FRM - Level 1 Part 2 - Quantitative Methods including Probability Theory

- 3. Probability?Functions ? Probability?function?p(x),?gives?the?probability? that?a?discrete?random?variable?will?take?on?a? value?x?[eg.?p(x)?=?x?/?15?for?X?=?{1,2,3,4,5}??®\>?p(3)? =?20%. ? Probability?Density?Function?(PDF)?f(x),?gives?the? probability?of?a?continuous?random?variable. ? Cumulative?distribution?function?(CDF)?F(x),?gives? the?probability?that?a?random?variable?will?be?less? than?or?equal?to?a?given?value.

- 4. Discrete?Uniform?Distribution ? Properties ©C Finite?number?of?possible?outcomes?will?equal? probability ? Example ©C p(x)?=?.2?for?X?=?{1,2,3,4,5}?

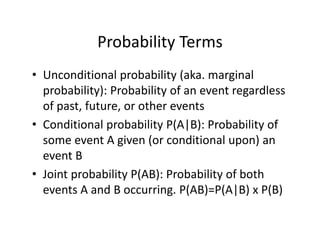

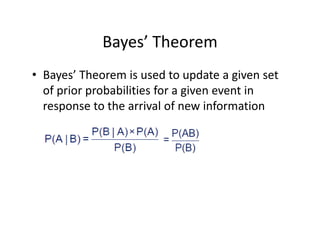

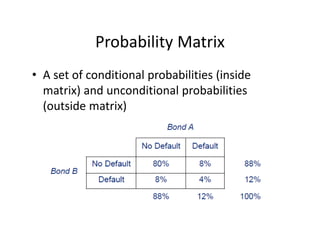

- 5. Probability?Terms ? Unconditional?probability?(aka.?marginal? probability):?Probability?of?an?event?regardless? of?past,?future,?or?other?events ? Conditional?probability?P(A|B):?Probability?of? some?event?A?given?(or?conditional?upon)?an? event?B ? Joint?probability?P(AB):?Probability?of?both? events?A?and?B?occurring.?P(AB)=P(A|B)?x?P(B)

- 6. Probability?Terms ? At?least?one?occurrence?P(A?or?B): ©C P(A?or?B)?=?P(A)?+?P(B)?©C P(AB) DonĪ»t?double? count?P(AB)

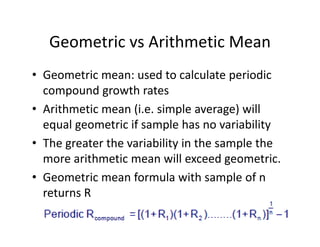

- 8. Geometric?vs?Arithmetic?Mean ? Geometric?mean:?used?to?calculate?periodic? compound?growth?rates ? Arithmetic?mean?(i.e.?simple?average)?will? equal?geometric?if?sample?has?no?variability? ? The?greater?the?variability?in?the?sample?the? more?arithmetic?mean?will?exceed?geometric. ? Geometric?mean?formula?with?sample?of?n? returns?R

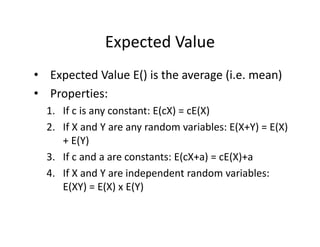

- 9. Expected?Value ? Expected?Value?E()?is?the?average?(i.e.?mean) ? Properties: 1. If?c?is?any?constant:?E(cX)?=?cE(X) 2. If?X?and?Y?are?any?random?variables:?E(X+Y)?=?E(X)? +?E(Y) 3. If?c?and?a?are?constants:?E(cX+a)?=?cE(X)+a? 4. If?X?and?Y?are?independent?random?variables:? E(XY)?=?E(X)?x?E(Y)?

- 10. Variance?and?Standard?Deviation ? Variance?=?”ę2 =?E[(X?©C E(X))2],?properties: 1. If?c is?constant:?Var(c)?=?0?and?VaR(cX)=c2 x?Var(X) 2. If?c and?a are?constants:?Var(aX+c )?=?a2 x?Var(X) 3. If?c?and?a are?constants:?E(cX+a)?=?cE(X)+a? 4. If?X?and?Y?are?independent?random?variables:? Var(X+Y)?=?Var(X®\Y)?=?Var(X)?+?Var(Y) ? Standard?Deviation?=?Square?root?of?Variance? =?”ę?=?{E[(X?©C E(X))2]}1/2

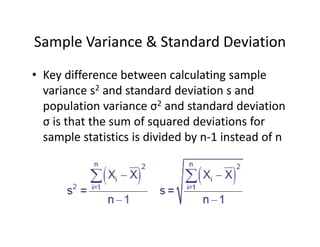

- 11. Sample?Variance?&?Standard?Deviation ? Key?difference?between?calculating?sample? variance?s2 and?standard?deviation?s?and? population?variance?”ę2 and?standard?deviation? ”ę?is?that?the?sum?of?squared?deviations?for? sample?statistics?is?divided?by?n®\1?instead?of?n

- 12. Covariance ? Covariance:?A?measure?of?how?to?variables?move?together. Cov(X,Y)?=?E[(X®\E(X))(Y®\E(Y))]?=?E(XY)®\E(X)E(Y)? ? Interpretation: ©C Values?range?from?negative?to?positive?infinity.? ©C Positive?(negative)?covariance?means?when?one?variable?has? been?above?its?mean?the?other?variable?has?been?above?(below)? its?mean. ©C Units?of?covariance?are?difficult?to?interpret?which?is?why?we? more?commonly?use?correlation (next?slide) ? Properties: ©C If?X?and?Y?are?independent?then?Cov(X,Y)?=?0 ©C Covariance?of?a?variable?X?with?itself?is?Var(X) ©C If?X?and?Y?are?NOT?independent: ? Var(X+Y)?=?Var(X)?+?Var(Y)?+?2(Cov(X,Y) ? Var(X®\Y)?=?Var(X)?+?Var(Y)?®\ 2(Cov(X,Y)

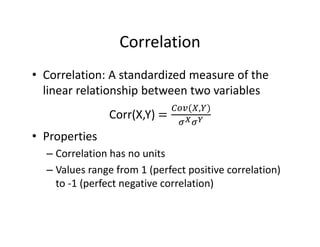

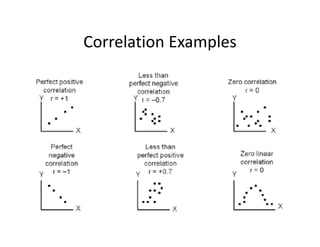

- 13. Correlation ? Correlation:?A?standardized?measure?of?the? linear?relationship?between?two?variables Corr(X,Y)? , ? Properties ©C Correlation?has?no?units ©C Values?range?from?1?(perfect?positive?correlation)? to?®\1?(perfect?negative?correlation)?

