Features of the Plan.pptx

Download as pptx, pdf0 likes431 views

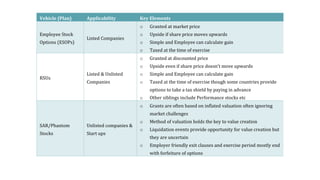

Employee stock options are granted at market price by listed companies and provide upside if the share price increases, while being simple to calculate gains which are taxed at exercise. RSUs can be granted by both listed and unlisted companies at a discounted price, providing upside even without share price growth and allowing simple gain calculation taxed at exercise or in advance. SAR/Phantom stocks used by startups are often based on inflated valuations ignoring challenges, with valuation method key to value creation if liquidation events occur, but employer-friendly clauses usually result in option forfeiture.

1 of 1

Download to read offline

Ad

Recommended

Esop presentation

Esop presentationPriyanka Jadhav

╠²

Employee stock option plans (ESOPs) are becoming increasingly popular retention programs in India. A survey found that 63% of companies have or plan to have an ESOP within 12 months. ESOPs allow employees to purchase company shares at a predetermined price in the future. They motivate employees and improve performance and retention. Common ESOP structures give senior management more allocation than middle or junior levels. ESOPs can create wealth for employees if the share price increases between grant and exercise dates. Regulations require shareholder approval and minimum vesting periods for ESOPs.COMPENSATION SYSTEM MANAGEMENT :Esop and Eva

COMPENSATION SYSTEM MANAGEMENT :Esop and EvaVishakha Choudhary

╠²

This document discusses employee stock option plans (ESOPs). It defines an ESOP as an opportunity for employees to purchase company stock at a predetermined price for a stated period, which could be at the market price or a preferential lower price. Key terms like grant date, vesting date and period, and exercise date and price are explained. Companies offer ESOPs to increase employee loyalty and motivation by giving them an ownership stake. ESOPs also improve company performance and provide tax benefits. The document outlines the process of issuing ESOPs through a trust and how ESOPs work to distribute company contributions to employee accounts.EMPLOYEE STOCK OPTION PLAN (ESOP)

EMPLOYEE STOCK OPTION PLAN (ESOP)Dr. Abzal Basha H S

╠²

ESOPs are popular employee retention programs that allow employees to purchase company shares. Some key points:

- ESOPs give employees options to buy company shares in the future at a preset price, rewarding performance and loyalty.

- Over 63% of Indian companies surveyed had or planned to implement ESOP programs to attract and retain talent.

- ESOPs can be structured as direct grants to employees or through an employee trust to administer the program.

- Regulatory requirements depend on if the company is listed or not. Listed companies must follow additional SEBI guidelines.Employee stock option plan (esop)

Employee stock option plan (esop)Sundaram Subramanian

╠²

An employee stock option plan (ESOP) allows employees to purchase company shares at a predetermined price, as compensation and motivation. Employees must wait a vesting period before exercising their option. ESOP objectives include retention, compensation, ownership culture, and performance improvement. Coverage differs between industries, with IT companies offering ESOPs to more employees. Shares can be allotted directly or through a trust. Benefits include recruitment, tax savings, and alignment. Limitations include undiversified risk, share dilution, and cash requirements for retiring employees. Infosys and Airtel pioneered successful ESOP programs in India.Employee Stock Option Scheme

Employee Stock Option SchemeCorporate Professionals

╠²

The document outlines the importance of employee stock option plans (ESOPs) as a tool for attracting and retaining employees while promoting a culture of ownership among them. It details the regulatory framework, procedures for implementing ESOPs as per the Companies Act, and the valuation methods necessary for managing them. Additionally, it offers insights into the organizational support available for companies implementing ESOPs through Corporate Professionals.Keeping Your Options Open - Employee Share Schemes for Startup Founders

Keeping Your Options Open - Employee Share Schemes for Startup FoundersLegalVision

╠²

The document outlines employee share option plans (ESOPs), detailing their structure, valuation, vesting, and exercise processes, as well as implications when employees leave or in the event of a company exit. It highlights changes in tax laws for eligible startups to facilitate the integration of ESOPs into employee remuneration. Additionally, it emphasizes the importance of engagement strategies for employees to understand their contributions to company growth and share value.ESOP Presentation_NIRC Seminar_final.pptx

