Game boy

- 1. Nintendo The Launch of Game Boy Color Kazi Muhammad Mushtaq Raheel Muneeb Khan Owais Shafqat Khursheed Ahmed Syed Maktoom Hassan

- 2. Nintendo History ŌĆó 1889: Nintendo was founded by Fusajiro Yamauchi as a manufacturer of 'HanafudaŌĆś - Japanese playing cards. ŌĆó The name 'Nintendo' actually means 'leave luck to heavenŌĆÖ ŌĆó 1970: first field of video entertainment after creating the Beam Gun with opto-electronics ŌĆó 1980: launched Game & Watch which was an LCD based platform that had 59 games ŌĆó 1983: introduced first home console, Nintendo Entertainment System (NES) ŌĆó 1989: released Game Boy, a smaller portable version of Game & Watch that had great potential in terms of graphics and interchangeable games

- 3. Nintendo History ŌĆó Since the release of Game Boy, Nintendo has also introduced, Super Nintendo, Nintendo 64, and Game Boy Advance to the market ŌĆó 1997: it was estimated that more than 40% of U.S. households owned a Nintendo game system ŌĆó Nintendo is the worldwide leader in home gaming systems.

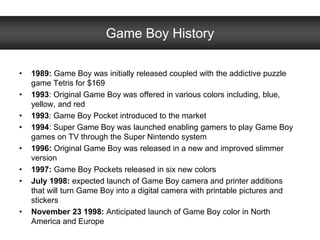

- 4. Game Boy History ŌĆó 1989: Game Boy was initially released coupled with the addictive puzzle game Tetris for $169 ŌĆó 1993: Original Game Boy was offered in various colors including, blue, yellow, and red ŌĆó 1993: Game Boy Pocket introduced to the market ŌĆó 1994: Super Game Boy was launched enabling gamers to play Game Boy games on TV through the Super Nintendo system ŌĆó 1996: Original Game Boy was released in a new and improved slimmer version ŌĆó 1997: Game Boy Pockets released in six new colors ŌĆó July 1998: expected launch of Game Boy camera and printer additions that will turn Game Boy into a digital camera with printable pictures and stickers ŌĆó November 23 1998: Anticipated launch of Game Boy color in North America and Europe

- 6. Strengths

- 7. Strengths ŌĆó Game Boy is the most successful gaming platform in history ŌĆō sold more than 70 million units during its almost 10-year life ŌĆó Nintendo was the leader in the worldwide US$15 billion retail video game industry. ŌĆó Nintendo manufactured and marketed hardware and software for its game systems ŌĆó Nintendo 64 is named Time MagazineŌĆÖs ŌĆ£Machine of the YearŌĆØ for 1996. ŌĆó Control of the games that ran on its game machines, keeping its third-party software providers under tight control ŌĆó Improvements: o In 1994, an add-on for the Super Nintendo Entertainment System was launched, enabling gamers to play Game Boy games on that system. o In 1996, Game Boy was relaunched in a slimmer housing with further improvements in screen clarity. o In 1997, Game Boy Pocket was introduced in six new colors.. ŌĆó The new Game Boy color would display sharp and vivid color graphics. Game Boy ColorŌĆÖs screen was also not backlit, which meant two AA batteries would last about 12 hours. ŌĆó Nintendo Canada would have access to a broad selection of ads from the US that could appeal to all the target segments being considered for their launch plan.

- 8. Weaknesses

- 9. Weaknesses ŌĆó Both Game Boy hardware and software sales had declined steadily from 1992 to 1996 on a worldwide basis. ŌĆó By 1998, support of third-party developers for Game Boy was waning. Many viewed it as a ŌĆ£spent forceŌĆØ in the market and were reluctant to invest the US$200,000 to US$300,000 to develop a new Game Boy cartridge, when there were more attractive opportunities in the much larger console market. ŌĆó The marketing communications budget for Nintendo in Canada was only a small fraction of the Nintendo budget in the US. Also, Nintendo Canada selected its ads from the pool developed by Nintendo in the US. ŌĆó When the original Game Boy was launched in 1989, it had been priced slightly higher in Canada than the US, attributing to Game BoyŌĆÖs proportionately greater sales in the US.

