Foreign Trade Zone Benefits

- 1. Foreign Trade Zone Benefits Edison, New Jersey

- 2. What Benefits do Zones Offer? ŌĆó Increased flexibility with just-in-time delivery, quotas and reduced Customs delays. ŌĆó Duty elimination on: ŌĆō manufacturing in the U.S. and selling domestically. ŌĆō utilizing pick-and-pack operations where the "set" has a lower duty rate than the individual pieces. ŌĆó Duty-deferral until merchandise is shipped from the Zone into Customs territory. Merchandise may be held in a Zone indefinitely. ŌĆó Ability to hold most merchandise subject to quotas until the quota opens and/or the ability to bring such goods into the Zone and subsequently re-export them.

- 3. What can you do in an FTZ? A facility where goods may be: ŌŚÅ received ŌŚÅ stored ŌŚÅ manipulated ŌŚÅ manufactured ŌŚÅ exhibited ŌŚÅ examined ŌŚÅ tested ŌŚÅ calibrated ŌŚÅ destroyed ŌŚÅ exported ŌŚÅ repacked ŌŚÅ assembled ŌŚÅ mixed with domestic goods ŌŚÅ title transferred

- 4. Is an FTZ right for You? IF YOU ANSWER ŌĆ£YESŌĆØ TO ANY OF THE FOLLOWING THEN LOCATING IN AN FTZ CAN HELP. ’āś Do you manufacture, assemble or process with imports? ’āś Do you regularly pay more than $485 per week in merchandise processing fees? ’āś Do you scrap, reject, destroy, waste, or return some of your imports? ’āś Do you export previously imported materials?

- 5. Is an FTZ right for You? IF YOU ANSWER ŌĆ£YESŌĆØ TO ANY OF THE FOLLOWING THEN LOCATING IN AN FTZ CAN HELP. ’āś Do you have to wait long periods of time for your orders to get through border customs? ’āś Do you sell your imported products to companies that reside in Foreign Trade Zones? ’āś Are you selling to the military? ’āś Are you currently utilizing a Customs tariff- reduction program?

- 6. FTZ Savings ŌĆó Derived exclusively from a tax management approach to U.S. Customs Duties and Fees. ŌĆó Realized in Four Ways: - Customs Duty Elimination - Scrapping, Exports - Customs Duty Reduction - Inverted Tariffs - Customs Fee Reductions - Merchandise Processing Fees (MPF) - Deferral of Customs Duty Payment ŌĆō Inventory (a one time benefit usually the least profitable of the 3)

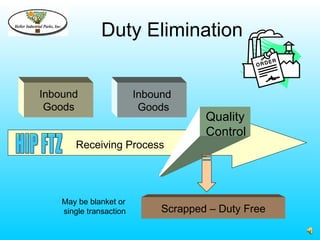

- 7. Duty Elimination Inbound Inbound Goods Goods Quality Control Receiving Process May be blanket or single transaction Scrapped ŌĆō Duty Free

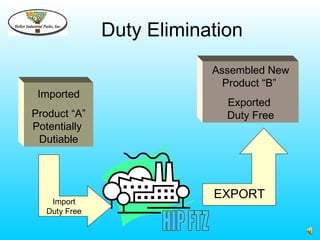

- 8. Duty Elimination Assembled New Product ŌĆ£BŌĆØ Imported Exported Product ŌĆ£AŌĆØ Duty Free Potentially Dutiable EXPORT Import Duty Free

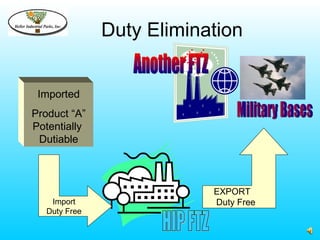

- 9. Duty Elimination Imported Product ŌĆ£AŌĆØ Potentially Dutiable EXPORT Import Duty Free Duty Free

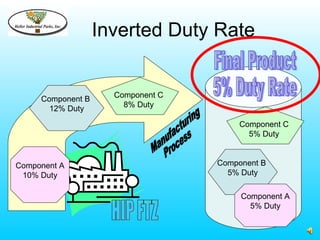

- 10. Inverted Duty Rate Component B Component C 12% Duty 8% Duty Component C 5% Duty Component A Component B 10% Duty 5% Duty Component A 5% Duty

- 11. Merchandise Process Fees Companies outside an FTZ pay a .21% merchandise fee per shipment. The minimum fee is $25.00 with the maximum being $485.00. The maximum is reached with a shipment valued at $230,952.00. In an FTZ the company lumps all shipments for a week into one filing resulting in a $485.00/week maximum fee. 15 shipments/week $485 x 15 = MPF $7275 Shipments into commerce 15 shipments/week 1 entry filed at end of week. MPF $485 Shipments into commerce with weekly entry

