Global Finance Strategy Of RIL

6 likes2,863 views

Reliance Industries Ltd (RIL) relies heavily on global capital markets to fund its operations and expansion due to lower foreign interest rates. Over the past decades, RIL has raised billions of dollars through various financing strategies, including Yankee bonds, syndicated loans, export credit facilities, and private placements. RIL manages foreign exchange risk through a diverse portfolio of foreign currencies for debt as well as hedging strategies like forwards, options, and maintaining foreign cash reserves in several global banks. RIL's strong credit profile and relationships with over 100 financial institutions help enable its extensive global financing activities.

1 of 15

Ad

Recommended

Strategic management notes

Strategic management notesDr. Syed Kashan Ali Shah

╠²

This document provides an outline for a course on strategic management. It defines key terms used in strategic management like strategists, mission statements, external opportunities/threats, internal strengths/weaknesses, objectives, strategies, and policies. It describes the stages of the strategic management process as strategy formulation, implementation, and evaluation. Environmental scanning is discussed as the process of gathering external information on opportunities and threats. The internal and external environments are also defined.Insurance company

Insurance companyglendapadillaforevs

╠²

This document discusses various topics related to insurance in the Philippines, including life insurance, non-life insurance, investment of insurance funds, the Insurance Commission as the regulatory body, key provisions of the Insurance Code of the Philippines, and the organizational structure and functions of the Insurance Commission. The summaries provide an overview of the high-level information covered.The New India Insurance Company

The New India Insurance CompanyPolicyX.com Private Limited

╠²

The New India Assurance Company, established in 1919 by Sir Dorabji Tata, is a state-owned insurance provider in India with a significant global presence, operating in 28 countries and offering nearly 170 insurance products. The company reported gross premiums reaching Rs. 15,149.50 crore in 2014-15 and has over 19,000 employees, supported by a vast network of offices and agents. NIA emphasizes financial security, transparency, and excellent customer support, providing various personal, commercial, industrial, liability, and social insurance plans.Star comprehensive health insurance presentation

Star comprehensive health insurance presentationDhanasekaran StarHealth Insurance

╠²

The Star Comprehensive Insurance Policy offers a family floater option with high sum insured limits, extensive coverage, and no sub-limits on room rent. Key features include coverage for hospitalization, maternity, outpatient dental and ophthalmic treatments, and health check-up benefits, with automatic restoration of sum insured. The policy also includes specific exclusions, co-payment requirements, and allows portability from other insurers.ULIP

ULIPAbhishek Kumar Singh

╠²

This document discusses Unit Linked Insurance Plans (ULIPs). It begins by defining ULIPs as innovative life insurance products that provide both life insurance coverage and opportunities for investment growth. It then discusses the different types of ULIP plans available, and provides data on the existing market share and growth of ULIP products in India over the past five years. Finally, it analyzes the ULIP industry using Porter's Five Forces model and compares the sales strategies of two major players, LIC and ICICI Prudential.Strategic control

Strategic controlnitinsoni02

╠²

Strategic control involves continually evaluating a strategy as it is implemented and making adjustments based on changes in the underlying assumptions. It includes four types of control: premise control checks assumptions, implementation control monitors resource allocation and progress, strategic surveillance broadly monitors internal and external events, and special control allows for rapid reassessment in response to unexpected crises. The overall goal is to continually assess the changing environment and make adjustments to ensure the strategy remains aligned with conditions.Hr practices in emirates airlines

Hr practices in emirates airlinespaulmartin315

╠²

The document provides an overview of HR practices at Emirates Airlines. It describes the airline's vision, organizational structure, strategic planning process, job analysis, recruitment and selection, compensation and benefits, training and development, performance appraisal, and references key HR functions. Training and development opportunities have improved employee satisfaction, while strategic alignment and understanding market conditions help ensure HR goals support business strategies. Performance appraisal allows management to measure productivity and provide tailored training to maximize employee contributions.Service Brand study on Emirates

Service Brand study on EmiratesAbhishek Duttagupta

╠²

Emirates is an airline based in Dubai that was established in 1985 with backing from Dubai's royal family. It has grown to become the largest airline in the Middle East operating nearly 3,400 flights per week to over 142 cities globally. Emirates is known for its high quality services across all cabin classes and seeks to be the first to offer new technologies to customers such as WiFi and personal entertainment screens on all flights. It uses a premium pricing strategy to target customers willing to pay more for luxury services.Organisational structure of Kingfisher airlines

Organisational structure of Kingfisher airlinesSuryadev Maity

╠²

Kingfisher Airlines was established in 2003 as a subsidiary of United Breweries Group. It began commercial operations in 2005 and was headed by CEO Sanjay Aggarwal. By 2011, Kingfisher had the second largest market share in India's domestic air travel market and had won awards, but it was suspended by IATA in 2012 due to financial issues. The organizational structure of Kingfisher Airlines included directors that reported to the Chairman of the Board, and departments like marketing, finance, operations, and more that reported to the CEO.Establishing objectives

