Global economy in 2014 (web version)

- 1. The global economy in 2014 Grant Thornton International Business Report

- 2. The global economy in 2014 2014 in numbers Drawing on data and insight from the Grant Thornton International Business Report (IBR), the Economist Intelligence Unit (EIU) and the International Monetary Fund (IMF), this short report considers the outlook for the global economy in 2014. Net business optimism 28% 22% number of economies 21% in the eurozone 38% Global GDP share of Trans Pacific BRIC 18 G7 following accession of Latvia India and Indonesia's Partnership economies share of global population Both have elections in 2014 600,000 Forecast GDP growth rates for FIFA World Cup Global expected vistors to Brazil 3.6% 5.1% Developing Developed 2%

- 3. The global economy in 2014 Foreword The global economy looks much healthier as we begin 2014 compared with 12 months ago. Then, fears over the Ąźfiscal cliffĄŻ in the United States, the recession in Europe and the rebalancing of ChinaĄŻs economy were dampening growth prospects across the world, and globally, business confidence was at its lowest since the financial crisis. Growth prospects looking a lot brighter Germany US UK Japan Though some are less bright Russia Brazil Italy France Today, global growth prospects look a lot brighter with most large developed economies, especially Japan, the United Kingdom and the United States expected to grow strongly in 2014. The optimism of business leaders in these economies has increased dramatically over the past year and the hope is that rising confidence will encourage them to invest more in their operations and their people to achieve long-term, sustainable growth. However, the situation in many emerging markets is something of a mirror image. Since the United States Federal Reserve announced plans to begin tapering its huge quantitative easing programme, many economies have seen their currencies slide and growth suffer. Business confidence in China, Brazil, India and South Africa all fell to record lows in 2013, and in Russia and Turkey to record lows since the financial crisis began. Confidence has rebounded, especially in China and India, but with many of these economies suffering from slowing growth, sliding currencies and social unrest, 2014 could be a period of significant adjustment. The eurozone crisis also remains delicately poised. Following a contraction of 0.4% in 2013, the currency bloc is expected to return to growth in 2014, but while Germany is expected to expand robustly, the next two largest economies in the currency bloc, France and Italy, look set to struggle and their business communities are amongst the least optimistic in the world. At the macro-level, we are seeing a convergence in growth prospects. In the years following the financial crisis, emerging economies drove growth in global output but this dynamic has shifted in recent months. The Economist Intelligence Unit expects that growth in non-OECD economies will outstrip that of those in the OECD in 2014, but that the gap will be the smallest since 2008. This is an important development: a more stable, balanced global economy is good for business growth prospects. There will be much change over the next year, but I am looking forward to it with optimism. Ed Nusbaum Global CEO Grant Thornton The global economy in 2014 3

- 4. The global economy in 2014 Economic outlook The global economy grew by approximately 2.9% in 2013, its slowest rate since 2009. However, prospects for 2014 look brighter with robust growth forecast in large developed economies such as Germany, Japan, the United Kingdom and the United States. Because of their scale, a recovery in these economies is likely to boost global growth to 3.6% in 2014, accelerating to 4.0% in 2015. Having contracted marginally in 2013, the eurozone is expected to return to growth, although the outlook remains tricky with debt levels continuing to rise, especially in troubled southern Europe. Growth in developing economies as a whole slowed in 2013, but they are still expected to expand faster than developed economy peers in 2014. The economies of developing Asia, led by China, India and Indonesia, are expected to grow by 6.5% in 2014. Strong growth is also forecast in Sub-Saharan Africa and the Middle East, and North Africa is expected to rebound after a tough 2013 complicated by the fallout from the Arab Spring. Central and Eastern European economies have suffered as major regional export markets have dried up but growth prospects are improving despite a lack of necessary reforms in Russia. Growth in Latin America continues to disappoint with Argentina and Brazil, despite gearing up to host the FIFA World Cup in June, seemingly stuck in a rut, although recent bold reforms in Mexico bode well for future growth. This healthier outlook for the global economy is complicated not only by the fragility of the eurozone, but also by the reduction of the US Federal ReserveĄŻs massive quantitative easing programme. Talk of tapering sent many emerging markets into a negative spiral in the middle of 2013 and while the reaction to the real thing has been less dramatic so far, the currencies of Brazil, India, Indonesia, South Africa and Turkey šC the so-called Ąźfragile fiveĄŻ šC are all thought to Global economy expanded by 2.9% in 2013 be at risk and central banks have started to raise interest rates sharply. In developed markets, a slowdown in the pace of bond-buying could precipitate a rise in interest rates from record lows, dampening business investment and consumer spending power, potentially choking off the recovery. ForecastGDP growth rates % % Forecast GDP growth rates Forecast GDP growth rates % Central and Eastern Europe Central and Eastern Europe 2.7 Latin America and the Caribbean Latin America and the Caribbean 3.3 3.1 Middle East and North Africa Middle East and North Africa 3.5 3.8 Emerging markets and developing economies Emerging markets and developing economies 4.2 5.1 Sub-Saharan Africa Sub-Saharan Africa 6.0 Developing Asia Developing Asia Euro area Euro area Advanced economies Advanced economies Non-euro/G7 advanced economies Non-euro/G7 advanced economies World World 4.2 5.7 6.5 1.0 6.6 1.4 2.0 2.5 3.1 3.3 3.6 4.0 The global economy in 2014 4

