Govt Budget & the Economy class 12 .pptx

Download as pptx, pdf3 likes29,405 views

The document discusses key components of government budgets including revenue and capital budgets, receipts and expenditures. It defines various types of receipts like revenue and capital receipts, their sources and differences. It also defines various types of expenditures like revenue and capital expenditures, and their differences. Finally, it discusses budget deficit, its types, and how deficit is financed. It outlines objectives of government budgets like allocating resources, achieving economic stability, and reducing inequality.

1 of 29

Downloaded 10 times

Recommended

government budget

government budgetNeeraj Garwal

╠²

The document discusses the key components of government budgets, including:

- Revenue receipts, which do not create liabilities or reduce assets, such as tax revenues. Tax revenues include direct taxes like income tax and indirect taxes like VAT. Non-tax revenues include fees, licenses, fines, and other sources.

- Capital receipts, which do create liabilities or reduce assets. These include borrowings, which create liabilities, and the sale of shares in public enterprises, which reduces assets.

- Expenditure, which is divided into revenue expenditure on ongoing activities and capital expenditure on infrastructure and other long-term investments.

The budget aims to allocate resources, reduce inequalities, promote stability andProject work-principles-of-management

Project work-principles-of-managementAniket Sharma

╠²

This document is a business studies project submitted by a student for class 12. It applies Henri Fayol's 14 principles of management to Cafe Coffee Day. The principles are explained and examples of their application at Cafe Coffee Day are provided, such as work specialization among employees, a clear chain of command, order and cleanliness maintained, and promoting team spirit. The project follows the standard format with an introduction, contents page, chapters on CCD and Fayol, and a conclusion.Money and Banking Class 12

Money and Banking Class 12HarshidKailash

╠²

1) Money was introduced to solve problems with barter systems like the "double coincidence of wants". Money acts as a medium of exchange, store of value, and standard for deferred payments.

2) Money supply refers to the total quantity of money in circulation and includes components like currency, demand deposits, and other deposits. It is classified into narrow (M1) and broad money (M2, M3, M4).

3) Commercial banks create money through the process of credit creation, lending out a multiple of the initial deposits based on required reserve ratios. They accept deposits and extend loans to earn profits.Poverty project

Poverty projectSohal Shende

╠²

Poverty in India is widespread, and a variety of methods have been proposed to measure it. The official measure of Indian government, before 2005, was based on food security and it was defined from per capita expenditure for a person to consume enough calories and be able to pay for associated essentials to survive. Since 2005, Indian government adopted the Tendulkar methodology which moved away from calorie anchor to a basket of goods and used rural, urban and regional minimum expenditure per capita necessary to survive.

The World Bank has similarly revised its definition and benchmarks to measure poverty since 1990, with $2.25 per day income on purchasing power parity basis as the definition in use from 2005 to 2013. Some semi-economic and non-economic indices have also been proposed to measure poverty in India; for example, the Multi-dimensional Poverty Index placed 33% weight on number of years spent in school and education and 6.25% weight on financial condition of a person, in order to determine if that person is poor.Newborn assessment

Newborn assessment jyoti dwivedi

╠²

This document provides guidance on newborn assessment, which is a systematic examination of the newborn conducted shortly after birth and within the first 24 hours. It involves reviewing the pregnancy and delivery history and thoroughly examining the newborn from head to toe. The goals are to evaluate the newborn's adaptation to extrauterine life, detect any medical issues or congenital abnormalities, and assess resuscitation needs. The assessment consists of evaluating vital signs, reflexes, muscle tone, appearance and measurements of the body. It is important for ensuring the health of the newborn.coordination compounds

coordination compoundsRupendra Jugral

╠²

The document discusses coordination compounds and their classification. It begins by introducing coordination compounds and providing examples like chlorophyll and hemoglobin. It then summarizes Werner's theory of coordination compounds from 1898, which proposed that metals form primary ionic bonds and secondary non-ionic bonds of fixed coordination number with ligands in coordination spheres. The document defines key terms like ligands, coordination number, and isomers. It also describes common coordination polyhedra and provides rules for naming coordination compounds.Economic project.pptx

Economic project.pptxDeepakkumar894597

╠²

The document summarizes key aspects of government budgets including:

- Components of government budgets include revenue receipts, capital receipts, and expenditures. Revenue receipts do not create liabilities while capital receipts do.

- Measures of budget deficits include revenue deficit, fiscal deficit, and primary deficit. The revenue deficit is the excess of revenue expenditure over revenue receipts. The fiscal deficit is the excess of total expenditure over total receipts.

- Deficits can imply the government is dissaving, borrowing more, or paying more in interest on previous loans. Well-managed budgets aim to minimize deficits.Evolution of Money

Evolution of MoneyGhulam Hasnain

╠²

IŌĆÖm a young Pakistani Blogger, Academic Writer, Freelancer, Quaidian & MPhil Scholar, Quote Lover, Co-Founder at Essar Student Fund & Blueprism Academia, belonging from Mehdiabad, Skardu, Gilgit Baltistan, Pakistan.

I am an academic writer & freelancer! I can work on Research Paper, Thesis Writing, Academic Research, Research Project, Proposals, Assignments, Business Plans, and Case study research.

Expertise:

Management Sciences, Business Management, Marketing, HRM, Banking, Business Marketing, Corporate Finance, International Business Management

For Order Online:

Whatsapp: +923452502478

Portfolio Link: https://blueprismacademia.wordpress.com/

Email: arguni.hasnain@gmail.com

Follow Me:

Linkedin: arguni_hasnain

Instagram : arguni.hasnain

Facebook: arguni.hasnain

Gov budget and economy

Gov budget and economyvibhor07

╠²

The document discusses government budgets. It explains that a budget is an annual financial statement that contains estimated receipts and expenditures for the coming fiscal year. The key points are:

- Budgets are prepared by governments at all levels and include estimated expenditures and receipts to achieve government objectives.

- The main components of a budget are the revenue budget and capital budget. Revenue budget covers revenue receipts and expenditures, while capital budget covers capital receipts and expenditures.

