Fraser Wealth Management Performance Protector

- 1. Performance Protector Presentation Fraser

- 2. Why do we believe that we need to offer you an enhanced service for handling investments?

- 3. To answer that question I’ll ask you one of my own

- 4. If you invested in the Top 50 funds 5 years ago where would these funds be ranked now?

- 5. Only 10 funds would still be in the top 150. Only 3 funds would still be in the top 50. Only 6 funds would still be in the top 100. Only 12 funds would still be in the top 200.

- 6. So if buy and hold doesn't work anymore, what should you do?

- 7. We believe that we have adopted a winning strategy by introducing ‘ Performance Protector’.

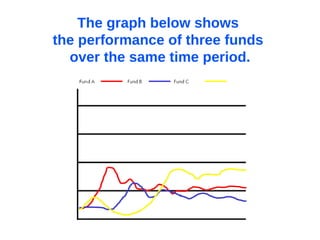

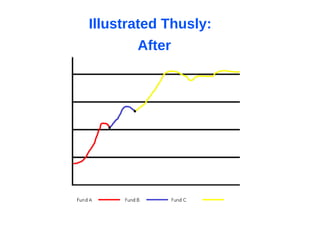

- 9. The graph below shows the performance of three funds over the same time period.

- 10. Wouldn’t it be great if you could switch from the good funds before they went bad?

- 11. Performance Protector offers the ability achieve this.

- 12. On a monthly basis it screens the statistical data on your funds.

- 13. If these fall below the threshold that we have set Performance Protector alerts us, the fund is sold, and the best fund in the sector is bought.

- 14. This should produce a more ‘smoothed’ effect for portfolio performance

- 15. Before After Illustrated Thusly:

- 16. The Results

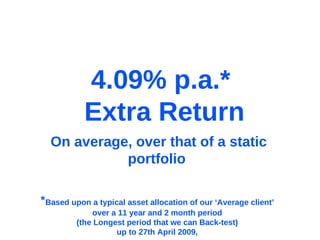

- 17. * Based upon a typical asset allocation of our ‘Average client’ over a 11 year and 2 month period (the Longest period that we can Back-test) up to 27th April 2009, On average, over that of a static portfolio 4.09% p.a.* Extra Return

- 18. On every £100,000, that Represents a Massive £61,549 Extra Return on top of that achieved by a statically held portfolio.*

- 19. Additionally, all this would have been achieved with less risk