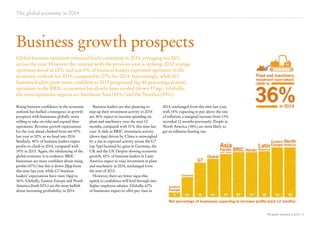

- 5. The global economy in 2014 Business growth prospects Global business optimism remained fairly consistent in 2013, averaging net 28% across the year. However the contrast with the previous year is striking: 2012 average optimism stood at 12% and just 4% of business leaders expressed optimism in the economic outlook for 2013, compared to 27% for 2014. Interestingly, while G7 business leaders grew more confident as 2013 progressed (up 44 percentage points), optimism in the BRIC economies has slowly been eroded (down 17 pp). Globally, the most optimistic regions are Southeast Asia (45%) and the Nordics (39%). Rising business confidence in the economic outlook has fuelled a resurgence in growth prospects with businesses globally more willing to take on risks and expand their operations. Revenue growth expectations for the year ahead climbed from net 45% last year to 52% as we head into 2014. Similarly, 40% of business leaders expect profits to climb in 2014, compared with 35% in 2013. Again, the rebalancing of the global economy is in evidence: BRIC businesses are more confident about rising profits (47%) but this is down 28pp from this time last year, while G7 business leadersĄŻ expectations have risen 16pp to 36%. Globally, Eastern Europe and North America (both 52%) are the most bullish about increasing profitability in 2014. Business leaders are also planning to step up their investment activity in 2014: net 36% expect to increase spending on plant and machinery over the next 12 months, compared with 31% this time last year. A slide in BRIC investment activity (down 4pp) driven by China is outweighed by a rise in expected activity across the G7 (up 7pp) boosted by gains in Germany, the UK and the US. Despite slowing economic growth, 42% of business leaders in Latin America expect to raise investment in plant and machinery in 2014, unchanged from 3.3 the start of 2013. However, there are fewer signs this uptick in confidence will feed through into higher employee salaries. Globally, 67% of businesses expect to offer pay rises in Plant and machinery investment expectations climb to 36% in 2014 2014, unchanged from this time last year, with 14% expecting to pay above the rate of inflation, a marginal increase from 13% recorded 12 months previously. People in North America (18%) are most likely to Net percentage expecting to increase profits (next 12 months) get an inflation-busting rise. Asia Eastern Pacific BRIC Nordic 45 47 47 (excl. Japan) G7 North 52 52 Latin Europe America America Global Eurozone Southern Europe 5 21 36 40 48 Net percentage of businesses expecting to increase profits (next 12 months) The global economy in 2014 5

