Financial presentation

- 3. By Failing to PrepareYou Are Preparing to Fail

- 5. SpirituallyRegular Church & Temple AttendanceTithing & Other OfferingsMagnify Your CallingsPrayer & Holy GhostTemporally Food StorageHealthy ActivitiesFinancial Soundness

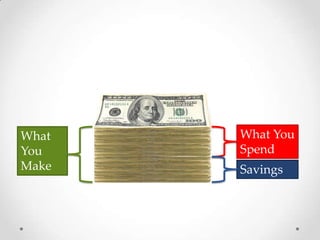

- 7. Financial SoundnessWhatYou MakeWhat You SpendSavings

- 8. Earnings

- 9. What You SpendQuestion: Need? Or Want?

- 14. Credit Card Payment15% Rate$2,000 Balance$50 Payments57 Month (5yrs)Cost = $2,850$850

- 15. Car Payment8% Rate$25,000 Loan$500 Payments62 Months (5+yrs)Cost = $31,000$8,000 ($23,000)

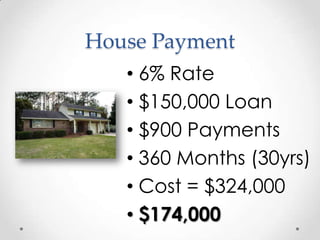

- 16. House Payment6% Rate$150,000 Loan$900 Payments360 Months (30yrs)Cost = $324,000$174,000

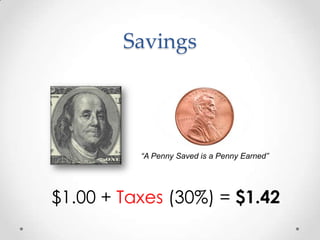

- 17. Savings“A Penny Saved is a Penny Earned”$1.00 + Taxes (30%) = $1.42

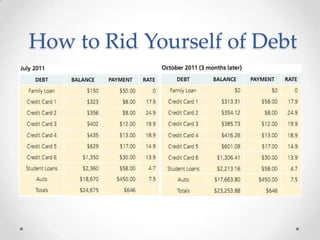

- 20. How to Rid Yourself of Debt

- 21. WhatYou MakeWhat You SpendSavings

- 22. What You SpendWhatYou MakeSavings

- 25. Pay the debt thou hast contracted.Release thyself from bondage.D&C 19:35

Editor's Notes

- #2: It’ doesn’t have to be a balancing act.

- #3: The problem is choice. We have more choices and options nowadays.

- #5: Mathew 25: 1-13Were the 5 wise virgins wrong?By choosing not to prepare yourself are you relying on others to share with you? Is that fair?

- #6: There are two main ways of being prepared. Spiritually and Temporally

- #7: What is Financial Soundness?

- #8: Simple math, Make more or spend less to increase the gap of money you have to save with.

- #9: Ways to earn more. Education, 2nd job, small season jobs, spare time jobs like computer repair, selling produce from your garden

- #10: What do we truly need. And what do we spend on empty short lasting wants?

- #11: Make instead of buying gifts. Research brands before you buy. Ten second rule. Wait ten seconds pondering if it is a want or a need.

- #12: Adjust the Thermostat and put on a sweater or turn on a ceiling fan. Turning your thermostat down in the Winter and Up ion the Summer can save you more than you think.

- #13: Turn off the TV. Spend the time elsewhere with family, magnifying church callings. Don’t let the idiot box lead you around and tell you what you should believe. Read.

- #16: This is assuming you have good credit. At the end of the loan your card (if in good condition with 90,000 miles is worth $8,000 with a net loss of $23,000.

- #17: But your house could be worth more, however this only is worth it to you if you plan to sell.

- #18: A Penny saved is actually more than a penny earned when you take into account the taxes you pay.

- #19: Never go into debt except for a house, education or a sound business venture. Its better to repair a current car than buy a new one. If you are in debt, take steps to get out today.

- #21: There are two main ways to accomplish this. The smallest first or the costliest first.

- #24: As you “knock off” debts you get motivated. Apply the payments to the debts that are paid off to the next debt and you get an effective snowball effect.

- #25: Break the chains that you have created and be free

- #26: “We are carrying a message of self-reliance throughout the Church. Self-reliance cannot obtain when there is serious debt hanging over a household. One has neither independence nor freedom from bondage when he is obligated to others.”National Debt - Currency