ESOP Presentation_NIRC Seminar_final.pptxhiren855355

╠²

The document discusses employee stock option plans (ESOPs), including their importance for attracting and retaining employees, the mechanisms of granting and exercising options, and regulatory frameworks governing their implementation. It outlines various modes of ESOPs such as stock appreciation rights, employee stock purchase plans, and restricted stock units, along with tax implications for employees and companies. It also addresses challenges faced by ESOPs in startups and public sectors, as well as requirements for compliance and valuation.ESOPs LEGAL & PROCEDURAL ASPECTS

ESOPs LEGAL & PROCEDURAL ASPECTSCorporate Professionals

╠²

Employee stock option plans (ESOPs) are used by companies to attract, motivate, and retain employees. There are several types of ESOPs that provide equity incentives like stock options, stock purchase plans, restricted stock units, and stock appreciation rights. Key aspects of ESOPs include how they are granted and vested over time, tax implications, regulatory requirements, and accounting treatment. ESOPs must be implemented according to the rules for listed and unlisted companies set out by the Companies Act, Income Tax Act, SEBI, and other regulatory bodies to ensure proper governance and compliance.Stock and similar plans may 2019

Stock and similar plans may 2019www.growthlaw.com

╠²

The document outlines various stock and compensation plans including incentives for employees and independent contractors, detailing their tax implications, dilution risks, and cash flow effects. It explains different stock option variants such as restricted stock plans, stock appreciation rights, and phantom stock, along with statutory stock options like ISO and ESPP. Specific tax rules and requirements for employers and employees are also highlighted, including the importance of plan documentation and potential penalties for non-compliance.ESOP Presentation.pdf

ESOP Presentation.pdfCA Sachin Miniyar

╠²

This document provides an overview of employee stock option plans (ESOPs) in India. It defines what an ESOP is and discusses the ESOP lifecycle. It covers key ESOP concepts like vesting periods and exercise price. The document compares Indian and US perspectives on ESOPs. It also examines ESOP types, implementation modes, applicable regulations, taxation, and accounting treatment. CA Sachin Miniyar hosted a company law master class on ESOPs on June 1, 2021 to discuss these topics.Priya Singh (ESOP Presentation).pptx

Priya Singh (ESOP Presentation).pptxPriyaSingh660519

╠²

This document discusses employee stock option plans (ESOPs) which allow companies to offer equity shares to employees at a discounted price in order to attract, reward, motivate, and retain talent. It describes the different types of ESOPs including employee stock option plans, stock appreciation rights, and employee stock purchase plans. The document outlines how ESOPs are implemented either through a direct route of issuing shares directly to employees or through a trust route using an employee welfare trust. It also discusses factors companies consider when granting ESOPs and the process for issuing ESOPs, from general meetings to board approval to vesting periods.Converting Employees to Owners: Employee Share Purchase Plans

Converting Employees to Owners: Employee Share Purchase PlansNow Dentons

╠²

The document outlines the various types of Employee Share Purchase Plans (ESPPs), including stock option, share purchase, phantom stock, and stock bonus plans, each with specific characteristics and objectives to incentivize and retain employees. It discusses the importance of legal and financial advisors in structuring these plans, detailing considerations such as taxation implications, plan documentation, and the need for professional guidance to navigate complexities. Additionally, it covers financing options for employees to acquire shares, including structured loan programs, and highlights distinctions in tax treatment between different types of corporations.ESOP's

ESOP'sMayur Jaguwala

╠²

Employee stock option plans (ESOPs) allow employees to purchase company stock at a future date for a predetermined price. ESOPs are used as rewards for employee performance and motivation. There is typically a vesting period before employees can exercise their option to purchase shares. ESOPs give employees the option to buy company shares at a discounted price after a vesting period. How ESOPs are taxed depends on whether gains are considered perquisites or capital gains. The Companies Act of 2013 established regulations for ESOPs in unlisted companies regarding disclosure requirements. ESOPs have become an important way for companies to retain human capital and motivate employees through deferred compensation.Equity Incentives and Bonus Plans for Employees, Consultants & Advisors

Equity Incentives and Bonus Plans for Employees, Consultants & AdvisorsChirag Charlie Patel, PMP

╠²

The document discusses options for attracting, retaining, and incentivizing talent including offering equity incentives through an option or equity incentive plan. The main types of equity incentives that can be granted are options, restricted stock, and stock appreciation rights. Options allow an employee to purchase company stock at a set price for a period of time. Restricted stock transfers shares that vest over time if employment continues. Stock appreciation rights provide a cash payment based on stock value increases. Tax implications vary based on option type and timing of stock sales.Masterclass Employee Stock Ownership Plans

Masterclass Employee Stock Ownership PlansKevin Leuthardt

╠²

This document summarizes a presentation on employee stock ownership plans. It discusses:

1. Why startups should care about employee stock ownership to attract, retain, motivate and align employees.

2. The common forms of employee stock ownership plans including direct share grants, stock options, and phantom stocks. It compares the taxation and administration of each.