Establishing objectivesMd.Mojibul Hoque

╠²

The document discusses the importance of establishing objectives for effective strategy formulation, highlighting that objectives translate vision into measurable outcomes and must be specific, measurable, achievable, realistic, and time-bound (SMART). It categorizes objectives into short-term, intermediate, and long-term, emphasizing their role in guiding organizational direction, evaluation, and resource allocation. The text also contrasts goals and objectives and outlines different levels and approaches to setting objectives within an organization. ch01

ch01danqureshi

╠²

This chapter introduces key concepts in strategic management including strategy, competitive advantage, and the strategic management process. It describes two models for achieving above-average returns: the industrial organization model which focuses on external industry factors, and the resource-based model which emphasizes a firm's internal resources and capabilities. The chapter also discusses the changing competitive landscape driven by globalization and technology, and how vision, mission, and stakeholders influence strategic decisions.Exchange fluctuation risk bmw

Exchange fluctuation risk bmwIsha Joshi

╠²

BMW implemented a two-pronged strategy to manage foreign exchange risk from its global sales. It established a natural hedge by developing production facilities in key markets like the US, China, and India, which allowed revenues and costs to be in the local currency. It also used formal financial hedges managed through regional treasury centers. BMW's strategy reduced exchange rate losses by billions and shortened supply chains to be closer to customers overseas.Success Secret: Southwest airlines

Success Secret: Southwest airlinesHarsh Narula

╠²

Southwest Airlines started in 1971 with 3 aircraft and focused on keeping costs low to offer low fares. By emphasizing excellent customer service and a fun, supportive company culture, Southwest was able to achieve significant growth and market share. However, increased competition from other low-cost carriers poses a threat going forward. To sustain its success, Southwest will need to maintain its unique culture while continuing to find new ways to improve efficiency and reduce costs.Samsung Presentation on international marketing

Samsung Presentation on international marketingabhiroopsur

╠²

Samsung was founded in 1938 and originally manufactured electronics such as TVs and appliances. It is now a global leader in consumer electronics, telecommunications, and semiconductors. Samsung strives to develop innovative technologies that enrich people's lives and continues to make the company a digital leader. It has gained global market share through strategic international marketing approaches including segmentation, targeting, positioning and sponsorships.Singapore airlines ŌĆō an excellent, iconic asian

Singapore airlines ŌĆō an excellent, iconic asianTalla Srikanth

╠²

Singapore Airlines is renowned for its strong brand management and innovation, having pioneered in-flight service enhancements like meal choices and premium beverages. The airline has a commitment to exceptional customer experience, maintaining a modern fleet, and rigorous training programs for staff, exemplified by the iconic Singapore Girl. Their focus on brand differentiation, technological advancements, and customer loyalty strategies underpins their notable market position and brand equity.The Global Brewery Industry

The Global Brewery IndustrySobithan Sekar

╠²

The document discusses the global brewery industry and strategies used by major brewery companies to balance local responsiveness and standardization. It notes that beer is produced and sold locally due to its bulkiness and high export costs. Major brewers use licensing, acquisitions and joint ventures to gain local market presence while maintaining their brands. The document then analyzes the external factors driving consolidation in the industry and the strategies adopted by ABInbev, SABMiller, and Carlsberg to address the twin issues of localization and standardization.Subprime Crisis(Brief)

Subprime Crisis(Brief)Rohan Negi

╠²

The document discusses the causes and effects of the 2008 global financial crisis. It began with the collapse of the US housing market and subprime mortgage crisis. Low interest rates led to increased lending to subprime borrowers who took on mortgages they could not repay. These risky loans were repackaged and sold globally. When housing prices declined, borrowers defaulted, damaging financial institutions and triggering a global recession. India was impacted through declines in exports, foreign investments, and economic growth, though its banks were more stable due to stronger regulations.Spice|Jet Airlines

Spice|Jet AirlinesThomas Cook Ltd

╠²

SpiceJet Airlines is a low-cost airline based in Delhi, India. It began operations in 2005 and has grown to become one of India's largest airlines. SpiceJet aims to make flying affordable for all Indians. The presentation provides an overview of SpiceJet's history, leadership team, fleet, destinations served, and awards received for being voted the best low-cost airline in South Asia. It has expanded rapidly since its founding and continues its mission of providing low fares across India.Samsung Industry and Firm Analysis

Samsung Industry and Firm AnalysisJeril Peter

╠²

Samsung is a South Korean conglomerate and the second largest smartphone company in the world. It has captured a 21.6% share of the global smartphone market as of 2018. Samsung has achieved competitive advantage through effective market leadership, new product development, and high-quality smartphones across a wide price range. It faces intense competition from rivals like Apple but has adopted strategies like launching new models at competitive prices and expanding product lines like the Note series.fundamental analysis for axis bank in banking industry

fundamental analysis for axis bank in banking industryswapnilgangele

╠²

The document discusses various aspects of the banking industry in India including economic features, liquidity controls, demand for credit, barriers to entry, and the impact of the global financial crisis in 2008-2009. It provides data on key metrics for foreign and nationalized banks over several quarters from 2007-2008 to 2008-2009 showing growth in areas like deposits, advances, and capital despite challenges from higher NPAs and debt restructuring. The conclusion notes upcoming issues and challenges for Indian banks around risk management, consolidation, technology, reforms, and skilled manpower.A project report on comparative brand equity of hutch and airtel cell phone

A project report on comparative brand equity of hutch and airtel cell phoneProjects Kart

╠²

This document is a summer training report submitted in partial fulfillment of an MBA degree. It discusses conducting research on the comparative brand equity of Hutch and Airtel cell phones in Delhi, India. The report includes an introduction on brand equity, the mobile telephony industry in India, and an outline of the document structure, which will cover the company profiles, research methodology, data analysis, conclusions, and recommendations.Lufthansa Case Study

Lufthansa Case StudyDonnych Diaz

╠²

Lufthansa has operated internationally since the 1920s and formed the Star Alliance in the 1990s to expand its global network. It restructured in the 2000s to focus on its core passenger business. Currently, Lufthansa operates over 500 aircraft from hubs in Frankfurt, Munich, and Zurich, serving around 250 destinations. It uses a strategy of equity stakes in other airlines to expand while managing regulatory challenges.Cipla Balance Sheet analysis

Cipla Balance Sheet analysisNewGate India

╠²

The document provides an analysis of Cipla Ltd's financial statements and ratios from 2007-2009.

