Goods and Services Tax ppt

- 1. Goods And Service Tax (GST) ï SATIN JOSE ï DRASHTI THAKER ï JOAQUINA DâSOUZA ï VALENTINA FERNANDES ï MELISSA DâCOSTA

- 2. What is GST? âGâ - GOODS âSâ - SERVICE âTâ - TAX âš GST is one indirect tax for the whole nation âš A single tax on the supply of goods & services , right from manufacturer to consumer

- 3. Dual GST Destination based GST Uniform Classification Uniform Forms-returns , challans (in electronic mode) No cascading on Central and State Tax Cross credit between Central and State not allowed Tax levied from production to consumption

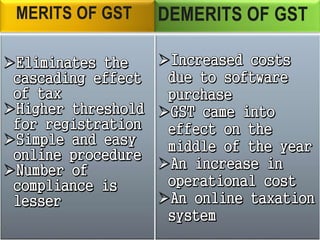

- 4. MERITS OF GST . DEMERITS OF GST

- 5. HOW KEY SECTORS OF THE ECONOMY REACTED

- 6. ïTHE ICAI GOODS AND SERVICE TAX MODULE. ïhttp://cleartax.in/s/benefits-of-gst-advantages- disadvantages/ ïwww.businessbatao.com ïwww.slideshare.net