3. Guidelines for implementing an employee stock ownership plan, including which employee roles should participate, how to size equity allocations, and key rules around vesting schedules, strike prices, and other considerations.ESOP for young entrepreneur(s)

ESOP for young entrepreneur(s)Legal Buddy

╠²

This document discusses employee stock ownership plans (ESOPs) for young entrepreneurs. It defines ESOPs as agreements that give employees the right to acquire company shares at an agreed price within a set timeframe. ESOPs are important for motivation and bringing a sense of ownership. The document outlines eligibility for ESOPs, pricing approaches, key terminology related to ESOP lifecycles, applicable legislation, and answers frequently asked questions about ESOPs.Dividing Stock Options In Divorce

Dividing Stock Options In Divorcetheaglazer

╠²

This document discusses how to divide employee stock options in a divorce. It defines key terms related to stock options like grant date, exercise price, vesting date, and expiration date. It explains the two main types of stock options - nonqualified options and incentive stock options - and how they differ in tax treatment and transferability. It also covers valuation methods like the HUG formula and Nelson formula, how to determine the community property share, and considerations for dividing and distributing the stock options between spouses.Understanding Esop & Its Importance.

Understanding Esop & Its Importance.LetsComply

╠²

The document provides information about Employee Stock Ownership Plans (ESOPs), including:

- ESOPs allow employees to acquire shares in the company they work for over time at a predetermined price.

- ESOPs can benefit startups by aligning employee and founder interests and improving company performance and finances.

- The document discusses the history, purpose, implementation process, taxation, and case studies of ESOPs to demonstrate their benefits for employee motivation, retention, and company productivity.Employee share ownership plans ( ESOP ) whitepaper june 2016

Employee share ownership plans ( ESOP ) whitepaper june 2016Craig West

╠²

The document discusses Employee Share Ownership Plans (ESOPs) as a tool for business succession, exit planning, and employee engagement, highlighting their potential to increase company performance and employee retention. It outlines the benefits of ESOPs, their implementation strategies, types, and includes testimonials, academic research findings, and government initiatives to promote their use in Australia. Additionally, it addresses common questions regarding risks, ownership structures, and employee rights within ESOPs.Does Your ESOP program makes you more attractive to VCs?

Does Your ESOP program makes you more attractive to VCs?ESOP ezee

╠²

The document discusses the advantages of implementing an Employee Stock Ownership Plan (ESOP) to attract venture capitalists (VCs) for startups. It outlines the criteria VCs consider when evaluating management teams and how a well-structured ESOP can enhance team retention and ownership, thereby aligning employee performance with the company's success. Additionally, it provides insights into option pool mathematics, valuation estimates, and best practices for setting up an ESOP plan.ESOP for young entrepreneur(s)

ESOP for young entrepreneur(s)LEGAL BUDDY

╠²

This document provides an overview of employee stock ownership plans (ESOPs) for young entrepreneurs. It discusses the importance of ESOPs in motivating employees, eligibility requirements, pricing considerations, key terminology, the lifecycle from grant to sale, applicable taxation, relevant legislation, and answers to frequently asked questions. ESOPs give employees the right to acquire company shares at a pre-agreed price within a set timeframe, aligning their interests with the company's growth.Eso Ps

Eso PsCenterPoint Business Advisors

╠²

This white paper discusses Employee Stock Ownership Plans (ESOPs) and how they can be used by business owners to sell their company. It explains that ESOPs allow owners to cash out at fair market value, pay no taxes on the sale, and transfer the company to employees. However, ESOPs require strong cash flow, good management, little debt, and aligned shareholder-employee interests to work well. The paper also outlines the ESOP buyout process, potential disadvantages like costs and fiduciary responsibilities, and questions owners should consider regarding ESOPs.ESOPs Demystified