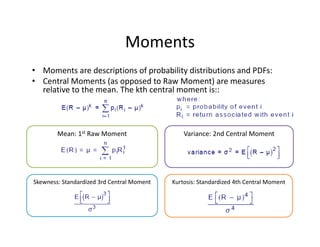

- 15. Variance:?2nd?Central?Moment?Mean:?1st Raw?Moment Moments ? Moments?are?descriptions?of?probability?distributions?and?PDFs:? ? Central?Moments?(as?opposed?to?Raw?Moment)?are?measures? relative?to?the?mean.?The?kth?central?moment?is::? Skewness:?Standardized?3rd?Central?Moment Kurtosis:?Standardized?4th?Central?Moment

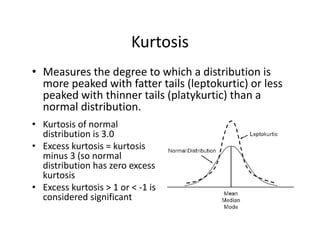

- 17. Kurtosis ? Measures?the?degree?to?which?a?distribution?is? more?peaked?with?fatter?tails?(leptokurtic)?or?less? peaked?with?thinner?tails?(platykurtic)?than?a? normal?distribution. ? Kurtosis?of?normal? distribution?is?3.0 ? Excess?kurtosis?=?kurtosis? minus?3?(so?normal? distribution?has?zero?excess? kurtosis ? Excess?kurtosis?>?1?or?<?®\1?is? considered?significant

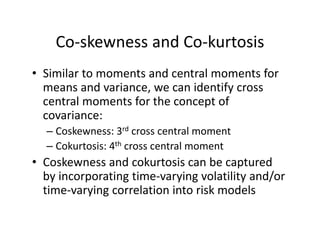

- 18. Co®\skewness and?Co®\kurtosis ? Similar?to?moments?and?central?moments?for? means?and?variance,?we?can?identify?cross? central?moments?for?the?concept?of? covariance: ©C Coskewness:?3rd cross?central?moment ©C Cokurtosis:?4th cross?central?moment ? Coskewness and?cokurtosis can?be?captured? by?incorporating?time®\varying?volatility?and/or? time®\varying?correlation?into?risk?models

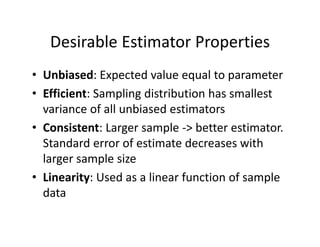

- 19. Desirable?Estimator?Properties ? Unbiased:?Expected?value?equal?to?parameter ? Efficient:?Sampling?distribution?has?smallest? variance?of?all?unbiased?estimators ? Consistent:?Larger?sample?®\>?better?estimator.? Standard?error?of?estimate?decreases?with? larger?sample?size ? Linearity:?Used?as?a?linear?function?of?sample? data

- 20. Distributions

- 21. Uniform?Distribution ? Continuous?Uniform?Distribution?(CUD)?is? defined?over?a?range?that?spans?between? some?lower?limit,?a,?and?some?upper?limit,?b,? which?are?the?only?two?parameters. ? Properties ©C For?a?random?variable?x?following?a?CUD,?a<x<b ©C P(X=x)=0?because?it?is?continuous

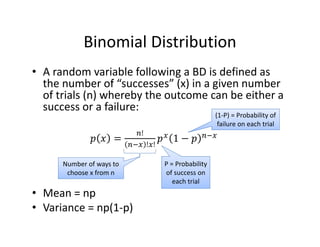

- 22. Binomial?Distribution ? A?random?variable?following?a?BD?is?defined?as? the?number?of?Ī░successesĪ▒?(x)?in?a?given?number? of?trials?(n)?whereby?the?outcome?can?be?either?a? success?or?a?failure: ! ! ! ? Mean?=?np ? Variance?=?np(1®\p) Number?of?ways?to? choose?x?from?n P?=?Probability? of?success?on? each?trial (1®\P)?=?Probability?of? failure?on?each?trial

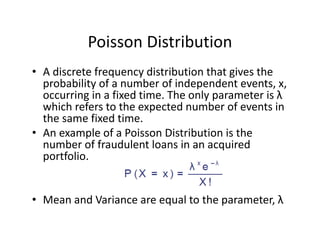

- 23. Poisson?Distribution ? A?discrete?frequency?distribution?that?gives?the? probability?of?a?number?of?independent?events,?x,? occurring?in?a?fixed?time.?The?only?parameter?is?”╦ which?refers?to?the?expected?number?of?events?in? the?same?fixed?time.? ? An?example?of?a?Poisson?Distribution?is?the? number?of?fraudulent?loans?in?an?acquired? portfolio. ? ▓č▒▓╣▓į?▓╣▓į╗Õ?│š▓╣░∙Š▒▓╣▓į│”▒?▓╣░∙▒?▒▒ń│▄▓╣▒¶?│┘┤Ū?│┘│¾▒?▒Ķ▓╣░∙▓╣│Š▒│┘▒░∙,?”╦

- 24. Binomial?vs?Poisson ? If?an?exact?probability?of?an?event?happening?is? given,?or?implied,?in?the?question,?and?you?are? asked?to?calculate?the?probability?of?this?event? happening?k?times?out?of?n,?then?the?Binomial? Distribution must?be?used. ? If?a?mean?or?average?probability?of?an?event? happening?per?unit?time/per?page/per?mile? cycled?etc.,?is?given,?and?you?are?asked?to? calculate?a?probability?of?n?events?happening?in?a? given?time/number?of?pages/number?of?miles? cycled,?then?the?Poisson?Distribution?is?used.?

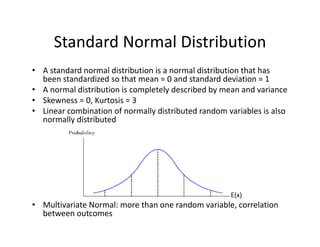

- 25. Standard?Normal?Distribution ? A?standard?normal?distribution?is?a?normal?distribution?that?has? been?standardized?so?that?mean?=?0?and?standard?deviation?=?1 ? A?normal?distribution?is?completely?described?by?mean?and?variance ? Skewness =?0,?Kurtosis?=?3 ? Linear?combination?of?normally?distributed?random?variables?is?also? normally?distributed ? Multivariate?Normal:?more?than?one?random?variable,?correlation? between?outcomes E(x)

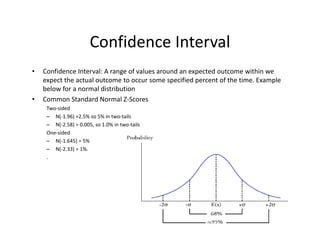

- 26. Confidence?Interval ? Confidence?Interval:?A?range?of?values?around?an?expected?outcome?within?we? expect?the?actual?outcome?to?occur?some?specified?percent?of?the?time.?Example? below?for?a?normal?distribution ? Common?Standard?Normal?Z®\Scores Two®\sided? ©C N(®\1.96)?=2.5%?so?5%?in?two®\tails? ©C N(®\2.58)?=?0.005,?so?1.0%?in?two®\tails? One®\sided? ©C N(®\1.645)?=?5% ©C N(®\2.33)?=?1%.? .?