[1] It includes a balance sheet overview showing that the company's total assets and equity increased over the period while investments declined. Current assets grew at an average rate of 24% while total liabilities increased at 24.5%.

[2] The profit and loss account overview found that total income and expenditure both increased at an average rate of over 20% each year. Operating profit rose 9.5% annually and net profit increased 7.32% on average.

[3] Financial analysis through horizontal and ratio analyses examined trends in key line items and ratios to evaluate the company's liquidity,Insurance, types, principles, life, fire ,marine, health

Insurance, types, principles, life, fire ,marine, healthGurinder Dhutty

╠²

Life insurance provides a monetary benefit to a beneficiary upon the death of the insured. It allows proceeds to be paid as a lump sum or annuity. Fire insurance covers property such as homes or shops against fire or destruction. Health insurance pays for medical expenses through reimbursement or direct payment to care providers. Marine insurance covers loss or damage to vessels and cargo during transit by covering losses from events like shipwreck or fire, excluding amounts recoverable from carriers. The key types of insurance are distinguished based on their subject matter (human life, physical property, ship/cargo), elements (protection, investment), duration (exceeds a year or not), measurable loss, and policy amounts.Strategic management quiz

Strategic management quiz Digvijai Srinag Sai Satti

╠²

1. The document describes a 35 question quiz on strategic management concepts.

2. The quiz covers topics like strategy formulation, implementation, Porter's five forces, the balanced scorecard, and international strategies.

3. Multiple choice questions with answers are provided for concepts in business strategy, corporate strategy, and operational strategy.Samsung Marketing PPT

Samsung Marketing PPTRaashid Malik

╠²

Samsung Electronics was founded in 1969 in South Korea and has since grown to become the world's largest technology company based on revenue. It operates R&D centers in India and has been the market leader in various electronics categories in India such as LED TVs, LCD TVs, and mobile handsets. Samsung competes against companies like Apple, Sony, and LG. Through strategic marketing initiatives involving brand ambassadors, content partnerships, and retail stores, Samsung has established itself as a leader in the Indian market through segmentation, targeting, positioning, and the 4Ps of marketing.STRATEGIC MANAGEMENT

STRATEGIC MANAGEMENT IFTM UNIVERSITY MORADABAD

╠²

The document discusses various strategies for strategy formulation, including stability strategies, growth strategies, and strategic alliances. It provides details on different types of stability strategies such as maintenance of status quo. Growth strategies discussed include internal growth, concentration, mergers and acquisitions, horizontal and vertical integration, and joint ventures. Strategic alliances are defined as teaming with other companies to help perform business activities across the supply chain. The objectives, characteristics, and forms of strategic alliances are also summarized.Nokia Case Study

Nokia Case StudySambit Mishra

╠²

The document provides a comprehensive overview of Nokia's history, highlighting its pioneering role in telecommunications and its entry into the Indian market in 1995. It discusses Nokia's strengths, weaknesses, opportunities, and threats, including its struggles in the smartphone sector and issues related to an asset freeze in India. The conclusion emphasizes Nokia's legacy and the risks faced by Microsoft following its acquisition amidst changing market dynamics.International Finance Analysis

International Finance Analysis Enow Eyong

╠²

The document analyzes funding options for XYZ company's plan to expand operations into Brazil. It compares the company's financial statements over two years and reviews currency denomination choices, centralized vs decentralized debt, and fixed vs floating debt. Equity financing options are also considered. Expanding manufacturing to Brazil could lower costs due to cheaper labor and construction. However, currency exchange rate fluctuations pose risks. The document recommends a decentralized debt structure denominated in both dollars and reals to diversify currency risk from US and Brazil cash flows. Equity funding is also suggested to stabilize operations, though it depends on investor reaction to returns in the new market.Nirma Limited Capital Structure

Nirma Limited Capital Structurevnitritesh

╠²

The document compares the capital structure of Nirma Ltd and Henkel India Ltd over several years:

1) Nirma Ltd is predominantly equity-based with very little debt and a debt-to-equity ratio below 0.2, while Henkel India has significantly higher debt levels with a debt-to-equity ratio above 0.8.

2) Nirma has increased its authorized capital over time but paid-up capital remains low, and it has large reserves. Henkel's capital levels have remained steady and it has lower reserves.

