Financial management- Intoduction

- 1. NTA UGC NET COMMERCE Financial Management Classes By- Sakshi Saxena

- 2. • Concept • Financial Goal-Profit Maximization & Wealth Maximization • Introduction to Capital Budgeting decisions Financial Management Classes By- Sakshi Saxena

- 3. • Financial management is that managerial activity which is concerned with planning and controlling of firm’s financial resources. • It has no unique body of knowledge. • The three most important activities of a business firm are- Production Marketing Finance Classes By- Sakshi Saxena

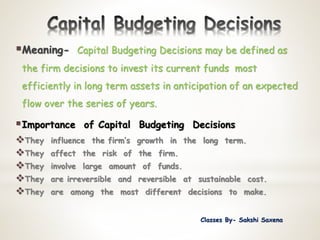

- 4. Meaning- Capital Budgeting Decisions may be defined as the firm decisions to invest its current funds most efficiently in long term assets in anticipation of an expected flow over the series of years. Importance of Capital Budgeting Decisions They influence the firm’s growth in the long term. They affect the risk of the firm. They involve large amount of funds. They are irreversible and reversible at sustainable cost. They are among the most different decisions to make. Classes By- Sakshi Saxena

- 5. Classes By- Sakshi Saxena  It influences the growth of the firm. It effect the risk of the firm. It involves the commitment of large amount for long period. They are most difficult decision to make. They are irreversible.

- 6. There are basically three types of investment decisions. They are as follows : oMutually Exclusive Investment oIndependent Investment o Contingent Investment Mutually Exclusive Investments : They serve the same purpose and compete with each other. Independent Investment Decisions They serve different purposes and do not compete with each other. Contingent Investment Decisions They are dependent projects the choice of one investment necessitates undertaking one or other investments. Classes By- Sakshi Saxena

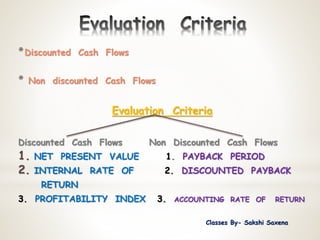

- 7. *Discounted Cash Flows * Non discounted Cash Flows Evaluation Criteria Discounted Cash Flows Non Discounted Cash Flows 1. NET PRESENT VALUE 1. PAYBACK PERIOD 2. INTERNAL RATE OF 2. DISCOUNTED PAYBACK RETURN 3. PROFITABILITY INDEX 3. ACCOUNTING RATE OF RETURN Classes By- Sakshi Saxena

Editor's Notes

- #5: They are the best decisions.