- Budgets can be balanced, in surplus, or in deficit depending on whether total estimated receipts equal, exceed, or are less than total estimated expenditures. Deficit budgets require the government to borrow funds.Government budget and the economy

Government budget and the economyAnjana P.V.Nair

╠²

The document discusses key concepts related to government budgets and deficits. It defines a government budget as an annual statement of estimated receipts and expenditures. The objectives of a budget include managing resources, reducing inequality, and achieving economic stability. Budgets have two main components - revenue and capital. Receipts are classified as revenue (e.g. taxes) or capital (e.g. borrowings), and expenditures are classified as revenue (e.g. salaries) or capital (e.g. infrastructure). Deficit measures include the revenue deficit, fiscal deficit, and primary deficit, which refer to excesses of expenditures over receipts from different sources.Principles of Management - 2 || Business Studies Project || Class 12 CBSE

Principles of Management - 2 || Business Studies Project || Class 12 CBSESaksham Mittal

╠²

Principles of Management

Business Studies Project

Class 12 CBSE

EDU RESOURCES

https://www.youtube.com/channel/UC3NkrW6yDrJy2w2DpxoH_HgGST Economic Project.pptx 1.pptx

GST Economic Project.pptx 1.pptxVishnu15600

╠²

hi I am Vishnu I made these project for my school if you like these please tell me to make your ppt with money mail to me to know any things ells etc ...

follow me on insta Vishnu_1807_

and subribe my youtube channel - https://www.youtube.com/@user-in4kz4ex2e

thank you Indian economic development project class 12

Indian economic development project class 12pradyumndubey124

╠²

Indian economic development class 12 project file 2023-24Economics project

Economics projectAkshita Grover

╠²

Economics project for class 12 on money and banking. it explains all the functions about RBI and includes everything needed to achieve good marks in project work.Indian Economy between 1950 to 1990, Class XII

Indian Economy between 1950 to 1990, Class XIIAnjaliKaur3

╠²

In this PPT, I have explained the following topics in detail. It will be helpful for teachers as well as students.

Content covered:

Economic System

Types of Economic System

Economic planning

Goal of five year plans

Problems faced by Indian Agriculture

Solutions to solve problems faced by Indian Agriculture

Problems under Green Revolution

Importance of Subsidies

Public and Private sectors in Indian Industrial Development

Industrial Policy Resolution, 1956

Industrial License

Industrial Concessions

Small Scale Industries

Trade policies: Import substitution

Also meaning of Green RevolutionClass 12 Accountancy Project 2022-23

Class 12 Accountancy Project 2022-23DivyaNatarajan21

╠²

Accountancy project for class 12. Accounts project for the year 2022-23. Accountancy project which has both specific and comprehensive project as well.

Cbse Boards internal assessment project for accountancy. Demonetisation - 1 Economics Project Class 12 CBSE

Demonetisation - 1 Economics Project Class 12 CBSESaksham Mittal

╠²

Demonetisation

Economics Project

Class 12 CBSE

EDU RESOURCES

https://www.youtube.com/channel/UC3NkrW6yDrJy2w2DpxoH_Hg

marketing on smartphone 12th bst project 2018-19

marketing on smartphone 12th bst project 2018-19Kunal Kevat

╠²

The document is a scanned copy of a legal contract for the sale of a residential property located in California. The contract details the purchase price of $1,100,000, down payment of $110,000, closing date, included and excluded items, and standard contractual terms for financing, inspection, insurance and other contingencies. Signatures are required from the buyer and seller to execute the real estate transaction.Government Budget and the Economy CLASS 12 NOTES (1).pdf

Government Budget and the Economy CLASS 12 NOTES (1).pdfRENAISSANCEACADEMY

╠²

The document provides an overview of government budgets and key concepts related to budgets in India. It discusses the objectives of budgets which include reallocating resources, redistributing income and wealth, and stabilizing the economy. It also defines important budget terms like revenue and capital budgets, budget receipts including tax and non-tax revenue, budget expenditures including plan/non-plan and revenue/capital. It further explains concepts such as budget deficits, types of taxes including direct, indirect, progressive and regressive taxes.BUSINESS STUDIES PROJECT ON PRINCIPLES OF MANAGEMENT

BUSINESS STUDIES PROJECT ON PRINCIPLES OF MANAGEMENTCHARAK RAY

╠²

BUSINESS STUDIES PROJECT ON PRINCIPLES OF MANAGEMENT, BUSINESS STUDIES PROJECT REPORT ON PRINCIPLES OF MANAGEMENT, BUSINESS STUDIES PROJECT REPORT ON PRINCIPLES OF MANAGEMENT OF A SWEETS MAKING COMPANY.Government budget

Government budgetVijay Kumar

╠²

Government Budget class 12th

CA-Inter Macroeconomics

Macroeconomics

Economics

Class XII

Unit 4 Government Budget and the EconomyDETERMINATION OF INCOME AND EMPLOYMENT

DETERMINATION OF INCOME AND EMPLOYMENTAmiteshYadav7

╠²

The document defines key macroeconomic concepts such as aggregate demand, aggregate supply, and their components. It discusses how equilibrium output is determined by the intersection of the aggregate demand and aggregate supply curves. The saving-investment approach to determining equilibrium is also covered, where equilibrium occurs at the point where planned saving equals planned investment. Factors that can cause excess demand and deficient demand are explained, along with their impacts and appropriate policy responses.ppt on government budget

ppt on government budgetKushagra Arora

╠²

The document discusses key aspects of government budgets including:

- Budgets show estimated annual receipts and expenditures and are divided into revenue and capital components.

- Objectives include reallocating resources, managing public enterprises, and promoting economic stability.

- Receipts are classified as revenue or capital, and expenditures are classified as revenue or capital.

- Budgets can be balanced, in surplus, or in deficit depending on a comparison of estimated receipts to expenditures.

