Fiscal cliff & its impact on india

Download as pptx, pdf0 likes352 views

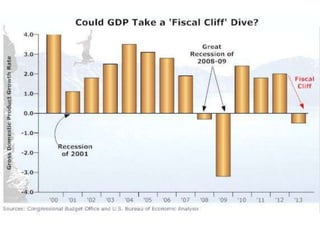

The document discusses the fiscal cliff faced by the US economy at the end of 2012. It was caused by the simultaneous expiration of tax cuts and introduction of tax increases and spending cuts. This would have pushed the US back into recession. The fiscal cliff was not caused by typical economic crises but rather the expiration of a number of laws providing tax relief and spending measures. These automatic changes would have raised taxes and cut spending starting in 2013 without Congressional action. The fiscal cliff threatened negative impacts on the US and Indian economies through reduction in consumption, business investment, and outsourcing. It could also increase inflation in India through higher gold prices and a weaker rupee.

1 of 13

Download to read offline

Ad

Recommended

Policy lags and crowding out

Policy lags and crowding outvideoaakash15

╠²

This document discusses policy lags, the crowding-out effect, and how monetary and fiscal policy tools can impact inflation and real output in the short-run. It defines inside lags as the time for policymakers to recognize the need for and implement policy changes, and outside lags as the time for an economy to respond to policy. Crowding-out refers to how increased government borrowing to finance deficits can increase interest rates and crowd-out private borrowing and investment. The document uses aggregate demand and supply models to illustrate these concepts and how monetary policy actions like changing the money supply can lessen or reinforce the crowding-out effect of fiscal policy.Tutorial: Is the Government Debt Out of Control?

Tutorial: Is the Government Debt Out of Control?Ed Dolan

╠²

The tutorial discusses concerns over U.S. government debt and its sustainability, explaining that debt levels can be assessed through metrics like debt-to-GDP ratios and primary structural balances. As of 2015, the Congressional Budget Office estimates indicated a manageable federal deficit, with projections suggesting that debt growth may become problematic post-2019 due to demographic changes and increased spending. Overall, the evidence does not support the idea that the federal debt is currently out of control, provided that appropriate policy measures are taken.HFIN Economic Impacts of Fiscal Options - draft conclusions (ISER 2.25.2016)

HFIN Economic Impacts of Fiscal Options - draft conclusions (ISER 2.25.2016)Brad Keithley

╠²

The document discusses the economic impacts of various fiscal options in Alaska, including spending cuts, taxes, and dividend reductions, without advocating for any specific option. It highlights the direct effects on different income groups and the overall Alaskan economy, pointing out that most options would reduce disposable income and potentially lead to job losses. Furthermore, the study warns of the pressing need to address the deficit to avoid significant negative economic consequences for the state.25 government debt

25 government debtBaterdene Batchuluun

╠²

The document discusses government debt and budget deficits. It defines government debt as the accumulation of all past annual budget deficits, where the budget deficit equals government spending minus revenue. It also discusses different ways of measuring the deficit and debt, including adjusting for inflation, subtracting assets, and including hidden liabilities. Finally, it discusses debates around the traditional and Ricardian views of how budget deficits and debt affect the economy.US Budgeting

US BudgetingInfinity Business School

╠²

The document discusses the trade deficit and fiscal deficit issues facing the US economy. It provides an overview of key economic indicators like GDP, inflation, and monetary and fiscal policies. It then analyzes the US trade deficit in more depth, noting that imports exceeded exports in 2010, leaving a $43 billion deficit. Major trade partners with deficits are China, Canada, and Mexico. The document also examines the country's large fiscal deficit, which was $1.56 trillion in 2010 and has historically increased government debt levels over time. A variety of approaches to balancing the deficit are mentioned, including increasing tax revenues, reducing spending, and issuing more government bonds.Government and Fiscal Policy

Government and Fiscal PolicyLumen Learning

╠²

Fiscal policy uses changes in government spending and taxation to influence economic activity. It is a tool governments can use to address recessions or inflation. When the economy is in recession, expansionary fiscal policy like tax cuts or increased spending can boost aggregate demand. When the economy is overheating, contractionary fiscal policy such as tax increases or spending cuts can cool it down. However, fiscal policy is difficult to implement effectively in practice as politicians often fail to enact contractionary policy in good times. This has led to large budget deficits and government debt over time in many countries.Test Today

Test Todaywebmommee SuperMom

╠²

1) The Congressional Budget Office presentation discusses the challenges of estimating the federal budget and economy in light of the fiscal stimulus and ongoing recovery from recession.

2) It notes that while the recovery is underway, several factors will dampen its strength, including financial market fragility and restrained household spending.

