Financial final

Download as docx, pdf0 likes772 views

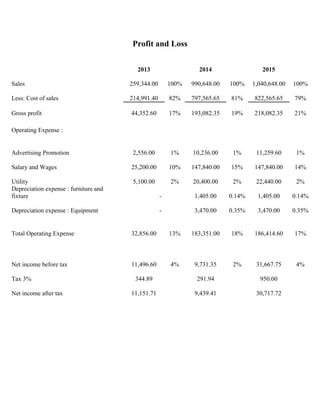

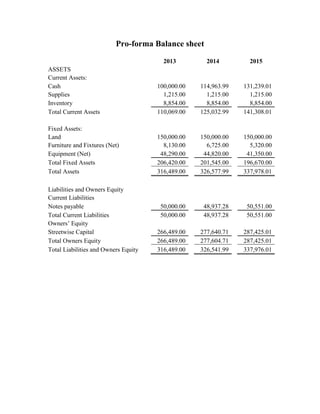

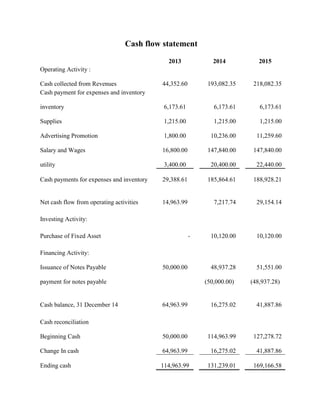

The document shows the profit and loss, balance sheet, and cash flow statement for a company from 2013 to 2015. Sales and profits increased each year while costs remained around 80% of sales. Net income grew from around $11,000 to over $30,000 from 2013 to 2015. Total assets increased each year as cash balances rose and fixed assets declined through depreciation. Owner's equity also increased each year due to retained earnings. The cash flow statement indicates operating activities provided increasing cash flow each year as revenues rose.

1 of 4

Download to read offline

Ad

Recommended

Olympique de Marseille season 2014-2015

Olympique de Marseille season 2014-2015FitnessInSoccer

?

This document summarizes statistics for Olympique de Marseille's 2014-2015 season, including:

- The difference in total distance covered between the first and second halves of matches, with most games seeing greater distance run in the second half.

- Total training distances in the two weeks leading up to matches.

- Accumulated fatigue levels throughout the preseason and in-season periods.

- The total number of goals scored.Anand Tableau Test Report 6

Anand Tableau Test Report 6Anand Chokshi

?

This document contains a table showing sales data from 2010 to 2013 including the sum of sales, percentage of total sales, difference in sales from the previous year, and percentage difference in sales from the previous year. The data is broken down by year of the order date and product category, which includes furniture, office supplies, and technology. A line below the table indicates that the table shows trends in these sales metrics over time and how they vary by product category.ID workshop 2009 presentation

ID workshop 2009 presentationguest825788f

?

The document outlines the engineering innovation and design project by Chua Yew Hang, a 3rd year undergraduate in mechanical engineering at Nanyang Technological University. It includes a monthly cash flow projection for a vending machine project spanning from August 2008 to November 2009, detailing cash receipts and expenditures. The final product is presented during an Eid open house, accompanied by a Q&A session.trial_balance 08012013 14012013

trial_balance 08012013 14012013Dorota Szmytkowska

?

This trial balance report shows the debits and credits for various accounts of a furniture business between January 8-14, 2013. It lists income and expense accounts such as sales, purchases, costs, and VAT amounts. The total debits equal the total credits of ?17,917.00, indicating the accounting records are in balance.§¯§à§Ó§à§Ó§Ó§Ö§Õ§Ö§ß§Ú§ñ

§¯§à§Ó§à§Ó§Ó§Ö§Õ§Ö§ß§Ú§ñAnatol Novikau

?

§¥§à§Ü§å§Þ§Ö§ß§ä §â§Ñ§ã§ã§Þ§Ñ§ä§â§Ú§Ó§Ñ§Ö§ä §Ü§à§ß§è§Ö§á§è§Ú§ð §ß§à§Ó§à§Ó§Ó§Ö§Õ§Ö§ß§Ú§Û, §á§à§Õ§é§Ö§â§Ü§Ú§Ó§Ñ§ñ, §é§ä§à §ß§à§Ó§Ñ§ä§à§â§í §ã§ä§Ñ§Ý§Ü§Ú§Ó§Ñ§ð§ä§ã§ñ §ã §ã§à§á§â§à§ä§Ú§Ó§Ý§Ö§ß§Ú§Ö§Þ §Ú §â§Ú§ã§Ü§à§Þ §á§à§ä§Ö§â§Ú §ã§ä§Ñ§ä§å§ã§Ñ. §µ§ã§á§Ö§ê§ß§í§Ö §ß§à§Ó§à§Ó§Ó§Ö§Õ§Ö§ß§Ú§ñ §ä§â§Ö§Ò§å§ð§ä §Ô§Ý§å§Ò§à§Ü§à§Ô§à §á§à§ß§Ú§Þ§Ñ§ß§Ú§ñ §Ú §á§à§Õ§Õ§Ö§â§Ø§Ü§Ú §â§Ö§ã§å§â§ã§à§Ó, §Ñ §ä§Ñ§Ü§Ø§Ö §à§Ò§ñ§Ù§Ñ§ß§í §Ò§í§ä§î §á§â§Ú§ß§ñ§ä§í§Þ§Ú §Ú §â§Ö§Ñ§Ý§Ú§Ù§à§Ó§Ñ§ß§ß§í§Þ§Ú §á§â§à§æ§Ö§ã§ã§Ú§à§ß§Ñ§Ý§Ñ§Þ§Ú. §°§ã§ß§à§Ó§ß§í§Ö §à§ê§Ú§Ò§Ü§Ú §Ó§à§Ù§ß§Ú§Ü§Ñ§ð§ä §Ú§Ù-§Ù§Ñ §ß§Ö§Õ§à§ã§ä§Ñ§ä§Ü§Ñ §à§Ò§ñ§Ù§Ñ§ä§Ö§Ý§î§ß§à§ã§ä§Ú §ß§à§Ó§à§Ó§Ó§Ö§Õ§Ö§ß§Ú§Û §Ú §à§ä§ã§å§ä§ã§ä§Ó§Ú§ñ §Ü§à§ß§ä§â§à§Ý§ñ §ß§Ñ§Õ §ã§à§Ò§Ý§ð§Õ§Ö§ß§Ú§Ö§Þ §ß§à§Ó§í§ç §á§â§Ñ§Ó§Ú§Ý.Planning my text

Planning my textAbi-Fletcher

?

