Flowserve Has A Bright Future With Limited Risk - Flowserve Corporation (NYSE:FLS)

- 1. Flowserve Has A Bright Future With Limited Risk - Flowserve Corporation (NYSE:FLS) Summary With a series of strengths and differentiating factors, Flowserve's business model looks very strong. Diversification across various industries and geographic regions limit risk and maximize exposure to growth opportunities. The company's progress in the last few years has been fantastic and positions them for further success in coming years. Company And Market Overview Flowserve Corp. (NYSE: FLS) is an industrial flow management company that offers pumps, valves, seals, and more. Founded in 1912, Flowserve became the company it is known as today through a merger between two fluid motion companies in 1997. The company has roots in the industry dating as far back as 1790. Through organic growth and acquisitions, the company has grown tremendously and currently has 18,000 employees and a market capitalization of about $10 billion. In 2013, Flowserve had almost $5 billion in sales with about $486 million in net earnings. The company serves customers in the oil and gas, chemical, industrial, and other markets across the globe: (click to enlarge) Source: Company Website The flow management industry is definitely a market ready for considerable growth, and Flowserve aims to capture a significant amount of this. The pump, valve, and seal market has been growing

- 2. exceptionally well in the last few years. One of the primary drivers of this is GDP growth in developed nations around the world. As nations continue to grow in prosperity, it allows for greater investment in energy, infrastructure, and other areas where flow control systems play a key role. This trend is depicted in the chart below: Source: Analyst Day Presentation As you can see, Flowserve benefits from the growth of the overall economy. With the global economy still in recovery from the Great Recession, GDP growth can be expected to continue into the foreseeable future: Source:OECD Website Additional driving factors include population growth, higher demand for energy to help growing populations thrive, and increased industrial production (has been on the rise and should continue as the economy recovers). Each of these are undeniable megatrends that will increase the demand for pumps, valves, and seals as a variety of infrastructure projects continue to pop up across numerous industries and geographies. Flowserve estimates the size of the total available market for pumps, valves, and seals to be about $130 billion. Flowserve addresses around 75% of this, which is a little under $100 billion. Clearly, the company has room for exponential growth. An Arsenal Of Competitive Strengths The company has numerous strengths that help it achieve operational excellence while serving customers' needs. The first notable strength the company has is remarkable punctuality. The company is renowned in the industry for having on time delivery. When someone is running a

- 3. business, it is critical to them that major components of the business's assets arrive on time. For the Flowserve's customers, this means delivering pumps, seals, and valves by a specified time that works for all parties involved. This helps Flowserve's customers run their businesses much more smoothly, as there are very few instances where operations would have to be delayed because a control system or part didn't arrive on time. This is part of the company's Continuous Improvement Process (CIP), which focuses on achieving customer fulfillment while maximizing internal productivity. The CIP also entails a Six Sigma business strategy accompanied by a focus on lean manufacturing. This has resulted in cost savings for the company. The next strength is the company's highly qualified management team, which has helped the company to achieve record revenues and earnings in recent years. With this group of men having already taken Flowserve to new heights, it will be interesting to see what they can achieve in the coming years: CEO Mark Blinn has held the position since October 2009. Starting back in 2004, he had served as CFO before taking this position and also had additional experience elsewhere in the industry prior to joining Flowserve. Having such a competent person to lead the company is an encouraging sign. The current CFO, Michael S. Taff, has held that title since 2012. Prior to joining Flowserve, he had bounced around as CFO of three other companies in related industries. Thomas L. Pajonas joined Flowserve in 2004 as President of the Flow Control Division. He has been SVP since 2006 and COO since 2012. A third major strength is superb product innovation. This means continually strengthening product lines as well as the portfolio of companies and brands under Flowserve. Maximizing both exploitation and exploration, Flowserve is always looking for ways to enhance current products while also developing new ones to extend product lines. Part of providing a great product is giving high quality education to both customers and employees. For this reason, the company has an extensive catalog of educational services to differentiate themselves. A recent product development is the addition of a linear base to actuators to expand the realm of applications and push the technology into new markets. With game changing improvements such as this one, Flowserve can satisfy customers even more. Historically, the company has invested large and growing amounts toward research and development. In fiscal 2013, the company has research and development expenses of $37.8 million. This is a nearly 30% increase from 2009 expenses. What this means is that going forward, we should see an increase in either the differentiation of existing products, or an extension of one or more product lines. Being in a fairly competitive environment, the continual improvement of the company's product arsenal is critical for staying relevant and maintaining strong customer relationships. With increased R&D spend, this may also be an indicator of higher sales in the near future due to improved products. R&D is especially important in an industry like Flowserve's where the products are nearly entirely judged on functionality. Even just small improvements in Flowserve's products that help customers operate more efficiently or profitably can be a true difference maker. Furthermore, continued investment in these products throughout time has evolved them to a world-class caliber. Customer Centric Culture Leads To Strong Relationships And Growth The highly effective management team has been the basis of the "One Flowserve" culture at the company. This initiative ensures that ethics, safety, and strong focus on customers serve as a powerful foundation for Flowserve. The culture is designed to fuel Flowserve in its efforts to gain market share, leverage current customer relationships, strategic investments, and operational