- 10. Opportunities

- 11. Opportunities ŌĆó On November 23, 1998, a color version of NintendoŌĆÖs Game Boy would be released simultaneously in North America and Europe, one of the most important launches in NintendoŌĆÖs history. ŌĆó Game Boy Camera and Game Boy Printer were scheduled to be released in July 1998. ŌĆó Retailers had ŌĆ£open to buyŌĆØ dollars that could be shifted around during the year to support the ŌĆ£hotŌĆØ products. ŌĆó Sega and other competitors lacked new exciting software for their handheld hardware. Handheld users seemed to want exciting, current software. ŌĆó Six new games, specifically developed to take advantage of the 56-color palette on Game Boy Color, were expected to be available at the launch date.

- 12. Threats

- 13. Threats ŌĆó In 1998 Nintendo began to lose momentum as some of the third-party developers began focusing more of their development effort on Sony Playstation, which was viewed as an easier platform on which to develop games, and the Sony business model was viewed as being a more profitable one. ŌĆó Sega had been much more aggressive in promoting its console business in Canada than in the US. ŌĆó Third-party developers were spending fewer marketing dollars in Canada due to the relatively small size of the Canadian market. Canada represented only about 3 percent of the global Game Boy software market, whereas the US accounted for between 35 percent to 40 percent. ŌĆó As sales velocity slowed in the mid to late 1990s, retailers shifted more of their shelf space to Nintendo consoles and competing platforms and reduced their advertising and promotional support for Game Boy. ŌĆó In the late 1990s, a number of specialty stores had delisted Game Boy because they felt that they were not achieving competitive returns on their sales of Game Boy hardware and software. ŌĆó Competition: o Atari Lynx, the worldŌĆÖs first color handheld video game system. o TurboExpress o SegaŌĆÖs Game Gear o SegaŌĆÖs Nomad

- 14. Issue Identification ŌĆó Issue #1: Choosing the right target market and the right positioning ŌĆó Issue #2: Choosing the right market approach ŌĆó Issue #3: How to price Game Boy Color in Canada ŌĆó Issue #4: Product

- 15. Issue #1: Target Market and Positioning ŌĆó Alternative #1: Focus on teens who were more likely to already own a Game Boy ŌĆó Alternative #2: Focus on new kid/tween users

- 16. Issue #2: Marketing approach ŌĆó Alternative #1: In-store interactive display ŌĆó Alternative #2: Mall tour ŌĆó Alternative #3: Cross Canada tour

- 17. ŌĆó Alternative #1: Price Game Boy Color according to the mid-1998 exchange rate conversion of U.S. price ŌĆó U.S.= $79.95 Cdn =$120 ŌĆó Alternative #2: Price Game Boy Color at a lower cost of Cdn= $100 Issue #3: Pricing

- 18. Issue #4: Product - Alternative #1: Continue to offer the Black and White version of the product - Alternative #2: Stop offering the black and white version Game Boy - Alternative #3: Bundle a game cartridge with the Game Boy Color - Alternative #4: Do not bundle a game cartridge with the Game Boy Color

- 19. Group Discussions ŌĆó Issue #1: Choosing the right target market and the right positioning ŌĆó Issue #2: Choosing the right market approach ŌĆó Issue #3: How to price Game Boy Color in Canada ŌĆó Issue #4: Product

- 20. Issue #1. TM and Positioning ŌĆó Alternative #1:Focus on teens who were more likely to already own a Game Boy ŌĆō PROs: ŌĆó If successful in getting teens to adopt, this might spur sales among kids and particularly tweens, who often aspired to use the same products as teens ŌĆó Teens tended to purchase machines with their own money, making their purchases all year round, not just at holiday times ŌĆó If teens already owned a Game Boy we know that they are interested in this type of handheld device, and we know how to target them because we have reached them in the past ŌĆō CONs: ŌĆó If Nintendo Canada targeted teens that had used Game Boy in the past, they might view the Game Boy as a product that was great when they were younger but not sophisticated enough to meet their current gaming needs ŌĆó If Nintendo was unsuccessful in getting teens to adopt, then perhaps kids and tweens would avoid it as well ŌĆó Many in this segment already had a black and white Game Boy and a library of five or six games and viewed the product as ŌĆ£old technologyŌĆØ ŌĆó Many teens appeared to have moved past the handheld machines to consoles, which offered greater speed and game complexity ŌĆó Only represent 6.7% of the total population of Canada