- Deficits include revenue deficit, fiscal deficit, and primary deficit, with fiscal deficit being the broadest measure of imbalance.Accountancy Comprehensive Project For Class - 12th on Partnership Firm

Accountancy Comprehensive Project For Class - 12th on Partnership FirmPriyanka Sahu

╠²

This slide is about the comprehensive project given to the students of class 12 for their practical examination. this project is strictly based on the CBSE guidelines. This is a format for making the project. Students can choose any of question in partnership firm and can solve it ,Business studies project

Business studies projectNi234

╠²

This is a sample business studies project for class 11 cbse from the topic aids to trade i hope this project helps you to finish your projectEconomic reforms 1991

Economic reforms 1991 Pranav Krishna

╠²

Economic Reforms 1991: New Economic Policy(NEP), Main Economic Reforms, Liberalization, Privatization, Globalization, Merits & Demerits of Economic reformsSolved Accounting Ratios with Balance Sheet(vertical) and Statement of Profit...

Solved Accounting Ratios with Balance Sheet(vertical) and Statement of Profit...Dan John

╠²

I assure you that this project of mine will fetch you a very good score.

Good Luck!!

Go to the links below for the following...

Solved Cbse Class 12 Accountancy Full Project(Comprehensive Project, Ratio Analysis and Cash Flow Statements with Conclusion)

http://www.slideshare.net/dankjohn/solved-cbse-class-12-accountancy-full-projectcomprehensive-project-ratio-analysis-and-cash-flow-statements-with-conclusion

Solved Comprehensive Project Cbse Class 12 Accountancy Project

http://www.slideshare.net/dankjohn/solved-comprehensive-project-cbse-class-12-accountancy-project

Solved Cash Flow Statements with Balance Sheet (vertical) and Notes to Accounts - Cbse Class 12 Accountancy Project

http://www.slideshare.net/dankjohn/solved-cash-flow-statements-with-balance-sheet-vertical-and-notes-to-accounts-cbse-class-12-accountancy-projectLiberlisation privatisation and globalisation - an apprraisal

Liberlisation privatisation and globalisation - an apprraisalmadan kumar

╠²

The document summarizes India's economic reforms since 1991 known as the New Economic Policy (NEP). It describes the economic crisis prior to 1991 that necessitated reforms, including high fiscal and trade deficits. The NEP introduced liberalization, privatization, and globalization. Key reforms included reducing licensing, opening sectors to FDI, trade liberalization, and greater private sector participation. The goals were to stabilize and grow the economy. Impacts have included increased GDP growth across all sectors, higher FDI inflows, and larger foreign exchange reserves.Unit 4 Government Budget & The Economy

Unit 4 Government Budget & The EconomyRitvik Tolumbia

╠²

A fantastic PPT on a very important and scoring topic. A quick and easy explanation of the chapter Government Budget & The Economy. It has got all the material information required to enhance one's knowledge about the topic. Excellent and interesting facts. HAPPY LEARNING !!More Related Content

What's hot (20)

Gov budget and economy

Gov budget and economyvibhor07

╠²

The document discusses government budgets. It explains that a budget is an annual financial statement that contains estimated receipts and expenditures for the coming fiscal year. The key points are:

- Budgets are prepared by governments at all levels and include estimated expenditures and receipts to achieve government objectives.

- The main components of a budget are the revenue budget and capital budget. Revenue budget covers revenue receipts and expenditures, while capital budget covers capital receipts and expenditures.

- Budgets can be balanced, in surplus, or in deficit depending on whether total estimated receipts equal, exceed, or are less than total estimated expenditures. Deficit budgets require the government to borrow funds.Government budget and the economy

Government budget and the economyAnjana P.V.Nair

╠²

The document discusses key concepts related to government budgets and deficits. It defines a government budget as an annual statement of estimated receipts and expenditures. The objectives of a budget include managing resources, reducing inequality, and achieving economic stability. Budgets have two main components - revenue and capital. Receipts are classified as revenue (e.g. taxes) or capital (e.g. borrowings), and expenditures are classified as revenue (e.g. salaries) or capital (e.g. infrastructure). Deficit measures include the revenue deficit, fiscal deficit, and primary deficit, which refer to excesses of expenditures over receipts from different sources.Principles of Management - 2 || Business Studies Project || Class 12 CBSE

Principles of Management - 2 || Business Studies Project || Class 12 CBSESaksham Mittal

╠²

Principles of Management

Business Studies Project

Class 12 CBSE

EDU RESOURCES

https://www.youtube.com/channel/UC3NkrW6yDrJy2w2DpxoH_HgGST Economic Project.pptx 1.pptx

GST Economic Project.pptx 1.pptxVishnu15600

╠²

hi I am Vishnu I made these project for my school if you like these please tell me to make your ppt with money mail to me to know any things ells etc ...

follow me on insta Vishnu_1807_

and subribe my youtube channel - https://www.youtube.com/@user-in4kz4ex2e

thank you Indian economic development project class 12

Indian economic development project class 12pradyumndubey124

╠²

Indian economic development class 12 project file 2023-24Economics project

Economics projectAkshita Grover

╠²

Economics project for class 12 on money and banking. it explains all the functions about RBI and includes everything needed to achieve good marks in project work.Indian Economy between 1950 to 1990, Class XII

Indian Economy between 1950 to 1990, Class XIIAnjaliKaur3

╠²

In this PPT, I have explained the following topics in detail. It will be helpful for teachers as well as students.

Content covered:

Economic System

Types of Economic System

Economic planning

Goal of five year plans

Problems faced by Indian Agriculture

Solutions to solve problems faced by Indian Agriculture

Problems under Green Revolution

Importance of Subsidies

Public and Private sectors in Indian Industrial Development

Industrial Policy Resolution, 1956

Industrial License

Industrial Concessions

Small Scale Industries

Trade policies: Import substitution

Also meaning of Green RevolutionClass 12 Accountancy Project 2022-23

Class 12 Accountancy Project 2022-23DivyaNatarajan21

╠²

Accountancy project for class 12. Accounts project for the year 2022-23. Accountancy project which has both specific and comprehensive project as well.