3) A key issue is that under current policies, spending for programs like Social Security and Medicare will exceed total federal revenues by 2020, meaning significant changes will be needed to taxes or other spending.The Budget Deficit

The Budget DeficitNational Journal Membership

╠²

The document discusses the federal budget deficit, which was $1.1 trillion for fiscal year 2012, highlighting that government spending significantly exceeded revenue. It predicts a decrease in the deficit from 2012 to 2015, yet anticipates that it will remain historically high through the next decade and increase again by 2023 due to rising health care and entitlement costs. Key terms and factors affecting the deficit are outlined, alongside projections for future deficits.Glide Paths from the Fiscal Cliff

Glide Paths from the Fiscal CliffKishore Jethanandani, MBA, MA, MPhil,

╠²

Companies are taking actions to minimize the impact of potential tax increases resulting from the fiscal cliff negotiations between Congress and the President. These actions include paying special dividends, accelerating acquisitions and capital gains realization, and leveraging overseas cash to fund domestic dividends. The fiscal cliff uncertainty is also impacting the corporate bond market as companies raise funds at current low rates in preparation for potential economic recession. The document then outlines four scenarios for how the fiscal cliff negotiations may play out and the expected economic impacts of each.Ashley dsol

Ashley dsolsarahmotes

╠²

The document discusses the growing problem of government debt in the United States. It notes that the annual deficit has grown substantially in recent years, reaching over $1 trillion in 2010 and 2011. This level of deficit requires significant government borrowing each year. The total national debt held by the public is over $10 trillion. Cutting spending, raising taxes, and economic growth are the three main strategies proposed to address the debt, but each faces challenges. The high and growing level of debt poses economic risks going forward.Recession

RecessionDiksha Saxena

╠²

The document discusses recession, its causes and impacts. It defines recession as a period of reduced economic activity lasting more than a few months, as measured by declines in GDP, income, employment, production and sales. Common causes are listed as currency/energy crises, underconsumption, overproduction and fiscal policy issues. The Great Recession of 2007-2009 is summarized as the largest global economic decline since WWII, caused by issues like the housing market crisis and excessive private debt levels. Impacts included credit crunches, reduced savings, unemployment and falling sales/profits. Government responses to recession through fiscal and monetary policies aim to stimulate aggregate demand and recovery.State of Minnesota Economic Outlook: Implications for the System

State of Minnesota Economic Outlook: Implications for the SystemBecky LaPlant

╠²

This document summarizes the economic outlook and budget challenges facing the state of Minnesota through fiscal year 2013. It notes that state revenues have fallen below forecasts in recent years due to the recession. The state faces budget gaps in upcoming fiscal years due to slowing revenue growth and increasing spending pressures from an aging population. This will reduce funding available for higher education and the Minnesota State Colleges and Universities system.Averting a Fiscal Crisis

Averting a Fiscal CrisisCRFB.org

╠²

The document outlines the growing fiscal challenges faced by the U.S. government, projecting deficits and debt levels that may lead to a fiscal crisis if left unaddressed. Key drivers of increasing entitlement spending, insufficient revenues, and rising healthcare costs are identified, alongside potential consequences for economic growth and government investment. The authors advocate for immediate fiscal reforms to stabilize the budget and ensure generational fairness. 07 fiscal policy

07 fiscal policyNepDevWiki

╠²

ŌłåT = change in aggregate demand / tax multiplier

ŌłåT = -$500 billion / -4 = $125 billion

The correct answer is increasing taxes by $125 billion.US Fiscal Cliff Deal 2012

US Fiscal Cliff Deal 2012Naman Rastogi

╠²

The document discusses the U.S. fiscal cliff that arose at the end of 2012, outlining the implications of tax breaks expiration and spending cuts, and the response from the government through the American Taxpayer Relief Act of 2012. It analyzes the socio-economic impacts of the fiscal deal on various sectors of the economy and debates the effectiveness of the strategies adopted to manage the national debt. The research highlights both benefits and drawbacks of the government's decisions, emphasizing the need for a balance between tax revenue and sustained economic growth.Tax code spending, the fiscal cliff

Tax code spending, the fiscal cliffmslideshare11

╠²

This document summarizes the tax code changes and spending cuts that would go into effect on January 1, 2013 if Congress fails to act, known as the "fiscal cliff." Most individual income tax rates would increase substantially. Capital gains and dividend tax rates would also rise significantly. Spending cuts of 9.4% for defense and 8.2% for non-defense programs would take effect. The Congressional Budget Office predicts this would cause the economy to enter a recession with unemployment rising to over 9%. There is debate around a more balanced approach that raises revenues through tax reform in addition to spending cuts.CHAPTER 22 FISCAL POLICY

CHAPTER 22 FISCAL POLICYVisualBee.com

╠²

The document discusses the economic functions of the government which include educating citizens, maintaining national defense, providing public goods, and ensuring economic stability. It also describes how governments use fiscal policy tools like taxation and spending to influence aggregate demand, resource allocation, and income distribution. The document outlines how governments can run budget deficits or surpluses and use debt to manage cash flows. It notes that excessive debt can reduce resources available for production and investment and frustrate unemployed workers. The document concludes by discussing moratoriums on debt payments as a last resort during economic crises to provide time to stabilize finances.Unit 4.ppt

Unit 4.pptBethany Bryski

╠²

This document provides information about measuring economic performance, including GDP, GDP per capita, inflation, unemployment, and business cycles. It discusses how economists calculate GDP using the expenditures approach and defines real GDP. It explains how the consumer price index is used to measure inflation and defines the labor force in determining the unemployment rate. The document also introduces aggregate supply and demand analysis and how it can explain economic fluctuations between expansion, peak, contraction, and trough.Fiscal toolbox