- 21. Issue #1: TM and Positioning ŌĆó Alternative #2: Focus on new kid/tween users ŌĆō PROs: ŌĆó If Nintendo targeted kids and tweens and was able to convince kids/tween nonusers of Game Boy that Game Boy Color was a ŌĆ£coolŌĆØ product, it could become a ŌĆ£gotta haveŌĆØ for the younger set ŌĆó This younger audience was less likely to already own a Game Boy product ŌĆó Kid/Tween users represent 19.9% of the total population of Canada ŌĆō CONs: ŌĆó The difference between being cool or not cool with the younger set was a very fine line ŌĆó If focused on the kids and tweens, it might turn off the teens because Game Boy Color was ŌĆ£a kidŌĆÖs toyŌĆØ ŌĆó Game Boys were typically purchased for kids and tweens by their parents as gifts, resulting in peak sales occurring in November and December for holiday gift giving and in June as a graduation or ŌĆ£great report cardŌĆØ present

- 22. Issue #2: Marketing approach ŌĆó Alternatives #1: low-cost interactive display ŌĆō Pros: ŌĆó generate brand/product awareness when teens/kids/tweens visit the stores ŌĆó Estimated in store interactive displays would be used approximately 20 % of store hours for an average of 3 min/use. ŌĆó No sales staff required to monitoring the displays ( easy to operate) ŌĆó 1000 potential outlets and Nintendo could achieve an 80% placement rate ŌĆó Low Cost ŌĆō Cons: ŌĆó No one is there to explain the new product or the benefits of the product if kids/tweens/teens have questions ŌĆó Most sales clerks knew little about Game Boy Color hardware or software ŌĆó Competitors have similar displays ’āĀ Direct Competition

- 23. Issue #2: Marketing approach ŌĆó Alternative #2: Mall Tours ŌĆō Pros: ŌĆó Nintendo reprehensive is highly knowledgeable gamers, and would show game insights and tricks that kiosk visitor could use to improve their scores on popular games ŌĆó Incentives encourage trial among teens/tweens/kids ’āĀ Mall tour visitors can enter contests for Nintendo products and would receive a temporary Nintendo tattoo when they left ŌĆó 6-8 minutes on the product ( more than store displays which lasts only 3 minutes) ŌĆó Teens/kids/tweens spend a lot of time in the mall ŌĆō Cons: ŌĆó Expensive: $10,000 per Mall visit, means only 25 mall tours per year ŌĆó Mall selection problems ŌĆó staff is limited/place is limited

- 24. Issue #2: Marketing approach ŌĆó Alternative #3: Cross-Canada tour ŌĆō Pros: ŌĆó Most likely to generate buzz/PR ŌĆó Automatically high awareness due to scale of the events ŌĆó More freedom to promote in a bold manner ŌĆó Bigger kiosks, more staff to promote the new product ŌĆó High reach due to the size of audiences attending each event ---80% ŌĆō Cons: ŌĆó costly $150,000 per year for major regional or national events: CNE, Klondike Days, and the Calgary Stampede ŌĆó Events only take place in summer months

- 25. Issue #3: Pricing ŌĆó Alternative 1: Price Game Boy Color according to the mid-1998 exchange rate conversion of U.S. price ŌĆō Pros: ŌĆó Remain consistent with pricing in the US ŌĆó Nintendo Canada wouldnŌĆÖt experience proportionately lower sales than the US similar to when the original version had been launched in 1989 ŌĆó Prevent black market trafficking and sales from the US to Canada because of the cheaper price ŌĆó produce a retail margin of 20% on Game Boy consoles ŌĆō Cons: ŌĆó Hardware price would be too high to drive-high volume sales in Canadian market ŌĆó Higher cost make it unaffordable for kids/tweens market ŌĆó Could lose business to competitors because of high cost of gaming system