Cbse Boards internal assessment project for accountancy. Demonetisation - 1 Economics Project Class 12 CBSE

Demonetisation - 1 Economics Project Class 12 CBSESaksham Mittal

╠²

Demonetisation

Economics Project

Class 12 CBSE

EDU RESOURCES

https://www.youtube.com/channel/UC3NkrW6yDrJy2w2DpxoH_Hg

marketing on smartphone 12th bst project 2018-19

marketing on smartphone 12th bst project 2018-19Kunal Kevat

╠²

The document is a scanned copy of a legal contract for the sale of a residential property located in California. The contract details the purchase price of $1,100,000, down payment of $110,000, closing date, included and excluded items, and standard contractual terms for financing, inspection, insurance and other contingencies. Signatures are required from the buyer and seller to execute the real estate transaction.Government Budget and the Economy CLASS 12 NOTES (1).pdf

Government Budget and the Economy CLASS 12 NOTES (1).pdfRENAISSANCEACADEMY

╠²

The document provides an overview of government budgets and key concepts related to budgets in India. It discusses the objectives of budgets which include reallocating resources, redistributing income and wealth, and stabilizing the economy. It also defines important budget terms like revenue and capital budgets, budget receipts including tax and non-tax revenue, budget expenditures including plan/non-plan and revenue/capital. It further explains concepts such as budget deficits, types of taxes including direct, indirect, progressive and regressive taxes.BUSINESS STUDIES PROJECT ON PRINCIPLES OF MANAGEMENT

BUSINESS STUDIES PROJECT ON PRINCIPLES OF MANAGEMENTCHARAK RAY

╠²

BUSINESS STUDIES PROJECT ON PRINCIPLES OF MANAGEMENT, BUSINESS STUDIES PROJECT REPORT ON PRINCIPLES OF MANAGEMENT, BUSINESS STUDIES PROJECT REPORT ON PRINCIPLES OF MANAGEMENT OF A SWEETS MAKING COMPANY.Government budget

Government budgetVijay Kumar

╠²

Government Budget class 12th

CA-Inter Macroeconomics

Macroeconomics

Economics

Class XII

Unit 4 Government Budget and the EconomyDETERMINATION OF INCOME AND EMPLOYMENT

DETERMINATION OF INCOME AND EMPLOYMENTAmiteshYadav7

╠²

The document defines key macroeconomic concepts such as aggregate demand, aggregate supply, and their components. It discusses how equilibrium output is determined by the intersection of the aggregate demand and aggregate supply curves. The saving-investment approach to determining equilibrium is also covered, where equilibrium occurs at the point where planned saving equals planned investment. Factors that can cause excess demand and deficient demand are explained, along with their impacts and appropriate policy responses.ppt on government budget

ppt on government budgetKushagra Arora

╠²

The document discusses key aspects of government budgets including:

- Budgets show estimated annual receipts and expenditures and are divided into revenue and capital components.

- Objectives include reallocating resources, managing public enterprises, and promoting economic stability.

- Receipts are classified as revenue or capital, and expenditures are classified as revenue or capital.

- Budgets can be balanced, in surplus, or in deficit depending on a comparison of estimated receipts to expenditures.

- Deficits include revenue deficit, fiscal deficit, and primary deficit, with fiscal deficit being the broadest measure of imbalance.Accountancy Comprehensive Project For Class - 12th on Partnership Firm

Accountancy Comprehensive Project For Class - 12th on Partnership FirmPriyanka Sahu

╠²

This slide is about the comprehensive project given to the students of class 12 for their practical examination. this project is strictly based on the CBSE guidelines. This is a format for making the project. Students can choose any of question in partnership firm and can solve it ,Business studies project

Business studies projectNi234

╠²

This is a sample business studies project for class 11 cbse from the topic aids to trade i hope this project helps you to finish your projectEconomic reforms 1991

Economic reforms 1991 Pranav Krishna

╠²

Economic Reforms 1991: New Economic Policy(NEP), Main Economic Reforms, Liberalization, Privatization, Globalization, Merits & Demerits of Economic reformsSolved Accounting Ratios with Balance Sheet(vertical) and Statement of Profit...

Solved Accounting Ratios with Balance Sheet(vertical) and Statement of Profit...Dan John

╠²

I assure you that this project of mine will fetch you a very good score.

Good Luck!!

Go to the links below for the following...

Solved Cbse Class 12 Accountancy Full Project(Comprehensive Project, Ratio Analysis and Cash Flow Statements with Conclusion)

http://www.slideshare.net/dankjohn/solved-cbse-class-12-accountancy-full-projectcomprehensive-project-ratio-analysis-and-cash-flow-statements-with-conclusion

Solved Comprehensive Project Cbse Class 12 Accountancy Project

http://www.slideshare.net/dankjohn/solved-comprehensive-project-cbse-class-12-accountancy-project

Solved Cash Flow Statements with Balance Sheet (vertical) and Notes to Accounts - Cbse Class 12 Accountancy Project

http://www.slideshare.net/dankjohn/solved-cash-flow-statements-with-balance-sheet-vertical-and-notes-to-accounts-cbse-class-12-accountancy-projectLiberlisation privatisation and globalisation - an apprraisal

Liberlisation privatisation and globalisation - an apprraisalmadan kumar

╠²

The document summarizes India's economic reforms since 1991 known as the New Economic Policy (NEP). It describes the economic crisis prior to 1991 that necessitated reforms, including high fiscal and trade deficits. The NEP introduced liberalization, privatization, and globalization. Key reforms included reducing licensing, opening sectors to FDI, trade liberalization, and greater private sector participation. The goals were to stabilize and grow the economy. Impacts have included increased GDP growth across all sectors, higher FDI inflows, and larger foreign exchange reserves.Similar to Govt Budget & the Economy class 12 .pptx (20)

Unit 4 Government Budget & The Economy

Unit 4 Government Budget & The EconomyRitvik Tolumbia

╠²

A fantastic PPT on a very important and scoring topic. A quick and easy explanation of the chapter Government Budget & The Economy. It has got all the material information required to enhance one's knowledge about the topic. Excellent and interesting facts. HAPPY LEARNING !!Government Budget

Government BudgetAmiteshYadav7

╠²

The document defines key terms related to government budgets including:

- Components are revenue and capital budgets, with receipts classified as tax, non-tax, capital or revenue, and expenditures classified as capital or revenue.