Fiscal toolboxCRFB.org

╠²

The document summarizes a report from the Peterson-Pew Commission on Budget Reform that compares different fiscal policy tools for controlling government debt, such as targets, triggers, caps, and fail-safes. It notes that these tools have various advantages and disadvantages and that the right approach may incorporate aspects of several plans. The Commission's new Fiscal Toolbox resource compares tools based on their goals, enforcement mechanisms, exemptions, escape valves, and other factors to help policymakers design effective tools for addressing growing debt levels.Fiscal cliff jnap_8-1-12

Fiscal cliff jnap_8-1-12JP Marketing | NE

╠²

The 'fiscal cliff' refers to the combination of tax increases and spending cuts set to take effect on January 1, 2013, which could negatively impact the economy. The expiration of tax breaks and implementation of new taxes, including higher Medicare contributions for high earners, are key components of this issue. If not addressed, these changes could lead to a significant recession as projected by the Congressional Budget Office.Current issue in management

Current issue in managementLeomar Miano

╠²

The document discusses W. Edwards Deming and his contributions to quality management. It provides background on Deming, including that he was born in Iowa in 1900 and studied physics and statistics. It outlines Deming's famous 14 Points for management, which focus on continuous improvement, eliminating fear in the workplace, and involving all employees. It discusses some of Deming's key ideas, including that 85% of a worker's effectiveness depends on their environment, not individual skill. Deming believed in cooperation and eliminating competition between workers. His theory of profound knowledge emphasized understanding psychology and systems thinking. Deming had a significant impact on management practices in the 20th century by pioneering statistical quality control and total quality management.Federal budget slide show civic club version

Federal budget slide show civic club versionAlex Cardenas

╠²

This document discusses myths and realities about the US federal budget and deficits. It contends that tax policies rather than spending have mainly driven deficits since 1981. While spending cuts could help, the largest expenditure - wars and the military - is often treated as untouchable. It also argues that solving budget problems requires addressing growing inequality in wealth and political power between the richest 10% and everyone else. Specific myths debunked include claims that Social Security and Medicare contribute to deficits, and that tax cuts for the wealthy encourage job creation. Charts show how spending has changed under Democratic and Republican presidents.Tax Cuts and Jobs Act

Tax Cuts and Jobs ActDavid Doney

╠²

The document summarizes the key elements and economic impacts of the Tax Cuts and Jobs Act. It finds that the tax cuts will add $1-1.5 trillion to the national debt over 10 years, benefit high-income groups the most, and potentially increase the number of uninsured by 13 million people. While proponents claim it will boost economic growth and job creation, most experts estimate only a small, temporary GDP increase with limited benefits that fade over time. There are also risks that higher debt could crowd out private investment and increase the chances of a fiscal crisis.Haider Ellalee & Walid Y Alali; GDP Growth and the US Debt Sustainability

Haider Ellalee & Walid Y Alali; GDP Growth and the US Debt SustainabilityOxford Institute for Economic Studies

╠²

The document discusses the sustainability of U.S. debt amid rising economic challenges, emphasizing the need for a structured approach to managing both debt payments and economic growth. It evaluates conflicting opinions on government spending, taxation, and their implications for GDP and income inequality. The future projection indicates that without restructuring fiscal policy, sustaining high debt levels will become increasingly burdensome, potentially leading to economic instability.Joint Committee Report: Fact Sheet

Joint Committee Report: Fact SheetObama2012

╠²

The President's plan aims to boost economic growth and job creation through short-term investments while reducing the deficit over 10 years. It includes $4.4 trillion in deficit reduction through spending cuts, health care savings, and tax reforms. The plan cuts the payroll tax for workers and businesses, extends unemployment benefits, and invests in infrastructure to create jobs now while reducing tax breaks for the wealthy to cut the long-term deficit. If enacted, the national debt would fall to 73% of GDP by 2021 compared to 90.7% if no action is taken.Americas Hidden Debt Bombs

Americas Hidden Debt Bombsjenkan04

╠²

The document discusses America's growing debt problem and some potential solutions. It outlines several "hidden debt bombs" not captured in official debt figures, such as losses from Fannie Mae and Freddie Mac, unfunded promises for Social Security and Medicare, and reduced tax revenue from tax breaks. Some proposed solutions mentioned include raising the Social Security retirement age, reducing health insurance tax breaks, broadening the tax base, and considering new revenue options like a value-added tax.Fiscal policy

Fiscal policyUmair Aslam

╠²

Fiscal policy uses government spending, taxes, and borrowing to influence macroeconomic variables. Expansionary fiscal policy, such as tax cuts or increased spending, increases aggregate demand to boost a recession-plagued economy. Contractionary fiscal policy, like tax increases or spending cuts, decreases aggregate demand to curb inflation. Automatic stabilizers like unemployment insurance and the progressive tax system counter cyclical changes automatically. Discretionary policy actively manipulates fiscal tools but faces time lags and crowding out effects.Obama tax hikes

Obama tax hikesThe Heritage Foundation

╠²

This document analyzes the potential economic and fiscal effects of President Obama's proposed tax increases. It finds that enacting these tax increases would:

1) Slow economic growth significantly over the next decade, reducing GDP by $1.1 trillion total and eliminating hundreds of thousands of jobs each year on average.

2) Reduce business investment, personal savings, consumer spending and disposable income while increasing unemployment.

3) Have widespread negative impacts beyond just high-income taxpayers by slowing the overall economy, reducing job opportunities and income.

