Final Monster Ppt Presentation

- 2. Table of Contents I. LBO Trigger: CEO Iannuzzi & R. W. Baird Co. Conference II. Executive Summary and Financial Request III. Company Background IV. Financial Review V. Q&A VI. References

- 3. LBO Trigger: Monster’s CEO Iannuzzi & the R. W. Baird & Co. Conference  59% Decline in Stock Value since March 31, 2011  The Oracle Speaks: “…strategic alternatives…”  Marketing Accounted for 21% of 2011 Revenue  A 25% Spike Registered in Intraday Trading following Comments

- 4. Executive Summary • Conditions Prompting the LBO Proposal • Business Growth Cycle Stage • Financial Performance Record to Date • Causes for Poor Performance: Internal and External Factors • LBO Management Reorganization/Restructuring Bid

- 5. Executive Summary Continued…: Company Background Monster Worldwide, Inc. • World’s #1 Online Employment Service Solutions Company • 93 Million Passive and Active Job 622 Third Avenue Employees: 6,000 Financials in: USD (mil) Company Type: Public Fiscal Year End: 31-Dec- Seekers per Month 39th Floor, 622 Third Avenue Parent 2011 Corporate Family: 46 Reporting Currency: US NEW YORK, NY 10017 Companies Dollar United States Traded: New York Stock Annual Sales: 1,040.1 • 55 Countries around the World Tel: 212-351-7000 Exchange: MWW Incorporation Date: 1996 Net Income: 53.8 Total Assets: 2,058.0 Fax: 646-658-0540 Auditor: BDO USA, LLP Market Value: 860.4 Toll Free: 888-225-5867 (17-Feb-2012) • Three Major Business Segments www.about-monster.com

- 6. Executive Summary Continued…: Monster’s Worldwide Locations

- 7. Monster Forces on the Competitive Landscape Intense Competition Niche Industry CareerBuilders. Dice.com USAJobs.com com The LinkedIn.com SnagaJob.com Ladders.com Simply Technology and Internet Indeed.com Hired.com Job.com Patent and Innovation Proliferation & Moore’s Wars Law Impact

- 8. LBO Monster Deal Structure • Form of Acquisition: Friendly Taker • Form of Payment: Capital Structure – Multiple Tranches • Tax Considerations: Tax Shields • Acquisition Vehicle: • Accounting Limited Liability Considerations and Company (LLC) Requirements: • Post-Closing Organization: • Legal Form of Selling Entity: • Sources and Uses of Funds at Closing:

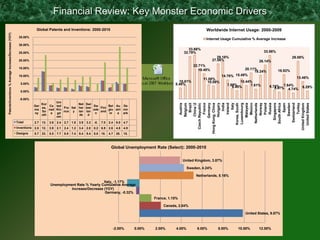

- 9. Financial Review: Key Monster Economic Drivers Global Patents and Inventions: 2000-2010 Worldwide Internet Usage: 2000-2009 Patents/Inventions % Average Increase/Decrease (YOY) 35.00% Internet Usage Cumulative % Average Increase 30.00% 33.66% 25.00% 32.79% 33.56% 29.18% 29.08% 20.00% 27.06% 26.14% 22.71% 15.00% 20.11% 19.48% 18.24% 18.82% 10.00% 14.76% 15.49% 13.46% 11.00% 10.61% 10.09% 10.44% 5.00% 8.48% 7.89% 6.45% 7.61% 6.75% 7.64% 5.47% 4.74% 6.29% 0.00% -5.00% Uni Germany Norway Italy Hungary Switzerland Turkey India France Singapore Spain Sweden Belgium Luxembourg Russia Czech Republic Mexico Poland Brazil China 2 Ireland Korea, South Hong Kong, China Netherlands Malaysia United States United Kingdom Austria Kor Net Swi South Africa Ger Ca ted Sw Bel Au De ea, Fra Ital her tzer Finl ma nad Kin ede giu stri nm So nce y lan lan and ny a gd n m a ark uth ds d om Total 2.7 13. 3.8 2.4 2.7 1.8 3.9 3.3 -0. 7.0 2.4 6.0 4.7 Inventions 2.5 12. 3.9 2.1 2.4 1.2 3.4 2.8 0.2 6.9 2.6 4.8 4.9 Designs 8.7 23. 5.5 7.7 8.9 7.4 9.4 9.4 5.0 18. 4.7 28. 15. Global Unemployment Rate (Select): 2000-2010 United Kingdom, 3.87% Sweden, 4.24% Netherlands, 5.16% Italy, -1.17% Unemployment Rate % Yearly Cumulative Average Increase/Decrease (YOY) Germany, -0.32% France, 1.15% Canada, 2.04% United States, 9.87% -2.00% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00%