- 4. excellence. Just like a heavy focus on timeliness, this type of initiative improves customer relationships and internal performance. The company's "Customer Centric Culture" is a true differentiating factor, as management focuses reliability, customer service, product quality, and on time delivery. All of these focuses make Flowserve a wonderful company to do business with. Customer intimacy allows Flowserve to not just ship a small centrifugal pump few valves to a company, but be right by their side through the duration of a product, supplying flow control equipment whenever needed. With heavy involvement in a customer's business, Flowserve knows which of their products can help out the customer and in what ways. These products, as I have discussed, are very high quality due to heavy investment and significant improvements throughout the company's history. One of the key value adders that is aligned with this culture is the company's more than 140 Quick Response Centers around the globe. They serve customers' needs when it comes to new parts, repairs, service, and technical advice. These centers ensure that all customers are maximizing their return on their investment in Flowserve products. This keeps customers coming back. Most flygt pump mechanical seal installed pumps were not initially designed for their current use. Very frequently, a line in a factory is moved and the pump that at one time provided cooling fluid to an injection molding machine is now asked to move oil from a rail car to a tank. All too often, this causes a substantial number of problems for the pump and the company. Pumps operate where the pump curve crosses the system curve. If you move a pump from one system to another, this means that the system curve is different. This new system may cause the pump to operate away from its best efficiency point, leading to noise and other component problems that are merely symptoms of a mis-matched pump and system.for more. Although it seems clear enough that Flowserve has strong customer relationships, it might now be clear how exactly this impacts the company. Overall, Flowserve benefits from this customer centric model because it simply gets them more business by pleasing their customers. As I already addressed, research and development investments ensure that Flowserve has high quality products that get the job done. So, for example, let's say that Flowserve does a small amount of business with an oil and gas company. Perhaps they provide the company with control valves for their pipelines. Over time, the company will find that Flowserve has done the following: Increased their customer's efficiency and profitability through intelligent valve design Provided high quality products at realistic prices Provided a product that truly gets the job done and isn't more of a headache than a help Consistently built a strong relationship with the customer through timely delivery, technical assistance, and putting themselves last in each negotiation. When it comes time to sign a few new supplier contracts, the oil and gas company will likely continue getting their pipeline valves from Flowserve. Furthermore, they might even decide to get pumps, emergency shutdown valves, and sealing products from Flowserve as well. By putting the customer first, Flowserve increases their sales by always qualifying themselves and proving that their products are worthy of heftier orders. Instead of remaining content while doing a little business with their customers, Flowserve aims to get all they can out of each relationship. Diversification Creates Exposure To High Growth Markets While Shrinking Risk Flowserve is wonderfully diversified in multiple respects. Thanks to the large portfolio of reputable brands, Flowserve has over 10,000 customers across the globe. Management does not believe any

- 5. single customer makes up 10% or more of the company's sales. Operations are divided into three segments: Engineered Product Division (50% of revenues) Flow Control Division (32%) Industrial Product Division (18%) Furthermore, the charts below shows that Flowserve is diversified in terms of geography, end markets, and customer type: (click to enlarge) Source: Investor Presentation The significance of this diversification is that exposure to growth opportunities is very large, while risk is minimized. For example, the company derives 34% of sales from North America, much of which is probably from the US. This is a considerably reliable revenue source going forward. On the other hand, the company has exposure to emerging markets in Africa, Latin America, the Middle East, etc. As the drivers of success in each region is dependent upon the economic performance of that region, the performance in each area is relatively uncorrelated, thus decreasing risk. Of course, this doesn't work out the same way during global economic booms or downturns. But the company, in general, has significant exposure to emerging markets but can also rely on slow and steady growth in developed regions. Similarly, the drivers of success (and in turn greater investment, which results in more sales for Flowserve) among companies in the various industries that Flowserve targets are different, and thus risk is minimized yet again. With limited risk due to high diversification, the opportunities in emerging markets appear even more exciting, and Flowserve hasn't failed in their attempts to capitalize on them. In 2007, 36% of total bookings and 16% of total employees were in emerging markets. There are some basic improvements which ought tobe madeto a commercial centrifugal or positive displacement pump. Beginning with pumps containing overhung impellers, changing to a solid shaft is a easy upgrade over the more common sleeved shafts. Mechanical seals are able to be upgraded with tungsten carbide faces, and elastomers can be replaced with Viton. In conclusion, magnetic bearing protectors will be a huge step upin relationship to the lip seals which most industrial pumps depend on to prevent contamination of bearing sump oil. Those numbers have risen to 46% and 28%, respectively. The impact of this on the stock, over the long term, is eventual higher earnings as the company enters into high growth markets with demand