3) Both companies have some preference shares but Nirma relies more on equity financing due to its strong financial position, while Henkel pursuesMore Related Content

What's hot (20)

Organisational structure of Kingfisher airlines

Organisational structure of Kingfisher airlinesSuryadev Maity

╠²

Kingfisher Airlines was established in 2003 as a subsidiary of United Breweries Group. It began commercial operations in 2005 and was headed by CEO Sanjay Aggarwal. By 2011, Kingfisher had the second largest market share in India's domestic air travel market and had won awards, but it was suspended by IATA in 2012 due to financial issues. The organizational structure of Kingfisher Airlines included directors that reported to the Chairman of the Board, and departments like marketing, finance, operations, and more that reported to the CEO.Establishing objectives

Establishing objectivesMd.Mojibul Hoque

╠²

The document discusses the importance of establishing objectives for effective strategy formulation, highlighting that objectives translate vision into measurable outcomes and must be specific, measurable, achievable, realistic, and time-bound (SMART). It categorizes objectives into short-term, intermediate, and long-term, emphasizing their role in guiding organizational direction, evaluation, and resource allocation. The text also contrasts goals and objectives and outlines different levels and approaches to setting objectives within an organization. ch01

ch01danqureshi

╠²

This chapter introduces key concepts in strategic management including strategy, competitive advantage, and the strategic management process. It describes two models for achieving above-average returns: the industrial organization model which focuses on external industry factors, and the resource-based model which emphasizes a firm's internal resources and capabilities. The chapter also discusses the changing competitive landscape driven by globalization and technology, and how vision, mission, and stakeholders influence strategic decisions.Exchange fluctuation risk bmw

Exchange fluctuation risk bmwIsha Joshi

╠²

BMW implemented a two-pronged strategy to manage foreign exchange risk from its global sales. It established a natural hedge by developing production facilities in key markets like the US, China, and India, which allowed revenues and costs to be in the local currency. It also used formal financial hedges managed through regional treasury centers. BMW's strategy reduced exchange rate losses by billions and shortened supply chains to be closer to customers overseas.Success Secret: Southwest airlines

Success Secret: Southwest airlinesHarsh Narula

╠²

Southwest Airlines started in 1971 with 3 aircraft and focused on keeping costs low to offer low fares. By emphasizing excellent customer service and a fun, supportive company culture, Southwest was able to achieve significant growth and market share. However, increased competition from other low-cost carriers poses a threat going forward. To sustain its success, Southwest will need to maintain its unique culture while continuing to find new ways to improve efficiency and reduce costs.Samsung Presentation on international marketing

Samsung Presentation on international marketingabhiroopsur

╠²

Samsung was founded in 1938 and originally manufactured electronics such as TVs and appliances. It is now a global leader in consumer electronics, telecommunications, and semiconductors. Samsung strives to develop innovative technologies that enrich people's lives and continues to make the company a digital leader. It has gained global market share through strategic international marketing approaches including segmentation, targeting, positioning and sponsorships.Singapore airlines ŌĆō an excellent, iconic asian

Singapore airlines ŌĆō an excellent, iconic asianTalla Srikanth

╠²

Singapore Airlines is renowned for its strong brand management and innovation, having pioneered in-flight service enhancements like meal choices and premium beverages. The airline has a commitment to exceptional customer experience, maintaining a modern fleet, and rigorous training programs for staff, exemplified by the iconic Singapore Girl. Their focus on brand differentiation, technological advancements, and customer loyalty strategies underpins their notable market position and brand equity.The Global Brewery Industry

The Global Brewery IndustrySobithan Sekar

╠²

The document discusses the global brewery industry and strategies used by major brewery companies to balance local responsiveness and standardization. It notes that beer is produced and sold locally due to its bulkiness and high export costs. Major brewers use licensing, acquisitions and joint ventures to gain local market presence while maintaining their brands. The document then analyzes the external factors driving consolidation in the industry and the strategies adopted by ABInbev, SABMiller, and Carlsberg to address the twin issues of localization and standardization.Subprime Crisis(Brief)

Subprime Crisis(Brief)Rohan Negi

╠²

The document discusses the causes and effects of the 2008 global financial crisis. It began with the collapse of the US housing market and subprime mortgage crisis. Low interest rates led to increased lending to subprime borrowers who took on mortgages they could not repay. These risky loans were repackaged and sold globally. When housing prices declined, borrowers defaulted, damaging financial institutions and triggering a global recession. India was impacted through declines in exports, foreign investments, and economic growth, though its banks were more stable due to stronger regulations.Spice|Jet Airlines

Spice|Jet AirlinesThomas Cook Ltd

╠²

SpiceJet Airlines is a low-cost airline based in Delhi, India. It began operations in 2005 and has grown to become one of India's largest airlines. SpiceJet aims to make flying affordable for all Indians. The presentation provides an overview of SpiceJet's history, leadership team, fleet, destinations served, and awards received for being voted the best low-cost airline in South Asia. It has expanded rapidly since its founding and continues its mission of providing low fares across India.Samsung Industry and Firm Analysis

Samsung Industry and Firm AnalysisJeril Peter

╠²

Samsung is a South Korean conglomerate and the second largest smartphone company in the world. It has captured a 21.6% share of the global smartphone market as of 2018. Samsung has achieved competitive advantage through effective market leadership, new product development, and high-quality smartphones across a wide price range. It faces intense competition from rivals like Apple but has adopted strategies like launching new models at competitive prices and expanding product lines like the Note series.fundamental analysis for axis bank in banking industry

fundamental analysis for axis bank in banking industryswapnilgangele

╠²

The document discusses various aspects of the banking industry in India including economic features, liquidity controls, demand for credit, barriers to entry, and the impact of the global financial crisis in 2008-2009. It provides data on key metrics for foreign and nationalized banks over several quarters from 2007-2008 to 2008-2009 showing growth in areas like deposits, advances, and capital despite challenges from higher NPAs and debt restructuring. The conclusion notes upcoming issues and challenges for Indian banks around risk management, consolidation, technology, reforms, and skilled manpower.A project report on comparative brand equity of hutch and airtel cell phone

