Futures and swaps

- 1. FUTURES AND SWAPS SUBMITTED BY:- SUPRIT AKHILESH RAJESH

- 2. DERIVATIVES âĒ A financial contract of pre-determined duration, whose value is derived from the value of an underlying asset âĒ The asset may be:- ïSecurities ï commodities ï bullion ï precious metals ï currency ï livestock ï index such as interest rates, exchange rates , etc

- 3. What do derivatives do? Minimize the loss âĒ arising from adverse price movements of the underlying asset Maximize the profits âĒ arising out of favorable price fluctuation.

- 5. Types of Derivatives Commodity Financial Index DERIVATIVES

- 6. PARTICIPANTS

- 7. DERIVATIVE INSTRUMENTS Forward Contracts Future Contracts âĒ Commodity âĒ Financial Options âĒ Put âĒ Call Swaps âĒ Interest rate âĒ currency

- 8. Forward Contracts âĒ A one to one bipartite contract, which is to be performed in future at the terms decided today. âĒ Product ,Price ,Quantity & Time have been determined in advance by both the parties. âĒ Delivery and payments will take place as per the terms of this contract on the designated date and place.

- 9. Options âĒ An option is a contract giving the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. âĒ An option is a security, just like a stock or bond, and is a binding contract with strictly defined terms and properties.

- 11. Future Contracts Standardized contract between two parties Exchange of a specified asset Standardized quantity and quality Price agreed today Delivery occurring at a specified future date

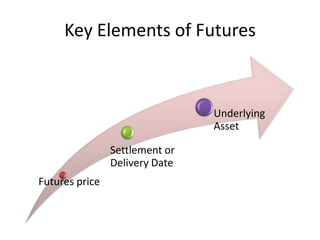

- 12. Key Elements of Futures Underlying Asset Settlement or Delivery Date Futures price

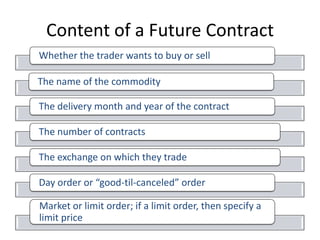

- 13. Content of a Future Contract Whether the trader wants to buy or sell The name of the commodity The delivery month and year of the contract The number of contracts The exchange on which they trade Day order or âgood-til-canceledâ order Market or limit order; if a limit order, then specify a limit price

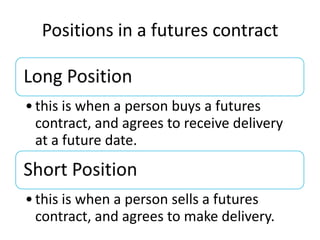

- 14. Positions in a futures contract âĒ this is when a person buys a futures contract, and agrees to receive delivery at a future date. âĒ this is when a person sells a futures contract, and agrees to make delivery.

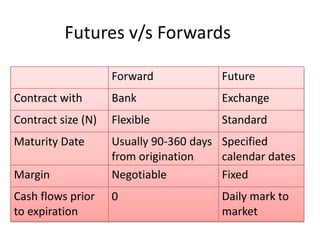

- 15. Futures v/s Forwards Forward Future Contract with Bank Exchange Contract size (N) Flexible Standard Maturity Date Usually 90-360 days Specified from origination calendar dates Margin Negotiable Fixed Cash flows prior 0 Daily mark to to expiration market

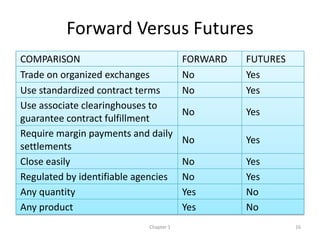

- 16. Forward Versus Futures COMPARISON FORWARD FUTURES Trade on organized exchanges No Yes Use standardized contract terms No Yes Use associate clearinghouses to No Yes guarantee contract fulfillment Require margin payments and daily No Yes settlements Close easily No Yes Regulated by identifiable agencies No Yes Any quantity Yes No Any product Yes No Chapter 1 16

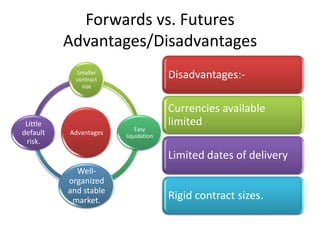

- 17. Forwards vs. Futures Advantages/Disadvantages Smaller contract Disadvantages:- size Currencies available Little limited Easy default Advantages liquidation risk. Limited dates of delivery Well- organized and stable market. Rigid contract sizes.