The document outlines plans for a horror film trailer about 5 teenagers who go camping. The writer will collaborate with Tom Jolliffe to film the trailer in a field near their house. It will focus on one girl who feels threatened by strange noises and shadows. During the night, she is kidnapped while her friends do not believe her warnings. The trailer aims to shock audiences and set up a mystery about the threat in the woods.§©§ß§Ñ§Ü §Ó §®§Ú§ß§ã§Ü§Ö, §â§ñ§Õ§à§Þ §ã §Ü§à§ä§à§â§í§Þ §Ó§ã§Ö §æ§à§ä§à§Ô§â§Ñ§æ§Ú§â§å§ð§ä§ã§ñ

§©§ß§Ñ§Ü §Ó §®§Ú§ß§ã§Ü§Ö, §â§ñ§Õ§à§Þ §ã §Ü§à§ä§à§â§í§Þ §Ó§ã§Ö §æ§à§ä§à§Ô§â§Ñ§æ§Ú§â§å§ð§ä§ã§ñAnatol Novikau

?

§©§ß§Ñ§Ü §Ó §®§Ú§ß§ã§Ü§Ö, §ã§à§Ù§Õ§Ñ§ß§ß§í§Û §¡§â§ä§Ö§Þ§Ú§Ö§Þ §§Ö§Ò§Ö§Õ§Ö§Ó§í§Þ §Ó 2012 §Ô§à§Õ§å, §ã§ä§Ñ§Ý §ã§Ú§Þ§Ó§à§Ý§à§Þ §å§Ý§Ú§é§ß§à§Ô§à §Ú§ã§Ü§å§ã§ã§ä§Ó§Ñ §Ú §Þ§Ö§ã§ä§à§Þ §Õ§Ý§ñ §æ§à§ä§à§Ô§â§Ñ§æ§Ú§Û. §µ§ã§ä§Ñ§ß§à§Ó§Ü§Ñ §Ñ§ß§Ñ§Ý§à§Ô§Ú§é§ß§í§ç §Ù§ß§Ñ§Ü§à§Ó §Ó §¢§Ö§Ý§Ñ§â§å§ã§Ú §á§à§Õ§Õ§Ö§â§Ø§Ú§Ó§Ñ§Ö§ä§ã§ñ §Ô§à§ã§å§Õ§Ñ§â§ã§ä§Ó§Ö§ß§ß§í§Þ§Ú §Ñ§Ô§Ö§ß§ä§ã§ä§Ó§Ñ§Þ§Ú §Ú §Þ§Ö§ã§ä§ß§í§Þ§Ú §Ú§ß§Ú§è§Ú§Ñ§ä§Ú§Ó§Ñ§Þ§Ú §ã §è§Ö§Ý§î§ð §å§Ý§å§é§ê§Ö§ß§Ú§ñ §Ú§Þ§Ú§Õ§Ø§Ñ §Ô§à§â§à§Õ§à§Ó §Ú §á§â§Ú§Ó§Ý§Ö§é§Ö§ß§Ú§ñ §ä§å§â§Ú§ã§ä§à§Ó. §±§â§à§Ö§Ü§ä §ä§â§Ö§Ò§å§Ö§ä §ã§à§Ô§Ý§Ñ§ã§à§Ó§Ñ§ß§Ú§ñ §ã §Ó§Ý§Ñ§ã§ä§ñ§Þ§Ú §Ú §ã§á§à§ß§ã§à§â§à§Ó §Õ§Ý§ñ §â§Ö§Ñ§Ý§Ú§Ù§Ñ§è§Ú§Ú, §á§â§Ö§Õ§Ý§Ñ§Ô§Ñ§ñ §â§Ñ§Ù§ß§í§Ö §Ó§Ñ§â§Ú§Ñ§ß§ä§í §Ú§Ù§Ô§à§ä§à§Ó§Ý§Ö§ß§Ú§ñ §Ù§ß§Ñ§Ü§Ñ.Summary dyneema purity? 2011

Summary dyneema purity? 2011DSM

?

Dyneema Purity? fiber is a medical grade fiber made from ultra high molecular weight polyethylene. It is the strongest fiber available for medical use. The document discusses the properties of Dyneema Purity? fiber that make it suitable for applications such as sutures and ligament repair, including its high strength, flexibility, durability, and biocompatibility. Over 10 million patients have had medical devices implanted using Dyneema Purity? fiber due to its unique combination of properties.Steel versus uhmwpe fiber in sternum closure

Steel versus uhmwpe fiber in sternum closureDSM

?

The document compares the mechanical behavior of steel wires and ultra-high molecular weight polyethylene (UHMWPE) cables for sternum closure after open-heart surgery. It highlights that while steel wires are traditionally used, UHMWPE cables offer higher maximum load and more reproducible mechanical behavior with less scatter, though they require more complex knotting techniques for connection. Overall, UHMWPE cables demonstrate superior performance in terms of load capacity and reliability compared to steel wires.Ipad 2

Ipad 2mirimf

?

The document describes a new A5 chip that is twice as powerful and more fluid than previous chips. It has a thinner and lighter design with a front and back camera for video calling. It maintains a 10 hour battery life and comes in pink, red, or blue colors with optional smart covers in additional colors. Accessories include a wireless keyboard that connects via Bluetooth. It is priced at $499.Women in the workforce

Women in the workforceMegan Olivier

?

Women face additional challenges to succeed due to gender biases, as noted by Clare Boothe Luce. The document discusses whether women are paid less than men and face glass ceiling effects. It provides statistics showing that while women make up 59% of the American workforce, they only hold 15% of upper-level management positions.Perlaksanaan Projek RMK9 Air Kelantan Sdn Bhd

Perlaksanaan Projek RMK9 Air Kelantan Sdn Bhdaksb

?

Projek RMK 9 Pakej 1 melibatkan kerja-kerja menaiktaraf dan membina loji air di Bukit Remah dan Merbau Chondong, untuk meningkatkan kapasiti pengeluaran air dari 30 mld kepada 40 mld serta dari 40 mld kepada 50 mld, bagi menyelesaikan masalah bekalan air di kawasan sekitar. Kos kontrak bagi projek ini adalah RM 14,980,000.00 dan dijadualkan siap dalam tempoh 12 bulan. Beberapa pakej projek lain juga dirangkumi, termasuk pembinaan loji baru dan pemasangan paip bagi meningkatkan lagi kapasiti bekalan air di Kelantan.Itil 2011 spanish_(latin_american)_glossary_v1.0Walter Zubiaur Alejos

?

Este documento presenta el glosario de t¨¦rminos y definiciones en espa?ol (latinoamericano) de ITIL. Agradece a los autores del glosario original en ingl¨¦s y a los expertos que participaron en la traducci¨®n al espa?ol. Incluye t¨¦rminos comunes de ITIL con sus definiciones correspondientes en espa?ol.Caribe entertainment powerpoint week 6

Caribe entertainment powerpoint week 6Caribe Entertainment

?