4) Exacerbate the country's fiscal problems by reducing the tax base as taxpayers adapt to higher rates, rather than solving the deficit issue through higher revenues alone. Congress shouldFiscal PolicyAll the people in the United States are effected by.docx

Fiscal PolicyAll the people in the United States are effected by.docxvoversbyobersby

╠²

The document discusses the effects of U.S. fiscal policies, including budget deficits, surpluses, and debt, on various groups such as taxpayers, future social security and Medicare users, the unemployed, and students. It highlights negative impacts like increased taxes and reduced government benefits due to deficits, while surpluses can lead to tax refunds and investment stimulation. Additionally, it addresses how these fiscal policies influence the U.S. financial reputation internationally and affect domestic industries like automotive and importing sectors.Deficit Spending After World War II

Deficit Spending After World War IIPamela Wright

╠²

The document discusses the differences between the national debt and the federal deficit of the United States. The federal deficit refers to the amount of money the government spends beyond what it collects in revenue each year. The national debt is the total accumulation of all past deficits minus any surpluses. Interest payments on the national debt contribute to the annual deficit. While deficits are not always negative, sustained large deficits pose risks if the money is not spent on investments that improve economic growth over the long term.More Related Content

What's hot (15)

Glide Paths from the Fiscal Cliff

Glide Paths from the Fiscal CliffKishore Jethanandani, MBA, MA, MPhil,

╠²

Companies are taking actions to minimize the impact of potential tax increases resulting from the fiscal cliff negotiations between Congress and the President. These actions include paying special dividends, accelerating acquisitions and capital gains realization, and leveraging overseas cash to fund domestic dividends. The fiscal cliff uncertainty is also impacting the corporate bond market as companies raise funds at current low rates in preparation for potential economic recession. The document then outlines four scenarios for how the fiscal cliff negotiations may play out and the expected economic impacts of each.Ashley dsol

Ashley dsolsarahmotes

╠²

The document discusses the growing problem of government debt in the United States. It notes that the annual deficit has grown substantially in recent years, reaching over $1 trillion in 2010 and 2011. This level of deficit requires significant government borrowing each year. The total national debt held by the public is over $10 trillion. Cutting spending, raising taxes, and economic growth are the three main strategies proposed to address the debt, but each faces challenges. The high and growing level of debt poses economic risks going forward.Recession

RecessionDiksha Saxena

╠²

The document discusses recession, its causes and impacts. It defines recession as a period of reduced economic activity lasting more than a few months, as measured by declines in GDP, income, employment, production and sales. Common causes are listed as currency/energy crises, underconsumption, overproduction and fiscal policy issues. The Great Recession of 2007-2009 is summarized as the largest global economic decline since WWII, caused by issues like the housing market crisis and excessive private debt levels. Impacts included credit crunches, reduced savings, unemployment and falling sales/profits. Government responses to recession through fiscal and monetary policies aim to stimulate aggregate demand and recovery.State of Minnesota Economic Outlook: Implications for the System

State of Minnesota Economic Outlook: Implications for the SystemBecky LaPlant

╠²

This document summarizes the economic outlook and budget challenges facing the state of Minnesota through fiscal year 2013. It notes that state revenues have fallen below forecasts in recent years due to the recession. The state faces budget gaps in upcoming fiscal years due to slowing revenue growth and increasing spending pressures from an aging population. This will reduce funding available for higher education and the Minnesota State Colleges and Universities system.Averting a Fiscal Crisis

Averting a Fiscal CrisisCRFB.org

╠²

The document outlines the growing fiscal challenges faced by the U.S. government, projecting deficits and debt levels that may lead to a fiscal crisis if left unaddressed. Key drivers of increasing entitlement spending, insufficient revenues, and rising healthcare costs are identified, alongside potential consequences for economic growth and government investment. The authors advocate for immediate fiscal reforms to stabilize the budget and ensure generational fairness. 07 fiscal policy

07 fiscal policyNepDevWiki

╠²

ŌłåT = change in aggregate demand / tax multiplier

ŌłåT = -$500 billion / -4 = $125 billion

The correct answer is increasing taxes by $125 billion.US Fiscal Cliff Deal 2012

US Fiscal Cliff Deal 2012Naman Rastogi

╠²

The document discusses the U.S. fiscal cliff that arose at the end of 2012, outlining the implications of tax breaks expiration and spending cuts, and the response from the government through the American Taxpayer Relief Act of 2012. It analyzes the socio-economic impacts of the fiscal deal on various sectors of the economy and debates the effectiveness of the strategies adopted to manage the national debt. The research highlights both benefits and drawbacks of the government's decisions, emphasizing the need for a balance between tax revenue and sustained economic growth.Tax code spending, the fiscal cliff

Tax code spending, the fiscal cliffmslideshare11

╠²

This document summarizes the tax code changes and spending cuts that would go into effect on January 1, 2013 if Congress fails to act, known as the "fiscal cliff." Most individual income tax rates would increase substantially. Capital gains and dividend tax rates would also rise significantly. Spending cuts of 9.4% for defense and 8.2% for non-defense programs would take effect. The Congressional Budget Office predicts this would cause the economy to enter a recession with unemployment rising to over 9%. There is debate around a more balanced approach that raises revenues through tax reform in addition to spending cuts.CHAPTER 22 FISCAL POLICY

