Forms 1118 And 5471

- 1. Compliance Aspects of the Forms 1118 and 5471North AmericanInternational Tax ConferenceEdward Umling CPA, LLMDecember 7, 20090

- 2. 1Form 1118 â Foreign Tax Credits â Corporations This form is not mandatory. It is used to claim a credit for income taxes paid to a foreign country on which U.S. taxes are also paid on the same income. You have up to 10 years to file this form!

- 3. Form 5471 â Information return of US Persons â Certain Foreign CorporationsForm 5471 is used by certain U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. The form and schedules are used to satisfy the reporting requirements of I.R.C. § 6038 and 6046. Form 5471 is due when your income tax return is due, including extensions. Attach Form 5471 and schedules to your income tax return. 2

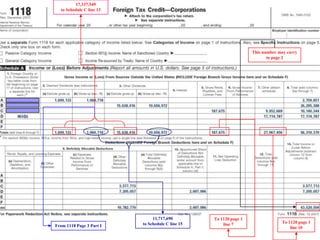

- 5. 4 17,337,549 to Schedule C line 13This number may carry to page 2 11,717,690 to Schedule C line 15To 1120 page 1 line 7To 1120 page 1 line 10From 1118 Page 3 Part I

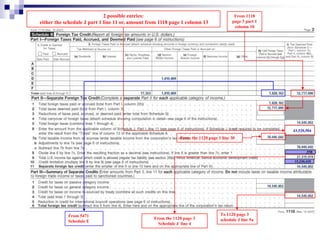

- 6. 52 possible entries: either the schedule J part 1 line 11 or, amount from 1118 page 1 column 13From 1118 page 3 part 1 column 1043,520,504From the 1120 page 1 line 30.55815,230,420To 1120 page 3 schedule J line 5a From 5471 Schedule EFrom the 1120 page 3 Schedule J line 4

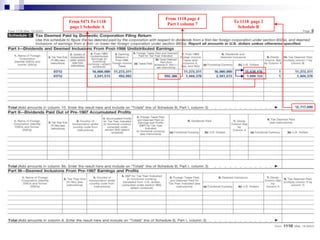

- 7. 6From 1118 page 4 Part 1 column 7To 1118 page 2 Schedule BFrom 5471 To 1118 page 1 Schedule A

- 8. 7To Page 3 Schedule C Column 6bFrom 5471 page 4 Schedule I

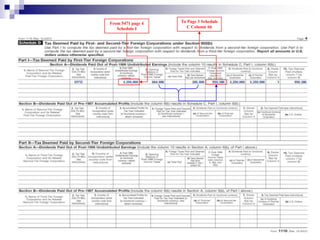

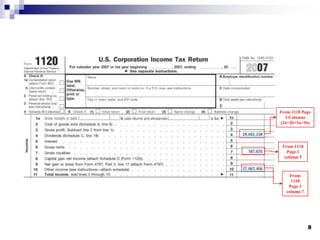

- 9. 8From 1118 Page 1 Columns (2a+2b+3a+3b)From 1118 Page 1 column 5From 1118 Page 1 column 7

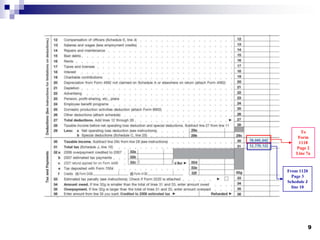

- 10. 9To Form 1118 Page 2 Line 7aFrom 1120 Page 3 Schedule J line 10

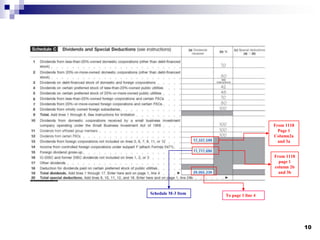

- 11. 10From 1118 Page 1 Column2a and 3aFrom 1118 page 1 column 2b and 3bSchedule M-3 ItemTo page 1 line 4

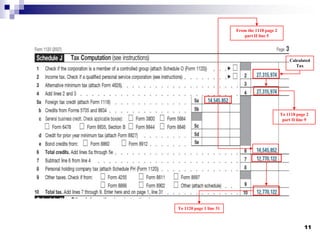

- 12. 11From the 1118 page 2 part II line 5Calculated TaxTo 1118 page 2 part II line 9To 1120 page 1 line 31

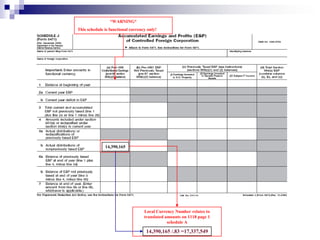

- 13. *WARNING* This schedule is functional currency only!14,390,165Local Currency Number relates to translated amounts on 1118 page 1 schedule A14,390,165 /.83 =17,337,549

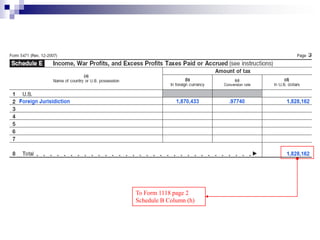

- 14. Actual Taxes Paid To Form 1118 page 2 Schedule B Column (h)

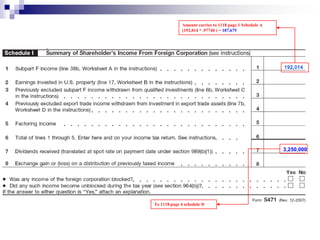

- 15. Amount carries to 1118 page 1 Schedule A(192,014 * .97740 ) = 187,6753,250,000To 1118 page 4 schedule D

- 16. Debrief15ïDividends must reconcileOther income items must reconcileTax liability must reconcileForeign reporting must tie-outïïï

- 17. The informal comments and the information presented in these slides should not be construed as constituting tax advice applicable to any specific taxpayer because each taxpayerâs facts are differentTo ensure compliance with requirements imposed by the IRS, we inform you that any U.S. tax advice mentioned in the presentation or contained in these slides is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transactions or matters addressed herein. If you have any questions please contact Edward Umling, Parente Randolph, LLCPhone (412) 697-6427, email: eumling@parentenet.com

- 18. Thank You for Attending The ConferenceEdward Umling CPA, LLM412-391-1994 Ext 259eumling@urishpopeck.com