The document proposes opening a non-smoking and non-alcoholic lounge for young musicians to perform that would provide a safe environment for teens. It presents examples of successful similar businesses and provides a financial plan and projections for a proposed Caribbean-themed lounge called Caribe Entertainment, including startup costs, sales forecasts, expenses, and balance sheets. The financial analysis suggests it could be a profitable venture.9th presentation f

9th presentation fWash Me

?

The document contains financial projections and analyses for a business over a 5 year period, including income statements, balance sheets, and cash flow statements. The income statement projects increasing revenues but losses in the first two years turning to profits in years 3-5. Projected balance sheets show growing assets and liabilities. The cash flow statement forecasts an initial negative cash flow turning positive by the end of the projection period.financial accounting

financial accounting nishant bhatia

?

This document contains the financial statements of Asian Paints Company for the years ended March 31, 2013 and March 31, 2012. It includes the statement of profit and loss, balance sheet, key financial ratios and common size statements for both years. The company saw increases in total revenue, net profit, assets and liabilities from 2012 to 2013. Revenue increased by 14.71% to Rs. 9,990.04 crores and net profit increased by 9.55% to Rs. 1,050 crores. Total assets grew by 17.77% to Rs. 5,648.28 crores over the period.Plan de Negocios - Cuadros

Plan de Negocios - CuadrosMaricel Jorge

?

The document contains projected balance sheets, profit and loss statements, and cash flows for the first three years of operations of Mia Boutique. It shows increasing assets, equity, and cash over the three years as the business grows. Profits also increase each year from $12,347 in year 1 to $135,963 in year 3 as sales rise and costs become a smaller percentage of sales. The monthly profit and loss breakdown shows seasonality in sales and fluctuations in monthly profits.Harvey Norman 2016 Financial Analysis (Full year ended 30 June)

Harvey Norman 2016 Financial Analysis (Full year ended 30 June)VCE Accounting - Michael Allison

?

The financial analysis summarizes Harvey Norman's 2016 full year results. Key findings show increases in profitability metrics like gross profit margin, net profit margin, return on assets and return on investment compared to the previous period. Efficiency also improved with higher asset turnover and lower stock turnover. Liquidity was slightly lower for working capital and quick asset ratios but the cash flow ratio improved. Debt levels decreased, enhancing stability. Overall, the results indicate improved financial performance across most measures.Honda

HondaJamshid Raufi

?

This document contains financial information for a company from 2014-2012, including income statements, balance sheets, and key financial ratios. It shows that from 2014-2013, the company's sales increased 29.33% while costs increased 25.91%, leading to a 97.45% increase in gross profit. Several liquidity, activity, debt, profitability, and market ratios are also calculated and analyzed.Bootstrapping Entrepeneurs & Their Business Ppt

Bootstrapping Entrepeneurs & Their Business PptCaroline Cummings

?

The document provides a comprehensive guide on bootstrapping entrepreneurship, emphasizing financial management, goal-setting, and milestone tracking for startups. Key financial tools such as profit and loss statements, breakeven analysis, and various projections are discussed to aid in understanding costs and market dynamics. It stresses the importance of responsible cash management while highlighting the projected growth and financial assumptions over the years.Dick Smith 2015 Financial Analysis (Full Year Ended 30 June)

Dick Smith 2015 Financial Analysis (Full Year Ended 30 June)VCE Accounting - Michael Allison

?

The document analyzes Dick Smith's 2015 financial reports, finding:

- Profitability metrics like net profit margin improved but remained thin. Gross profit margin declined slightly.

- Liquidity was poor, with barely enough current assets to cover current liabilities and operating activities losing cash.

- Debt levels were high at 67% of total assets, requiring constant interest and principal repayments.Business Plan Presentation - Simit Shop

Business Plan Presentation - Simit ShopEren Kongu

?

This document presents a business plan for a simit shop in Madrid, Spain. It includes an introduction to simit, a SWOT analysis, target market details, marketing and operational strategies, financial projections, and feasibility analysis. Key details include projected annual sales revenue of €200,000-€266,000, total startup costs of €85,000-€56,000, and profitability achieved in the first year of operations based on financial modeling and break-even analysis. The conclusion is that the simit shop is economically viable and has great growth potential in Madrid.Release 1 t11 (eng)

Release 1 t11 (eng)BRMALLS

?

BRMalls reported financial results for the first quarter of 2011 with the following highlights:

- Net revenue increased 68.4% to R$179.1 million.

- Adjusted EBITDA reached R$140.6 million, up 58.6% compared to the first quarter of 2010.

- Occupancy rates across malls averaged 98.1%, up 0.2 percentage points from the prior year quarter.B401 Consulting Project

B401 Consulting ProjectJordan Rust

?

This document provides an analysis of Fortune Pizza, a restaurant located in Portland, OR that is currently listed for sale at $58,000. The analysis includes a balance sheet, income statement, and assumptions based on comparable market data and geographic trends. It calculates that with an initial investment of $235,272, the company would have a 5.41% weighted average cost of capital and 5.71% internal rate of return, indicating it is undervalued. The document also includes a mortgage table and expansion option tables to help evaluate financing options.Williams sonoma model

Williams sonoma model Trishala Rasya

?

This document provides financial information for Williams-Sonoma Inc. including income statements, balance sheets, and statements of cash flows for fiscal years 2011-2021. Key figures include total revenues of $5.2 billion in 2016, net income of $310 million in 2016, total current assets of $1.9 billion in 2017, total current liabilities of $1.2 billion in 2017, and property and equipment, net of $885 million in 2016. The company had $367 million in cash and cash equivalents as of the 2016 balance sheet date.Property Investment Model

Property Investment ModelFlevy.com Best Practices

?

This document outlines an investment model for acquiring, renovating, and renting out a residential property. Key aspects of the model include:

- Acquiring a property for $50,500 including fees and renovating it for $28,800.

- The renovated property will have 18 rental rooms and be rented out to generate income which increases 10% annually.

- Operational costs also increase 10% per year and the property is expected to be sold after 10 years for $472,040, realizing a gain of $238,738.

- Financial projections show the investment has a net present value of $685.60, internal rate of return of 30.22%, and pays back inCaribe entertainment powerpoint

Caribe entertainment powerpointCaribe Entertainment

?

There is a need for a safe, drug and smoke-free entertainment venue for young people and musicians to socialize and perform. The document discusses opening an internet caf¨¦ and lounge that provides wifi, music, and non-alcoholic drinks. Startup costs are estimated at $59,817 with additional assets of $181,500 needed. Financial projections over 3 years estimate sales growth from $167,575 to $179,055 and net income increasing from $370 to $5,791.More Related Content

Viewers also liked (8)

§©§ß§Ñ§Ü §Ó §®§Ú§ß§ã§Ü§Ö, §â§ñ§Õ§à§Þ §ã §Ü§à§ä§à§â§í§Þ §Ó§ã§Ö §æ§à§ä§à§Ô§â§Ñ§æ§Ú§â§å§ð§ä§ã§ñ

§©§ß§Ñ§Ü §Ó §®§Ú§ß§ã§Ü§Ö, §â§ñ§Õ§à§Þ §ã §Ü§à§ä§à§â§í§Þ §Ó§ã§Ö §æ§à§ä§à§Ô§â§Ñ§æ§Ú§â§å§ð§ä§ã§ñAnatol Novikau

?