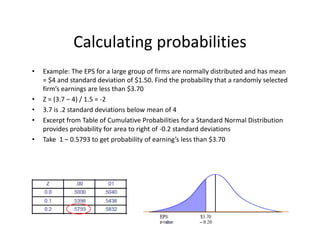

- 27. Calculating?probabilities ? Example:?The?EPS?for?a?large?group?of?firms?are?normally?distributed?and?has?mean? =?$4?and?standard?deviation?of?$1.50.?Find?the?probability?that?a?randomly?selected? firmĪ»s?earnings?are?less?than?$3.70 ? Z?=?(3.7?©C 4)?/?1.5?=?®\2 ? 3.7?is?.2?standard?deviations?below?mean?of?4 ? Excerpt?from?Table?of?Cumulative?Probabilities?for?a?Standard?Normal?Distribution? provides?probability?for?area?to?right?of?®\0.2?standard?deviations ? Take??1?©C 0.5793?to?get?probability?of?earningĪ»s?less?than?$3.70

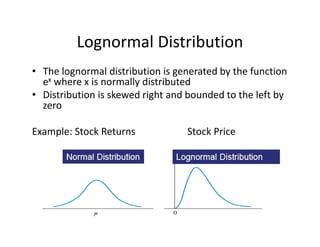

- 28. Lognormal?Distribution ? The?lognormal?distribution?is?generated?by?the?function? ex where?x?is?normally?distributed ? Distribution?is?skewed?right?and?bounded?to?the?left?by? zero Example:?Stock?Returns Stock?Price

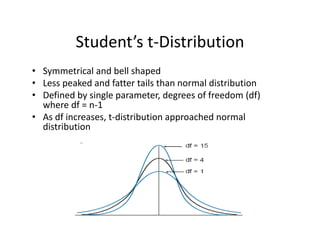

- 29. StudentĪ»s?t®\Distribution ? Symmetrical?and?bell?shaped ? Less?peaked?and?fatter?tails?than?normal?distribution ? Defined?by?single?parameter,?degrees?of?freedom?(df)? where?df =?n®\1 ? As?df increases,?t®\distribution?approached?normal? distribution

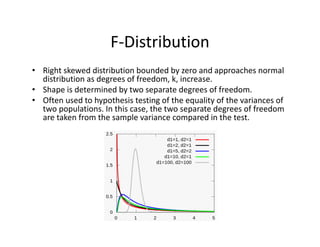

- 31. F®\Distribution ? Right?skewed?distribution?bounded?by?zero?and?approaches?normal? distribution?as?degrees?of?freedom,?k,?increase. ? Shape?is?determined?by?two?separate?degrees?of?freedom.? ? Often?used?to?hypothesis?testing?of?the?equality?of?the?variances?of? two?populations.?In?this?case,?the?two?separate?degrees?of?freedom? are?taken?from?the?sample?variance?compared?in?the?test.

- 35. BayesĪ»?vs?Frequency ? Bayesian?Approach:?Assume?priors?and?update? using?new?information ? Frequentist?Approach:?Do?not?impose?priors? on?the?data.?Use?the?probabilities?implied?by? what?information?is?available. ? Rule?of?thumb: ©C Use?Bayesian?approach?when?lacking?data ©C Use?Frequentist?approach?with?large?data

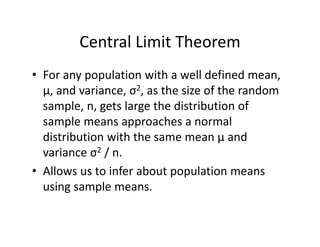

- 37. Central?Limit?Theorem ? For?any?population?with?a?well?defined?mean,? ?,?and?variance,?”ę2,?as?the?size?of?the?random? sample,?n,?gets?large?the?distribution?of? sample?means?approaches?a?normal? distribution?with?the?same?mean???and? variance?”ę2 /?n. ? Allows?us?to?infer?about?population?means? using?sample?means.?

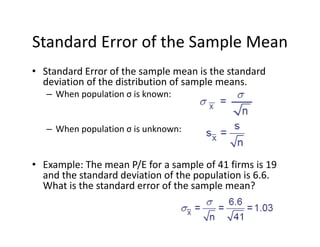

- 38. Standard?Error?of?the?Sample?Mean ? Standard?Error?of?the?sample?mean?is?the?standard? deviation?of?the?distribution?of?sample?means. ©C When?population?”ę is?known: ©C When?population?”ę is?unknown: ? Example:?The?mean?P/E?for?a?sample?of?41?firms?is?19? and?the?standard?deviation?of?the?population?is?6.6.? What?is?the?standard?error?of?the?sample?mean?

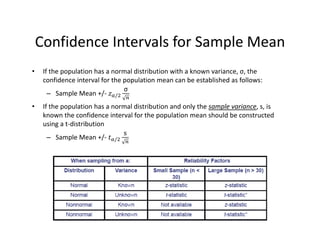

- 39. Confidence?Intervals?for?Sample?Mean ? If?the?population?has?a?normal?distribution?with?a?known?variance,?”ę,?the? confidence?interval?for?the?population?mean?can?be?established?as?follows: ©C Sample?Mean?+/®\ / ”ę ? If?the?population?has?a?normal?distribution?and?only?the?sample?variance,?s,?is? known?the?confidence?interval?for?the?population?mean?should?be?constructed? using?a?t®\distribution ©C Sample?Mean?+/®\ / s

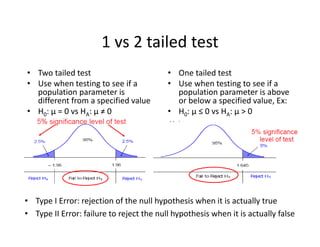

- 41. 1?vs?2?tailed?test ? Two?tailed?test ? Use?when?testing?to?see?if?a? population?parameter?is? different?from?a?specified?value ? H0:?”╠ =?0?vs?HA:?”╠ Ī┘?0 ? One?tailed?test ? Use?when?testing?to?see?if?a? population?parameter?is?above? or?below?a?specified?value,?Ex: ? H0:?”╠ Ī▄?0?vs?HA:?”╠ >?0 ? Type?I?Error:?rejection?of?the?null?hypothesis?when?it?is?actually?true ? Type?II?Error:?failure?to?reject?the?null?hypothesis?when?it?is?actually?false