- 12. Deferred Duty Product ŌĆ£AŌĆØ Duty Owed Product ŌĆ£AŌĆØ Duty Paid

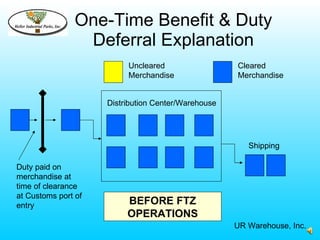

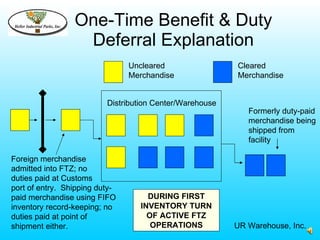

- 13. One-Time Benefit & Duty Deferral Explanation Uncleared Cleared Merchandise Merchandise Distribution Center/Warehouse Shipping Duty paid on merchandise at time of clearance at Customs port of entry BEFORE FTZ OPERATIONS UR Warehouse, Inc.

- 14. One-Time Benefit & Duty Deferral Explanation Uncleared Cleared Merchandise Merchandise Distribution Center/Warehouse Formerly duty-paid merchandise being shipped from facility Foreign merchandise admitted into FTZ; no duties paid at Customs port of entry. Shipping duty- paid merchandise using FIFO DURING FIRST inventory record-keeping; no INVENTORY TURN duties paid at point of OF ACTIVE FTZ shipment either. OPERATIONS UR Warehouse, Inc.

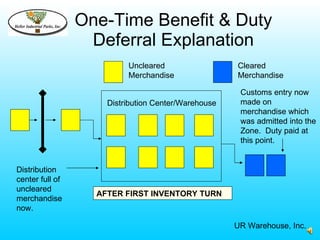

- 15. One-Time Benefit & Duty Deferral Explanation Uncleared Cleared Merchandise Merchandise Customs entry now Distribution Center/Warehouse made on merchandise which was admitted into the Zone. Duty paid at this point. Distribution center full of uncleared AFTER FIRST INVENTORY TURN merchandise now. UR Warehouse, Inc.

- 16. Other Benefits ŌĆó Lower administrative costs. ŌĆó Lower security and insurance costs. ŌĆó No time constraints on storage. ŌĆó Shorter transit time ŌĆō direct delivery. ŌĆó Improved inventory control. ŌĆó Informed customs officer

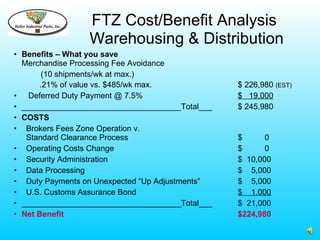

- 17. FTZ Cost/Benefit Analysis Warehousing & Distribution ŌĆó Benefits ŌĆō What you save Merchandise Processing Fee Avoidance (10 shipments/wk at max.) .21% of value vs. $485/wk max. $ 226,980 (EST) ŌĆó Deferred Duty Payment @ 7.5% $ 19,000 ŌĆó ____________________________________Total___ $ 245,980 ŌĆó COSTS ŌĆó Brokers Fees Zone Operation v. Standard Clearance Process $ 0 ŌĆó Operating Costs Change $ 0 ŌĆó Security Administration $ 10,000 ŌĆó Data Processing $ 5,000 ŌĆó Duty Payments on Unexpected ŌĆ£Up AdjustmentsŌĆØ $ 5,000 ŌĆó U.S. Customs Assurance Bond $ 1,000 ŌĆó ____________________________________Total___ $ 21,000 ŌĆó Net Benefit $224,980

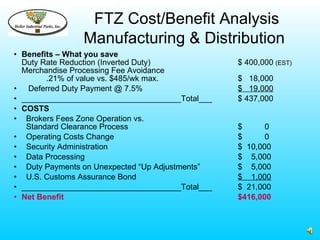

- 18. FTZ Cost/Benefit Analysis Manufacturing & Distribution ŌĆó Benefits ŌĆō What you save Duty Rate Reduction (Inverted Duty) $ 400,000 (EST) Merchandise Processing Fee Avoidance .21% of value vs. $485/wk max. $ 18,000 ŌĆó Deferred Duty Payment @ 7.5% $ 19,000 ŌĆó ____________________________________Total___ $ 437,000 ŌĆó COSTS ŌĆó Brokers Fees Zone Operation vs. Standard Clearance Process $ 0 ŌĆó Operating Costs Change $ 0 ŌĆó Security Administration $ 10,000 ŌĆó Data Processing $ 5,000 ŌĆó Duty Payments on Unexpected ŌĆ£Up AdjustmentsŌĆØ $ 5,000 ŌĆó U.S. Customs Assurance Bond $ 1,000 ŌĆó ____________________________________Total___ $ 21,000 ŌĆó Net Benefit $416,000