Flood Insurance Update 11/2013

- 1. National Flood Insurance Program What you and Your Clients Need to Know about Rising Risks, Rising Rates and their Effects on Closing CostsŌĆ”. Sandy Emerson, NFS StoneRiver Regional Field Relations Manager

- 2. HISTORY OF THE NFIP ’üō Established when Congress passed the National Flood Insurance Act of 1968 ’üō The Flood Disaster Protection Act of 1973 amended the 1968 Act ’üō Administered by the Federal Insurance Mitigation Administration, a component of the Federal Emergency Management Agency (FEMA) ’üō 1983: The Write-Your-Own Program established

- 3. Who Needs Flood Insurance? All Owners of Insurable Property

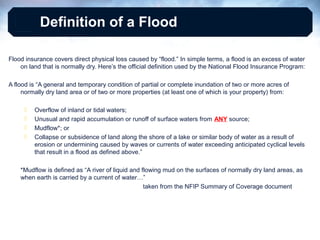

- 4. Definition of a Flood Flood insurance covers direct physical loss caused by ŌĆ£flood.ŌĆØ In simple terms, a flood is an excess of water on land that is normally dry. HereŌĆÖs the official definition used by the National Flood Insurance Program: A flood is ŌĆ£A general and temporary condition of partial or complete inundation of two or more acres of normally dry land area or of two or more properties (at least one of which is your property) from: ’üō ’üō ’üō ’üō Overflow of inland or tidal waters; Unusual and rapid accumulation or runoff of surface waters from ANY source; Mudflow*; or Collapse or subsidence of land along the shore of a lake or similar body of water as a result of erosion or undermining caused by waves or currents of water exceeding anticipated cyclical levels that result in a flood as defined above.ŌĆØ *Mudflow is defined as ŌĆ£A river of liquid and flowing mud on the surfaces of normally dry land areas, as when earth is carried by a current of waterŌĆ”ŌĆØ taken from the NFIP Summary of Coverage document

- 5. Single Peril Policy DIRECT PHYSICAL LOSS BY OR FROM FLOOD

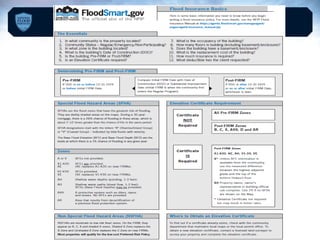

- 6. Pre-FIRM and Post-FIRM ’üō Pre-FIRM: ’āś Buildings built or substantially improved prior to December 31, 1974 OR prior to the date the community entered the regular program ’āś Insured has the option of using Pre-FIRM or Post-FIRM rates, whichever provides the best rates ’üō Post-FIRM: ’āś Building was built or substantially improved after the community entered the regular program ’āś Zone must be determined from the FIRM; Rates for coverage are based on the zone

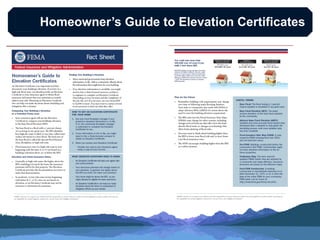

- 7. Elevation Certificates ’üō When are Elevation Certificates required? ’üō Where do I get an Elevation Certificate? ’üō Why are Elevation Certificates Required?

- 8. Click to edit Master title style 25-30% of Flood Insurance Claims originate in LOW to MODERATE RISK areas

- 9. Facts to Know and Remember ’üō Flood Policies duration (1 year) ’üō Policy Expiration and Renewal Process ’āś 30 day grace period without a lapse in coverage ’āś Reinstatement if paid between 31st and 90th days ’üō Federal Policy Fee: Mandated by Congress ’āś $40 on all standard flood insurance policies ’āś $20 on the PRP ’üō Full Premium must be submitted/uploaded with the application or the endorsement

- 10. Effective Dates - New Policies ’üō 30-Day Waiting Period from the date of application and presentment of premium for Voluntary Purchase

- 11. Exceptions to 30-Day Waiting Period ’üō Loan Closing ’üō Lender Portfolio Review ’üō Map Revision

- 12. Cancellations ’üō A flood policy may be cancelled at any time BUT ’üō A refund of premium money will only be made when a valid reason for cancellation is listed

- 14. Offer Flood Coverage ’üō Everyone is in a flood zone ’āś A Zones and V Zones ŌĆō SFHAŌĆÖs ŌĆó 1% chance of flooding in any given year ’āś B, C, X, D and A99 Zones ŌĆō Non SFHAŌĆÖs ŌĆó .2% chance of flooding in any given year ’üō Run a zone determination on every risk ’üō Offer flood insurance ’üō Document rejection with an Agency Responsibility Waiver form

- 15. Resources ’üō NFS, Stoneriver PO Box 2057 Kalispell, MT 59903-2057 800.637.3846 ’üō Write Your Own Company ’üō FEMA Websites ’āś www.agents.floodsmart.gov ŌĆó Co-Op Program ŌĆó Referral Program ’āś www.nfipiservice.com ’āś www.fema.gov/business/nfip ’āś http://bsa.nfipstat.com