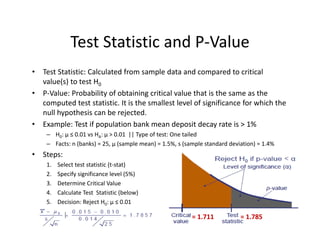

- 42. Test?Statistic?and?P®\Value ? Test?Statistic:?Calculated?from?sample?data?and?compared?to?critical? value(s)?to?test?H0 ? P®\Value:?Probability?of?obtaining?critical?value?that?is?the?same?as?the? computed?test?statistic.?It?is?the?smallest?level?of?significance?for?which?the? null?hypothesis?can?be?rejected. ? Example:?Test?if?population?bank?mean?deposit?decay?rate?is?>?1% ©C H0:?”╠ Ī▄?0.01?vs?HA:?”╠ >?0.01??||?Type?of?test:?One?tailed ©C Facts:?n (banks)?=?25,???(sample?mean)?=?1.5%,?s?(sample?standard?deviation)?=?1.4% ? Steps: 1. Select?test?statistic?(t®\stat) 2. Specify?significance?level?(5%) 3. Determine?Critical?Value? 4. Calculate?Test??Statistic?(below) 5. Decision:?Reject?H0:?”╠ Ī▄?0.01 =?1.711 =?1.785

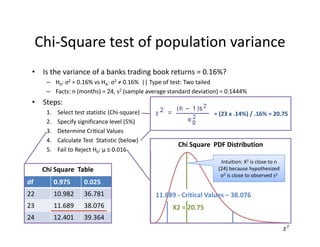

- 43. ? Is?the?variance?of?a?banks?trading?book?returns?=?0.16%? ©C H0:?”ę2 =?0.16%?vs?HA:?”ę2 Ī┘?0.16%??||?Type?of?test:?Two?tailed ©C Facts:?n?(months)?=?24,?s2 (sample?average?standard?deviation)?=?0.1444% ? Steps: 1. Select?test?statistic?(Chi®\square) 2. Specify?significance?level?(5%) 3. Determine?Critical?Values? 4. Calculate?Test??Statistic?(below) 5. Fail?to?Reject?H0:?”╠ Ī▄?0.016 =?(23?x?.14%)?/?.16%?=?20.75 Chi®\Square?test?of?population?variance df 0.975 0.025 22 10.982 36.781 23 11.689 38.076 24 12.401 39.364 Chi?Square??Table Chi?Square??PDF?Distribution 11.689?®\ Critical?Values?©C 38.076? X2?=?20.75 Intuition:?X2 is?close?to?n? (24)?because?hypothesized? ”ę2 is?close?to?observed?s2

- 44. ? An?F®\test?is?any?statistical?test?in?which?the?test?statistic?has?an?F®\distribution?under?the?null? hypothesis.? ? Often?used?to?determine?the?best?of?two?statistical?models?by?identifying?the?one?that?best? fits?the?data?they?were?both?estimated?upon.? ? Tests?whether?any?independent?variables?explain?variation?in?dependent?variable. F®\statistic?with?k?and?n?©C (k+1)?degrees?of?freedom ? k?=?number?of?independent?variables??(attributable?to?ESS) ? n?©C (k+1)?=?observations?minus?number?of?coefficients Example:? ? The?ESS?and?SSR?from?a?model?are?500?and?200?respectivly ? Sample?observations?=?100,?Model?has?3?variables ? F?=?(500?/?3)?/?[200?/(100®\3®\1)]?=?80 ? Critical?95%?F®\Value?for?3?and?96?df =?2.72? F®\Test Numerator?Degrees? of?Freedom Denominator?Degrees? of?Freedom

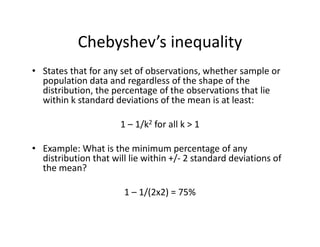

- 45. ChebyshevĪ»s inequality ? States?that?for?any?set?of?observations,?whether?sample?or? population?data?and?regardless?of?the?shape?of?the? distribution,?the?percentage?of?the?observations?that?lie? within?k?standard?deviations?of?the?mean?is?at?least: 1?©C 1/k2 for?all?k?>?1 ? Example:?What?is?the?minimum?percentage?of?any? distribution?that?will?lie?within?+/®\ 2?standard?deviations?of? the?mean? 1?©C 1/(2x2)?=?75%

- 46. Copulas

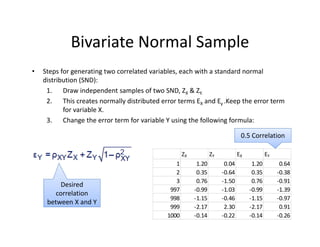

- 47. Bivariate?Normal?Sample ? Steps?for?generating?two?correlated?variables,?each?with?a?standard?normal? distribution?(SND): 1. Draw?independent?samples?of?two?SND,?ZX &?ZY. 2. This?creates?normally?distributed?error?terms?EX and?Ey .Keep?the?error?term? for?variable?X. 3. Change?the?error?term?for?variable?Y?using?the?following?formula: Desired? correlation? between?X?and?Y ZX ZY EX EY 1 1.20 0.04 1.20 0.64 2 0.35 ®\0.64 0.35 ®\0.38 3 0.76 ®\1.50 0.76 ®\0.91 997 ®\0.99 ®\1.03 ®\0.99 ®\1.39 998 ®\1.15 ®\0.46 ®\1.15 ®\0.97 999 ®\2.17 2.30 ®\2.17 0.91 1000 ®\0.14 ®\0.22 ®\0.14 ®\0.26 0.5?Correlation

- 48. Factor?Models ? Factor?models?can?be?used?to?define?correlations?between?normally?distributed? variables.? ? Equation?below?is?for?a?one®\factor?model?where?each?Ui has?a?component? dependent?on?one?common?factor?F?in?addition?to?another?idiosyncratic?factor?Zi that?is?uncorrelated?with?other?variables. ? Steps?to?construct: 1. Create?the?SND?common?factor?F 2. Choose?a?weight?”┴ for?each?Ui 3. Create?correlations?with?F?(previous?slide) 4. Draw?i?number?of?SND?idiosyncratic?factors?Z 5. Calculate?U?using?equation?to?right ? Advantages?of?Single?Factor?Models: ©C Covariance?matrix?is?positive®\semidefinite ©C Number?of?correlation?estimations?is?reduced?to?N?from?[Nx(N®\1)]/2 ? Capital?Asset?Pricing?Model?(CAPM)?is?well?known?example?of?Single?Factor?Model Common? Factor Idiosyncratic? Factor