- 10. Financial Review Continued: Assumptions & Statistical Analysis • Market-Based Assumptions (Current) • Market- and Industry-Based Exclusivity • %-Based Weighted Arithmetic Means • Conservative Rates, Where Permitted (e.g., Termination Fee %) One-Year Libor Rate (March Market Rate (Equity Risk FSP = firm size premium = 2.3 Shares Outstanding (as of April 17, 2012) = 2012): 1.0103% Premium): 5.5% (percentage points added to CAPM 123,923,000 estimate) 10-Year Treasury Note: Monster Risk Free Rate: 2.97% WACC = Since there is no debt or Market Value = $1,106,632,000 1.988% preferred stock, the WACC is the Return on Stock, 16.6681 Line of Credit (LOC): Prime Expected Rate of Return on Cost of Equity =16.6681 Effective Tax Rate = 20% Rate plus Libor Rate Equity = 8.47% Prime Rate: 3.25% Monster Beta: Range 2.16-2.97; Stock Price (as of April 17, 2012) = Termination Fee = 8.5% of Deal Value Average 2.57 $8.93 Business Revenue Segmentation Regression Analysis: Null Hypothesis: Monster Worldw ide revenue is af f ected by [selected] global economic f actors Regression Statistics Multiple R 0.80 R Square 0.64 Adjusted R Square 0.10 Standard Error 102385.87 Observations 11 ANOVA df SS MS F Significance F Regression 6 75188006372 12531334395 1.20 0.45 Residual 4 41931462351 10482865588 Total 10 1.17119E+11 Coefficients Standard Error t Stat P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0% Intercept 187945.772 77026.25135 2.44002231 0.07 -25913.39 401804.93 -25913.39 401804.93 Unemployment Rate % Yearly Weighted Average Increase/Decrease2.070606638 2610827.75 1260899.922 (YOY) 0.11 -889991.67 6111647.17 -889991.67 6111647.17 CPI Delta % Average -1632.6281 28574.67459 -0.057135491 0.96 -80968.64 77703.39 -80968.64 77703.39 Real GDP per Employee Person Average Increase/Decrease % (YOY) -3509900.7 10764750.06 -0.32605501 0.76 -33397638.31 26377836.92 -33397638.31 26377836.92 Patents Total (YOY) 3538123.76 22226157.7 0.159187378 0.88 -58171582.99 65247830.51 -58171582.99 65247830.51 Patents Inventions (YOY) -1135330 22299430 -0.050912959 0.96 -63048473.24 60777813.32 -63048473.24 60777813.32 Patents Designs (YOY) -469805.11 1340318.171 -0.350517602 0.74 -4191124.94 3251514.72 -4191124.94 3251514.72

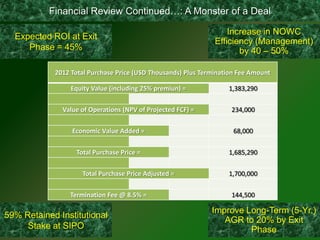

- 11. Financial Review Continued…: A Monster of a Deal Increase in NOWC Expected ROI at Exit Efficiency (Management) Phase = 45% by 40 – 50% 2012 Total Purchase Price (USD Thousands) Plus Termination Fee Amount Equity Value (including 25% premiun) = 1,383,290 Value of Operations (NPV of Projected FCF) = 234,000 Economic Value Added = 68,000 Total Purchase Price = 1,685,290 Total Purchase Price Adjusted = 1,700,000 Termination Fee @ 8.5% = 144,500 Improve Long-Term (5-Yr.) 59% Retained Institutional AGR to 20% by Exit Stake at SIPO Phase

