhatrapati Shivaji Maharaj. By funding regular maintenance, technological upgrades, and inclusive programs, the Foundation ensures that Shivsrushti remains an engaging learning space for students and visitors. The park combines traditional craftsmanship with digital storytelling to make history accessible and memorable. It also empowers local youth and artisans through training and employment while promoting hands-on education through creative workshops. With plans for future expansion, Shivsrushti stands as a living example of cultural preservation powered by collaboration and philanthropy.Family Owned Business Succession/Estate Planning

Family Owned Business Succession/Estate Planningimccci

?

Family Owned Business Succession/Estate Planningconditionals1 cccccccccccccccccccccc.ppt

conditionals1 cccccccccccccccccccccc.pptAhaf5

?

eeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeAd

Facts about Banking in Kenya

- 1. Did you know: Data: Average value of deposit per deposit account ©C KShs. Citibank DBK Victoria Comm Mid. East Bank 22,006,000 3,476,500 2,520,333 1,953,500 Prime Bank 1,596,304 NIC 1,489,731 Fidelity 1,315,875 BOI 1,305,857 Habib 1,298,750 Guardian 1,296,750 Equatorial Comm. 1,296,300 Citibank has the Ī«richestĪ» client base in the businessĪŁ Average value of deposit per client? KShs. 22million. Data: Average value of deposit per deposit account ©C KShs. FCB 187,936 TransNational 176,622 KCB Conversely, Ī«poorestĪ» client baseĪŁ Jamii Bora. Average value of deposit per client? KShs. 12,378 174,196 BBK 121,618 NBK 116,192 CBA 75,184 Co-op 69,762 K-Rep 31,517 Family 21,417 Equity 19,970 Jamii Bora Source: Bank Supervision Annual Report 2012 ©C Central Bank of Kenya 12,378

- 2. Does Size Matter? 9% 4% 9% 10% 20% 38% 35% 38% Yes, apparently. The 6 largest banks* in Kenya control: ? 53% of net assets 76% 53% 56% 52% ? 52% of total deposits ? 56% of total capital and Net Assets Total Deposits Large Banks Total Capital Medium Banks Deposit Accounts ? 76% of deposit accounts Small Banks Source: Bank Supervision Annual Report 2012 ©C Central Bank of Kenya * The 6 largest banks are KCB, Equity, Co-op Bank, Standard Chartered, Barclays and CFC Stanbic in that order

- 3. Does Size Matter? Not necessarily. The larger banks have smaller average deposit per account. Ī░Mid-sizedĪ▒ banks have the largest deposits. Even Ī░Small-sizedĪ▒ banks have larger deposits than Ī░Large-sizedĪ▒ banks. 2,167,687 940,157 344,466 Large Peer Group Medium Peer Group Small Peer Group Data: Average deposit amount per deposit account holder - KShs Source: Bank Supervision Annual Report 2012 ©C Central Bank of Kenya