CHAPTER 22 FISCAL POLICYVisualBee.com

╠²

The document discusses the economic functions of the government which include educating citizens, maintaining national defense, providing public goods, and ensuring economic stability. It also describes how governments use fiscal policy tools like taxation and spending to influence aggregate demand, resource allocation, and income distribution. The document outlines how governments can run budget deficits or surpluses and use debt to manage cash flows. It notes that excessive debt can reduce resources available for production and investment and frustrate unemployed workers. The document concludes by discussing moratoriums on debt payments as a last resort during economic crises to provide time to stabilize finances.Unit 4.ppt

Unit 4.pptBethany Bryski

╠²

This document provides information about measuring economic performance, including GDP, GDP per capita, inflation, unemployment, and business cycles. It discusses how economists calculate GDP using the expenditures approach and defines real GDP. It explains how the consumer price index is used to measure inflation and defines the labor force in determining the unemployment rate. The document also introduces aggregate supply and demand analysis and how it can explain economic fluctuations between expansion, peak, contraction, and trough.Fiscal toolbox

Fiscal toolboxCRFB.org

╠²

The document summarizes a report from the Peterson-Pew Commission on Budget Reform that compares different fiscal policy tools for controlling government debt, such as targets, triggers, caps, and fail-safes. It notes that these tools have various advantages and disadvantages and that the right approach may incorporate aspects of several plans. The Commission's new Fiscal Toolbox resource compares tools based on their goals, enforcement mechanisms, exemptions, escape valves, and other factors to help policymakers design effective tools for addressing growing debt levels.Fiscal cliff jnap_8-1-12

Fiscal cliff jnap_8-1-12JP Marketing | NE

╠²

The 'fiscal cliff' refers to the combination of tax increases and spending cuts set to take effect on January 1, 2013, which could negatively impact the economy. The expiration of tax breaks and implementation of new taxes, including higher Medicare contributions for high earners, are key components of this issue. If not addressed, these changes could lead to a significant recession as projected by the Congressional Budget Office.Current issue in management

Current issue in managementLeomar Miano

╠²

The document discusses W. Edwards Deming and his contributions to quality management. It provides background on Deming, including that he was born in Iowa in 1900 and studied physics and statistics. It outlines Deming's famous 14 Points for management, which focus on continuous improvement, eliminating fear in the workplace, and involving all employees. It discusses some of Deming's key ideas, including that 85% of a worker's effectiveness depends on their environment, not individual skill. Deming believed in cooperation and eliminating competition between workers. His theory of profound knowledge emphasized understanding psychology and systems thinking. Deming had a significant impact on management practices in the 20th century by pioneering statistical quality control and total quality management.Federal budget slide show civic club version

Federal budget slide show civic club versionAlex Cardenas

╠²

This document discusses myths and realities about the US federal budget and deficits. It contends that tax policies rather than spending have mainly driven deficits since 1981. While spending cuts could help, the largest expenditure - wars and the military - is often treated as untouchable. It also argues that solving budget problems requires addressing growing inequality in wealth and political power between the richest 10% and everyone else. Specific myths debunked include claims that Social Security and Medicare contribute to deficits, and that tax cuts for the wealthy encourage job creation. Charts show how spending has changed under Democratic and Republican presidents.Tax Cuts and Jobs Act

Tax Cuts and Jobs ActDavid Doney

╠²

The document summarizes the key elements and economic impacts of the Tax Cuts and Jobs Act. It finds that the tax cuts will add $1-1.5 trillion to the national debt over 10 years, benefit high-income groups the most, and potentially increase the number of uninsured by 13 million people. While proponents claim it will boost economic growth and job creation, most experts estimate only a small, temporary GDP increase with limited benefits that fade over time. There are also risks that higher debt could crowd out private investment and increase the chances of a fiscal crisis.Similar to Fiscal cliff & its impact on india (20)

Haider Ellalee & Walid Y Alali; GDP Growth and the US Debt Sustainability

Haider Ellalee & Walid Y Alali; GDP Growth and the US Debt SustainabilityOxford Institute for Economic Studies

╠²

The document discusses the sustainability of U.S. debt amid rising economic challenges, emphasizing the need for a structured approach to managing both debt payments and economic growth. It evaluates conflicting opinions on government spending, taxation, and their implications for GDP and income inequality. The future projection indicates that without restructuring fiscal policy, sustaining high debt levels will become increasingly burdensome, potentially leading to economic instability.Joint Committee Report: Fact Sheet

Joint Committee Report: Fact SheetObama2012

╠²

The President's plan aims to boost economic growth and job creation through short-term investments while reducing the deficit over 10 years. It includes $4.4 trillion in deficit reduction through spending cuts, health care savings, and tax reforms. The plan cuts the payroll tax for workers and businesses, extends unemployment benefits, and invests in infrastructure to create jobs now while reducing tax breaks for the wealthy to cut the long-term deficit. If enacted, the national debt would fall to 73% of GDP by 2021 compared to 90.7% if no action is taken.Americas Hidden Debt Bombs

Americas Hidden Debt Bombsjenkan04

╠²

The document discusses America's growing debt problem and some potential solutions. It outlines several "hidden debt bombs" not captured in official debt figures, such as losses from Fannie Mae and Freddie Mac, unfunded promises for Social Security and Medicare, and reduced tax revenue from tax breaks. Some proposed solutions mentioned include raising the Social Security retirement age, reducing health insurance tax breaks, broadening the tax base, and considering new revenue options like a value-added tax.Fiscal policy