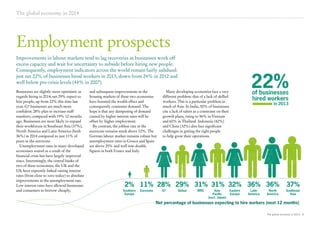

- 6. The global economy in 2014 Employment prospects Improvements in labour markets tend to lag recoveries as businesses work off excess capacity and wait for uncertainty to subside before hiring new people. Consequently, employment indicators across the world remain fairly subdued: just net 22% of businesses hired workers in 2013, down from 24% in 2012 and well below pre-crisis levels (44% in 2007). Businesses are slightly more optimistic as regards hiring in 2014; net 29% expect to hire people, up from 22% this time last year. G7 businesses are much more confident: 28% plan to increase staff numbers, compared with 19% 12 months ago. Businesses are most likely to expand their workforces in Southeast Asia (37%), North America and Latin America (both 36%) in 2014 compared to just 11% of peers in the eurozone. Unemployment rates in many developed economies soared as a result of the financial crisis but have largely improved since. Interestingly, the central banks of two of these economies, the UK and the US, have expressly linked raising interest rates (from close to zero today) to absolute improvements in the unemployment rate. Low interest rates have allowed businesses and consumers to borrow cheaply, and subsequent improvements in the housing markets of these two economies have boosted the wealth effect and consequently consumer demand. The hope is that any dampening of demand caused by higher interest rates will be offset by higher employment. By contrast, the jobless rate in the eurozone remains stuck above 12%. The German labour market remains robust but unemployment rates in Greece and Spain are above 25% and well into double figures in both France and Italy. 22% of businesses hired workers Many developing economies face a very different problem: that of a lack of skilled workers. This is a particular problem in much of Asia. In India, 50% of businesses cite a lack of talent as a constraint on their growth plans, rising to 56% in Vietnam and 60% in Thailand. Indonesia (42%) and China (32%) also face significant challenges in getting the right people to help grow their operations. in 2013 2% 11% 28% 29% 31% 31% 32% 36% 36% Southern Europe Eurozone G7 Global BRIC Asia Pacific (excl. Japan) Eastern Europe Latin America North America 37% Southeast Asia Net percentage of businesses expecting to hire workers (next 12 months) The global economy in 2014 6

- 7. The global economy in 2014 Business growth constraints With the global economy still in recovery, business leaders rank economic uncertainty (42%) as the principal constraint on their expansion plans in 2014. The trade-off between risk and reward is intrinsic to any analysis of business growth prospects; a certain level of uncertainty is to be expected. But this is a major issue for businesses across the globe: more than two in five business leaders in both the G7 and BRIC economies feel their growth plans constrained by uncertainty; in other words, they are not confident enough in the potential rewards to risk investment in the year ahead. Bureaucracy is the second most pressing constraint globally (34%) although it has eased off compared with this time last year in both G7 and BRIC economies. Businesses in southern Europe are most concerned (49%) while peers in the Nordics are least concerned (17%). Demand conditions have improved markedly in recent years as consumer spending and world trade recover. In 2009, 49% of business leaders cited a shortage of orders as a constraint on growth but this dropped to 33% in 2013, close to pre-crisis levels. 32% of business leaders expect demand constraints to hinder growth prospects in 2014, down from 38% this time last year with conditions improving notably in North America (down 14pp to 17%) but remaining elevated in Asia-Pacific (49%). A lack of skilled workers has climbed in the last four years, a further indication that the recovery is taking hold, to average 30% in 2013. It is a much greater concern in BRIC economies (39%) where skills and unemployment are generally lower compared with the G7 economies (26%). Businesses in Southeast Asia (46%) are struggling most to fill talent gaps with peers in southern Europe (15%) at the other end of the spectrum. Both exchange rate fluctuations (37%) and a shortage of finance (32%) are much greater problems for businesses in the BRIC economies compared with peers in the G7. These results highlight the issues businesses in these developing economies could face as the US Federal Reserve steps up the tapering of asset purchases. Percentage of businesses citing factors as a constraint on growth 44 41 Economic uncertainty 42 ?? 37 XR fluctuations 32 35 Regulations & red tape 29 Shortage of orders 39 26 Lack of skilled workers BRIC 17 Shortage of finance 27 41 16 ? ? 12 ICT infrastructure 25 9 Transport infrastructure G7 The global economy in 2014 7

- 8. IBR 2014 methodology The Grant Thornton International Business Report (IBR) is the leading mid-market business survey in the world, interviewing approximately 3,300 senior executives every quarter in listed and privately-held businesses all over the world. Launched in 1992 in nine European countries, the report now surveys more than 12,500 businesses leaders in 45 economies on an annual basis, providing insights on the economic and commercial issues affecting companies globally. The data in this report are drawn from interviews with chief executive officers, managing directors, chairmen and other senior decision-makers from all industry sectors. 2014 data is drawn from 3,500 interviews globally conducted in November and December 2013. 2013 data is drawn from over 12,500 interviews conducted between January and December 2013. To find out more about IBR, please visit: www.internationalbusinessreport.com. Dominic King Global research manager Grant Thornton T +44 (0)207 391 9537 E dominic.king@gti.gt.com ? 2014 Grant Thornton International Ltd. ĄźGrant ThorntonĄŻ refers to the brand under which the Grant Thornton member firms provide assurance, tax and advisory services to their clients and/or refers to one or more member firms, as the context requires. Grant Thornton International Ltd (GTIL) and the member firms are not a worldwide partnership. GTIL and each member firm is a separate legal entity. Services are delivered by the member firms. GTIL does not provide services to clients. GTIL and its member firms are not agents of, and do not obligate, one another and are not liable for one anotherĄŻs acts or omissions. www.gti.org CA1401-03