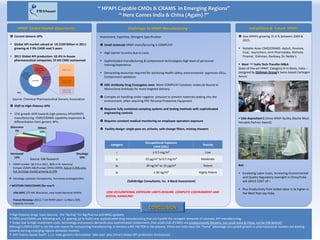

HPAPI Summit- Poster Presentation - Philadelphia-July 2013

- 1. HPAPI Global Market Opportunity Challenges to HPAPI Manufacturing - India/China & Future HPAPI Investment, Expertise, Stringent Specification ’éŻ Small molecule HPAPI manufacturing is COMPLEX! ’é¤ High barrier to entry due to costs ’é¤ Sophisticated manufacturing & containment technologies-high level of personnel training/experience ’é¤ Demanding resources required for achieving health safety, environmental approvals-OELs, Containment validation ’éŻ ADC-Antibody Drug Conjugates even More COMPLEX! Cytotoxic molecule Bound to Monoclonal Antibody for more targeted delivery ’éŻ Complex air handling under negative pressure to prevent materials leaking into the environment, often requiring PPE-Personal Protective Equipment ’éŻ Requires fully contained sampling systems and testing methods with sophisticated engineering controls ’éŻ Requires constant medical monitoring on employee operators exposure ’éŻ Facility design: single-pass air, airlocks, safe-change filters, misting showers Oncology 59% Hormonal 19% Glaucoma 7% Others 15% ’éŻ Current Generic APIs ’é¤ Global API market valued at US $109 Billion in 2011- growing at 7.9% CAGR next 5 years ’é¤ 2011 Global API production- 62.4% in-house pharmaceutical companies, 37.6% CMO outsourced ’éŻ Shift to High-Potency APIs ’é¤ 15% growth shift towards high potency APIs(HPAPI) manufacturing -CMO/CRAMS capability expansion & differentiation from generic APIs ’éŻ Asia HPAPIs growing 15.4 % between 2009 & 2015. ’é¤ Notable Asian CMO/CRAMS -Aptuit, Hovione, Eisai, Asymchem, Arch Pharmalabs, Nicholas Piramal, Dishman, Ranbaxy, Dr. ReddyŌĆÖs ’é¤ West India Tech-Transfer-M&A: State-of-the-art HPAPI Category IV in Bavla, India ŌĆō designed by Dishman GroupŌĆÖs Swiss-based Carbogen Amcis: category Occupational Exposure Limit (OEL) Toxicity I Ōēź 0.5 mg/m┬│ Low II 10 ┬Ąg/m┬│ to 0.5 mg/m┬│ Moderate III 30 ng/m┬│ to 10 ┬Ąg/m┬│ Potent IV Ōēż 30 ng/m┬│ Highly Potent ’é¤ HPAPI market -$8.9 B in 2011, 80% in N. America/ Europe USA(45.6&)/Europe (35%) (2009), Asia at 9.35% only- but oncology market growing at 20% ’üČ Oncology cytotoxic therapeutics, hormones prostaglandins. ’é¤ WESTERN CMO/CRAMS (for now?) - USA-SAFC $75 Mil Wisconsin, new Israel bacterial HPAPIs - France-Novasep US$12.7 mil HPAPI plant- Le Mans-50% Capacity increase (SafeBridge Consultants, Inc. 4-Band Assessment) LOW OCCUPATIONAL EXPOSURE LIMITS REQUIRE COMPLETE CONTAINMENT AND SPECIAL HANDLING! ’é¤ USA AsymchemŌĆÖs China HPAPI facility (Roche Most Valuable Partner Award): But: ’é¤ Escalating Labor Costs, increasing Environmental and Quality Regulatory oversight in China/India will DRIVE COST UP ! ’é¤ Plus Productivity from skilled labor is 3x higher in the West than say India. Captive - Proprietary and Generic API 62% Outsourced - Proprietary API 19% Outsourced - Generic API 19% 2011 ROW, 7.47% China, 6.98% CAGR 12.6% India, 4.25% CAGR 10.3% US$109B ’é®High Potency drugs have become the ŌĆ£darlingŌĆØ for Big Pharma and MNCs globally. ’é®CMOs and CRAMs are following suit, i.e. gearing up to build new, sophisticated drug manufacturing that can handle the stringent demands of cytotoxic API manufacturing. ’é®Today, due to high investment costs, technology and process demands plus sophisticated containment ,that small club of CMOs are predominantly Western, but could India & China not be FAR behind? Although LOWER COST is not the sole reason for outsourcing manufacturing, it remains a BIG FACTOR in the process. China and India have the ŌĆ£homeŌĆØ advantage plus global growth in pharmaceutical markets are leaning towards serving emerging regions domestic markets. ’é® Will history repeat itself? (, i.e. India generics formulation take-over plus ChinaŌĆÖs Global API production dominance) ŌĆ£ HPAPI Capable CMOs & CRAMS in Emerging RegionsŌĆØ ŌĆ£ Here Comes India & China (Again) ?ŌĆØ Source: Chemical Pharmaceutical Generic Association Source: GBI Research