Fiscal policyUmair Aslam

╠²

Fiscal policy uses government spending, taxes, and borrowing to influence macroeconomic variables. Expansionary fiscal policy, such as tax cuts or increased spending, increases aggregate demand to boost a recession-plagued economy. Contractionary fiscal policy, like tax increases or spending cuts, decreases aggregate demand to curb inflation. Automatic stabilizers like unemployment insurance and the progressive tax system counter cyclical changes automatically. Discretionary policy actively manipulates fiscal tools but faces time lags and crowding out effects.Obama tax hikes

Obama tax hikesThe Heritage Foundation

╠²

This document analyzes the potential economic and fiscal effects of President Obama's proposed tax increases. It finds that enacting these tax increases would:

1) Slow economic growth significantly over the next decade, reducing GDP by $1.1 trillion total and eliminating hundreds of thousands of jobs each year on average.

2) Reduce business investment, personal savings, consumer spending and disposable income while increasing unemployment.

3) Have widespread negative impacts beyond just high-income taxpayers by slowing the overall economy, reducing job opportunities and income.

4) Exacerbate the country's fiscal problems by reducing the tax base as taxpayers adapt to higher rates, rather than solving the deficit issue through higher revenues alone. Congress shouldFiscal PolicyAll the people in the United States are effected by.docx

Fiscal PolicyAll the people in the United States are effected by.docxvoversbyobersby

╠²

The document discusses the effects of U.S. fiscal policies, including budget deficits, surpluses, and debt, on various groups such as taxpayers, future social security and Medicare users, the unemployed, and students. It highlights negative impacts like increased taxes and reduced government benefits due to deficits, while surpluses can lead to tax refunds and investment stimulation. Additionally, it addresses how these fiscal policies influence the U.S. financial reputation internationally and affect domestic industries like automotive and importing sectors.Deficit Spending After World War II

Deficit Spending After World War IIPamela Wright

╠²

The document discusses the differences between the national debt and the federal deficit of the United States. The federal deficit refers to the amount of money the government spends beyond what it collects in revenue each year. The national debt is the total accumulation of all past deficits minus any surpluses. Interest payments on the national debt contribute to the annual deficit. While deficits are not always negative, sustained large deficits pose risks if the money is not spent on investments that improve economic growth over the long term.The Carlyle Group - The Economic Outlook

The Carlyle Group - The Economic OutlookAlyson Davis

╠²

The document discusses the looming 'fiscal cliff' in the U.S., where automatic deficit reduction could reduce the annual deficit by $607 billion, or nearly 4% of GDP, starting January 1, 2013, while also potentially pushing the economy into recession. Although this fiscal tightening would alleviate near-term fiscal issues, it is viewed as politically unfavorable and could result in a sharp economic contraction. The document concludes that while immediate action is needed to address ongoing deficits, an extension of current fiscal policies might lead to worse long-term economic outcomes.Fiscal Policy Essay

Fiscal Policy EssayPaper Writing Services Reviews

╠²

Fiscal policy uses government spending and taxation to influence economic activity. However, many economists and the CBO believe fiscal policy has little impact and that the economy is determined by private markets. The article argues that fiscal policy will need to be substantially expanded through increased government spending to avoid a prolonged recession, contradicting the current political view. It concludes that private borrowing cannot sustain the current expansion indefinitely and fiscal stimulus will be needed.Cbizmhm special report_fiscal-year-2016-budget-proposals

Cbizmhm special report_fiscal-year-2016-budget-proposalsCBIZ, Inc.

╠²

President Obama released his $3.99 trillion FY 2016 budget proposal calling for tax increases on higher-income individuals and businesses, expanded tax credits for families and education, and making some business tax breaks like research credit permanent. The budget also proposed international tax reforms including a one-time 14% tax on foreign earnings and a 19% minimum tax on foreign profits. Congressional Republicans and Democrats have indicated willingness to discuss tax reform but differ on key issues like rates and which deductions to eliminate.Contemporary Australian Fiscal Policy (2019)

Contemporary Australian Fiscal Policy (2019)AndrewTibbitt1

╠²

The document summarizes contemporary fiscal policy in Australia, specifically focusing on budget repair efforts since the global financial crisis. It discusses how the government has aimed to return the budget to surplus through spending restraint and maintaining tax revenue in order to reduce high net government debt levels. However, budget repair has been a slow process due to economic weakness, revenue shortfalls, and difficulties passing savings measures. The document also outlines tax reform proposals to address bracket creep in the income tax system by expanding brackets to prevent more people being pushed into higher tax brackets over time due to inflation.10 Key Components of the Fiscal Cliff

10 Key Components of the Fiscal CliffOpen Knowledge

╠²

The document outlines 10 key components of the fiscal cliff, detailing expiring tax breaks and automatic spending cuts set for the end of 2012, which could significantly impact the economy. It includes perspectives on each component from both Democrats and Republicans, highlighting their positions on issues like the Bush tax cuts, unemployment benefits, and healthcare law taxes. Overall, the potential fiscal cliff could have a total impact of 6.9% of GDP, amounting to $1.2 trillion.Prelude to union budget fy21