A project report on comparative brand equity of hutch and airtel cell phoneProjects Kart

╠²

This document is a summer training report submitted in partial fulfillment of an MBA degree. It discusses conducting research on the comparative brand equity of Hutch and Airtel cell phones in Delhi, India. The report includes an introduction on brand equity, the mobile telephony industry in India, and an outline of the document structure, which will cover the company profiles, research methodology, data analysis, conclusions, and recommendations.Lufthansa Case Study

Lufthansa Case StudyDonnych Diaz

╠²

Lufthansa has operated internationally since the 1920s and formed the Star Alliance in the 1990s to expand its global network. It restructured in the 2000s to focus on its core passenger business. Currently, Lufthansa operates over 500 aircraft from hubs in Frankfurt, Munich, and Zurich, serving around 250 destinations. It uses a strategy of equity stakes in other airlines to expand while managing regulatory challenges.Cipla Balance Sheet analysis

Cipla Balance Sheet analysisNewGate India

╠²

The document provides an analysis of Cipla Ltd's financial statements and ratios from 2007-2009.

[1] It includes a balance sheet overview showing that the company's total assets and equity increased over the period while investments declined. Current assets grew at an average rate of 24% while total liabilities increased at 24.5%.

[2] The profit and loss account overview found that total income and expenditure both increased at an average rate of over 20% each year. Operating profit rose 9.5% annually and net profit increased 7.32% on average.

[3] Financial analysis through horizontal and ratio analyses examined trends in key line items and ratios to evaluate the company's liquidity,Insurance, types, principles, life, fire ,marine, health

Insurance, types, principles, life, fire ,marine, healthGurinder Dhutty

╠²

Life insurance provides a monetary benefit to a beneficiary upon the death of the insured. It allows proceeds to be paid as a lump sum or annuity. Fire insurance covers property such as homes or shops against fire or destruction. Health insurance pays for medical expenses through reimbursement or direct payment to care providers. Marine insurance covers loss or damage to vessels and cargo during transit by covering losses from events like shipwreck or fire, excluding amounts recoverable from carriers. The key types of insurance are distinguished based on their subject matter (human life, physical property, ship/cargo), elements (protection, investment), duration (exceeds a year or not), measurable loss, and policy amounts.Strategic management quiz

Strategic management quiz Digvijai Srinag Sai Satti

╠²

1. The document describes a 35 question quiz on strategic management concepts.

2. The quiz covers topics like strategy formulation, implementation, Porter's five forces, the balanced scorecard, and international strategies.

3. Multiple choice questions with answers are provided for concepts in business strategy, corporate strategy, and operational strategy.Samsung Marketing PPT

Samsung Marketing PPTRaashid Malik

╠²

Samsung Electronics was founded in 1969 in South Korea and has since grown to become the world's largest technology company based on revenue. It operates R&D centers in India and has been the market leader in various electronics categories in India such as LED TVs, LCD TVs, and mobile handsets. Samsung competes against companies like Apple, Sony, and LG. Through strategic marketing initiatives involving brand ambassadors, content partnerships, and retail stores, Samsung has established itself as a leader in the Indian market through segmentation, targeting, positioning, and the 4Ps of marketing.STRATEGIC MANAGEMENT

STRATEGIC MANAGEMENT IFTM UNIVERSITY MORADABAD

╠²

The document discusses various strategies for strategy formulation, including stability strategies, growth strategies, and strategic alliances. It provides details on different types of stability strategies such as maintenance of status quo. Growth strategies discussed include internal growth, concentration, mergers and acquisitions, horizontal and vertical integration, and joint ventures. Strategic alliances are defined as teaming with other companies to help perform business activities across the supply chain. The objectives, characteristics, and forms of strategic alliances are also summarized.Nokia Case Study

Nokia Case StudySambit Mishra

╠²

The document provides a comprehensive overview of Nokia's history, highlighting its pioneering role in telecommunications and its entry into the Indian market in 1995. It discusses Nokia's strengths, weaknesses, opportunities, and threats, including its struggles in the smartphone sector and issues related to an asset freeze in India. The conclusion emphasizes Nokia's legacy and the risks faced by Microsoft following its acquisition amidst changing market dynamics.Similar to Global Finance Strategy Of RIL (20)

International Finance Analysis

International Finance Analysis Enow Eyong

╠²

The document analyzes funding options for XYZ company's plan to expand operations into Brazil. It compares the company's financial statements over two years and reviews currency denomination choices, centralized vs decentralized debt, and fixed vs floating debt. Equity financing options are also considered. Expanding manufacturing to Brazil could lower costs due to cheaper labor and construction. However, currency exchange rate fluctuations pose risks. The document recommends a decentralized debt structure denominated in both dollars and reals to diversify currency risk from US and Brazil cash flows. Equity funding is also suggested to stabilize operations, though it depends on investor reaction to returns in the new market.Nirma Limited Capital Structure

Nirma Limited Capital Structurevnitritesh

╠²

The document compares the capital structure of Nirma Ltd and Henkel India Ltd over several years:

1) Nirma Ltd is predominantly equity-based with very little debt and a debt-to-equity ratio below 0.2, while Henkel India has significantly higher debt levels with a debt-to-equity ratio above 0.8.