§©§ß§Ñ§Ü §Ó §®§Ú§ß§ã§Ü§Ö, §ã§à§Ù§Õ§Ñ§ß§ß§í§Û §¡§â§ä§Ö§Þ§Ú§Ö§Þ §§Ö§Ò§Ö§Õ§Ö§Ó§í§Þ §Ó 2012 §Ô§à§Õ§å, §ã§ä§Ñ§Ý §ã§Ú§Þ§Ó§à§Ý§à§Þ §å§Ý§Ú§é§ß§à§Ô§à §Ú§ã§Ü§å§ã§ã§ä§Ó§Ñ §Ú §Þ§Ö§ã§ä§à§Þ §Õ§Ý§ñ §æ§à§ä§à§Ô§â§Ñ§æ§Ú§Û. §µ§ã§ä§Ñ§ß§à§Ó§Ü§Ñ §Ñ§ß§Ñ§Ý§à§Ô§Ú§é§ß§í§ç §Ù§ß§Ñ§Ü§à§Ó §Ó §¢§Ö§Ý§Ñ§â§å§ã§Ú §á§à§Õ§Õ§Ö§â§Ø§Ú§Ó§Ñ§Ö§ä§ã§ñ §Ô§à§ã§å§Õ§Ñ§â§ã§ä§Ó§Ö§ß§ß§í§Þ§Ú §Ñ§Ô§Ö§ß§ä§ã§ä§Ó§Ñ§Þ§Ú §Ú §Þ§Ö§ã§ä§ß§í§Þ§Ú §Ú§ß§Ú§è§Ú§Ñ§ä§Ú§Ó§Ñ§Þ§Ú §ã §è§Ö§Ý§î§ð §å§Ý§å§é§ê§Ö§ß§Ú§ñ §Ú§Þ§Ú§Õ§Ø§Ñ §Ô§à§â§à§Õ§à§Ó §Ú §á§â§Ú§Ó§Ý§Ö§é§Ö§ß§Ú§ñ §ä§å§â§Ú§ã§ä§à§Ó. §±§â§à§Ö§Ü§ä §ä§â§Ö§Ò§å§Ö§ä §ã§à§Ô§Ý§Ñ§ã§à§Ó§Ñ§ß§Ú§ñ §ã §Ó§Ý§Ñ§ã§ä§ñ§Þ§Ú §Ú §ã§á§à§ß§ã§à§â§à§Ó §Õ§Ý§ñ §â§Ö§Ñ§Ý§Ú§Ù§Ñ§è§Ú§Ú, §á§â§Ö§Õ§Ý§Ñ§Ô§Ñ§ñ §â§Ñ§Ù§ß§í§Ö §Ó§Ñ§â§Ú§Ñ§ß§ä§í §Ú§Ù§Ô§à§ä§à§Ó§Ý§Ö§ß§Ú§ñ §Ù§ß§Ñ§Ü§Ñ.Summary dyneema purity? 2011

Summary dyneema purity? 2011DSM

?

Dyneema Purity? fiber is a medical grade fiber made from ultra high molecular weight polyethylene. It is the strongest fiber available for medical use. The document discusses the properties of Dyneema Purity? fiber that make it suitable for applications such as sutures and ligament repair, including its high strength, flexibility, durability, and biocompatibility. Over 10 million patients have had medical devices implanted using Dyneema Purity? fiber due to its unique combination of properties.Steel versus uhmwpe fiber in sternum closure

Steel versus uhmwpe fiber in sternum closureDSM

?

The document compares the mechanical behavior of steel wires and ultra-high molecular weight polyethylene (UHMWPE) cables for sternum closure after open-heart surgery. It highlights that while steel wires are traditionally used, UHMWPE cables offer higher maximum load and more reproducible mechanical behavior with less scatter, though they require more complex knotting techniques for connection. Overall, UHMWPE cables demonstrate superior performance in terms of load capacity and reliability compared to steel wires.Ipad 2

Ipad 2mirimf

?

The document describes a new A5 chip that is twice as powerful and more fluid than previous chips. It has a thinner and lighter design with a front and back camera for video calling. It maintains a 10 hour battery life and comes in pink, red, or blue colors with optional smart covers in additional colors. Accessories include a wireless keyboard that connects via Bluetooth. It is priced at $499.Women in the workforce

Women in the workforceMegan Olivier

?

Women face additional challenges to succeed due to gender biases, as noted by Clare Boothe Luce. The document discusses whether women are paid less than men and face glass ceiling effects. It provides statistics showing that while women make up 59% of the American workforce, they only hold 15% of upper-level management positions.Perlaksanaan Projek RMK9 Air Kelantan Sdn Bhd

Perlaksanaan Projek RMK9 Air Kelantan Sdn Bhdaksb

?

Projek RMK 9 Pakej 1 melibatkan kerja-kerja menaiktaraf dan membina loji air di Bukit Remah dan Merbau Chondong, untuk meningkatkan kapasiti pengeluaran air dari 30 mld kepada 40 mld serta dari 40 mld kepada 50 mld, bagi menyelesaikan masalah bekalan air di kawasan sekitar. Kos kontrak bagi projek ini adalah RM 14,980,000.00 dan dijadualkan siap dalam tempoh 12 bulan. Beberapa pakej projek lain juga dirangkumi, termasuk pembinaan loji baru dan pemasangan paip bagi meningkatkan lagi kapasiti bekalan air di Kelantan.Itil 2011 spanish_(latin_american)_glossary_v1.0Walter Zubiaur Alejos

?

Este documento presenta el glosario de t¨¦rminos y definiciones en espa?ol (latinoamericano) de ITIL. Agradece a los autores del glosario original en ingl¨¦s y a los expertos que participaron en la traducci¨®n al espa?ol. Incluye t¨¦rminos comunes de ITIL con sus definiciones correspondientes en espa?ol.§©§ß§Ñ§Ü §Ó §®§Ú§ß§ã§Ü§Ö, §â§ñ§Õ§à§Þ §ã §Ü§à§ä§à§â§í§Þ §Ó§ã§Ö §æ§à§ä§à§Ô§â§Ñ§æ§Ú§â§å§ð§ä§ã§ñ

§©§ß§Ñ§Ü §Ó §®§Ú§ß§ã§Ü§Ö, §â§ñ§Õ§à§Þ §ã §Ü§à§ä§à§â§í§Þ §Ó§ã§Ö §æ§à§ä§à§Ô§â§Ñ§æ§Ú§â§å§ð§ä§ã§ñAnatol Novikau

?