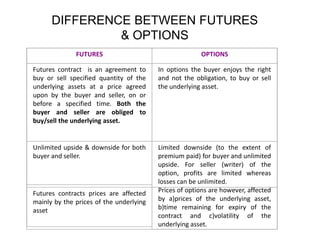

- 18. DIFFERENCE BETWEEN FUTURES & OPTIONS FUTURES OPTIONS Futures contract is an agreement to In options the buyer enjoys the right buy or sell specified quantity of the and not the obligation, to buy or sell underlying assets at a price agreed the underlying asset. upon by the buyer and seller, on or before a specified time. Both the buyer and seller are obliged to buy/sell the underlying asset. Unlimited upside & downside for both Limited downside (to the extent of buyer and seller. premium paid) for buyer and unlimited upside. For seller (writer) of the option, profits are limited whereas losses can be unlimited. Futures contracts prices are affected Prices of options are however, affected mainly by the prices of the underlying by a)prices of the underlying asset, asset b)time remaining for expiry of the contract and c)volatility of the underlying asset.

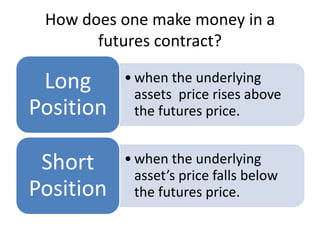

- 19. How does one make money in a futures contract? Long âĒ when the underlying assets price rises above Position the futures price. Short âĒ when the underlying assetâs price falls below Position the futures price.

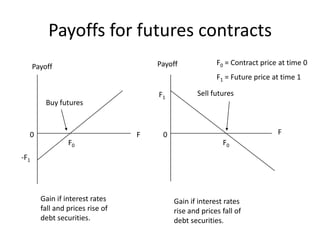

- 20. Payoffs for futures contracts Payoff F0 = Contract price at time 0 Payoff F1 = Future price at time 1 F1 Sell futures Buy futures 0 F 0 F F0 F0 -F1 Gain if interest rates Gain if interest rates fall and prices rise of rise and prices fall of debt securities. debt securities.

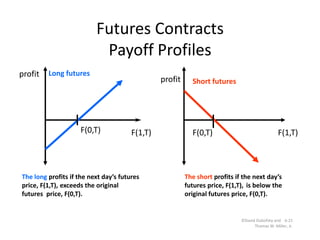

- 21. Futures Contracts Payoff Profiles profit Long futures profit Short futures F(0,T) F(1,T) F(0,T) F(1,T) The long profits if the next dayâs futures The short profits if the next dayâs price, F(1,T), exceeds the original futures price, F(1,T), is below the futures price, F(0,T). original futures price, F(0,T). ÂĐDavid Dubofsky and 6-21 Thomas W. Miller, Jr.