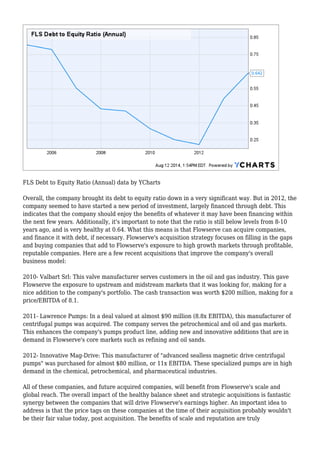

- 6. for flow control systems. But thanks to the great diversification, not only does the company have multiple revenue streams that it can capitalize on, but it has multiple revenue streams to fall back on if one of the less stable markets isn't getting the job done. Flowserve's Recent Success And Its Implications In the past few years, Flowserve has done extremely well. The strides that the company has made in sales, margins, efficiency, and more are best summarized by the table below: As you can see, Flowserve has become a better overall company in the last few years. Going forward, the progress that the company has made will come in handy. The particular area I would like to focus on is acquisitions. Around 2008, the company's current ratio was right around 1.5, and it's now making a run toward 2, currently at 1.83. The debt to equity ratio tells a similar story, except the inflection point has already come, as the chart below shows:

- 7. FLS Debt to Equity Ratio (Annual) data by YCharts Overall, the company brought its debt to equity ratio down in a very significant way. But in 2012, the company seemed to have started a new period of investment, largely financed through debt. This indicates that the company should enjoy the benefits of whatever it may have been financing within the next few years. Additionally, it's important to note that the ratio is still below levels from 8-10 years ago, and is very healthy at 0.64. What this means is that Flowserve can acquire companies, and finance it with debt, if necessary. Flowserve's acquisition strategy focuses on filling in the gaps and buying companies that add to Flowserve's exposure to high growth markets through profitable, reputable companies. Here are a few recent acquisitions that improve the company's overall business model: 2010- Valbart Srl: This valve manufacturer serves customers in the oil and gas industry. This gave Flowserve the exposure to upstream and midstream markets that it was looking for, making for a nice addition to the company's portfolio. The cash transaction was worth $200 million, making for a price/EBITDA of 8.1. 2011- Lawrence Pumps: In a deal valued at almost $90 million (8.8x EBITDA), this manufacturer of centrifugal pumps was acquired. The company serves the petrochemical and oil and gas markets. This enhances the company's pumps product line, adding new and innovative additions that are in demand in Flowserve's core markets such as refining and oil sands. 2012- Innovative Mag-Drive: This manufacturer of "advanced sealless magnetic drive centrifugal pumps" was purchased for almost $80 million, or 11x EBITDA. These specialized pumps are in high demand in the chemical, petrochemical, and pharmaceutical industries. All of these companies, and future acquired companies, will benefit from Flowserve's scale and global reach. The overall impact of the healthy balance sheet and strategic acquisitions is fantastic synergy between the companies that will drive Flowserve's earnings higher. An important idea to address is that the price tags on these companies at the time of their acquisition probably wouldn't be their fair value today, post acquisition. The benefits of scale and reputation are truly

- 8. underestimated. After joining Flowserve, the companies such as the ones I mentioned above have access to all of Flowserve's resources and expertise. With further product innovation, greater availability of capital, exposure to new suppliers (which likely already offer Flowserve substantial volume discounts), and other factors dramatically change the fate of the company. Valbart, Lawrence Pumps, and Innovative Mag-Drive are much better brands when they have the support of a massive corporation like Flowserve. Additionally, each of these companies complement Flowserve nicely by adding to their arsenal of well-respected brands. Brand heritage and reputation is a critical distinguishing factor for the company. Valuation As the charts below show, Flowserve has experienced continually rising multiples in the recent past. This is likely due to the success the company has enjoyed, which has set it up to achieve even greater success and growth in the coming years. FLS Price to Book Value data by YCharts

- 9. FLS PE Ratio (TTM) data by YCharts The chart below shows the fair value estimates of Flowserve's shares based on a discount rate of 11% and diluted EPS for the trailing twelve months of $3.53: Earnings Growth- Next Five Years 10% 12% 14% 16% 18% Terminal Growth Rate 3.50% $63.74 $69.08 $74.80 $80.90 $87.42

- 10. 4.00% $67.30 $72.98 $79.06 $85.55 $92.49 4.50% $71.42 $77.49 $83.98 $90.92 $98.33 As you can see, there is a decent amount of potential upside from current prices around $72, which justifies the high metrics. Assuming that continued growth will bring a little more multiple expansion, there is likely around 20% upside from here. Considering the fact that the company's diversified operations mitigate risk and expose the company to high growth industries and regions that could send five-year growth rates toward the right side of the table, Flowserve looks like a strong buy at these prices. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. (More...)