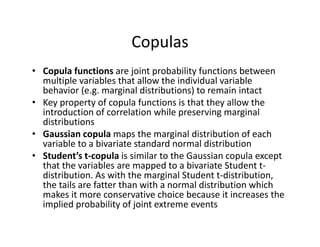

- 49. Copulas ? Copula?functions?are?joint?probability?functions?between? multiple?variables?that?allow?the?individual?variable? behavior?(e.g.?marginal?distributions)?to?remain?intact ? Key?property?of?copula?functions?is?that?they?allow?the? introduction?of?correlation?while?preserving?marginal? distributions ? Gaussian?copula?maps?the?marginal?distribution?of?each? variable?to?a?bivariate?standard?normal?distribution ? StudentĪ»s?t®\copula?is?similar?to?the?Gaussian?copula?except? that?the?variables?are?mapped?to?a?bivariate?Student?t®\ distribution.?As?with?the?marginal?Student?t®\distribution,? the?tails?are?fatter?than?with?a?normal?distribution?which? makes?it?more?conservative?choice?because?it?increases?the? implied?probability?of?joint?extreme?events

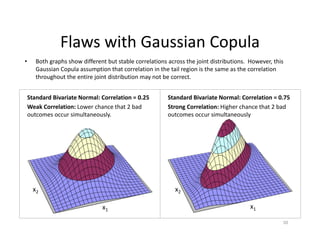

- 50. ? Both?graphs?show?different?but?stable?correlations?across?the?joint?distributions.??However,?this? Gaussian?Copula?assumption?that?correlation?in?the?tail?region?is?the?same?as?the?correlation? throughout?the?entire?joint?distribution?may?not?be?correct.?? 50 Standard Bivariate Normal : Correlation = 0.75Standard Bivariate Normal : Correlation = 0.25 x1 x2 x1 x2 Flaws?with?Gaussian?Copula Standard?Bivariate?Normal:?Correlation?=?0.25 Weak?Correlation:?Lower?chance?that?2?bad? outcomes?occur?simultaneously. Standard?Bivariate?Normal:?Correlation?=?0.75 Strong?Correlation:?Higher?chance?that?2?bad? outcomes?occur?simultaneously

- 52. OLS?©C Popular?method?of?Linear?Regression ? Linear?relationship?between?dependent?and?independent?variables ? Assumptions ©C Independent?variable?uncorrelated?with?error?term ©C Expected?value?of?error?term?is?zero ©C Variance?of?error?term?is?constant ©C Error?term?is?normally?distributed Error? Term Independent? Variable Slope? Coefficient Intercept Dependent? Variable Sum?of?Squared? Residuals?(SSR) Explained??Sum? of?Squares?(ESS) Total??ĪŁ? (TSS) Analysis?of?Variance?(ANOVA)

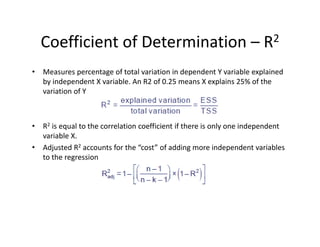

- 53. Coefficient?of?Determination?©C R2 ? Measures?percentage?of?total?variation?in?dependent?Y?variable?explained? by?independent?X?variable.?An?R2?of?0.25?means?X?explains?25%?of?the? variation?of?Y ? R2 is?equal?to?the?correlation?coefficient?if?there?is?only?one?independent? variable?X. ? Adjusted?R2 accounts?for?the?Ī░costĪ▒?of?adding?more?independent?variables? to?the?regression

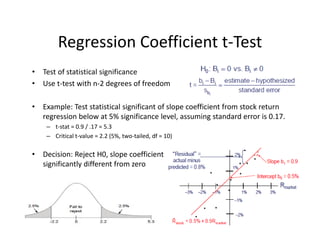

- 54. Regression?Coefficient?t®\Test ? Test?of?statistical?significance ? Use?t®\test?with?n®\2?degrees?of?freedom ? Example:?Test?statistical?significant?of?slope?coefficient?from?stock?return? regression?below?at?5%?significance?level,?assuming?standard?error?is?0.17. ©C t®\stat?=?0.9?/?.17?=?5.3 ©C Critical?t®\value?=?2.2?(5%,?two®\tailed,?df =?10) ? Decision:?Reject?H0,?slope?coefficient? significantly?different?from?zero?

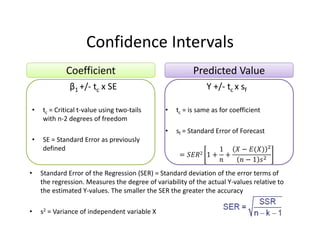

- 55. Confidence?Intervals ”┬1?+/®\ tc x?SE ? tc =?Critical?t®\value?using?two®\tails? with?n®\2?degrees?of?freedom ? SE?=?Standard?Error?as?previously? defined Y?+/®\ tc x?sf ? tc =?is?same?as?for?coefficient ? sf =?Standard?Error?of?Forecast 2 1 1 1 Coefficient Predicted?Value ? Standard?Error?of?the?Regression?(SER)?=?Standard?deviation?of?the?error?terms?of? the?regression.?Measures?the?degree?of?variability?of?the?actual?Y®\values?relative?to? the?estimated?Y®\values.?The?smaller?the?SER?the?greater?the?accuracy ? s2 =?Variance?of?independent?variable?X

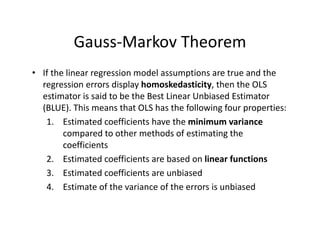

- 56. Gauss®\Markov?Theorem ? If?the?linear?regression?model?assumptions?are?true?and?the? regression?errors?display?homoskedasticity,?then?the?OLS? estimator?is?said?to?be?the?Best?Linear?Unbiased?Estimator? (BLUE).?This?means?that?OLS?has?the?following?four?properties: 1. Estimated?coefficients?have?the?minimum?variance compared?to?other?methods?of?estimating?the? coefficients 2. Estimated?coefficients?are?based?on?linear?functions 3. Estimated?coefficients?are?unbiased? 4. Estimate?of?the?variance?of?the?errors?is?unbiased