2) Nirma has increased its authorized capital over time but paid-up capital remains low, and it has large reserves. Henkel's capital levels have remained steady and it has lower reserves.

3) Both companies have some preference shares but Nirma relies more on equity financing due to its strong financial position, while Henkel pursuesLuxembourgthe international hub_for_financial_services (1)

Luxembourgthe international hub_for_financial_services (1)tapask7889

╠²

Luxembourg is an international hub for financial services. It is the leading investment fund center in Europe and leading wealth management center in the Eurozone. Financial services make up 45% of Luxembourg's GDP. Luxembourg has competitive advantages due to its highly skilled multi-lingual workforce, political and economic stability, and membership in the EU which allows passporting of financial services.Galloway Institutional Presentation

Galloway Institutional Presentationandrepsimon

╠²

This document discusses an investment opportunity in emerging and frontier markets fixed income. It notes that emerging markets have experienced high GDP growth compared to developed economies. The fund, called the Galloway Global Emerging Markets Fixed Income Fund, aims to provide equity-like returns through investing in emerging market corporate and sovereign bonds while maintaining a fixed income risk profile. The fund utilizes a rigorous investment process including multi-faceted due diligence and risk management controls.External and internal economic vulnerabilities of brazilian economy and how ...

External and internal economic vulnerabilities of brazilian economy and how ...Fernando Alcoforado

╠²

This document analyzes the external and internal economic vulnerabilities of the Brazilian economy by examining 18 variables, including its trade balance, balance of payments, foreign direct investment, industrial participation in GDP, and international reserves. It finds that Brazil has run deficits in its trade balance and balance of payments since 2008 due to falling commodity prices and rising profit remittances by multinational companies. While high foreign direct investment and international reserves have helped cover financing needs, they have also contributed to the deindustrialization and denationalization of the Brazilian economy.Sovereign Wealth Funds & Private Equity

Sovereign Wealth Funds & Private EquityTuck Seng Low

╠²

The document discusses the current challenging conditions in the private equity market due to the global credit crisis. It notes that some of the largest private equity funds wrote down investments in their European portfolios by 40-70% in 2008. It then examines how sovereign wealth funds could position themselves in this environment, noting they have significant financial resources but also may face political concerns about gaining undue influence. It argues sovereign wealth funds could consider alternative investment structures and sectors like healthcare, education, and alternative energy that could have multiplier effects.Galloway Presentation

Galloway Presentationalepreuss

╠²

This document provides an investment case for the Galloway Global Emerging Markets Fixed Income Fund. It summarizes the opportunity in investing in emerging market bonds which offer higher yields than developed markets. The fund aims to generate consistent risk-adjusted returns through a diversified portfolio of emerging market corporate and sovereign bonds, using rigorous due diligence and risk management practices. It has achieved strong historical performance since inception in 2009.Global Investor May 2004

Global Investor May 2004dariusznowak

╠²

The article discusses the opportunities and challenges for foreign asset managers in the pension markets of eight Central and Eastern European countries that joined the EU on May 1, 2004. While the potential for growth is large, early entrants have faced significant regulatory, distribution, and cultural barriers. The Polish pension market is the largest and most promising but still restricts foreign investment and third-party management. Overall distribution challenges and a need for local infrastructure make it difficult for foreign firms to penetrate these emerging markets.January - September 2012 results

January - September 2012 resultsSantander UK Corporate Banking

╠²

Grupo Santander reported a net attributable profit of EUR 1.804 billion, a 66% decline from the previous year, primarily due to extensive provisions for real estate exposure in Spain. The bank's pre-provision profit increased by 3% to EUR 18.184 billion, while non-performing loans (NPL) rose to 4.33%, with coverage improving to 70%. Latin America remains a significant contributor to profits, accounting for 50% of total earnings, amidst a challenging economic backdrop in Europe.Mendel_University_Brno_Conference_2014

Mendel_University_Brno_Conference_2014Miss. Antónia FICOVÁ, Engineer. (Not yet Dr.)

╠²

This document summarizes research on the impact of debt crisis on corporate firm performance in Slovakia. It finds that 91% of changes in debt ratios of firms with 3000-3999 employees can be explained by changes in variables like profit, assets, and debt to EBITDA. A comparison of 2010 and 2013 data showed an increase in firm assets. The conclusion is that firms need to make timely changes to improve financial performance during a debt crisis.Chapter15 International Finance Management

Chapter15 International Finance ManagementPiyush Gaur

╠²

This document provides suggested answers and solutions to end-of-chapter questions from a textbook on international portfolio investment. It includes:

1) Answers to 12 multiple choice or short answer questions on topics like factors driving international investment, security return correlations across countries, world beta, and the impact of exchange rate fluctuations.

2) Solutions to 7 quantitative problems calculating returns, risks, and optimal portfolio weights for international investments considering exchange rate movements and correlations between different markets.

