Free banks tables

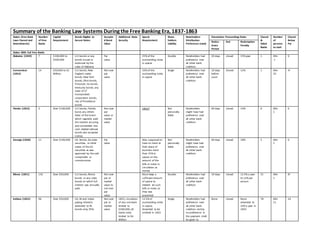

- 1. Summary of the Banking Law Systems During the Free Banking Era, 1837-1863 States (Free Bank Laws Passed and Amendments) Number of Free Banks Capital Requirement Bonds Eligible to Secure Notes Accepte d Bond Value Additional Note Security Specie Requirement Share- holders Liability Noteholders Distribution Preference (rank) Dissolution Proceedings Rules Closed & failed Banks Number of persons to start Closed Below Par Notice - Grace Period End Redemption Penalty States With Full Free Banks Alabama (1849) 7 $100,000 to $500,000 U.S bonds or any bonds issued or endorsed by the state of Alabama Par value 25% of the outstanding notes in specie Double Noteholders had preference over all other bank creditors 20 days closed 15% year 1 Min 1 0 Connecticut (1852) 14 $50,000 to $1 Million U.S bonds, New England states bonds, New York bonds, Ohio bonds, Pa bonds, Va bonds, Kentucky bonds, any state of CT incorporated corporation bonds, city of Providence bonds Not over par value 10% of the outstanding notes in specie Single Noteholders had preference over all other bank creditors 10 days before court Closed 12% 1 Min 25 4! Florida (1853) 2 Over $100,000 U.S bonds, Florida bond, any others State of the Union which regularly paid the interest accruing and convertible into cash. Added-railroad bonds also accepted (1856) Not over par value or market value silent? Not personally liable Noteholders might have had preference over all other bank creditors 60 days closed 14% 0 Min 1 0 Georgia (1838) 11 Over $100,000 US. Bonds, Ga state securities, or other states of the US securities as was approved by the said comptroller or commissioner Par value Was supposed to have on hand at their place of business more than 25% in specie on the amount of the bills or notes in circulation as money Not personally liable Noteholders might have had preference over all other bank creditors 60 days closed 18% 5 Min 1 0 Illinois (1851) 132 Over $50,000 U.S bonds, Illinois bonds or any state bonds on which full interest was annually paid. Not over par or market value to not over par value Must keep a sufficient amount of specie to redeem all such bills or notes as they was presented Double Noteholders had preference over all other bank creditors 10 days closed 12.5% a year to 12% per annum 31 Min 1 8! Indiana (1852) 96 Over $50,000 US, IN and states paying interests amended to IN bonds only, 95%. Not over par or market value 1855, circulation of any one bank limited to $200,000; all banks total limited to $6 Million 12.5% of outstanding notes in specie, Amended to be omitted in 1855 Single, Noteholders had preference over all other bank creditors motsly no preference in the payment shall be given to None closed None amended to 10% a year in 1855 78 Min 11 24

- 2. protested over non protected Iowa (1858) 1 Over $50,000 then over $25,000 US bonds, or any state on which full interest was paid Was supposed to have sufficient amount of species to redeem all such bills or notes and equal to 25% of the amount of species deposits. single Noteholders had preference over all other bank creditors and not preference among creditors 10 days closed 12.5% 0 Min 5 0 Louisiana (1853) 6 Over $100,000 U.S bonds, bonds of Louisiana or bonds of the consolidated debt of the city of New Orleans Not over par or market value Was to supposed to have on hand at all time species an amount equal to 1/3 of all cash liabilities and 2/3 of said liabilities. double Noteholders had preference over all other bank creditors 3 days Seek judge action then 10 day notice 12% 0 Min 1 0 Massachusetts (1851) 4 $100,000 and $1 Million US bonds, city or town in this Commonwealth or by either of the states of Massachusetts, Maine, New Hampshire, Vermont, Connecticut, Rhode Island or New York Not over par and market value Was supposed to be requested Noteholders had preference over all other bank creditors 10 days closed 0 Min 50 to 10 0 Michigan (1837 to 1857) 38 $50,000 to $300,000 TO over $50,000 Any public bonds, MI mortgages, other personal bonds TO US, MI, NY, New England states, PA, IN, Illinois, OH or Kentucky At par 0.5% of capital paid into security fund, semi-annual Notes, loans and discounts under 2.5 times capital stock Single Noteholders had preference over all other bank creditors 60 days TO 20 days closed 20% TO 14% 37 Min 1 30est. Minnesota (1858) 16 Over $25,000 U.S bonds or any State of the US on which full interest was semi-annually paid; amended to US bonds in 1861 Not over par value 25% of notes or 10% more stocks than circulating notes silent Double Noteholders had preference over all other bank creditors 40 days Closed, liquidati on after 30 days None 11 Min 1 12 New Jersey (1850) 26 $50,000 to $500,000 U.S, NJ, and MA bonds or mortgages Not over par or market value Amount of outstanding notes was supposed not to exceed 3 Million of dollars Single Noteholders had preference over all other bank creditors 10 days (after first 3 days notificat ion to the media) Closed 12% 18 Min 2 2! New York (1838) 423 Over $100,000 US, NY or any state bonds or NY mortgages, amended in 1840 to NY bonds only and Mortgage; 100%; minimum of market Not over par value 12.5% of outstanding notes in specie, Repealed in 1840 Not personally liable or limited, Amended to individuals responsible for all banks debts Noteholders had preference over all other bank creditors 10 days Closed 14% Amended to 20% in 1840 140 (180?) Min 1 34

- 3. Ohio (1851) 14 $25,000 to $500,000 U.S or OH bonds TO MA, NY, MD, PA, KY, IN, Ill, MI, OH and U.S bonds Not over par or market value Notes was not supposed to be 3 times capital or less than 3rd of liabilities 30% of outstanding notes in specie Single Noteholders had preference over all other bank creditors 20 days Closed (10 consecutive days publication to sale) 15% 2 Min 3 1! Pennsylvania (1860) 1 $50,000 to $1 Million US or PA bonds Not over par value 25% of outstanding notes in specie Double? Noteholders had preference over all other bank creditors 20 days closed 0 Min 5 0 Tennessee (1852) 2 Over $50,000 ($100,000 subscribed and paid by free bank to start business) U.S bonds, TN bonds, incorporated and TN endorsed corporate bonds Not over par value A least ? of the securities deposited was supposed to be bonds of the state of TN 10% of outstanding notes specie Noteholders had preference over all other bank creditors 10 days closed 12% 1 Min 10 stockhol ders for free bank 1 Vermont (1851) 1 $50,000 to $500,000 U.S bonds, DC bonds guaranteed by the U.S, State of Vermont bonds, state of Maine bonds, State of NY bonds or state of Ohio bonds Not over par value or market value Note personally liable Noteholders had preference over all other bank creditors 10 days closed 12% 0 Min 5 1! Wisconsin (1852) 143 $25,000 to $500,000 Any public bonds and Wisconsin railroad bonds; amended to US bonds and WI bonds if selling at above par Not over par or market value Amended to limited to capital stock paid in 1861 Silent Single NONE 10 days closed 5% 79 (31?) Min 1 37 States With Bond Secured Note-Issues Kentucky (1858) 0 Missouri (1858) 0 Virginia (1851) 0 States Without Free Banks Arkansas 0 Delaware 0 Kansas 0 Maine 0 Maryland 0 Mississippi 0 Nebraska 0 New Hampshire 0 North Carolina 0 Rhode Island 0 South Carolina 0 Total 937 404 (412?)