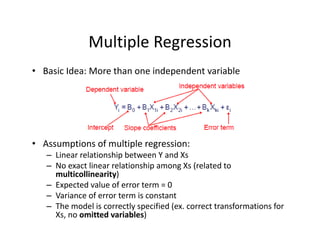

- 57. Multiple?Regression ? Basic?Idea:?More?than?one?independent?variable ? Assumptions?of?multiple?regression: ©C Linear?relationship?between?Y?and?Xs ©C No?exact?linear?relationship?among?Xs (related?to? multicollinearity) ©C Expected?value?of?error?term?=?0 ©C Variance?of?error?term?is?constant ©C The?model?is?correctly?specified?(ex.?correct?transformations?for? Xs,?no?omitted?variables)

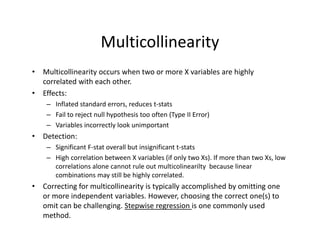

- 58. Multicollinearity ? Multicollinearity occurs?when?two?or?more?X?variables?are?highly? correlated?with?each?other.? ? Effects: ©C Inflated?standard?errors,?reduces?t®\stats ©C Fail?to?reject?null?hypothesis?too?often?(Type?II?Error)? ©C Variables?incorrectly?look?unimportant ? Detection: ©C Significant?F®\stat?overall?but?insignificant?t®\stats ©C High?correlation?between?X?variables?(if?only?two?Xs).?If?more?than?two?Xs,?low? correlations?alone?cannot?rule?out?multicolinearilty because?linear? combinations?may?still?be?highly?correlated. ? Correcting?for?multicollinearity is?typically?accomplished?by?omitting?one? or?more?independent?variables.?However,?choosing?the?correct?one(s)?to? omit?can?be?challenging.?Stepwise?regression?is?one?commonly?used? method.

- 59. Omitted?Variable?Bias ? Omitted?Variable?Bias?can?produce?biased? estimates.?An?omitted?variable?is: 1. Correlated?with?the?movement?of?at?least?one? independent?variable?and 2. Is?determinant?of?dependent?variable

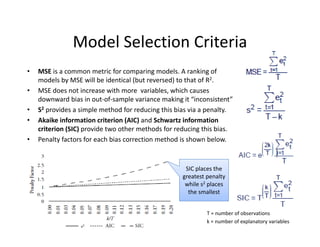

- 60. Model?Selection?Criteria ? MSE is?a?common?metric?for?comparing?models.?A?ranking?of? models?by?MSE?will?be?identical?(but?reversed)?to?that?of?R2.? ? MSE?does?not?increase?with?more??variables,?which?causes? downward?bias?in?out®\of®\sample?variance?making?it?Ī░inconsistentĪ▒? ? S2 provides?a?simple?method?for?reducing?this?bias?via?a?penalty. ? Akaike information?criterion?(AIC)?and?Schwartz?information? criterion?(SIC)?provide?two?other?methods?for?reducing?this?bias.?? ? Penalty?factors?for?each?bias?correction?method?is?shown?below. SIC?places?the? greatest?penalty? while?s2 places? the?smallest T?=?number?of?observations k =?number?of?explanatory?variables

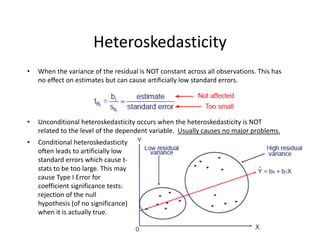

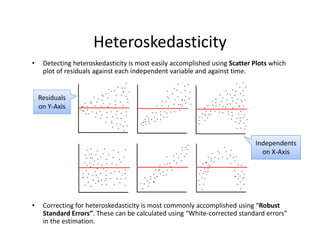

- 62. ? When?the?variance?of?the?residual?is?NOT?constant?across?all?observations.?This?has? no?effect?on?estimates?but?can?cause?artificially?low?standard?errors. ? Unconditional?heteroskedasticity occurs?when?the?heteroskedasticity is?NOT? related?to?the?level?of?the?dependent?variable.??Usually?causes?no?major?problems. Heteroskedasticity ? Conditional?heteroskedasticity often?leads?to?artificially?low? standard?errors?which?cause?t®\ stats?to?be?too?large.?This?may? cause?Type?I?Error?for? coefficient?significance?tests:? rejection?of?the?null? hypothesis?(of?no?significance)? when?it?is?actually?true.

- 63. ? Detecting?heteroskedasticity is?most?easily?accomplished?using?Scatter?Plots which? plot?of?residuals?against?each?independent?variable?and?against?time. ? Correcting?for?heteroskedasticity is?most?commonly?accomplished?using?Ī░Robust? Standard?ErrorsĪ▒.?These?can?be?calculated?using?Ī░White®\corrected?standard?errorsĪ▒? in?the?estimation. Heteroskedasticity Residuals? on?Y®\Axis Independents? on?X®\Axis

- 64. Covariance?Stationarity ? Constant?and?finite?expected?value ? Constant?and?finite?variance ? Constant?and?finite?covariance?between?lags All?are?examples?of? non®\stationarity

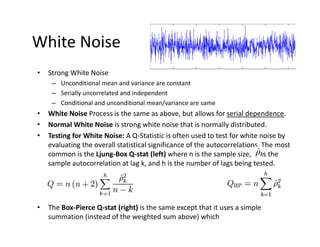

- 65. White?Noise ? Strong?White?Noise ©C Unconditional?mean?and?variance?are?constant ©C Serially?uncorrelated?and?independent ©C Conditional?and?unconditional?mean/variance?are?same ? White?Noise?Process?is?the?same?as?above,?but?allows?for?serial?dependence. ? Normal?White?Noise?is?strong?white?noise?that?is?normally?distributed. ? Testing?for?White?Noise:?A?Q®\Statistic?is?often?used?to?test?for?white?noise?by? evaluating?the?overall?statistical?significance?of?the?autocorrelations.?The?most? common?is?the?Ljung®\Box?Q®\stat?(left)?where?n?is?the?sample?size,? is?the? sample?autocorrelation?at?lag?k,?and?h?is?the?number?of?lags?being?tested. ? The?Box®\Pierce?Q®\stat?(right) is?the?same?except?that?it?uses?a?simple? summation?(instead?of?the?weighted?sum?above)?which?