- Objectives include reducing inequality, achieving stability, and economic growth.

- Deficit, revenue, fiscal and primary deficits are defined relating to differences between expenditures and receipts.Presentation 19.pptx (1).pdf

Presentation 19.pptx (1).pdfNuonika

╠²

The document defines key terms related to government budgets, including revenue and capital budgets, receipts, expenditures, and types of deficits. It explains that a budget is the government's annual financial plan, outlining estimated revenues and expenditures. The objectives of budgets are to allocate resources, encourage investment, reduce inequality, and promote economic stability and growth. Revenue comes from taxes and non-tax sources, while expenditures are classified as revenue or capital. Deficits can be revenue-based, fiscal, or primary.Public Finance.pptx

Public Finance.pptxHimaanHarish

╠²

Powerpoint presentation for Under graduation economics BA and BSc (Honours) course.

Recommended for Class 12 ISC Economics. 1pptx-180412171248.pdf

1pptx-180412171248.pdfPayalAggarwal41

╠²

The document provides an overview of government budgets and their key components in India. It discusses:

- The meaning and objectives of government budgets, which are annual financial plans that help governments allocate resources and plan expenditures.

- The major components of government budgets, including revenue receipts (taxes, fees), capital receipts (borrowings, disinvestments), revenue expenditure, and capital expenditure.

- Measures of government deficits, including revenue deficit (when revenue expenditures exceed receipts), fiscal deficit (when total expenditures exceed total receipts), and primary deficit.

The document examines these concepts in the context of the Indian government's central budget and provides examples to illustrate revenue versus capital receipts and expenditures.Budget

BudgetMD SALMAN ANJUM

╠²

The document outlines key aspects of government budgets in India. It provides estimates of planned receipts and expenditures for the coming fiscal year. The budget is presented annually in Parliament and must be approved before implementation. It aims to allocate resources according to priorities like agriculture, education, and infrastructure, while also pursuing fiscal consolidation and tax reforms.Fiscal policy

Fiscal policymanuelmathew1

╠²

This document discusses key aspects of fiscal policy in India. It defines fiscal policy as the government's approach to taxation, spending, and borrowing to achieve economic objectives like growth. The main objectives of fiscal policy are promoting growth, stabilizing the economy during recessions and booms, creating jobs, and redistributing income. It describes countercyclical fiscal policy, which aims to counter economic cycles through tax and spending adjustments. It also discusses concepts like the revenue budget, capital budget, budget deficits, and deficit financing.Government budget

Government budgetAmiteshYadav7

╠²

1. A government budget is an annual statement of estimated receipts and expenditures for a fiscal year, which runs from April 1 to March 31.

2. The budget aims to allocate resources properly, reduce inequality, and achieve economic stability and growth through taxation and expenditure policies.

3. Components of the budget include revenue and capital receipts and expenditures. Receipts are classified as tax or non-tax revenue, and capital or current. Expenditures are classified as plan or non-plan, developmental or non-developmental, revenue or capital.Government budget

Government budget Neeraj Garwal

╠²

A Brief Overview of Budget :

Introduction, Meaning of Government Budget, Objective of Government Budget, Components of Budget, Revenue Receipts, Capital Receipts, Budget Expenditure, Measures of Government Deficit

(with some latest data)

Fiscal Policy.pptx

Fiscal Policy.pptxNidhi Bansal

╠²

Fiscal policy refers to the government's use of spending and tax policies to influence economic conditions. The key instruments of fiscal policy are the budget, taxation, public expenditure, and public debt. Governments use fiscal policy to achieve macroeconomic goals like employment generation and economic growth. India's fiscal policy aims to stabilize the economy and reduce fiscal deficits. Recent reforms have aimed to simplify taxes, lower rates, and reduce non-essential spending.Government budget

Government budgetAmiteshYadav7

╠²

The document discusses key components and classifications of government budgets including:

- Revenue and capital budget components

- Classification of receipts as capital or revenue and of expenditures as capital or revenue

- Meanings of balanced, surplus, and deficit budgets and definitions of revenue, fiscal, and primary deficits

- Key budget receipts come from taxes (direct and indirect) and non-tax sources, while expenditures are categorized as revenue or capitalPublic Finance

Public FinanceGAURAV. H .TANDON

╠²

Public finance deals with government revenue sources like taxes and expenditures on areas like infrastructure, education, and health. It aims to stabilize the economy, promote growth, and provide essential public goods. Government budgets classify spending into areas and sources of revenue like taxes. A budget deficit occurs when spending exceeds taxes, while a surplus exists when taxes are higher than spending. Deficit financing allows governments to fund spending by borrowing or money creation, but too much can crowd out private investment and cause inflation. Fiscal policy uses taxes and spending to influence employment, growth, and prices.Fiscal policy

Fiscal policyBhawnaBhardwaj24

╠²

Fiscal policy deals with government taxation and spending decisions. The major instruments of fiscal policy include the budget, taxation, public expenditure, public revenue, public debt, and fiscal deficit. The objectives of India's fiscal policy are to promote economic growth, reduce income and wealth inequalities, generate employment, ensure price stability, achieve balanced regional development, and increase national income through mobilizing resources, public investments, and subsidies.A monetary policy that lowers interest rates and stimulates borrowing is an

A monetary policy that lowers interest rates and stimulates borrowing is anBhawnaBhardwaj24

╠²

Fiscal policy deals with government taxation and spending decisions. The major instruments of fiscal policy include the budget, taxation, public expenditure, public revenue, public debt, and fiscal deficit. The objectives of India's fiscal policy are to promote economic growth, reduce income and wealth inequalities, generate employment, ensure price stability, achieve balanced regional development, and increase national income through mobilizing resources, public investments, and subsidies.FISCAL POLICY.docx