- 12. Monstering Up A Little Q & A

- 13. Monster References • Cravath, Swaine & Moore LLP (2012). Home: Information. Retrieved March 2, 2012, from http://www.cravath.com/ • Credit Suisse Group AG (1997-2012). Home: Information. Retrieved March 2, 2012, from https://www.credit- suisse.com/investment_banking/advisory_services/en/mergers_and_aquisitions.jsp • Culbert, K. (2011). Ibis World Industry Report. Retrieved February 14, 2012, from www.ibisworld.com • Datamonitor (2012). Monster Worldwide, Inc.: SWOT Analysis. Retrieved February 14, 2012, from http://0- online.datmonitor.com.library.ggu.edu • Federal Trade Commission (2012). FTC Premerger Notification Program. Retrieved March 24, 2012, from http://www.ftc.gov/bc/hsr/hsrform.shtm • Hermann, J. T. (2003). Pacific Coast Capital, Inc.: Writing a Business Plan for a Leveraged Buyout. Retrieved on April 02, 2012 from www.pacific-coast-capital.com • International Monetary Fund.com (2012). Economic Outlook. Retrieved February 14, 2012, from www.imf.com • Mergent.com (N/A). Mergent Online Search. Retrieved February 14, 2012, from http://0-online.mergent.com.library.ggu.edu • Monster Worldwide, Inc. (2012). About Us. Retrieved March 1, 2012, from www.about-monster.com • MorningStar, Inc. (2012). Investment Research Center. Retrieved on April 12, 2012 from http://0- library.morningstar.com.library.ggu.edu/ • Observations (2011). Average Stock Market Returns. Retrieved April 2, 2012, from http://observationsandnotes.blogspot.com/2009/03/average-annual-stock-market-return.html • OneSource Information Services, Inc. (2012). Company Summary Report: Monster Worldwide, Inc. Retrieved February 14, 2012, from http://0-online.onesource.com.library.ggu.edu • Standard & Poor’s (2012). S&P Capital IQ: NetAdvantage. Retrieved April 12, 2012 from http://0- www.netadvantage.standardandpoors.com.library.ggu.edu/NASApp/NetAdvantage/cp/companyIndustrySurvey.do?task=showP DFIndustrySurveyByTicker • The Securities and Exchange Commission (2010). Filings & Forms. Retrieved March 14, 2012, from http://www.sec.gov/about/forms/secforms.htm#proxy • U.S. Census Bureau (2011). Statistical Abstract. Retrieved March 24, 2012, from http://www.census.gov/compendia/statab/cats/international_statistics.html • Yahoo, Inc. (2012). Yahoo Finance. Retrieved February 14, 2012, from http://finance.yahoo.com/q/bc?t=1d&s=MWW&l=on&z=m&q=l&c=%5EYHOh825

Editor's Notes

- #5: Online Advertising Expected CAGR to Increase to 8% (currently at 2-3%)Global Recruitment to Reach 6% (currently at 1-2%)

![Financial Review Continued: Assumptions & Statistical Analysis

• Market-Based Assumptions (Current) • Market- and Industry-Based Exclusivity

• %-Based Weighted Arithmetic Means • Conservative Rates, Where Permitted

(e.g., Termination Fee %)

One-Year Libor Rate (March Market Rate (Equity Risk FSP = firm size premium = 2.3 Shares Outstanding (as of April 17, 2012) =

2012): 1.0103% Premium): 5.5% (percentage points added to CAPM 123,923,000

estimate)

10-Year Treasury Note: Monster Risk Free Rate: 2.97% WACC = Since there is no debt or Market Value = $1,106,632,000

1.988% preferred stock, the WACC is the

Return on Stock, 16.6681

Line of Credit (LOC): Prime Expected Rate of Return on Cost of Equity =16.6681 Effective Tax Rate = 20%

Rate plus Libor Rate Equity = 8.47%

Prime Rate: 3.25% Monster Beta: Range 2.16-2.97; Stock Price (as of April 17, 2012) = Termination Fee = 8.5% of Deal Value

Average 2.57 $8.93

Business Revenue Segmentation Regression Analysis:

Null Hypothesis: Monster Worldw ide revenue is af f ected by [selected] global economic f actors

Regression Statistics

Multiple R 0.80

R Square 0.64

Adjusted R Square 0.10

Standard Error 102385.87

Observations 11

ANOVA

df SS MS F Significance F

Regression 6 75188006372 12531334395 1.20 0.45

Residual 4 41931462351 10482865588

Total 10 1.17119E+11

Coefficients Standard Error t Stat P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0%

Intercept 187945.772 77026.25135 2.44002231 0.07 -25913.39 401804.93 -25913.39 401804.93

Unemployment Rate % Yearly Weighted Average Increase/Decrease2.070606638

2610827.75 1260899.922 (YOY) 0.11 -889991.67 6111647.17 -889991.67 6111647.17

CPI Delta % Average -1632.6281 28574.67459 -0.057135491 0.96 -80968.64 77703.39 -80968.64 77703.39

Real GDP per Employee Person Average Increase/Decrease % (YOY)

-3509900.7 10764750.06 -0.32605501 0.76 -33397638.31 26377836.92 -33397638.31 26377836.92

Patents Total (YOY) 3538123.76 22226157.7 0.159187378 0.88 -58171582.99 65247830.51 -58171582.99 65247830.51

Patents Inventions (YOY) -1135330 22299430 -0.050912959 0.96 -63048473.24 60777813.32 -63048473.24 60777813.32

Patents Designs (YOY) -469805.11 1340318.171 -0.350517602 0.74 -4191124.94 3251514.72 -4191124.94 3251514.72](https://image.slidesharecdn.com/finalmonsterpptpresentation-13356543671139-phpapp02-120428180848-phpapp02/85/Final-Monster-Ppt-Presentation-10-320.jpg)