Prelude to union budget fy21Inves Trekk

╠²

The document discusses the challenges facing the Indian economy as it experiences a significant slowdown, emphasizing the urgent need for effective policy responses to break a vicious cycle of low growth and high unemployment. It critiques the government's aggressive reforms, noting their impact on economic stability, and calls for pro-business policies to foster entrepreneurship and investment. The finance minister is urged to avoid fiscal irresponsibility while focusing on structural changes to support economic recovery and growth.US Fiscal Cliff

US Fiscal CliffAnurag Agarwal

╠²

The document discusses the US fiscal cliff, which refers to a combination of expiring tax cuts and automatic spending cuts scheduled to take effect at the end of 2012. It would have resulted in tax increases of almost $400 billion and spending cuts of $160 billion in 2013. This would have significantly reduced GDP growth and increased unemployment. The document outlines the various tax cuts and spending policies that were set to expire and analyses the potential economic impact in both the US and globally if lawmakers failed to address the fiscal cliff. It concludes by discussing the deal passed by Congress and approved by Obama in January 2013 to avert most of the impacts of the fiscal cliff.Michael Taft, SIPTU post budget 2020 analysis 16 Oct 19

Michael Taft, SIPTU post budget 2020 analysis 16 Oct 19NevinInstitute

╠²

This document provides an analysis and summary of Ireland's Budget 2020. Some key points:

- The budget avoids using the term "recession" despite projections showing the Irish economy's GNI* measure will enter recession in 2020. Growth projections for GNI* are sluggish through 2024.

- In a disorderly Brexit scenario, the government is relying heavily on a Ōé¼1 billion contingency fund to stimulate the economy, but there may not be enough support if the recession is longer or deeper than expected.

- In an orderly Brexit scenario, real spending cuts of 2.8% for public services and 6% for social payments are projected through 2024 to maintain prudent budgets, but this will squeeze publicSpring Budget 2021: The big questions

Spring Budget 2021: The big questionsDeloitte UK

╠²

The 2021 budget outlines the UK's public financial outlook post-pandemic, highlighting lasting economic scars and anticipated pressures for future spending. The Chancellor has prioritized recovery support while signaling potential tax rises and an uncertain economic outlook due to factors like rising debt and interest rates. Despite a focus on maintaining a larger state to address various societal challenges, the government must balance sustainability with necessary investments and fiscal measures.The Spring Budget: The big questions

The Spring Budget: The big questionsDeloitte UK

╠²

The document discusses the outlook for the UK's public finances in the context of the 2021 budget, emphasizing persistent pressures on spending due to the pandemic and longer-term economic challenges. The Chancellor's strategy includes temporary fiscal support to aid economic recovery, while potential tax increases are anticipated to address future deficits. It also highlights the evolving perspective on borrowing and public spending since the global financial crisis, indicating a probable permanent increase in state size post-pandemic.Budget 2021 the big questions final

Budget 2021 the big questions finalDeloitte UK

╠²

The document discusses key questions around the UK's public finances in light of the 2021 budget. It notes that while the economic outlook has improved, the pandemic will likely leave lasting scars and elevated public borrowing. The Chancellor has extended many COVID support measures but only announced limited tax rises. There is debate around whether now is the right time to tackle high debt levels, as growth is the priority, but consideration of fiscal sustainability is also important. Any future deficit reduction would likely rely more on tax rises than spending cuts due to public sentiment against austerity.National Debt and How to Deal With It

National Debt and How to Deal With ItLuke Rzepiennik

╠²

The document discusses the national debt of the United States, which currently stands at over $18 trillion. It explores the history of rising US debt levels and the economic effects of increasing versus consolidating the debt. Increasing debt leads to higher interest rates, less investment, and reduced GDP growth. Consolidating debt has short-term negative effects but long-term benefits like lower interest rates and more funding for programs. The document also examines threats of sovereign default and financial crises based on examples from other countries.Budget Outlook

Budget Outlookjoshkaufman

╠²

The document discusses the federal budget deficit and its drivers. It notes that the deficit grew significantly from large surpluses in the early 2000s due to tax cuts, defense spending increases, and rising healthcare costs. Making the tax cuts permanent would cost trillions over time. The president's proposed budget would cut domestic programs and Medicaid while extending the tax cuts, worsening deficits. A balanced approach of spending cuts and revenue increases is recommended to reduce deficits in a responsible way.Haider Ellalee & Walid Y Alali; GDP Growth and the US Debt Sustainability

Haider Ellalee & Walid Y Alali; GDP Growth and the US Debt SustainabilityOxford Institute for Economic Studies

╠²

Ad

Fiscal cliff & its impact on india

- 1. By, Abijith Kavi, Shrishail M & Suresh A M

- 2. ’é¢ ŌĆ£Fiscal cliffŌĆØ is a phrase coined by Federal Reserve Chairman Ben Bernanke. WhatŌĆÖs the Fiscal Cliff? ’é¢ A situation in which sudden changes in government expenditure and taxation have a profound effect on a country's economy. ’é¢ This refers to the simultaneous expiry of tax breaks and the introduction of tax increases and spending cuts that were due at the end of 2012, the cumulation of which were expected to push the US back into recession. ’é¢ If Congress and President Obama do not act to avert this perfect storm of legislative changes, America will, in the media's terms, "fall over the cliff." Among other things, it will mean a tax increase the size of which has not been seen by Americans in 60 years.