Similar to Financial final (20)

Caribe entertainment powerpoint week 6

Caribe entertainment powerpoint week 6Caribe Entertainment

?

The document proposes opening a non-smoking and non-alcoholic lounge for young musicians to perform that would provide a safe environment for teens. It presents examples of successful similar businesses and provides a financial plan and projections for a proposed Caribbean-themed lounge called Caribe Entertainment, including startup costs, sales forecasts, expenses, and balance sheets. The financial analysis suggests it could be a profitable venture.9th presentation f

9th presentation fWash Me

?

The document contains financial projections and analyses for a business over a 5 year period, including income statements, balance sheets, and cash flow statements. The income statement projects increasing revenues but losses in the first two years turning to profits in years 3-5. Projected balance sheets show growing assets and liabilities. The cash flow statement forecasts an initial negative cash flow turning positive by the end of the projection period.financial accounting

financial accounting nishant bhatia

?

This document contains the financial statements of Asian Paints Company for the years ended March 31, 2013 and March 31, 2012. It includes the statement of profit and loss, balance sheet, key financial ratios and common size statements for both years. The company saw increases in total revenue, net profit, assets and liabilities from 2012 to 2013. Revenue increased by 14.71% to Rs. 9,990.04 crores and net profit increased by 9.55% to Rs. 1,050 crores. Total assets grew by 17.77% to Rs. 5,648.28 crores over the period.Plan de Negocios - Cuadros

Plan de Negocios - CuadrosMaricel Jorge

?

The document contains projected balance sheets, profit and loss statements, and cash flows for the first three years of operations of Mia Boutique. It shows increasing assets, equity, and cash over the three years as the business grows. Profits also increase each year from $12,347 in year 1 to $135,963 in year 3 as sales rise and costs become a smaller percentage of sales. The monthly profit and loss breakdown shows seasonality in sales and fluctuations in monthly profits.Harvey Norman 2016 Financial Analysis (Full year ended 30 June)

Harvey Norman 2016 Financial Analysis (Full year ended 30 June)VCE Accounting - Michael Allison

?

The financial analysis summarizes Harvey Norman's 2016 full year results. Key findings show increases in profitability metrics like gross profit margin, net profit margin, return on assets and return on investment compared to the previous period. Efficiency also improved with higher asset turnover and lower stock turnover. Liquidity was slightly lower for working capital and quick asset ratios but the cash flow ratio improved. Debt levels decreased, enhancing stability. Overall, the results indicate improved financial performance across most measures.Honda

HondaJamshid Raufi

?

This document contains financial information for a company from 2014-2012, including income statements, balance sheets, and key financial ratios. It shows that from 2014-2013, the company's sales increased 29.33% while costs increased 25.91%, leading to a 97.45% increase in gross profit. Several liquidity, activity, debt, profitability, and market ratios are also calculated and analyzed.Bootstrapping Entrepeneurs & Their Business Ppt

Bootstrapping Entrepeneurs & Their Business PptCaroline Cummings

?

The document provides a comprehensive guide on bootstrapping entrepreneurship, emphasizing financial management, goal-setting, and milestone tracking for startups. Key financial tools such as profit and loss statements, breakeven analysis, and various projections are discussed to aid in understanding costs and market dynamics. It stresses the importance of responsible cash management while highlighting the projected growth and financial assumptions over the years.Dick Smith 2015 Financial Analysis (Full Year Ended 30 June)

Dick Smith 2015 Financial Analysis (Full Year Ended 30 June)VCE Accounting - Michael Allison

?

The document analyzes Dick Smith's 2015 financial reports, finding:

- Profitability metrics like net profit margin improved but remained thin. Gross profit margin declined slightly.

- Liquidity was poor, with barely enough current assets to cover current liabilities and operating activities losing cash.

- Debt levels were high at 67% of total assets, requiring constant interest and principal repayments.Business Plan Presentation - Simit Shop

Business Plan Presentation - Simit ShopEren Kongu

?

This document presents a business plan for a simit shop in Madrid, Spain. It includes an introduction to simit, a SWOT analysis, target market details, marketing and operational strategies, financial projections, and feasibility analysis. Key details include projected annual sales revenue of €200,000-€266,000, total startup costs of €85,000-€56,000, and profitability achieved in the first year of operations based on financial modeling and break-even analysis. The conclusion is that the simit shop is economically viable and has great growth potential in Madrid.Release 1 t11 (eng)

Release 1 t11 (eng)BRMALLS

?

BRMalls reported financial results for the first quarter of 2011 with the following highlights:

- Net revenue increased 68.4% to R$179.1 million.

- Adjusted EBITDA reached R$140.6 million, up 58.6% compared to the first quarter of 2010.

- Occupancy rates across malls averaged 98.1%, up 0.2 percentage points from the prior year quarter.B401 Consulting Project

B401 Consulting ProjectJordan Rust

?

This document provides an analysis of Fortune Pizza, a restaurant located in Portland, OR that is currently listed for sale at $58,000. The analysis includes a balance sheet, income statement, and assumptions based on comparable market data and geographic trends. It calculates that with an initial investment of $235,272, the company would have a 5.41% weighted average cost of capital and 5.71% internal rate of return, indicating it is undervalued. The document also includes a mortgage table and expansion option tables to help evaluate financing options.Williams sonoma model

Williams sonoma model Trishala Rasya

?

This document provides financial information for Williams-Sonoma Inc. including income statements, balance sheets, and statements of cash flows for fiscal years 2011-2021. Key figures include total revenues of $5.2 billion in 2016, net income of $310 million in 2016, total current assets of $1.9 billion in 2017, total current liabilities of $1.2 billion in 2017, and property and equipment, net of $885 million in 2016. The company had $367 million in cash and cash equivalents as of the 2016 balance sheet date.Property Investment Model

Property Investment ModelFlevy.com Best Practices

?

This document outlines an investment model for acquiring, renovating, and renting out a residential property. Key aspects of the model include:

- Acquiring a property for $50,500 including fees and renovating it for $28,800.

- The renovated property will have 18 rental rooms and be rented out to generate income which increases 10% annually.

- Operational costs also increase 10% per year and the property is expected to be sold after 10 years for $472,040, realizing a gain of $238,738.

- Financial projections show the investment has a net present value of $685.60, internal rate of return of 30.22%, and pays back inCaribe entertainment powerpoint

Caribe entertainment powerpointCaribe Entertainment

?

There is a need for a safe, drug and smoke-free entertainment venue for young people and musicians to socialize and perform. The document discusses opening an internet caf¨¦ and lounge that provides wifi, music, and non-alcoholic drinks. Startup costs are estimated at $59,817 with additional assets of $181,500 needed. Financial projections over 3 years estimate sales growth from $167,575 to $179,055 and net income increasing from $370 to $5,791.Vera Bradley Final Presentation

Vera Bradley Final PresentationBashayer Baljon

?