- 26. Issue #3: Pricing ŌĆó Alternative 2: Price Game Boy Color at a lower cost of Cdn= $98 ŌĆō Pros: ŌĆó Lower price makes the gaming system more attractive and affordable to buy, especially for kids/tween market segment ŌĆó Retailers could make more profitable returns per square meter ŌĆó Lowest sale price of Game Boy to date ŌĆō Cons: ŌĆó Could lead to black market exporting of product to other markets ŌĆó Nintendo Canada would only receive a gross margin of 5% instead of the past 6% ŌĆó With a lower margin received from each Game Boy sold, retailers might chose to spend their money on carrying and aggressively marketing other game systems

- 27. Issue #4: Product ŌĆó Alternative #1: continue to offer the black and white version of the product ŌĆō Pros: ŌĆó Low price ’āĀ Cdn $49 ŌĆó Backward compatibility of game boy color games mean that consumers could buy the black and white version and then trade up at a later date with out making their games obsoletes. ŌĆō Cons: ŌĆó With the low price, the black and white version would not generate any profits ŌĆó Cannibalizing sales of Game Boy color

- 28. Issue #4: Product ŌĆó Alternative #2: do not continue to offer the black and white version of the product ŌĆō Pros: ŌĆó Avoid losing money producing the black an white version ŌĆó Avoid cannibalizing sales of Game Boy color ŌĆō Cons: ŌĆó Excludes consumers looking for a more affordable option

- 29. Issue #4: Product ŌĆó Alternative #3: Nintendo Canada should bundle a game cartridge with Game Boy color at Launch ŌĆō Pros: ŌĆó Incentive to purchase ŌĆó Teens/Tweens/Kids can see the difference between color and black and white gamesŌĆ”and if they think color is superior, they would keep purchasing the color games instead of just keep using their old/already owned black and white games ŌĆó History could repeat itself with Game Boy having the same success it experienced when packaging Tetris with the original Game Boy ŌĆó Increased perceived value of game system ŌĆō Cons: ŌĆó A high price will be charge?? ŌĆó Lose revenue from independent game sales

- 30. Issue #4: Product ŌĆó Alternative #4: Nintendo Canada should not bundle a game cartridge with Game Boy color at launch ŌĆō Pros: ŌĆó Avoid higher retail prices ŌĆó Higher profits from the individual game sales ŌĆō Cons: ŌĆó Less incentive to buy ŌĆó Consumers may expect Game Boy to come with a game cartridge because that is what they have experienced in the past

- 31. Recommendations ŌĆō Focus on both teens already own a Game Boy and new kid/tween users ŌĆō The best marketing approach is a cross-Canada tour because we felt this is the best way to generate buzz and increase brand awareness and same time it is the most informative way to educate users on the new product. We also felt the other two approaches can be carried along after the launch of Game Boy Color ŌĆō PR: ŌĆó we also recommended what has been stated in the case ŌĆō Sales Reps visit leading magazine/web publications three month before product launch and let the writers to play the game for 5-6 hours ŌĆō We decided to price Game Boy Color at Cdn $120 to best satisfy factors such as profitability, consumer price sensibility and sufficient motivation for retailers to carry the product. ŌĆō Lastly, we have decided that Nintendo should stop offering the black and white version Game Boy and bundle a game cartridge with Game Boy Color. This will not only encourage users to try new Game Boy Color but also make them adopt to the new product faster.

- 32. Expert Choice ŌĆō See printouts

- 33. Implementations ŌĆó short-term: ŌĆō focus advertisements and literature on the $120 price, which includes a game cartridge, and towards both teen and new kid/tween user markets ŌĆō begin research and creation of the cross-canada tour ŌĆō gather information about consumer response and satisifaction ŌĆō advertise aggressively in the beginning to promote the new Game Boy Color to both target markets with separate campaigns focused at each market individually ŌĆó long-term: ŌĆō execute the cross-canada promotions tour ŌĆō sign a young celebrity as a spokesperson for Game Boy Color to appeal to the young target markets

- 34. Thank You