3) A description of input received from three consultants for a pension fund regarding the risks and rewards of international equity allocation, with two favoring it and one questioning the ability of international investing to reduce risk.Wang Xin (Beijing Sept 2010)

Wang Xin (Beijing Sept 2010)AmaliaKhachatryan

╠²

The document discusses the rise of BRICs' (Brazil, Russia, India, China) international financial power and its implications. It finds that while BRICs' financial openness and external investments have increased in recent years, their international financial influence remains relatively weak compared to their economic size due to lagging domestic financial development. The moderately enhanced financial power of BRICs can help provide low-cost capital and promote stability but BRICs have little influence over international financial governance. For BRICs to strengthen their global financial role, they need to accelerate domestic financial reforms and increase cooperation among themselves and with other economies.Debt Management Tarun Das

Debt Management Tarun Dastarundas

╠²

The document discusses sustainable external debt management. It defines external debt and outlines various types of risks including market, fiscal, country-specific, and operational risks. It then discusses measures for managing these risks, including through transparency, modifying debt structure, and stress tests. Various debt sustainability indicators are presented, including solvency, liquidity, burden, and structural ratios to monitor risk. Standard stress tests and identifying debt distress episodes are also covered.Banking g

Banking gAlok Rai

╠²

The document discusses the state of the Indian banking system. It notes that Indian banks have emerged stronger under regulatory oversight. State Bank of India improved its position in international rankings and saw its brand value increase. Nationalized banks accounted for over half of aggregate deposits, while public sector banks held over half of total bank credit. The government infused additional capital into public sector banks and passed banking reforms aimed at expanding their access to capital markets.ManagementofExchangeraterisk

ManagementofExchangerateriskSudiksha Joshi

╠²

IRFC borrows funds in foreign currencies like US dollars and Japanese yen from overseas markets at lower interest rates than domestic markets to lend to the Indian Railways. This exposes IRFC to risks from fluctuations in foreign exchange rates. To mitigate this risk, IRFC hedges the principal amount of foreign currency borrowings using currency swaps. For unfavorable hedging conditions, variation clauses are included in lease agreements to pass on exchange rate risks to Railways. IRFC also borrows in multiple currencies to reduce dependency on any single currency. Half-yearly interest payments are not hedged and associated risks are transferred to Railways.Earnings Release Report 1Q11

Earnings Release Report 1Q11BI&P - Banco Indusval & Partners - Investor Relations

╠²

Banco Indusval S.A. announced its financial results for Q1 2011, reporting a capital increase of R$ 201 million with new partners, including Warburg Pincus and a minority interest acquisition in Sertrading. The bank plans to enhance its corporate lending capabilities and expand its client base through strategic partnerships and management restructuring. Additionally, the first quarter results indicate increased allowances for loan losses as part of a conservative strategy to prepare for future operations.2007 relative risk performance of islamic finance

2007 relative risk performance of islamic finance9994533498

╠²

This document summarizes a study that examines the relative risk performance of the Dow Jones Islamic Index (DJIS) compared to the Dow Jones World Index (DJIM) using Value-at-Risk (VaR) models. The study finds that incorporating Islamic finance principles like profit-and-loss sharing reduces risk. Specifically:

1) Three VaR models (RiskMetrics, Student-t APARCH, skewed Student-t APARCH) were used to estimate risk for the two indices using 500 days of historical data.

2) The results showed that the VaR was lower for the DJIS index, indicating it had less risk than the DJIM index.

3) The profit-Financial analysis of Reliance industries and ONGC

Financial analysis of Reliance industries and ONGCRAJESH KUMAR

╠²

The document provides a comprehensive financial analysis of Reliance Industries Limited and Oil and Natural Gas Corporation, detailing their history, revenue, cost compositions, shareholder relations, and risk assessments. It highlights Reliance's strategic focus on increasing shareholder value, maintaining financial discipline, and investing in new projects, while ONGC is noted for its significant role in India's oil production and distribution of consistent dividends. Key metrics illustrate each company's financial health, risks, and strategies in the volatile oil market.Customer financing in Brazil

Customer financing in BrazilFredrik Boëthius

╠²

1. The document discusses various options for customer financing in Brazil for Finnish SME exporters, including through Brazilian banks, BNDES (Brazil's national development bank), and prepayments from buyers.

2. It emphasizes the importance of knowing the customer to evaluate creditworthiness when arranging financing. Credit reports and financial statements are typically required.

3. Prepayments from buyers can be secured through bonds or guarantees from banks like Finnvera, and letters of credit can protect exporters if a buyer cancels an order after manufacturing begins.Rupee-The Way Ahead

Rupee-The Way AheadBMA Wealth Creators

╠²

The Indian rupee has depreciated significantly, being one of Asia's worst-performing currencies, mostly due to a high current account deficit and a fragile domestic economic framework. The Reserve Bank of India has limited tools to stabilize the currency amid rising global risk aversion and capital flight towards the USD, further exacerbated by high oil prices and weak global growth. As a result, the rupee is expected to decline further, potentially reaching levels of 55-56 in the short term.External and internal economic vulnerabilities of brazilian economy and how ...

External and internal economic vulnerabilities of brazilian economy and how ...Fernando Alcoforado

╠²

Ad

Global Finance Strategy Of RIL

- 2. Need for a Global Finance StrategyGlobal Finance StrategiesForeign Funds raised by RILLong Term Financing StrategiesShort Term Financing StrategiesCash Management StrategiesFinal words about RIL

- 3. Reliance exports to 111 countriesThe percentage of exports in sales as increased over the years from 35% to 61%

- 4. Purchases are dominated by foreign imports accounting for nearly 96% of the total value. Value of Purchases has kept on increasing thereby increasing the foreign exchange risk of the company. Crude oil required for refining constitutes a huge portion of imports.