ESOPs DemystifiedManish Singhal

╠²

This document discusses employee stock ownership plans (ESOPs), including:

- The key stages of an ESOP including grant, vesting, exercise, and sale

- Factors to consider when designing an ESOP like number of shares to grant, strike/grant price, and vesting schedule

- Implementing an ESOP through steps like designing the plan, communicating to employees, and issuing grant letters

- Additional considerations for founders like their agreement, equity treatment if leaving, and more

The document provides an overview of ESOPs to help understand how they work and what goes into designing and implementing an effective ESOP for a company and its employees.Notes on esop

Notes on esopCA Yash Jagati

╠²

The document provides an overview of employee stock option plans (ESOPs) in India, including:

1) It describes the key aspects of ESOPs such as granting employees the right to purchase company shares in the future at a preset price, and how this can create wealth for employees as share prices appreciate over time.

2) It outlines the legal and regulatory framework for ESOPs in India, including guidelines from SEBI, the Companies Act, taxation rules, and accounting standards.

3) It discusses important considerations for companies in designing an ESOP scheme such as objectives, eligibility, pricing, vesting periods, and approvals required.AICPA Auto Dealership Conference

AICPA Auto Dealership ConferenceSES Advisors

╠²

The document discusses an agenda for a conference on liquidity and succession planning using ESOPs. It provides biographies of four speakers at the conference: Merri Ash, Kathryn Daly, Steven Greenapple, and an overview of a presentation by Merri Ash on leveraged ESOPs as a tool for shareholder liquidity and what they are and are not. It also provides an example case study of Eich Motors, a car dealership that established an ESOP for ownership transition.Business Succession: The ESOP Model

Business Succession: The ESOP ModelPeter E. Jones

╠²

The document discusses business succession planning, focusing on the Employee Stock Ownership Plan (ESOP) model as a tax-efficient mechanism for transferring ownership. It highlights the importance of strategic planning for ownership transfer, management succession, and legacy planning and provides statistics on the significant impact of not having a succession plan. Additionally, it explains the advantages of ESOPs, including employee involvement in company profits and the potential for improved business growth.Employee Stock Option Scheme (ESOP) and Sweat Equity Shares

Employee Stock Option Scheme (ESOP) and Sweat Equity SharesDVSResearchFoundatio

╠²

The document outlines the employee stock option scheme (ESOP) and sweat equity shares, detailing definitions, eligibility, terms, and requirements for their issuance in compliance with Indian regulations. It explains the approval process, implications for taxation, and differences between ESOPs and sweat equity shares, including their objectives, valuation, and conditions of issuance. Furthermore, it addresses judicial precedents related to ESOP expenditures and provides compliance directives for companies regarding documentation and record-keeping.Equity Final

Equity FinalShashi Bhushan Singh

╠²

The document discusses equity compensation plans or stock option plans offered by companies to employees. It provides details about different types of stock option plans like incentive stock options and non-qualified stock options. It mentions the key aspects of stock option plans like vesting period, exercise price, eligibility criteria. It also lists some advantages like allowing companies to share ownership with employees and aligning interests of employees with companies.ORGANIZATION Development and human ressoucre development .pdf

ORGANIZATION Development and human ressoucre development .pdfAyaSenhaji2

╠²

This is an introduction to what is organizational development and its impact on HRDMore Related Content

Similar to Features of the Plan.pptx (20)

Stock and similar plans may 2019

Stock and similar plans may 2019www.growthlaw.com

╠²

The document outlines various stock and compensation plans including incentives for employees and independent contractors, detailing their tax implications, dilution risks, and cash flow effects. It explains different stock option variants such as restricted stock plans, stock appreciation rights, and phantom stock, along with statutory stock options like ISO and ESPP. Specific tax rules and requirements for employers and employees are also highlighted, including the importance of plan documentation and potential penalties for non-compliance.ESOP Presentation.pdf

ESOP Presentation.pdfCA Sachin Miniyar

╠²

This document provides an overview of employee stock option plans (ESOPs) in India. It defines what an ESOP is and discusses the ESOP lifecycle. It covers key ESOP concepts like vesting periods and exercise price. The document compares Indian and US perspectives on ESOPs. It also examines ESOP types, implementation modes, applicable regulations, taxation, and accounting treatment. CA Sachin Miniyar hosted a company law master class on ESOPs on June 1, 2021 to discuss these topics.Priya Singh (ESOP Presentation).pptx