This document provides an overview and analysis of Vera Bradley, Inc. strategies to increase market share and profitability. It discusses three strategic initiatives - increasing market share through a new product line, closing the bottom 10% of underperforming stores, and halting new store openings to focus on renovating existing stores. Financial projections show the incremental positive impact of each strategy on net income. Combining all three strategies results in the highest net income. The presentation evaluates the strategies and their expected financial outcomes.SIC 5143 Line ofBusinessDairy products, except dried.docx

SIC 5143 Line ofBusinessDairy products, except dried.docxbudabrooks46239

?

The document presents financial metrics for the dairy products industry excluding dried or canned items, spanning from 2009 to 2012, examining solvency, efficiency, and profitability ratios. Key financial indicators include ratios such as quick ratio, current ratio, return on assets, and net profit margins, illustrating trends over the years. Additionally, it includes detailed annual financials, highlighting income statements, balance sheets, and cash flow statements in millions of US dollars.FIN421- Corporate Finance I--term paper

FIN421- Corporate Finance I--term paperSamiya Yesmin

?

This document provides an overview of Bangladesh Lamps PHILIPS and presents common size statements for the company's financials from 2008-2012. It includes vertical and horizontal common size balance sheets and income statements. The vertical balance sheet shows percentages of items compared to total assets each year. The vertical income statement shows percentages of items compared to sales each year. The horizontal statements show each item as a percentage of the base year (2008). Averages and standard deviations are also calculated.MARKETING

MARKETINGraza-ali

?

This document provides financial information for a proposed steak buffet restaurant, including:

1. Variable and fixed annual costs, with the total variable costs being 63.11% and total fixed costs being $485,718.

2. A break-even analysis showing that monthly revenue of $67,519 is needed to break even.

3. Three years of projected profit and loss statements, cash flow statements, and balance sheets to estimate the financial performance and position of the restaurant.

4. Key business ratios such as current ratio, quick ratio, and net profit margin are presented to benchmark the restaurant's financial health against industry standards.Renovation Nation Final Presentation

Renovation Nation Final Presentationboscollkid

?

The marketing plan outlines Renovation Nation's mission to be a complete tool rental company providing high quality service to homeowners and contractors in the home improvement industry. It analyzes the tool rental market trends, identifies key competitors, and establishes financial projections showing profitability from 2010 to 2014 as the company aims to capture 2.5% of the local market share. The plan also details strategies around target markets, a SWOT analysis, critical issues to address, differentiators from competitors, and a 5-year financial projection with a break-even point in 2011.Profit and loss projection

Profit and loss projectionPRACHI NAVGHARE

?

This document provides a profit and loss statement for Maruti Suzuki from 2013 to 2022. Some key highlights include:

- Revenue grew from Rs. 443 billion in 2013 to Rs. 1.2 trillion in 2022, averaging annual growth of 11.8%

- Cost of materials consumed averaged 67% of sales while purchases of stock-in-trade averaged 6% of sales

- Net profit grew from Rs. 24.7 billion in 2013 to Rs. 76.7 billion in 2022, with an average annual growth rate of 25%

- Total comprehensive income grew from Rs. 24.7 billion to Rs. 77.3 billion over the same periodAd

Recently uploaded (20)

Adrien Matray - A Prominent Macroeconomist

Adrien Matray - A Prominent MacroeconomistAdrien Matray

?

Adrien Matray is an applied macroeconomist whose research examines how finance shapes economic growth and economic inequality. Growing up in the less affluent suburbs of Paris, where economic disparities were stark, sparked his interest in understanding how financial systems affect well-being. His work addresses critical issues like income inequality and lack of access to formal financial institutions, aiming to inform policies that better regulate alternative financial services and promote equitable economic outcomes, especially for low-income communities.INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptx

INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptxAnkush Upadhyay

?

This presentation analyzes investment strategies for a 30-year-old risk-averse investor with ?50 lakhs. Based on a 35:65 equity-debt allocation, it recommends equity investments in HAL, BEL, and Bajaj Auto due to their strong financials and low debt, and debt investments in government and tax-free bonds with stable yields. The analysis balances risk and return for long-term portfolio growth in the defense sector and public sector bonds.×îаæÃÀ¹úÍþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ±ÏÒµÖ¤£¨±«°Â²Ñ±ÏÒµÖ¤Ê飩԰涨ÖÆ

×îаæÃÀ¹úÍþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ±ÏÒµÖ¤£¨±«°Â²Ñ±ÏÒµÖ¤Ê飩԰涨ÖÆtaqyea

?

2025Ô°æÍþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ±ÏÒµÖ¤Êépdfµç×Ӱ桾qÞ±1954292140¡¿ÃÀ¹ú±ÏÒµÖ¤°ìÀíUWMÍþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ±ÏÒµÖ¤Êé¶àÉÙÇ®£¿¡¾qÞ±1954292140¡¿º£Íâ¸÷´óѧDiploma°æ±¾£¬ÒòΪÒßÇéѧУÍƳٷ¢·ÅÖ¤Êé¡¢Ö¤ÊéÔ¼þ¶ªÊ§²¹°ì¡¢Ã»ÓÐÕý³£±ÏҵδÄÜÈÏ֤ѧÀúÃæÁÙ¾ÍÒµÌṩ½â¾ö°ì·¨¡£µ±ÔâÓö¹Ò¿Æ¡¢¿õ¿Îµ¼ÖÂÎÞ·¨ÐÞÂúѧ·Ö£¬»òÕßÖ±½Ó±»Ñ§Ð£ÍËѧ£¬×îºóÎÞ·¨±ÏÒµÄò»µ½±ÏÒµÖ¤¡£´ËʱµÄÄãÒ»¶¨ÊÖ×ãÎ޴룬ÒòΪÁôѧһ³¡£¬Ã»ÓлñµÃ±ÏÒµÖ¤ÒÔ¼°Ñ§ÀúÖ¤Ã÷¿Ï¶¨ÊÇÎÞ·¨¸ø×Ô¼ººÍ¸¸Ä¸Ò»¸ö½»´úµÄ¡£

¡¾¸´¿ÌÍþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ³É¼¨µ¥ÐÅ·â,Buy University of Wisconsin-Milwaukee Transcripts¡¿

¹ºÂòÈÕº«³É¼¨µ¥¡¢Ó¢¹ú´óѧ³É¼¨µ¥¡¢ÃÀ¹ú´óѧ³É¼¨µ¥¡¢°ÄÖÞ´óѧ³É¼¨µ¥¡¢¼ÓÄôó´óѧ³É¼¨µ¥£¨q΢1954292140£©Ð¼ÓÆ´óѧ³É¼¨µ¥¡¢ÐÂÎ÷À¼´óѧ³É¼¨µ¥¡¢°®¶ûÀ¼³É¼¨µ¥¡¢Î÷°àÑÀ³É¼¨µ¥¡¢µÂ¹ú³É¼¨µ¥¡£³É¼¨µ¥µÄÒâÒåÖ÷ÒªÌåÏÖÔÚÖ¤Ã÷ѧϰÄÜÁ¦¡¢ÆÀ¹ÀѧÊõ±³¾°¡¢Õ¹Ê¾×ÛºÏËØÖÊ¡¢Ìá¸ß¼ȡÂÊ£¬ÒÔ¼°ÊÇ×÷ΪÁôÐÅÈÏÖ¤ÉêÇë²ÄÁϵÄÒ»²¿·Ö¡£

Íþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ³É¼¨µ¥Äܹ»ÌåÏÖÄúµÄµÄѧϰÄÜÁ¦£¬°üÀ¨Íþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ¿Î³Ì³É¼¨¡¢×¨ÒµÄÜÁ¦¡¢Ñо¿ÄÜÁ¦¡££¨q΢1954292140£©¾ßÌåÀ´Ëµ£¬³É¼¨±¨¸æµ¥Í¨³£°üº¬Ñ§ÉúµÄѧϰ¼¼ÄÜÓëÏ°¹ß¡¢¸÷¿Æ³É¼¨ÒÔ¼°ÀÏʦÆÀÓïµÈ²¿·Ö£¬Òò´Ë£¬³É¼¨µ¥²»½öÊÇѧÉúѧÊõÄÜÁ¦µÄÖ¤Ã÷£¬Ò²ÊÇÆÀ¹ÀѧÉúÊÇ·ñÊʺÏij¸ö½ÌÓýÏîÄ¿µÄÖØÒªÒÀ¾Ý£¡

ÎÒÃdzÐŵ²ÉÓõÄÊÇѧУ԰æÖ½ÕÅ£¨Ô°æÖ½ÖÊ¡¢µ×É«¡¢ÎÆ·£©ÎÒÃǹ¤³§ÓµÓÐÈ«Ì×½ø¿ÚÔ×°É豸£¬ÌØÊ⹤ÒÕ¶¼ÊDzÉÓò»Í¬»úÆ÷ÖÆ×÷£¬·ÂÕæ¶È»ù±¾¿ÉÒÔ´ïµ½100%£¬ËùÓгÉÆ·ÒÔ¼°¹¤ÒÕЧ¹û¶¼¿ÉÌáÇ°¸ø¿Í»§Õ¹Ê¾£¬²»ÂúÒâ¿ÉÒÔ¸ù¾Ý¿Í»§ÒªÇó½øÐе÷Õû£¬Ö±µ½ÂúÒâΪֹ£¡

¡¾Ö÷ÓªÏîÄ¿¡¿

Ò»¡¢¹¤×÷δȷ¶¨£¬»Ø¹úÐèÏȸø¸¸Ä¸¡¢Ç×ÆÝÅóÓÑ¿´ÏÂÎÄƾµÄÇé¿ö£¬°ìÀí±ÏÒµÖ¤|°ìÀíÎÄƾ: Âò´óѧ±ÏÒµÖ¤|Âò´óѧÎÄƾ¡¾qÞ±1954292140¡¿Íþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУѧλ֤Ã÷ÊéÈçºÎ°ìÀíÉêÇ룿

¶þ¡¢»Ø¹ú½ø˽Æó¡¢ÍâÆó¡¢×Ô¼º×öÉúÒâµÄÇé¿ö£¬ÕâЩµ¥Î»ÊDz»²éѯ±ÏÒµÖ¤ÕæαµÄ£¬¶øÇÒ¹úÄÚûÓÐÇþµÀÈ¥²éѯ¹úÍâÎÄƾµÄÕæ¼Ù£¬Ò²²»ÐèÒªÌṩÕæʵ½ÌÓý²¿ÈÏÖ¤¡£¼øÓÚ´Ë£¬°ìÀíÃÀ¹ú³É¼¨µ¥Íþ˹¿µÐÇ´óѧÃܶûÎÖ»ù·ÖУ±ÏÒµÖ¤¡¾qÞ±1954292140¡¿¹úÍâ´óѧ±ÏÒµÖ¤, ÎÄƾ°ìÀí, ¹úÍâÎÄƾ°ìÀí, ÁôÐÅÍøÈÏÖ¤Making Heritage Inclusive at Shivsrushti - How a single donation made cultura...

Making Heritage Inclusive at Shivsrushti - How a single donation made cultura...Raj Kumble

?

Learn how Shivsrushti, with support from the Abhay Bhutada Foundation, is blending storytelling and technology for inclusive cultural education.

conditionals1 cccccccccccccccccccccc.ppt

conditionals1 cccccccccccccccccccccc.pptAhaf5

?

eeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeC.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 202...

C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 202...imccci

?

C.H. BHABHA MEMORIAL ENDOWMENT PUBLIC MEETING ON ANALYSIS OF UNION BUDGET 2025-26

chapter 5.pptx: Urban Poverty and Public Policy

chapter 5.pptx: Urban Poverty and Public PolicyAtoshe Elmi

?

This chapter analysis Urban Poverty and Public Policy Why the Most Successful Restaurants Never Touch Their Own Books.pdf

Why the Most Successful Restaurants Never Touch Their Own Books.pdfPacific Accounting & Business Services

?

Discover why thriving restaurants outsource accounting: navigate compliance, manage diverse revenue from platforms, and master financial strategies for success.

https://www.pacificabs.com/knowledge-center/blog/restaurant-accounting-services-why-owners-never-touch-their-books/Invoice Factoring Broker Training | Charter Capital

Invoice Factoring Broker Training | Charter CapitalKeith Mabe

?

If you are new to brokering invoice factoring deals. Here is a quick primer to get you started.SWING TRADING COURSE BY FINANCEWORLD.IO (PDF)

SWING TRADING COURSE BY FINANCEWORLD.IO (PDF)AndrewBorisenko3

?

Ride the Market Waves ¨C Swing Trading Course by FinanceWorld.io

Discover the smart way to profit from market ups and downs with FinanceWorld.io¡¯s comprehensive Swing Trading Course. This detailed PDF guide is perfect for those seeking a flexible, effective trading style that fits busy schedules, providing you with the strategies and confidence to capture short- to medium-term gains.

What¡¯s Inside This Course:

Introduction to swing trading and how it compares to day and long-term trading

Understanding market cycles and spotting profitable opportunities

Tools and platforms for successful swing trading

Technical analysis: identifying trends, support & resistance, and reversal patterns

Fundamental factors that influence price swings

Entry and exit timing techniques for maximum profit

Position sizing and risk management essentials

Swing trading psychology and staying disciplined

Case studies, real-world trade examples, and practical tips

Who Should Download This PDF?

Aspiring traders seeking a balance between day trading and investing

Busy professionals who want to trade without monitoring markets all day

Anyone looking to improve their trading results with proven, actionable strategies

Why FinanceWorld.io?