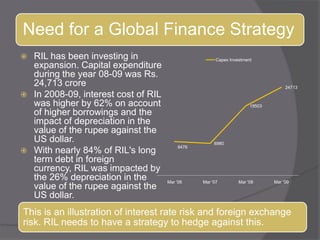

- 5. RIL has been investing in expansion. Capital expenditure during the year 08-09 was Rs. 24,713 croreIn 2008-09, interest cost of RIL was higher by 62% on account of higher borrowings and the impact of depreciation in the value of the rupee against the US dollar. With nearly 84% of RIL's long term debt in foreign currency, RIL was impacted by the 26% depreciation in the value of the rupee against the US dollar.

- 6. HedgingForward / Future HedgingMoney Market HedgingOptions HedgingCurrency DiversificationBonds & DepositariesYankee BondsADRŌĆÖs and GDRŌĆÖsWholly owned subsidiaries on foreign soil

- 7. Pre 2003-04In 1996, RIL floated $100 million 50-year Yankee bond in the US markets. First issue of such a long maturity. RIL went on issuing Yankee bonds periodically over the years since then which mitigated risk associated with US currency.2003-04RIL had issued over US$ 1.3 billion (Rs. 6,000 crore) of debt securities in international capital markets since 1996, with maturities ranging from 7 years to 100 years. RIL has so far bought back and cancelled US$ 744 million (Rs. 3,532 crore) of its bonds, which represents about 57 per cent of the total issued. The average final maturity of the CompanyŌĆÖs long-term foreign exchange debt is about 10 years.

- 8. 2004-05RIL availed a US$ 350 million loan (Rs 1,527 crore) and signed a EUR 116.2 million Export Credit Agency (ECA) backed BuyerŌĆÖs credit facility for project financing. 2005-06RIL bought back a total of Rs 140 crore of its debentures during the year. It availed US$ 350 million loan (equivalent to Rs 1,519 crore) Issued a Euro Yen Bond of JPY 17.5 billion (equivalent to US$ 150 million / Rs 670 crore) Availed Export Credit Agency (ECA) backed BuyerŌĆÖs Credit Facility of US$ 114 million and EUR 12 million (equivalent to Rs 559 crore).

- 9. 2006-07RIL funded the first ever debt issuance in the US private placement market by an Indian Company by launching a US$ 200 million issue which was increased to US$ 300 million owing to oversubscription. This was followed, in March 2007, by a US$ 150 million deal which was upsized to US$ 250 million.2007-08RIL set a new benchmark in Asia by raising a $ 2 billion syndicated term loan for a 10-year period with participation from 23 banks across the globe. This is a landmark deal as it makes RIL the first corporate borrower from India to have accessed the External Commercial Borrowings (ECB) market for this size. In September 2007 the Company also raised $ 500 million by way of a syndicated term loan at competitive rates amidst the subprime turmoil in the global markets.

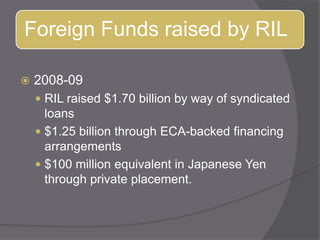

- 10. 2008-09RIL raised $1.70 billion by way of syndicated loans$1.25 billion through ECA-backed financing arrangements $100 million equivalent in Japanese Yen through private placement.

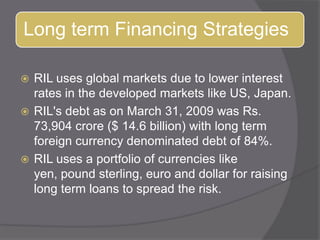

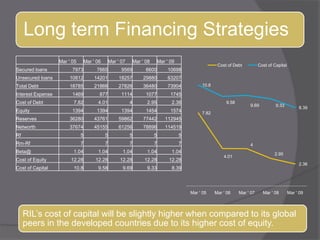

- 11. RIL uses global markets due to lower interest rates in the developed markets like US, Japan. RIL's debt as on March 31, 2009 was Rs. 73,904 crore ($ 14.6 billion) with long term foreign currency denominated debt of 84%. RIL uses a portfolio of currencies like yen, pound sterling, euro and dollar for raising long term loans to spread the risk.

- 13. The proportion of short term debt to total debt is conservative at 8.4%. RIL's liquidity position and committed working capital facilities mitigate any refinancing risk. The company has adopted a strategy of using foreign loans for working capital purposes to procure raw-material in foreign exchange. The company uses its export earnings and foreign exchange assets to hedge against foreign exchange risk.

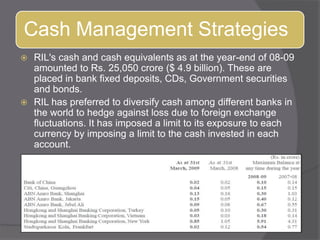

- 14. RIL's cash and cash equivalents as at the year-end of 08-09 amounted to Rs. 25,050 crore ($ 4.9 billion). These are placed in bank fixed deposits, CDs, Government securities and bonds. RIL has preferred to diversify cash among different banks in the world to hedge against loss due to foreign exchange fluctuations. It has imposed a limit to its exposure to each currency by imposing a limit to the cash invested in each account.

- 15. The strength of RIL's balance sheet, credit profile and earning capability is reflected in the fact that over 100 banks and financial institutions have financial commitments to the Company. RIL meets its working capital requirements through commercial credit lines issued by a consortium of banks. RIL undertakes liability management to reduce overall cost of debt and diversify its liability mix.