Priya Singh (ESOP Presentation).pptxPriyaSingh660519

╠²

This document discusses employee stock option plans (ESOPs) which allow companies to offer equity shares to employees at a discounted price in order to attract, reward, motivate, and retain talent. It describes the different types of ESOPs including employee stock option plans, stock appreciation rights, and employee stock purchase plans. The document outlines how ESOPs are implemented either through a direct route of issuing shares directly to employees or through a trust route using an employee welfare trust. It also discusses factors companies consider when granting ESOPs and the process for issuing ESOPs, from general meetings to board approval to vesting periods.Converting Employees to Owners: Employee Share Purchase Plans

Converting Employees to Owners: Employee Share Purchase PlansNow Dentons

╠²

The document outlines the various types of Employee Share Purchase Plans (ESPPs), including stock option, share purchase, phantom stock, and stock bonus plans, each with specific characteristics and objectives to incentivize and retain employees. It discusses the importance of legal and financial advisors in structuring these plans, detailing considerations such as taxation implications, plan documentation, and the need for professional guidance to navigate complexities. Additionally, it covers financing options for employees to acquire shares, including structured loan programs, and highlights distinctions in tax treatment between different types of corporations.ESOP's

ESOP'sMayur Jaguwala

╠²

Employee stock option plans (ESOPs) allow employees to purchase company stock at a future date for a predetermined price. ESOPs are used as rewards for employee performance and motivation. There is typically a vesting period before employees can exercise their option to purchase shares. ESOPs give employees the option to buy company shares at a discounted price after a vesting period. How ESOPs are taxed depends on whether gains are considered perquisites or capital gains. The Companies Act of 2013 established regulations for ESOPs in unlisted companies regarding disclosure requirements. ESOPs have become an important way for companies to retain human capital and motivate employees through deferred compensation.Equity Incentives and Bonus Plans for Employees, Consultants & Advisors

Equity Incentives and Bonus Plans for Employees, Consultants & AdvisorsChirag Charlie Patel, PMP

╠²

The document discusses options for attracting, retaining, and incentivizing talent including offering equity incentives through an option or equity incentive plan. The main types of equity incentives that can be granted are options, restricted stock, and stock appreciation rights. Options allow an employee to purchase company stock at a set price for a period of time. Restricted stock transfers shares that vest over time if employment continues. Stock appreciation rights provide a cash payment based on stock value increases. Tax implications vary based on option type and timing of stock sales.Masterclass Employee Stock Ownership Plans

Masterclass Employee Stock Ownership PlansKevin Leuthardt

╠²

This document summarizes a presentation on employee stock ownership plans. It discusses:

1. Why startups should care about employee stock ownership to attract, retain, motivate and align employees.

2. The common forms of employee stock ownership plans including direct share grants, stock options, and phantom stocks. It compares the taxation and administration of each.

3. Guidelines for implementing an employee stock ownership plan, including which employee roles should participate, how to size equity allocations, and key rules around vesting schedules, strike prices, and other considerations.ESOP for young entrepreneur(s)

ESOP for young entrepreneur(s)Legal Buddy

╠²

This document discusses employee stock ownership plans (ESOPs) for young entrepreneurs. It defines ESOPs as agreements that give employees the right to acquire company shares at an agreed price within a set timeframe. ESOPs are important for motivation and bringing a sense of ownership. The document outlines eligibility for ESOPs, pricing approaches, key terminology related to ESOP lifecycles, applicable legislation, and answers frequently asked questions about ESOPs.Dividing Stock Options In Divorce

Dividing Stock Options In Divorcetheaglazer

╠²

This document discusses how to divide employee stock options in a divorce. It defines key terms related to stock options like grant date, exercise price, vesting date, and expiration date. It explains the two main types of stock options - nonqualified options and incentive stock options - and how they differ in tax treatment and transferability. It also covers valuation methods like the HUG formula and Nelson formula, how to determine the community property share, and considerations for dividing and distributing the stock options between spouses.Understanding Esop & Its Importance.

Understanding Esop & Its Importance.LetsComply

╠²

The document provides information about Employee Stock Ownership Plans (ESOPs), including:

- ESOPs allow employees to acquire shares in the company they work for over time at a predetermined price.

- ESOPs can benefit startups by aligning employee and founder interests and improving company performance and finances.