Our clear, step-by-step guidance and expert insights make swing trading accessible to all, from beginners to those wanting to refine their approach. FinanceWorld.io gives you the knowledge and confidence to trade smarter, not harder.Family Owned Business Succession/Estate Planning

Family Owned Business Succession/Estate Planningimccci

?

Family Owned Business Succession/Estate PlanningShakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24

Shakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24Business Analysis

?

Qualitative Fundamental Analysis of Shakti Pumps (India) share for its future growth potential (based on the Annual Report FY2024)

Get a sense of the Shakti Pumps (India)'s business activities, by understanding its values, business and risks.

YouTube video: https://youtu.be/lx5SxXcu90g

Order a printed copy of this presentation: BusinessAnalysis.BA.info@gmail.com

--

Disclaimer:

We are not SEBI RIAs. This presentation is not an investment advice. It is only for study and reference purposes.The Rise of UPI & Cashless Transactions: How Mobile Payment Apps Are Transfor...

The Rise of UPI & Cashless Transactions: How Mobile Payment Apps Are Transfor...Digital Shende

?

Explore how UPI (Unified Payments Interface) and mobile payment apps like Google Pay, PhonePe, Paytm, and Amazon Pay are revolutionizing financial transactions in India. This ºÝºÝߣShare delves into the business models behind these apps, why their services are free, and how they profit from commissions, data, and additional financial products. Discover the strategic shift towards becoming super apps, offering a full suite of financial services beyond simple payments. Perfect for anyone interested in fintech, digital payments, and the future of banking in India.

Family Governance Presentation by Dinesh Kanabar

Family Governance Presentation by Dinesh Kanabarimccci

?

Family Governance Presentation by Dinesh Kanabar 15 2024Reviving Heritage through the Abhay Bhutada Foundation¡¯s Support.pdf

Reviving Heritage through the Abhay Bhutada Foundation¡¯s Support.pdfRaj Kumble

?

This presentation unfolds over seven slides, beginning with an introduction to Shivsrushti¡¯s immersive design and historical focus. It then highlights the strategic nature of the Abhay Bhutada Foundation¡¯s support, emphasizing long-term maintenance and educational outreach. The deck explores how the park integrates modern technology to engage visitors, followed by its inclusive access programs for underprivileged students and rural communities. Hands-on learning experiences and community empowerment initiatives illustrate the park¡¯s commitment to active participation and local development. Finally, the presentation concludes by reflecting on the leadership lessons imparted through Shivsrushti and the enduring cultural impact of the Foundation¡¯s patronage.Shivsrushti¡¯s Cultural Revival Backed Strongly by Abhay Bhutada Foundation.pdf

Shivsrushti¡¯s Cultural Revival Backed Strongly by Abhay Bhutada Foundation.pdfLokesh Agrawal

?

Shivsrushti, a cultural theme park near Pune dedicated to the legacy of Chhatrapati Shivaji Maharaj, has received strong and consistent support from the Abhay Bhutada Foundation. Under the guidance of historian Babasaheb Purandare, the park blends traditional fort replicas with modern technology like augmented reality and interactive exhibits to make history come alive. The Foundation¡¯s contributions have enabled operational upgrades, improved access for underprivileged students, and introduced mobile museums that take cultural learning to remote areas. Through hands-on workshops and community involvement, Shivsrushti promotes both education and local skill development. With plans for digital centres and cultural exchange, the Foundation¡¯s long-term commitment is helping transform the park into a vibrant, forward-looking hub of historical learning.Why the Most Successful Restaurants Never Touch Their Own Books.pdf

Why the Most Successful Restaurants Never Touch Their Own Books.pdfPacific Accounting & Business Services

?

Ad

Financial final

- 1. Profit and Loss 2013 2014 2015 Sales 259,344.00 100% 990,648.00 100% 1,040,648.00 100% Less: Cost of sales 214,991.40 82% 797,565.65 81% 822,565.65 79% Gross profit 44,352.60 17% 193,082.35 19% 218,082.35 21% Advertising Promotion 2,556.00 1% 10,236.00 1% 11,259.60 1% Salary and Wages 25,200.00 10% 147,840.00 15% 147,840.00 14% Utility Depreciation expense : furniture and fixture 5,100.00 2% 20,400.00 2% 22,440.00 2% - 1,405.00 0.14% 1,405.00 0.14% - 3,470.00 0.35% 3,470.00 0.35% Operating Expense : Depreciation expense : Equipment Total Operating Expense 32,856.00 13% 183,351.00 18% 186,414.60 17% Net income before tax 11,496.60 4% 9,731.35 2% 31,667.75 4% Tax 3% Net income after tax 344.89 291.94 950.00 11,151.71 9,439.41 30,717.72

- 2. Pro-forma Balance sheet 2013 2014 2015 ASSETS Current Assets: Cash Supplies Inventory Total Current Assets 100,000.00 1,215.00 8,854.00 110,069.00 114,963.99 1,215.00 8,854.00 125,032.99 131,239.01 1,215.00 8,854.00 141,308.01 Fixed Assets: Land Furniture and Fixtures (Net) Equipment (Net) Total Fixed Assets Total Assets 150,000.00 8,130.00 48,290.00 206,420.00 316,489.00 150,000.00 6,725.00 44,820.00 201,545.00 326,577.99 150,000.00 5,320.00 41,350.00 196,670.00 337,978.01 50,000.00 50,000.00 48,937.28 48,937.28 50,551.00 50,551.00 266,489.00 266,489.00 316,489.00 277,640.71 277,604.71 326,541.99 287,425.01 287,425.01 337,976.01 Liabilities and Owners Equity Current Liabilities Notes payable Total Current Liabilities Owners¡¯ Equity Streetwise Capital Total Owners Equity Total Liabilities and Owners Equity

- 3. Cash flow statement 2013 2014 2015 Operating Activity : Cash collected from Revenues Cash payment for expenses and inventory 44,352.60 193,082.35 218,082.35 inventory 6,173.61 6,173.61 6,173.61 Supplies 1,215.00 1,215.00 1,215.00 Advertising Promotion 1,800.00 10,236.00 11,259.60 Salary and Wages 16,800.00 147,840.00 147,840.00 utility 3,400.00 20,400.00 22,440.00 Cash payments for expenses and inventory 29,388.61 185,864.61 188,928.21 Net cash flow from operating activities 14,963.99 7,217.74 29,154.14 10,120.00 10,120.00 48,937.28 51,551.00 (50,000.00) (48,937.28) 64,963.99 16,275.02 41,887.86 Beginning Cash 50,000.00 114,963.99 127,278.72 Change In cash 64,963.99 16,275.02 41,887.86 Ending cash 114,963.99 131,239.01 169,166.58 Investing Activity: Purchase of Fixed Asset - Financing Activity: Issuance of Notes Payable 50,000.00 payment for notes payable Cash balance, 31 December 14 Cash reconciliation