- 16. What is BW 12ŌĆ”. ’üō The Biggert-Waters Flood Insurance Reform Act of 2012 is a law passed by Congress and signed by the President July 6, 2012 ’üō Many of the changes are designed to make the National Flood Insurance Program (NFIP) more financially stable ’üō Another purpose of these modifications is to ensure flood insurance rates more accurately reflect the real risk of flooding

- 17. Who Needs Flood Insurance? All Owners of Insurable Property

- 18. What Your Clients Need to KnowŌĆ” ’üō Flood Risks are Changing ŌĆó Risk may have increased since the last flood maps were created. ’üō Flood Insurance Rates Will Reflect those Changes ŌĆó With new flood insurance rate maps (FIRM), rates on properties will rise. ’üō Insured's Can No Longer Rely on Subsidized Rates ŌĆó Most subsidized rates for older properties will be eliminated. These are structures that were built before the flood maps were created for the Community. ’üō Building or Rebuilding higher lowers your risk and could save you money ŌĆó Consider the impact of flood insurance premiums when making construction decisions.

- 19. HomeownerŌĆÖs Guide to Elevation Certificates

- 20. Thank You!

Editor's Notes

- Basically, the government was trying to come up with a flood policy that would be available on a nationwide basis. In 1983, the Write Your Own program was established which meant that insurance companies could contract with the Federal Government agreeing to certain regulations and in doing so they would be able to write on their own paper. The same, rules, rates and regulations apply to each Write Your Own company.

- So who needs flood insurance? As you see here just about everyone; as long as they are eligible. So, make sure to offer it to owners of insurable properties and condo associations. Many times we still hear insureds say they are not in a flood zone so they donŌĆÖt need flood insurance. It is vital that we let them know everyone is in a flood zone! It may be that they are in a low risk zone, but the bottom line is they still need flood insurance.

- Flood is basically an excess of water on land that is normally dry. NFIP does follow a definition that is a little more detailed so letŌĆÖs take time to break it down and understand it better. The first part says it is a general and temporary condition of partial or complete inundation of 2 or more acres of normally dry land area, so if your insured owns 5 acres of land then we need at least 2 of those acres to be inundated with water that is normally not there. The definition continues with 2 or more properties at least one of which is yours. Now, the water can come from various sources. It can come from an overflow of inland or tidal waters; unusual and rapid accumulation or runoff of surface waters from any sourceŌĆ”.letŌĆÖs make sure we understand that oneŌĆ”it is telling us that the unusual and rapid accumulation or runoff of surface waters can come from other sources outside of rain or snow melting, so keep that in mind. The flooding can also be caused by mudflow or even collapse or subsidence of land along the shore of a lake or similar body of water as a result of erosion or undermining caused by waves or currents of water exceeding anticipated cyclical levels that result in a flood as defined above.

- When we talk about what flood covers we are talking about what was directly impacted by the flood waters. What was the direct physical loss by or from the flood to the insureds building and/or contents. We are not talking about additional living expenses, loss of use or loss of income. Those are not covered under the NFIP flood policy.

- Pre-Firm is defined as buildings built or substantially improved prior to December 31, 1974 OR prior to the date the community entered the regular program. If an insured has a pre-firm building then they have the option of using Pre-FIRM or Post-FIRM rates, whichever provides the best rates. This means they will either use an elevation certificate or not. Keep in mind, they donŌĆÖt have to have an elevation certificate if they are pre-firm, but if they do have one and it gives them a more beneficial rate then we would want to use it. If the building is post-firm then the building was built or substantially improved after the community entered the regular program. Zones must be determined from the FIRM. Rates for coverage are based on the zone. If the insured property is located in an A or V numbered, AE or VE zone, elevation certificates are required when they are post-firm.

- 25-30% of our flood losses come from those low risk areas and most of these property owners are the ones that think they donŌĆÖt need flood insurance. So, letŌĆÖs find out a little more about the PRP.

- The NFIP policy is for a 1 year term. A policy will renew without a lapse if the renewal premium payment is received within 30 days of the expiration date. If it is 31-90 days then it will have a 30 day lapse in coverage. After 90 days the agent must write a new policy. Fees: The Federal Policy fee is typically $40 and is not commissionable (the fee is higher on RCBAP policies). The flood policy is a ŌĆ£Cash with appŌĆØ policy. No partial payments accepted. Insureds can pay via check or credit card.

- There is a 30 day waiting period that applies to the flood policy when coverage is voluntarily purchased.

- Some exceptions would be a loan closing, lender portfolio review or a map revision. For a loan closing the policy will become effective the date of the loan closing. If there is a lender portfolio review and it is discovered that the property is in a SFHA then the policy will become effective the date of the application and presentment of premium. If there is a map revision then the insured has a 13 month period to take advantage of a 1 day waiting period.

- A flood policy may be cancelled at any time BUT A refund of premium money will only be made when a valid reason for cancellation is listed. There is a listing of these reasons in the NFIP manual so check out the manual.

- To wrap us up, Everyone is in a flood zone, some properties are at a higher risk of flooding than othersŌĆ”,Run a zone determination on every risk, Offer the coverage, Document rejection with an Agency Responsibility Waiver form.