- The document discusses the history, purpose, implementation process, taxation, and case studies of ESOPs to demonstrate their benefits for employee motivation, retention, and company productivity.Employee share ownership plans ( ESOP ) whitepaper june 2016

Employee share ownership plans ( ESOP ) whitepaper june 2016Craig West

╠²

The document discusses Employee Share Ownership Plans (ESOPs) as a tool for business succession, exit planning, and employee engagement, highlighting their potential to increase company performance and employee retention. It outlines the benefits of ESOPs, their implementation strategies, types, and includes testimonials, academic research findings, and government initiatives to promote their use in Australia. Additionally, it addresses common questions regarding risks, ownership structures, and employee rights within ESOPs.Does Your ESOP program makes you more attractive to VCs?

Does Your ESOP program makes you more attractive to VCs?ESOP ezee

╠²

The document discusses the advantages of implementing an Employee Stock Ownership Plan (ESOP) to attract venture capitalists (VCs) for startups. It outlines the criteria VCs consider when evaluating management teams and how a well-structured ESOP can enhance team retention and ownership, thereby aligning employee performance with the company's success. Additionally, it provides insights into option pool mathematics, valuation estimates, and best practices for setting up an ESOP plan.ESOP for young entrepreneur(s)

ESOP for young entrepreneur(s)LEGAL BUDDY

╠²

This document provides an overview of employee stock ownership plans (ESOPs) for young entrepreneurs. It discusses the importance of ESOPs in motivating employees, eligibility requirements, pricing considerations, key terminology, the lifecycle from grant to sale, applicable taxation, relevant legislation, and answers to frequently asked questions. ESOPs give employees the right to acquire company shares at a pre-agreed price within a set timeframe, aligning their interests with the company's growth.Eso Ps

Eso PsCenterPoint Business Advisors

╠²

This white paper discusses Employee Stock Ownership Plans (ESOPs) and how they can be used by business owners to sell their company. It explains that ESOPs allow owners to cash out at fair market value, pay no taxes on the sale, and transfer the company to employees. However, ESOPs require strong cash flow, good management, little debt, and aligned shareholder-employee interests to work well. The paper also outlines the ESOP buyout process, potential disadvantages like costs and fiduciary responsibilities, and questions owners should consider regarding ESOPs.ESOPs Demystified

ESOPs DemystifiedManish Singhal

╠²

This document discusses employee stock ownership plans (ESOPs), including:

- The key stages of an ESOP including grant, vesting, exercise, and sale

- Factors to consider when designing an ESOP like number of shares to grant, strike/grant price, and vesting schedule

- Implementing an ESOP through steps like designing the plan, communicating to employees, and issuing grant letters

- Additional considerations for founders like their agreement, equity treatment if leaving, and more

The document provides an overview of ESOPs to help understand how they work and what goes into designing and implementing an effective ESOP for a company and its employees.Notes on esop

Notes on esopCA Yash Jagati

╠²

The document provides an overview of employee stock option plans (ESOPs) in India, including:

1) It describes the key aspects of ESOPs such as granting employees the right to purchase company shares in the future at a preset price, and how this can create wealth for employees as share prices appreciate over time.

2) It outlines the legal and regulatory framework for ESOPs in India, including guidelines from SEBI, the Companies Act, taxation rules, and accounting standards.

3) It discusses important considerations for companies in designing an ESOP scheme such as objectives, eligibility, pricing, vesting periods, and approvals required.AICPA Auto Dealership Conference

AICPA Auto Dealership ConferenceSES Advisors

╠²

The document discusses an agenda for a conference on liquidity and succession planning using ESOPs. It provides biographies of four speakers at the conference: Merri Ash, Kathryn Daly, Steven Greenapple, and an overview of a presentation by Merri Ash on leveraged ESOPs as a tool for shareholder liquidity and what they are and are not. It also provides an example case study of Eich Motors, a car dealership that established an ESOP for ownership transition.Business Succession: The ESOP Model

Business Succession: The ESOP ModelPeter E. Jones

╠²

The document discusses business succession planning, focusing on the Employee Stock Ownership Plan (ESOP) model as a tax-efficient mechanism for transferring ownership. It highlights the importance of strategic planning for ownership transfer, management succession, and legacy planning and provides statistics on the significant impact of not having a succession plan. Additionally, it explains the advantages of ESOPs, including employee involvement in company profits and the potential for improved business growth.Employee Stock Option Scheme (ESOP) and Sweat Equity Shares