FISCAL POLICY.docxG.V.M.GIRLS COLLEGE SONEPAT

╠²

Fiscal policy deals with government taxation and expenditure decisions. The major instruments of fiscal policy include the budget, taxation, public expenditure, public revenue, public debt, and fiscal deficit. The objectives of India's fiscal policy are to promote economic growth, reduce income and wealth inequalities, generate employment, ensure price stability, correct balance of payments deficits, and provide effective administration. Fiscal policy aims to mobilize resources through taxation, public savings, and private savings to fund infrastructure development, employment programs, and social services.Recently uploaded (20)

Unit 4 Reverse Engineering Tools Functionalities & Use-Cases.pdf

Unit 4 Reverse Engineering Tools Functionalities & Use-Cases.pdfChatanBawankar

╠²

Reverse Engineering Tools Functionalities & Use-Cases[2025] Qualtric XM-EX-EXPERT Study Plan | Practice Questions + Exam Details![[2025] Qualtric XM-EX-EXPERT Study Plan | Practice Questions + Exam Details](https://cdn.slidesharecdn.com/ss_thumbnails/2025qualtricxm-ex-expertstudyplanpracticequestionsexamdetails-250527093747-448c8922-thumbnail.jpg?width=560&fit=bounds)

![[2025] Qualtric XM-EX-EXPERT Study Plan | Practice Questions + Exam Details](https://cdn.slidesharecdn.com/ss_thumbnails/2025qualtricxm-ex-expertstudyplanpracticequestionsexamdetails-250527093747-448c8922-thumbnail.jpg?width=560&fit=bounds)

![[2025] Qualtric XM-EX-EXPERT Study Plan | Practice Questions + Exam Details](https://cdn.slidesharecdn.com/ss_thumbnails/2025qualtricxm-ex-expertstudyplanpracticequestionsexamdetails-250527093747-448c8922-thumbnail.jpg?width=560&fit=bounds)

![[2025] Qualtric XM-EX-EXPERT Study Plan | Practice Questions + Exam Details](https://cdn.slidesharecdn.com/ss_thumbnails/2025qualtricxm-ex-expertstudyplanpracticequestionsexamdetails-250527093747-448c8922-thumbnail.jpg?width=560&fit=bounds)

[2025] Qualtric XM-EX-EXPERT Study Plan | Practice Questions + Exam DetailsJenny408767

╠²

Pass the SAP XM-EX-EXPERT exam with expert-designed practice tests, accurate questions, and a 100% success guarantee. Start your prep today!EVALUATION AND MANAGEMENT OF OPEN FRACTURE

EVALUATION AND MANAGEMENT OF OPEN FRACTUREBipulBorthakur

╠²

class on open fracture , for MS orthopaedics Decision Tree-ID3,C4.5,CART,Regression Tree

Decision Tree-ID3,C4.5,CART,Regression TreeGlobal Academy of Technology

╠²

Machine Learning

Decision Tree

Problems on Decision TreeFlower Identification Class-10 by Kushal Lamichhane.pdf

Flower Identification Class-10 by Kushal Lamichhane.pdfkushallamichhame

╠²

This includes the overall cultivation practices of rose prepared by:

Kushal Lamichhane

Instructor

Shree Gandhi Adarsha Secondary School

Kageshowri Manohara-09, Kathmandu, NepalSamarth QUIZ 2024-25_ FINAL ROUND QUESTIONS

Samarth QUIZ 2024-25_ FINAL ROUND QUESTIONSAnand Kumar

╠²

SAMARTH QUIZ 2024-25- FINAL ROUND: As a part of SAIL level Management Business Quiz, final round of Quiz conducted at DSP SAIL. YSPH VMOC Special Report - Measles Outbreak Southwest US 5-25-2025.pptx

YSPH VMOC Special Report - Measles Outbreak Southwest US 5-25-2025.pptxYale School of Public Health - The Virtual Medical Operations Center (VMOC)

╠²

CURRENT CASE COUNT: 880

ŌĆó Texas: 729 (+5) (56% of cases are in Gaines County)

ŌĆó New Mexico: 78 (+4) (83% of cases are from Lea County)

ŌĆó Oklahoma: 17

ŌĆó Kansas: 56 (38.89% of the cases are from Gray County)

HOSPITALIZATIONS: 103

ŌĆó Texas: 94 - This accounts for 13% of all cases in the State.

ŌĆó New Mexico: 7 ŌĆō This accounts for 9.47% of all cases in New Mexico.

ŌĆó Kansas: 2 - This accounts for 3.7% of all cases in Kansas.

DEATHS: 3

ŌĆó Texas: 2 ŌĆō This is 0.28% of all cases

ŌĆó New Mexico: 1 ŌĆō This is 1.35% of all cases

US NATIONAL CASE COUNT: 1,076 (confirmed and suspected)

INTERNATIONAL SPREAD

ŌĆó Mexico: 1,753 (+198) 4 fatalities

ŌĆÆ Chihuahua, Mexico: 1,657 (+167) cases, 3 fatalities, 9 hospitalizations

ŌĆó Canada: 2518 (+239) (Includes OntarioŌĆÖs outbreak, which began November 2024)

ŌĆÆ Ontario, Canada: 1,795 (+173) 129 (+10) hospitalizations

ŌĆÆ Alberta, Canada: 560 (+55)

Things to keep an eye on:

Mexico: Three children have died this month (all linked to the Chihuahua outbreak):

An 11-month-old and a 7-year-old with underlying conditions

A 1-year-old in Sonora whose family is from Chihuahua

Canada:

Ontario now reports more cases than the entire U.S.

AlbertaŌĆÖs case count continues to climb rapidly and is quickly closing in on 600 cases.

Emerging transmission chains in Manitoba and Saskatchewan underscore the need for vigilant monitoring of under-immunized communities and potential cross-provincial spread.

