Why SAVE With NSSF?

- 1. a better future. CHOOSE TO SAVE www.nssfug.org /nssfug nssfug 0800286773 TOLL - FREE LINE

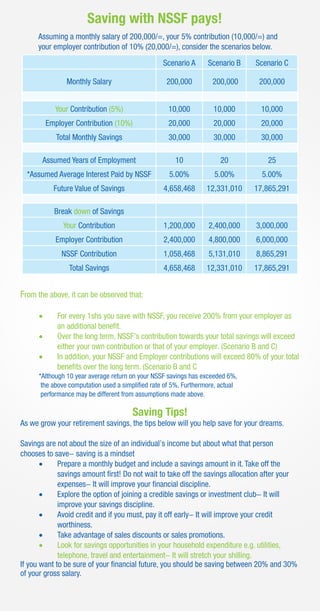

- 2. From the above, it can be observed that: • For every 1shs you save with NSSF, you receive 200% from your employer as an additional benefit. • Over the long term, NSSF’s contribution towards your total savings will exceed either your own contribution or that of your employer. (Scenario B and C) • In addition, your NSSF and Employer contributions will exceed 80% of your total benefits over the long term. (Scenario B and C *Although 10 year average return on your NSSF savings has exceeded 6%, the above computation used a simplified rate of 5%. Furthermore, actual performance may be different from assumptions made above. Saving Tips! As we grow your retirement savings, the tips below will you help save for your dreams. Savings are not about the size of an individual’s income but about what that person chooses to save- saving is a mindset • Prepare a monthly budget and include a savings amount in it. Take off the savings amount first! Do not wait to take off the savings allocation after your expenses- It will improve your financial discipline. • Explore the option of joining a credible savings or investment club- It will improve your savings discipline. • Avoid credit and if you must, pay it off early- It will improve your credit worthiness. • Take advantage of sales discounts or sales promotions. • Look for savings opportunities in your household expenditure e.g. utilities, telephone, travel and entertainment- It will stretch your shilling. If you want to be sure of your financial future, you should be saving between 20% and 30% of your gross salary. Scenario A Scenario B Scenario C Monthly Salary 200,000 200,000 200,000 Your Contribution (5%) 10,000 10,000 10,000 Employer Contribution (10%) 20,000 20,000 20,000 Total Monthly Savings 30,000 30,000 30,000 Assumed Years of Employment 10 20 25 *Assumed Average Interest Paid by NSSF 5.00% 5.00% 5.00% Future Value of Savings 4,658,468 12,331,010 17,865,291 Break down of Savings Your Contribution 1,200,000 2,400,000 3,000,000 Employer Contribution 2,400,000 4,800,000 6,000,000 NSSF Contribution 1,058,468 5,131,010 8,865,291 Total Savings 4,658,468 12,331,010 17,865,291 Assuming a monthly salary of 200,000/=, your 5% contribution (10,000/=) and your employer contribution of 10% (20,000/=), consider the scenarios below. Saving with NSSF pays!