Employee Stock Option Scheme (ESOP) and Sweat Equity SharesDVSResearchFoundatio

╠²

The document outlines the employee stock option scheme (ESOP) and sweat equity shares, detailing definitions, eligibility, terms, and requirements for their issuance in compliance with Indian regulations. It explains the approval process, implications for taxation, and differences between ESOPs and sweat equity shares, including their objectives, valuation, and conditions of issuance. Furthermore, it addresses judicial precedents related to ESOP expenditures and provides compliance directives for companies regarding documentation and record-keeping.Equity Final

Equity FinalShashi Bhushan Singh

╠²

The document discusses equity compensation plans or stock option plans offered by companies to employees. It provides details about different types of stock option plans like incentive stock options and non-qualified stock options. It mentions the key aspects of stock option plans like vesting period, exercise price, eligibility criteria. It also lists some advantages like allowing companies to share ownership with employees and aligning interests of employees with companies.Recently uploaded (9)

ORGANIZATION Development and human ressoucre development .pdf

ORGANIZATION Development and human ressoucre development .pdfAyaSenhaji2

╠²

This is an introduction to what is organizational development and its impact on HRDWebinar - Unlock the Power of Data in Your Compensation Strategy

Webinar - Unlock the Power of Data in Your Compensation StrategyPayScale, Inc.

╠²

Join compensation leaders from Mercer and Payscale as we explore how organizations can harness salary data to drive smarter compensation strategies.What Are the Hiring Process Steps_ A Complete Breakdown for Employers.pdf

What Are the Hiring Process Steps_ A Complete Breakdown for Employers.pdfKlay Hr Consultants

╠²

Hiring the right people isnŌĆÖt just about posting a job adŌĆöitŌĆÖs about following a structured process that ensures you find, evaluate, and onboard top talent effectively. In this informative guide, we break down the key hiring process steps every employer should followŌĆöfrom identifying a hiring need and crafting the perfect job description to screening candidates, conducting interviews, and onboarding new hires. Whether you're a growing business or an HR manager refining your recruitment approach, this step-by-step breakdown offers practical insights to streamline your efforts. We also highlight how partnering with the best HR consultancy in Dubai can help speed up and strengthen your hiring strategy. If you want to build a reliable, scalable hiring system that brings the right people into your team, this blog is a must-read. Discover how each stage of recruitment connects and how you can make smarter hiring decisions with confidence.HRMS_Software skill_Presentation_Sample.pptx

HRMS_Software skill_Presentation_Sample.pptxbalavig06

╠²

HRMS stands for human resource management system ŌĆō often referred to as human capital management (HCM) software. Companies use an HRMS to digitalise, automate, and centralise core HR processes, such as employee data storage, benefits administration, time and attendance, and payroll. In addition, an HRMS provides talent management capabilities, such as recruiting, onboarding, performance management, goal planning, learning and training, compensation, and succession planning.Module-IV- Culture and Global Management.pptx

Module-IV- Culture and Global Management.pptxpujamishrarnc

╠²

Module ŌĆō IV ŌĆō Culture and Organization

Culture and corporate structures, Culture and Leadership, Culture and Strategy, Cultural

change in Organizations, Culture and marketing, Cultural Diversity in OrganizationWebinar - Crafting a Clear Compensation Strategy for 2025

Webinar - Crafting a Clear Compensation Strategy for 2025PayScale, Inc.

╠²

Join compensation experts as they unpack the latest data, insights, and best practices to help you build or refine a compensation strategy that drives performance, retention, and equity.Ad

Features of the Plan.pptx

- 1. Vehicle (Plan) Applicability Key Elements Employee Stock Options (ESOPs) Listed Companies o Granted at market price o Upside if share price moves upwards o Simple and Employee can calculate gain o Taxed at the time of exercise RSUs Listed & Unlisted Companies o Granted at discounted price o Upside even if share price doesnŌĆÖt move upwards o Simple and Employee can calculate gain o Taxed at the time of exercise though some countries provide options to take a tax shield by paying in advance o Other siblings include Performance stocks etc SAR/Phantom Stocks Unlisted companies & Start ups o Grants are often based on inflated valuation often ignoring market challenges o Method of valuation holds the key to value creation o Liquidation events provide opportunity for value creation but they are uncertain o Employer friendly exit clauses and exercise period mostly end with forfeiture of options