United States:

North Dakota: Grand Forks County has confirmed its first cases (2), linked to international travel. The state total is 21 since May 2 (including 4 in Cass County and 2 in Williams County), with one hospitalization reported.

OUTLOOK: With the springŌĆōsummer travel season peaking between Memorial Day and Labor Day, both domestic and international travel may fuel additional importations and spread. Although measles transmission is not strictly seasonal, crowded travel settings increase the risk for under-immunized individuals.Protest - Student Revision Booklet For VCE English

Protest - Student Revision Booklet For VCE Englishjpinnuck

╠²

The 'Protest Student Revision Booklet' is a comprehensive resource to scaffold students to prepare for writing about this idea framework on a SAC or for the exam. This resource helps students breakdown the big idea of protest, practise writing in different styles, brainstorm ideas in response to different stimuli and develop a bank of creative ideas.Philosophical Basis of Curriculum Designing

Philosophical Basis of Curriculum DesigningAnkit Choudhary

╠²

The philosophical basis of curriculum refers to the foundational beliefs and values that shape the goals, content, structure, and methods of education. Major educational philosophiesŌĆöidealism, realism, pragmatism, and existentialismŌĆöguide how knowledge is selected, organized, and delivered to learners. In the digital age, understanding these philosophies helps educators and content creators design curriculum materials that are purposeful, learner-centred, and adaptable for online environments. By aligning educational content with philosophical principles and presenting it through interactive and multimedia formats.How to Add a Custom Menu, List view and FIlters in the Customer Portal Odoo 18

How to Add a Custom Menu, List view and FIlters in the Customer Portal Odoo 18Celine George

╠²

To create a new menu in the "My Accounts" portal and set up a list/form view in Odoo 18, follow these steps. For Example- The custom menu has now been added to the "Fleet" customer portal.Basic principles involved in the traditional systems of medicine, Chapter 7,...

Basic principles involved in the traditional systems of medicine, Chapter 7,...ARUN KUMAR

╠²

Basic principles involved in the traditional systems of medicine include:

Ayurveda, Siddha, Unani, and Homeopathy

Method of preparation of Ayurvedic formulations like:

Arista, Asava, Gutika, Taila, Churna, Lehya and Bhasma

0b - THE ROMANTIC ERA: FEELINGS AND IDENTITY.pptx

0b - THE ROMANTIC ERA: FEELINGS AND IDENTITY.pptxJuli├Īn Jes├║s P├®rez Fern├Īndez

╠²

Powerpoint introductorio en ingl├®s sobre el Romanticismo.SAMARTH QUIZ 2024-25_ PRELIMINARY ROUNDS

SAMARTH QUIZ 2024-25_ PRELIMINARY ROUNDSAnand Kumar

╠²

SAMARTH QUIZ 2024-25 PRELIMNARY ROUND : Conducted as a part of SAIL level Management Business Quiz at DSP SAIL.Low Vison introduction from Aligarh Muslim University

Low Vison introduction from Aligarh Muslim UniversityAligarh Muslim University, Aligarh, Uttar Pradesh, India

╠²

This is for optometry students for education purposeUnit Kali NetHunter is the official Kali Linux penetration testing platform f...

Unit Kali NetHunter is the official Kali Linux penetration testing platform f...ChatanBawankar

╠²

Kali NetHunter is the official Kali Linux penetration testing platform for Android devices. How to Use Owl Slots in Odoo 17 - Odoo ║▌║▌▀Żs

How to Use Owl Slots in Odoo 17 - Odoo ║▌║▌▀ŻsCeline George

╠²

In this slide, we will explore Owl Slots, a powerful feature of the Odoo 17 web framework that allows us to create reusable and customizable user interfaces. We will learn how to define slots in parent components, use them in child components, and leverage their capabilities to build dynamic and flexible UIs.Unit 1 Tools Beneficial for Monitoring the Debugging Process.pdf

Unit 1 Tools Beneficial for Monitoring the Debugging Process.pdfChatanBawankar

╠²

Unit 1 Tools Beneficial for Monitoring the Debugging Process.pdfHow to Configure Credit Card in Odoo 18 Accounting

How to Configure Credit Card in Odoo 18 AccountingCeline George

╠²

Odoo 18 allows businesses to manage credit card payments efficiently within the Accounting module. HereŌĆÖs how you can configure a credit card as a payment method.5503 Course Proposal Online Computer Middle School Course Wood M.pdf

5503 Course Proposal Online Computer Middle School Course Wood M.pdfMelanie Wood

╠²

Course Proposal for Online Computer Middle School Course completed in Spring 2025 at OSU for EDTC 5503.YSPH VMOC Special Report - Measles Outbreak Southwest US 5-25-2025.pptx

YSPH VMOC Special Report - Measles Outbreak Southwest US 5-25-2025.pptxYale School of Public Health - The Virtual Medical Operations Center (VMOC)

╠²

Low Vison introduction from Aligarh Muslim University

Low Vison introduction from Aligarh Muslim UniversityAligarh Muslim University, Aligarh, Uttar Pradesh, India

╠²

Govt Budget & the Economy class 12 .pptx

- 1. UNIT VIII : Government Budget And the Economy (Marks : 06) Ms S Chattopadhyay PGT Economics KV Ballygunge

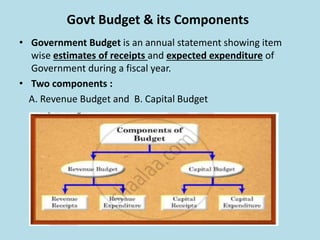

- 4. Govt Budget & its Components ŌĆó Government Budget is an annual statement showing item wise estimates of receipts and expected expenditure of Government during a fiscal year. ŌĆó Two components : A. Revenue Budget and B. Capital Budget

- 6. Receipts ŌĆó Either Increases Liability OR Reduces assets ŌĆ”.Capital receipt ŌĆó Neither increases liability nor reduces assetsŌĆ” Revenue receipt

- 8. Revenue Receipt & its sources ŌĆó Revenue Receipt : The receipt which neither creates any liability nor causes reduction in the assets of the government is called revenue receipt. ŌĆó Two sources of revenue receipts : A. Tax revenue such as income tax, corporation tax, sales tax, custom duty etc. B. Non-tax revenue such as interest , dividend, external grants, fees, fines, escheats etc.