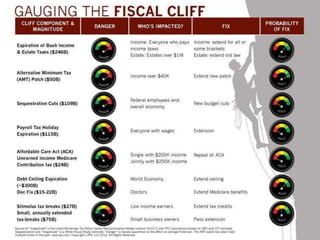

- 4. What Caused Fiscal Cliff ŌĆó Often, economic crises are caused by real physical problems ŌĆō like draught, war, demography or technological innovation that robs one economy of a competitive advantage over another. ŌĆó Other times, economic crises result when asset bubbles burst, or financial markets collapse. The Great Depression - and The Great Recession. ŌĆó The economic crisis of the moment - the "fiscal cliff" - does not result from any of these factors. In fact it is not a real "economic crisis" at all, except that it could inflict serious economic hardship on many Americans and could drive the economy back into recession.

- 5. A number of laws led to the fiscal cliff, including these provisions So what actually caused the cliff? ŌĆó Expiration of the Bush tax cuts enacted as part of the Economic Growth and Tax Relief Reconciliation Act of 2001 and the Jobs and Growth Tax Relief Reconciliation Act of 2003, as extended by the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010; ŌĆó Across-the-board spending cuts to most discretionary programs as directed by the Budget Control Act of 2011; ŌĆó Reversion of the Alternative Minimum Tax thresholds to their 2000 tax year levels; ŌĆó Expiration of measures delaying the Medicare Sustainable Growth Rate from going into effect as extended by the Middle Class Tax Relief and Job Creation Act of 2012.

- 6. C o n t i n u e d ŌĆó Expiration of the 2% Social Security payroll tax cut, most recently extended by MCTRJCA; ŌĆó Expiration of federal unemployment benefits, as extended by MCTRJCA. ŌĆó New taxes imposed by the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 ŌĆ” These provisions were to automatically go into effect on January 1, 2013 without new legislation Some provisions increased taxes while others reduced spending

- 7. CBO projections of the sources of deficit reduction in the FY2013 budget.

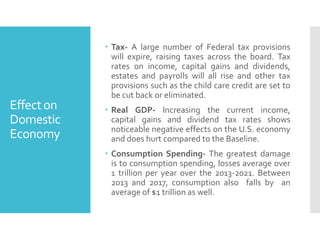

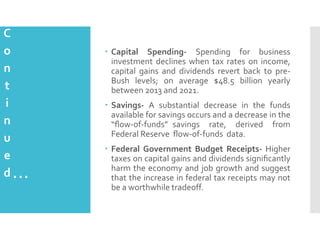

- 8. Effect on Domestic Economy ’é¢ Tax- A large number of Federal tax provisions will expire, raising taxes across the board. Tax rates on income, capital gains and dividends, estates and payrolls will all rise and other tax provisions such as the child care credit are set to be cut back or eliminated. ’é¢ Real GDP- Increasing the current income, capital gains and dividend tax rates shows noticeable negative effects on the U.S. economy and does hurt compared to the Baseline. ’é¢ Consumption Spending- The greatest damage is to consumption spending, losses average over 1 trillion per year over the 2013-2021. Between 2013 and 2017, consumption also falls by an average of $1 trillion as well.

- 9. C o n t i n u e d ’é¢ Capital Spending- Spending for business investment declines when tax rates on income, capital gains and dividends revert back to preBush levels; on average $48.5 billion yearly between 2013 and 2021. ’é¢ Savings- A substantial decrease in the funds available for savings occurs and a decrease in the ŌĆ£’¼éow-of-fundsŌĆØ savings rate, derived from Federal Reserve ’¼éow-of-funds data. ŌĆ” ’é¢ Federal Government Budget Receipts- Higher taxes on capital gains and dividends signi’¼ücantly harm the economy and job growth and suggest that the increase in federal tax receipts may not be a worthwhile tradeoff.

- 11. ’é¢ If American consumers have less money = they buy less= not good for Indian exporters (especially polished diamonds). Effect on Indian Economy ’é¢ Many American companies outsource their research and development work to India, particularly pharmaceuticals (clinical trials of drugs), software, engineering. If Obama removes the tax-benefits given to them (+consumer demand already down)= they'll either delay payments, cancel or renegotiate the contracts given to the Indian companies.

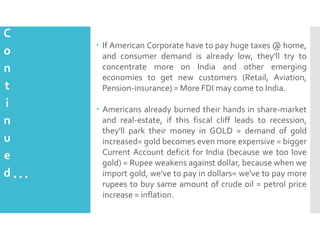

- 12. C o n t i n u e d ’é¢ If American Corporate have to pay huge taxes @ home, and consumer demand is already low, they'll try to concentrate more on India and other emerging economies to get new customers (Retail, Aviation, Pension-insurance) = More FDI may come to India. ŌĆ” ’é¢ Americans already burned their hands in share-market and real-estate, if this fiscal cliff leads to recession, they'll park their money in GOLD = demand of gold increased= gold becomes even more expensive = bigger Current Account deficit for India (because we too love gold) = Rupee weakens against dollar, because when we import gold, we've to pay in dollars= we've to pay more rupees to buy same amount of crude oil = petrol price increase = inflation.