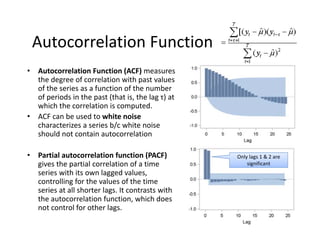

- 66. Autocorrelation?Function ? Autocorrelation?Function?(ACF)?measures? the?degree?of?correlation?with?past?values? of?the?series?as?a?function?of?the?number? of?periods?in?the?past?(that?is,?the?lag?”ė)?at? which?the?correlation?is?computed. ? ACF?can?be?used?to?white?noise? characterizes?a?series?b/c?white?noise? should?not?contain?autocorrelation ? Partial?autocorrelation?function?(PACF)? gives?the?partial?correlation?of?a?time? series?with?its?own?lagged?values,? controlling?for?the?values?of?the?time? series?at?all?shorter?lags.?It?contrasts?with? the?autocorrelation?function,?which?does? not?control?for?other?lags. Only?lags?1?&?2?are? significant

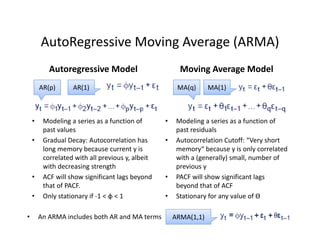

- 67. AutoRegressive Moving?Average?(ARMA) Autoregressive?Model ? Modeling?a?series?as?a?function?of? past?values ? Gradual?Decay:?Autocorrelation?has? long?memory?because?current?y?is? correlated?with?all?previous?y,?albeit? with?decreasing?strength? ? ACF?will?show?significant?lags?beyond? that?of?PACF. ? Only?stationary?if?®\1?<?”š <?1 Moving?Average?Model ? Modeling?a?series?as?a?function?of? past?residuals ? Autocorrelation?Cutoff:?Ī░Very?short? memoryĪ░?because?y?is?only?correlated? with?a?(generally)?small,?number?of? previous?y ? PACF?will?show?significant?lags? beyond?that?of?ACF ? Stationary?for?any?value?of?? AR(1)AR(p) MA(1)MA(q) ARMA(1,1)? An?ARMA?includes?both?AR?and?MA?terms

- 69. Estimating?Volatility ? Continuous?compounded?return?S?over?time?period?Ī░IĪ▒ ? Maximum?likelihood?estimator?of?variance?assuming?mean? return?of?zero;?where?Ī░mĪ▒?is?number?of?observations ? Provides?method?for?estimating?todayĪ»s?variance?using?equal? weight?on?historical?values??

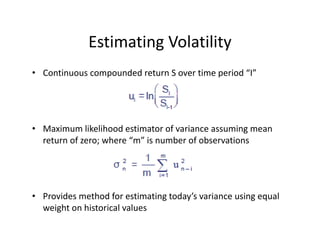

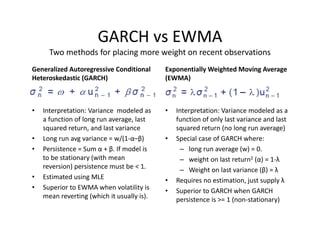

- 70. GARCH?vs?EWMA Two?methods?for?placing?more?weight?on?recent?observations Generalized?Autoregressive?Conditional? Heteroskedastic?(GARCH) ? Interpretation:?Variance??modeled?as? a?function?of?long?run?average,?last? squared?return,?and?last?variance ? Long?run?avg variance?=?w/(1®\”┴©C”┬) ? Persistence?=?Sum?”┴ +?”┬.?If?model?is? to?be?stationary?(with?mean? reversion)?persistence?must?be?<?1. ? Estimated?using?MLE ? Superior?to?EWMA?when?volatility?is? mean?reverting?(which?it?usually?is).? Exponentially?Weighted?Moving?Average? (EWMA) ? Interpretation:?Variance?modeled?as?a? function?of?only?last?variance?and?last? squared?return?(no?long?run?average) ? Special?case?of?GARCH?where: ©C long?run?average (w)?=?0.? ©C weight?on?last?return2 (”┴) =?1®\”╦ ©C Weight?on?last?variance?(”┬) =?”╦ ? Requires?no?estimation,?just?supply?”╦ ? Superior?to?GARCH?when?GARCH? persistence?is?>=?1?(non®\stationary)

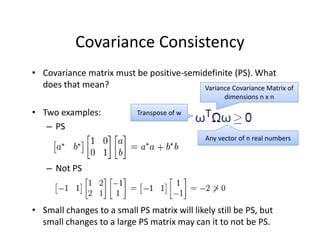

- 72. ? Covariance?matrix?must?be?positive®\semidefinite (PS).?What? does?that?mean? ? Two?examples: ©C PS ©C Not?PS ? Small?changes?to?a?small?PS?matrix?will?likely?still?be?PS,?but? small?changes?to?a?large?PS?matrix?may?can?it?to?not?be?PS. Covariance?Consistency Variance?Covariance?Matrix?of? dimensions?n?x?n Any?vector?of?n?real?numbers? Transpose?of?w

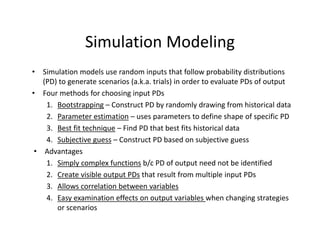

- 73. Simulation?Modeling ? Simulation?models?use?random?inputs?that?follow?probability?distributions? (PD)?to?generate?scenarios?(a.k.a.?trials)?in?order?to?evaluate?PDs?of?output? ? Four?methods?for?choosing?input?PDs 1. Bootstrapping ©C Construct?PD?by?randomly?drawing?from?historical?data 2. Parameter?estimation ©C uses?parameters?to?define?shape?of?specific?PD 3. Best?fit?technique ©C Find?PD?that?best?fits?historical?data? 4. Subjective?guess ©C Construct?PD?based?on?subjective?guess ? Advantages 1. Simply?complex?functions b/c?PD?of?output?need?not?be?identified 2. Create?visible?output?PDs that?result?from?multiple?input?PDs 3. Allows?correlation?between?variables 4. Easy?examination?effects?on?output?variables?when?changing?strategies? or?scenarios

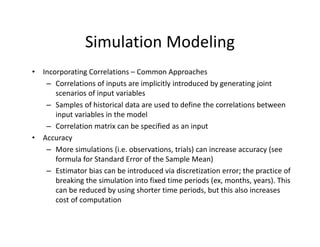

- 74. Simulation?Modeling ? Incorporating?Correlations?©C Common?Approaches ©C Correlations?of?inputs?are?implicitly?introduced?by?generating?joint? scenarios?of?input?variables ©C Samples?of?historical?data?are?used?to?define?the?correlations?between? input?variables?in?the?model ©C Correlation?matrix?can?be?specified?as?an?input ? Accuracy ©C More?simulations?(i.e.?observations,?trials)?can?increase?accuracy?(see? formula?for?Standard?Error?of?the?Sample?Mean) ©C Estimator?bias?can?be?introduced?via?discretization?error;?the?practice?of? breaking?the?simulation?into?fixed?time?periods?(ex,?months,?years).?This? can?be?reduced?by?using?shorter?time?periods,?but?this?also?increases? cost?of?computation

- 76. Inverse?Transform?Method ? Converts?a?random?number?u?that?is?between?0?and?1?to?a?number?from? the?inverse?of?the?cumulative?distribution?function?(CDF) ? For?discrete?distributions,?the?unit?interval?[0,1]?on?the?y®\axis?(representing? the?CDF)?is?split?into?segments?based?on?the?cumulative?probabilities?of? the?discrete?variables ? For?example,?cumulative?probabilities?of?40%?75%?and?100%?could? correspond?to?values?5,?20,?and?40.

