Fcel valuation

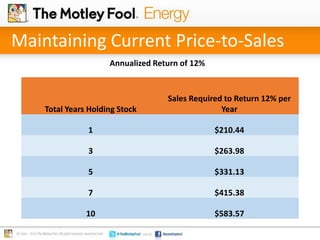

- 1. Maintaining Current Price-to-Sales Annualized Return of 12% Total Years Holding Stock Sales Required to Return 12% per Year 1 $210.44 3 $263.98 5 $331.13 7 $415.38 10 $583.57

- 2. Maintaining Current Price-to-Sales Annualized Return of 15% Total Years Holding Stock Sales Required to Return 15% per Year CAGR of sales for 15% Return 1 $216.08 15.12% 3 $272.45 13.22% 5 $328.82 11.87% 7 $385.18 10.82% 10 $469.74 9.61% Total Years Holding Stock Sales Required to Return 15% per Year 1 $216.08 3 $285.76 5 $377.92 7 $499.80 10 $760.14

- 3. Maintaining Current Price-to-Sales Desired Annualized Return of 20% Total Years Holding Stock Sales Required to Return 20% per Year CAGR of sales for 20% Return 1 $225.47 20.12% 3 $300.63 17.00% 5 $375.79 14.89% 7 $450.95 13.34% 10 $563.68 11.62% Total Years Holding Stock Sales Required to Return 20% per Year 1 $225.47 3 $324.68 5 $467.54 7 $673.26 10 $1,163.39

- 4. Maintaining Current Price-to-Sales Desired Annualized Return of 25% Total Years Holding Stock Sales Required to Return 25% per Year CAGR of sales for 25% Return 1 $234.87 25.13% 3 $328.82 20.55% 5 $422.76 17.63% 7 $516.71 15.56% 10 $657.63 13.36% Total Years Holding Stock Sales Required to Return 25% per Year 1 $234.87 3 $366.98 5 $573.41 7 $895.95 10 $1,749.91

- 5. Reaching Price to Sales Ratio of: 5.6 (Peer Avg.) Desired Annualized Return of 12% Total Years Holding Stock Sales Required to Return 12% per Year CAGR of Sales for 12% Return 1 $120.52 -35.79% 3 $151.18 -6.96% 5 $189.64 0.21% 7 $237.88 3.44% 10 $334.21 5.94%

- 6. Reaching Price to Sales Ratio of: 5.6 (Peer Avg.) Desired Annualized Return of 15% Total Years Holding Stock Sales Required to Return 15% per Year CAGR of Sales for 15% Return 1 $123.75 -34.07% 3 $163.66 -4.47% 5 $216.43 2.89% 7 $286.24 6.21% 10 $435.33 8.78%

- 7. Desired Annualized Return of 20% Reaching Price to Sales Ratio of: 5.6 (Peer Avg.) Total Years Holding Stock Sales Required to Return 20% per Year CAGR of Sales for 20% Return 1 $129.13 -31.21% 3 $185.94 -0.31% 5 $267.76 7.36% 7 $385.57 10.83% 10 $666.27 13.51%

- 8. Desired Annualized Return of 25% Reaching Price to Sales Ratio of: 5.6 (Peer Avg.) Total Years Holding Stock Sales Required to Return 25% per Year CAGR of Sales for 25% Return 1 $134.51 -28.34% 3 $210.17 3.84% 5 $328.39 11.84% 7 $513.11 15.45% 10 $1,002.16 18.24%

- 9. Reaching Price to Sales Ratio of: 1.7 (S&P Avg.) Desired Annualized Return of 12% Total Years Holding Stock Sales Required to Return 12% per Year CAGR of Sales for 12% Return 1 $399.84 113.02% 3 $501.56 38.77% 5 $629.16 27.37% 7 $789.21 22.77% 10 $1,108.79 19.44%

- 10. Reaching Price to Sales Ratio of: 1.7 (S&P Avg.) Desired Annualized Return of 15% Total Years Holding Stock Sales Required to Return 15% per Year CAGR of Sales for 15% Return 1 $410.55 118.73% 3 $542.95 42.48% 5 $718.05 30.78% 7 $949.63 26.06% 10 $1,444.26 22.64%

- 11. Desired Annualized Return of 20% Reaching Price to Sales Ratio of: 1.7 (S&P Avg.) Total Years Holding Stock Sales Required to Return 20% per Year CAGR of Sales for 20% Return 1 $428.40 128.24% 3 $616.90 48.68% 5 $888.33 36.47% 7 $1,279.20 31.54% 10 $2,210.45 27.97%

- 12. Desired Annualized Return of 25% Reaching Price to Sales Ratio of: 1.7 (S&P Avg.) Total Years Holding Stock Sales Required to Return 25% per Year CAGR of Sales for 25 % Return 1 $446.25 137.75% 3 $697.27 54.87% 5 $1,089.48 42.15% 7 $1,702.31 37.02% 10 $3,324.82 33.30%