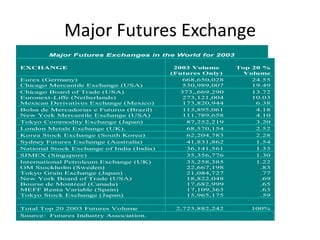

- 22. Major Futures Exchange Major Futures Exchanges in the World for 2003 EXCHANGE 2003 Volume Top 20 % (Futures Only) Volume Eurex (Germany) 668,650,028 24.55 Chicago Mercantile Exchange (USA) 530,989,007 19.49 Chicago Board of Trade (USA) 373,,669,290 13.72 Euronext-Liffe (Netherlands) 273,121,004 10.03 Mexican Derivatives Exchange (Mexico) 173,820,944 6.38 Bolsa de Mercadorias e Futuros (Brazil) 113,895,061 4.18 New York Mercantile Exchange (USA) 111,789,658 4.10 Tokyo Commodity Exchange (Japan) 87,252,219 3.20 London Metals Exchange (UK). 68,570,154 2.52 Korea Stock Exchange (South Korea) 62,204,783 2.28 Sydney Futures Exchange (Australia) 41,831,862 1.54 National Stock Exchange of India (India) 36,141,561 1.33 SIMEX (Singapore) 35,356,776 1.30 International Petroleum Exchange (UK) 33,258,385 1.22 OM Stockholm (Sweden) 22,667,198 .83 Tokyo Grain Exchange (Japan) 21,084,727 .77 New York Board of Trade (USA) 18,822,048 .69 Bourse de Montreal (Canada) 17,682,999 .65 MEFF Renta Variable (Spain) 17,109,363 .63 Tokyo Stock Exchange (Japan) 15,965,175 .59 Total Top 20 2003 Futures Volume 2,723,882,242 100% Source: Futures Industry Association.

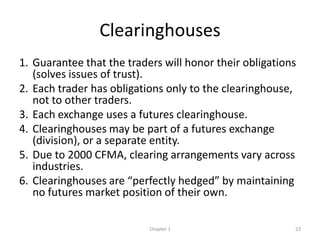

- 23. Clearinghouses 1. Guarantee that the traders will honor their obligations (solves issues of trust). 2. Each trader has obligations only to the clearinghouse, not to other traders. 3. Each exchange uses a futures clearinghouse. 4. Clearinghouses may be part of a futures exchange (division), or a separate entity. 5. Due to 2000 CFMA, clearing arrangements vary across industries. 6. Clearinghouses are âperfectly hedgedâ by maintaining no futures market position of their own. Chapter 1 23

- 24. Clearing houses Guarantee that the traders will honor their obligations Each trader has obligations only to the clearinghouse, not to other traders. Each exchange uses a futures clearinghouse. Clearinghouses may be part of a futures exchange, or a separate entity. clearing arrangements vary across industries. Clearinghouses are âperfectly hedgedâ by maintaining no futures market position of their own.

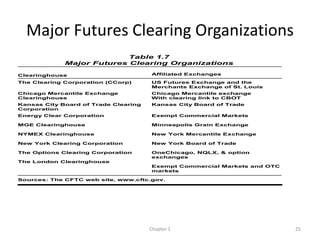

- 25. Major Futures Clearing Organizations Table 1.7 Major Futures Clearing Organizations Clearinghouse Affiliated Exchanges The Clearing Corporation (CCorp) US Futures Exchange and the Merchants Exchange of St. Louis Chicago Mercantile Exchange Chicago Mercantile exchange Clearinghouse With clearing link to CBOT Kansas City Board of Trade Clearing Kansas City Board of Trade Corporation Energy Clear Corporation Exempt Commercial Markets MGE Clearinghouse Minneapolis Grain Exchange NYMEX Clearinghouse New York Mercantile Exchange New York Clearing Corporation New York Board of Trade The Options Clearing Corporation OneChicago, NQLX, & option exchanges The London Clearinghouse Exempt Commercial Markets and OTC markets Sources: The CFTC web site, www.cftc.gov. Chapter 1 25

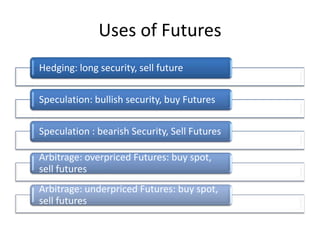

- 26. Uses of Futures Hedging: long security, sell future Speculation: bullish security, buy Futures Speculation : bearish Security, Sell Futures Arbitrage: overpriced Futures: buy spot, sell futures Arbitrage: underpriced Futures: buy spot, sell futures

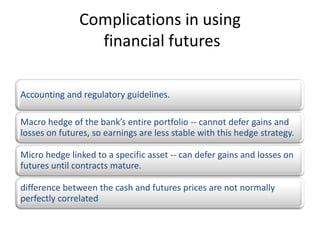

- 27. Complications in using financial futures Accounting and regulatory guidelines. Macro hedge of the bankâs entire portfolio -- cannot defer gains and losses on futures, so earnings are less stable with this hedge strategy. Micro hedge linked to a specific asset -- can defer gains and losses on futures until contracts mature. difference between the cash and futures prices are not normally perfectly correlated