Financial Accounts with Adjustments

- 2. Group Members ŌĆó H.M Amir Sharif Chishti ŌĆó Usman Ghani ŌĆó Amir Khalid ŌĆó Rizwan Javed

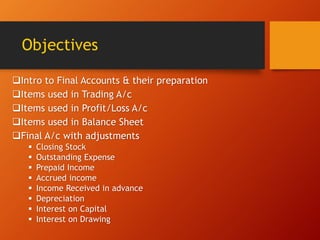

- 3. Objectives ’ü▒Intro to Final Accounts & their preparation ’ü▒Items used in Trading A/c ’ü▒Items used in Profit/Loss A/c ’ü▒Items used in Balance Sheet ’ü▒Final A/c with adjustments ’é¦ Closing Stock ’é¦ Outstanding Expense ’é¦ Prepaid Income ’é¦ Accrued income ’é¦ Income Received in advance ’é¦ Depreciation ’é¦ Interest on Capital ’é¦ Interest on Drawing

- 4. Final Accounts ŌĆóBASIC OBJECTIVE 1. Trading account , Profit & Loss account - to know profit or loss as a result of operations of business during the previous year. 2. Balance Sheet - to know the financial position at the end of the accounting year. also known as FINANCIAL STATEMENTS.

- 5. NECESSARY FOR FINAL A/C ŌĆóPrepared from Trial Balance ’ü▒ For this purpose both the sides of Trial Balance must tally. ’ü▒ If Trial Balance does not tally, Suspense Account must be opened for this purpose and put on the Dr. side or Cr. side(side having short total) as the case may be.

- 6. COMPOSITION OF FINAL ACCOUNTS These are called final accounts

- 7. Trading Account ’ü▒Prepared by trading concerns i.e., concerns which purchase and sell finished goods. ’ü▒To know the gross profit /loss. ’ü▒Gross profit /loss is the difference between the cost of goods sold and the proceeds of their sale. If the sale proceeds exceed the cost of goods sold ,the result is gross profit .Other wise, there is gross loss.

- 9. Profit & Loss Account ’ü▒Prepared to know the net profit/loss of business during a particular accounting year. ’ü▒Gross profit or loss is adjusted keeping in view the indirect expenses like administrative, selling and distribution and any other expenses and incomes to find out net profit or net loss.

- 10. Profit & Loss Account

- 11. Balance Sheet ’ü▒The last of financial statements . ’ü▒Shows the financial position of the business at the end of the accounting year i.e. balances of capital, liabilities & assets. ’ü▒All nominal accounts are closed by transferring these to Trading & Profit & Loss Account. ’ü▒Only personal & real accounts are left for Balance Sheet.

- 12. Balance Sheet

- 13. Adjustments ’ü▒Transactions occurring after preparing Trial Balance, that must be considered while preparing Final Accounts. ’ü▒GOLDEN RULE: All the items appearing in the Trial Balance are to be entered at one place out of these three, ITEMS IN ADJUSTMENT are to be treated at two places.

- 14. Adjustment item 1st Effect 2nd Effect Closing Stock Credit side of Trading a/c Assets side of Balance Sheet Outstanding Expenses Debit side of Trading and Profit & Loss a/c by way of addition to expenses Liabilities side of Balance Sheet Prepaid Expenses Debit side of Trading and Profit & Loss a/c by way of deduction from Expenses Assets side of Balance Sheet ContdŌĆ”

- 15. Adjustment item 1st Effect 2nd Effect Accrued Income (income earned but not received) Credit side of profit & loss a/c by way of addition to income Assets side of Balance Sheet Income Received in Advance (income received but not earned in the financial year) Credit side of Profit & loss a/c by way of deduction from the income Liabilities side of the Balance Sheet Depreciation Debit side of Profit & Loss a/c Assets side of Balance Sheet by way of deduction from the value of concerned asset. ContdŌĆ”

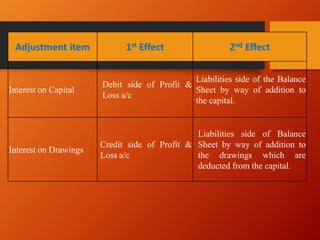

- 16. Adjustment item 1st Effect 2nd Effect Interest on Capital Debit side of Profit & Loss a/c Liabilities side of the Balance Sheet by way of addition to the capital. Interest on Drawings Credit side of Profit & Loss a/c Liabilities side of Balance Sheet by way of addition to the drawings which are deducted from the capital.

- 17. We just Discussed! ’ü▒Financial Accounts ’ü▒Trading A/c ’ü▒Profit/Loss A/c ’ü▒Balance Sheet ’ü▒Final A/c with adjustments ’é¦ Closing Stock ’é¦ Outstanding Expense ’é¦ Prepaid Income ’é¦ Accrued income ’é¦ Income Received in advance ’é¦ Depreciation ’é¦ Interest on Capital ’é¦ Interest on Drawing

- 18. Thank You