Cost Segregation Presentation

- 1. Cost Segregation – Maximizing Tax Savings Gil Mitchell – Director WTAS LLC 100 First Street, Suite 1600, San Francisco, CA 94105 gil.mitchell@wtas.com (Tel) 415.764.2750, (Fax) 415.764.2770 www.wtas.com

- 2. West Region Leader Gil Mitchell, ASA – San Francisco Has 25 years experience in : Cost Segregation, Property Tax Consulting, Machinery Appraisal and Real Estate Appraisal ASA in Machinery and Equipment Appraisal Certified General Real Estate Appraiser AG005951 Formerly with: Arthur Andersen, Grant Thornton, Moss Adams and Oregon Department of Revenue Gil’s Contact information: gil.mitchell@wtas.com (Tel) 415.764.2750, (Fax) 415.764.2770

- 3. Jack Young, GPPA, CPA Experience in: Financial Analysis Income Tax Consulting Machinery and Real Estate Appraisal USPAP appraiser of Machinery and Equipment Certified Public Accountant Formerly with: KPMG Price Kong, CPAs Bar None Auction West Auction Jack Young contact information (530) 219-7900 [email_address] www.norcalvaluation.com

- 4. Tax Deferral Strategy Analysis of project costs for constructed or purchased buildings & improvements Segregation of costs into “Personal Property” and “Real Property” A Means of Accelerating Depreciation Expense for Building Owner "A nickel isn't worth a dime today." What Is Cost Segregation?

- 5. How Does Cost Segregation Work? Cost Segregation analyzes project costs to identify personal property (an Investment Tax Credit Standard) within and without of the structure.

- 6. The IRS has established asset classes "1250 & 1245" and depreciable lives for constructed properties 27.5 years – Residential 1250 39 years – Commercial/Industrial 1250 Classes with shorter lives 15 years – Site Improvements 1250 7 years – Trade Fixtures 1245 5 years – Trade Fixtures 1245 Depreciation Lives Under Current Tax Law (MACRS)

- 7. New Construction Purchased Facilities Remodels Renovations Expansions Leasehold Improvements Estates (Change in Basis) What Kinds of Projects Benefit?

- 8. Can A Study Be Performed Retroactively? Yes! Depreciation is considered a method of accounting. A study that “looks back” to prior tax years and results in a depreciation adjustment is an IRC 481(a) adjustment and is deducted over one year. Prior returns are not amended. We can go back to 1987.

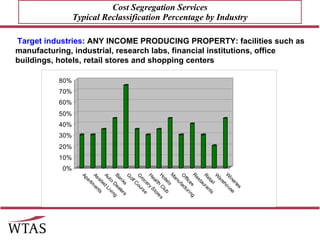

- 9. Cost Segregation Services Typical Reclassification Percentage by Industry Target industries : ANY INCOME PRODUCING PROPERTY: facilities such as manufacturing, industrial, research labs, financial institutions, office buildings, hotels, retail stores and shopping centers

- 10. Increased Cash Flow No Obligation Proposals We Estimate the Benefits in Advance A “Complete Depreciation Solution” for Clients Buying/Developing Real Estate Documentation Minimize property taxes Proceeds can be used for debt repayment, reinvestment, capital repairs, or other acquisitions Benefits to Client

- 11. Manufacturing Facility - Tenant Improvement Analysis Project cost = 1,671,450 Date place in service = 2002 Amount moved out of 39 year life to 5, 7 & 15 year lives = $1,379,000 1st year benefit with 30% bonus depreciation = $215,000

- 12. Office Building - Retroactive study Purchase price = $2,794,000 Date place in service = 1996 Amount moved out of 39 year life to 5, 7 & 15 year lives = $445,000 1st year increased depreciation = $266,200 1st year benefit with change of accounting = $93,170

- 13. Summary A Value-Added Service to Our Clients Easy to Explain - Compelling Benefits Documented Support for Our Client Written Marketing Materials No Obligation Proposals

- 14. Next Step: No Obligation Proposal What we need: Depreciation schedule for purchased property Contractors cost breakdown for new construction Your proposal will include: Documents suitable to take to your tax advisor. Estimated cost allocation of short lived items. Estimated tax savings Appraisal fee proposal

- 15. Brainstorming: What specific clients or properties would benefit from a Cost Segregation Study: Office buildings Wineries Apartments Shopping centers Retail Restaurants Grocery Stores Manufacturing

- 16. Questions? ? ? ?

Editor's Notes

- Projects over 1 million Post 1986 construction

- Why do clients want this done? Increased cash flow. It allows you, your clients to recapture your depreciation deductions sooner which can, in turn, be used elsewhere. Property Taxes: Overtime expenses, Fasttrack Environmental remediation – cleanups, Demoltion

- It has been a real pleasure to be here today to talk with you about the important opportunities that this major new federal deduction has created. I want to thank you for giving me your time and attention and, before we close up, I wanted to open the floor up one last time for questions. Also, please know, if you think of questions after I/we leave here today, you are more than welcome to follow up with us via email or with a telephone call.

![Jack Young, GPPA, CPA Experience in: Financial Analysis Income Tax Consulting Machinery and Real Estate Appraisal USPAP appraiser of Machinery and Equipment Certified Public Accountant Formerly with: KPMG Price Kong, CPAs Bar None Auction West Auction Jack Young contact information (530) 219-7900 [email_address] www.norcalvaluation.com](https://image.slidesharecdn.com/gilandjackwtascostsegregationpresentation-12533767036542-phpapp02/85/Cost-Segregation-Presentation-3-320.jpg)