- 77. Pseudorandom?Number?Generators ? Reduce?the?variance?of?an?estimate?if?the? same?sequence?of?random?numbers?is? reproduced?when?programming?the?model ? Examples: ©C Midsquare technique:?square?the?first?random? number?and?use?middle?digits?for?the?next?random? number ©C Congruential?pseudorandom?number?generator:? Avoids?the?short?cycle?problem?of?midsquare technique

![Variance?and?Standard?Deviation

? Variance?=?”ę2 =?E[(X?©C E(X))2],?properties:

1. If?c is?constant:?Var(c)?=?0?and?VaR(cX)=c2 x?Var(X)

2. If?c and?a are?constants:?Var(aX+c )?=?a2 x?Var(X)

3. If?c?and?a are?constants:?E(cX+a)?=?cE(X)+a?

4. If?X?and?Y?are?independent?random?variables:?

Var(X+Y)?=?Var(X®\Y)?=?Var(X)?+?Var(Y)

? Standard?Deviation?=?Square?root?of?Variance?

=?”ę?=?{E[(X?©C E(X))2]}1/2](https://image.slidesharecdn.com/6a7a5b80-4aac-4dda-ada0-970375a962a1-160726160328/85/FRM-Level-1-Part-2-Quantitative-Methods-including-Probability-Theory-10-320.jpg)

![Covariance

? Covariance:?A?measure?of?how?to?variables?move?together.

Cov(X,Y)?=?E[(X®\E(X))(Y®\E(Y))]?=?E(XY)®\E(X)E(Y)?

? Interpretation:

©C Values?range?from?negative?to?positive?infinity.?

©C Positive?(negative)?covariance?means?when?one?variable?has?

been?above?its?mean?the?other?variable?has?been?above?(below)?

its?mean.

©C Units?of?covariance?are?difficult?to?interpret?which?is?why?we?

more?commonly?use?correlation (next?slide)

? Properties:

©C If?X?and?Y?are?independent?then?Cov(X,Y)?=?0

©C Covariance?of?a?variable?X?with?itself?is?Var(X)

©C If?X?and?Y?are?NOT?independent:

? Var(X+Y)?=?Var(X)?+?Var(Y)?+?2(Cov(X,Y)

? Var(X®\Y)?=?Var(X)?+?Var(Y)?®\ 2(Cov(X,Y)](https://image.slidesharecdn.com/6a7a5b80-4aac-4dda-ada0-970375a962a1-160726160328/85/FRM-Level-1-Part-2-Quantitative-Methods-including-Probability-Theory-12-320.jpg)

![? An?F®\test?is?any?statistical?test?in?which?the?test?statistic?has?an?F®\distribution?under?the?null?

hypothesis.?

? Often?used?to?determine?the?best?of?two?statistical?models?by?identifying?the?one?that?best?

fits?the?data?they?were?both?estimated?upon.?

? Tests?whether?any?independent?variables?explain?variation?in?dependent?variable.

F®\statistic?with?k?and?n?©C (k+1)?degrees?of?freedom

? k?=?number?of?independent?variables??(attributable?to?ESS)

? n?©C (k+1)?=?observations?minus?number?of?coefficients

Example:?

? The?ESS?and?SSR?from?a?model?are?500?and?200?respectivly

? Sample?observations?=?100,?Model?has?3?variables

? F?=?(500?/?3)?/?[200?/(100®\3®\1)]?=?80

? Critical?95%?F®\Value?for?3?and?96?df =?2.72?

F®\Test

Numerator?Degrees?

of?Freedom

Denominator?Degrees?

of?Freedom](https://image.slidesharecdn.com/6a7a5b80-4aac-4dda-ada0-970375a962a1-160726160328/85/FRM-Level-1-Part-2-Quantitative-Methods-including-Probability-Theory-44-320.jpg)

![Factor?Models

? Factor?models?can?be?used?to?define?correlations?between?normally?distributed?

variables.?

? Equation?below?is?for?a?one®\factor?model?where?each?Ui has?a?component?

dependent?on?one?common?factor?F?in?addition?to?another?idiosyncratic?factor?Zi

that?is?uncorrelated?with?other?variables.

? Steps?to?construct:

1. Create?the?SND?common?factor?F

2. Choose?a?weight?”┴ for?each?Ui

3. Create?correlations?with?F?(previous?slide)

4. Draw?i?number?of?SND?idiosyncratic?factors?Z

5. Calculate?U?using?equation?to?right

? Advantages?of?Single?Factor?Models:

©C Covariance?matrix?is?positive®\semidefinite

©C Number?of?correlation?estimations?is?reduced?to?N?from?[Nx(N®\1)]/2

? Capital?Asset?Pricing?Model?(CAPM)?is?well?known?example?of?Single?Factor?Model

Common?

Factor

Idiosyncratic?

Factor](https://image.slidesharecdn.com/6a7a5b80-4aac-4dda-ada0-970375a962a1-160726160328/85/FRM-Level-1-Part-2-Quantitative-Methods-including-Probability-Theory-48-320.jpg)

![Inverse?Transform?Method

? Converts?a?random?number?u?that?is?between?0?and?1?to?a?number?from?

the?inverse?of?the?cumulative?distribution?function?(CDF)

? For?discrete?distributions,?the?unit?interval?[0,1]?on?the?y®\axis?(representing?

the?CDF)?is?split?into?segments?based?on?the?cumulative?probabilities?of?

the?discrete?variables

? For?example,?cumulative?probabilities?of?40%?75%?and?100%?could?

correspond?to?values?5,?20,?and?40.](https://image.slidesharecdn.com/6a7a5b80-4aac-4dda-ada0-970375a962a1-160726160328/85/FRM-Level-1-Part-2-Quantitative-Methods-including-Probability-Theory-76-320.jpg)