- 10. Tax & Its type ŌĆó Tax : Tax is a legally compulsory payment imposed by the government on the households and producers. ŌĆó Types : A. Direct Tax B. Indirect Tax

- 11. Direct & Indirect Tax Basis Direct Tax Indirect Tax Impact Taxes are levied on individuals & companies. Taxes are levied on goods & services. Shift of burden The burden of tax cannot be shifted i.e. impact & incidence are on the same person. The burden of tax can be shifted i.e. the impact & incidence are on different persons. Nature Generally progressive in nature Generally proportional in nature Coverage Limited coverage as they do not reach all sections of the society. Wide coverage as they reach all sections of the economy. Example Income tax, Corporation tax, Wealth tax etc. Sales tax, Excise duty, Custom duty, GST etc.

- 12. Capital Receipt & its components ŌĆó Capital Receipt : The receipt which either creates a liability or causes reduction in the asset of the government is called Capital receipt. ŌĆó Components of Capital Receipt : A. Recovery of loan (as it reduces asset) B. Borrowings (as it increases liability) C. Disinvestments (as it reduces assets)

- 14. Revenue receipts vs Capital receipts Revenue receipts Capital receipts 1. Neither create liability nor lead to reduction in assets of the government. 1. Either create a liability for the government or reduces the assets of the government. 2. Receipts are regular & recurring in nature. 2. Receipts are generally non recurring in nature. 3. Ex. Tax revenue such as Income tax etc and Non-tax revenue such as interest, fees, fines etc. 3. Ex. Public borrowing, recovery of loan, disinvestment etc.

- 15. Expenditure ŌĆó Either Reduces liability OR Increases assets ŌĆ”.Capital expenditure ŌĆó Neither Reduces liability nor Increases assetsŌĆ” Revenue expenditure

- 16. Revenue Expenditure ŌĆó Revenue Expenditure : Revenue expenditure refers to the expenditure which neither reduces the liability nor creates any asset of the government. ŌĆó Examples of Revenue expenditure : Payments of salaries, pensions, subsidies, payments of grants etc.

- 17. Capital Expenditure ŌĆó Capital Expenditure : Capital Expenditure is defined as the expenditure which either reduces the liability or creates an asset of the government. ŌĆó Examples of Capital expenditure : Loan, repayment of borrowings, expenditure of building roads, flyovers etc.

- 18. Revenue Expenditure vs Capital Expenditure ŌĆó Revenue Expenditure Capital Expenditure 1. Rev. expenditure neither creates any asset nor causes reduction in the liability of the government. 1. Cap. expenditure either creates an asset or causes reduction in liability of the government. 2. It is incurred on normal functioning of the government departments. 2. It is incurred on acquisition of assets, granting of loans, repayments of borrowings etc. 3. Ex. Payment of salaries, pension, interest payments etc. 3. Ex. Loan, expenditure for construction work etc.

- 22. Budget deficit Budget deficit : ŌĆó Budget deficit is the excess of total expenditures over total receipts of the government in a year. ŌĆó Budget deficit = Total Expenditure ŌĆō Total Receipts. Revenue Deficit : ŌĆó Revenue deficit refers to excess of revenue expenditures over revenue receipts. ŌĆó Revenue Deficit = Revenue Expenditure ŌĆō Revenue Receipt Fiscal Deficit : ŌĆó Fiscal deficit refers to the excess of total expenditure over total receipts excluding borrowing. ŌĆó Fiscal Deficit = Total Expenditure ŌĆō Total Receipt excluding borrowing. Primary Deficit : ŌĆó Primary deficit refers to the difference between fiscal deficit and interest payments. Primary Deficit = Fiscal Deficit ŌĆō Interest Payments .

- 24. Financing deficit .. The deficit in the budget can be financed by :- ŌĆó Monetary expansion ŌĆō This amounts to printing of currency notes to the extent of deficit. ŌĆó Borrowing from the public ŌĆō The government may raise loan from general public by issuing bonds of various types. ŌĆó Disinvestment ŌĆō The govt may sale its existing shares in public sector or joint sector enterprises. Deficit financing is a process of financing the deficit in the budget by printing notes, public borrowing, issue of shares etc.

- 26. Objects of Government Budget ŌĆó Re-allocation of resources with a view to maximize social welfare. ŌĆó Re-distribution of income & wealth to reduce economic inequality through subsidy, taxation policy etc. ŌĆó Stabilization of economic activities & reduction in business fluctuation through revenue and expenditure policy. ŌĆó Management of public enterprises for the social welfare of the people & development of economic and social infrastructures.

- 27. Use of budgetary policy for allocation of resources in the economy ŌĆó The government of a country through its budgetary policy directs the allocation of resources in such a manner that there is a balance between the goals of profit maximization and social welfare. ŌĆó Production of goods which are injurious to health is discouraged through heavy taxation. On the other hand, production of socially useful goods is encouraged through subsidies.

- 28. Use of budgetary policy for economic stability in the economy ŌĆó Economic stability means controlling of inflationary and deflationary situation in the economy. The budget can be used as an important instrument to combat this situation. ŌĆó During the time of inflation the government should increase the direct tax as well as reduce unproductive expenditure. Similarly , during the time of deflation the government should design its policy in such a way that production and income in the economy be increased.

- 29. Use of budgetary policy in reducing inequality in income & wealth ŌĆó Government budgetary policy can help in reducing inequality in income through redistributing income & wealth in the economy. To achieve this objective, the government uses the fiscal instruments of taxation & subsidies. ŌĆó By imposing taxes on rich and giving subsidy to the poor, government redistributes income in the society. Equitable distribution of income and wealth is a sign of social justice which is achieved through government budget